Friday☕️

Trending:

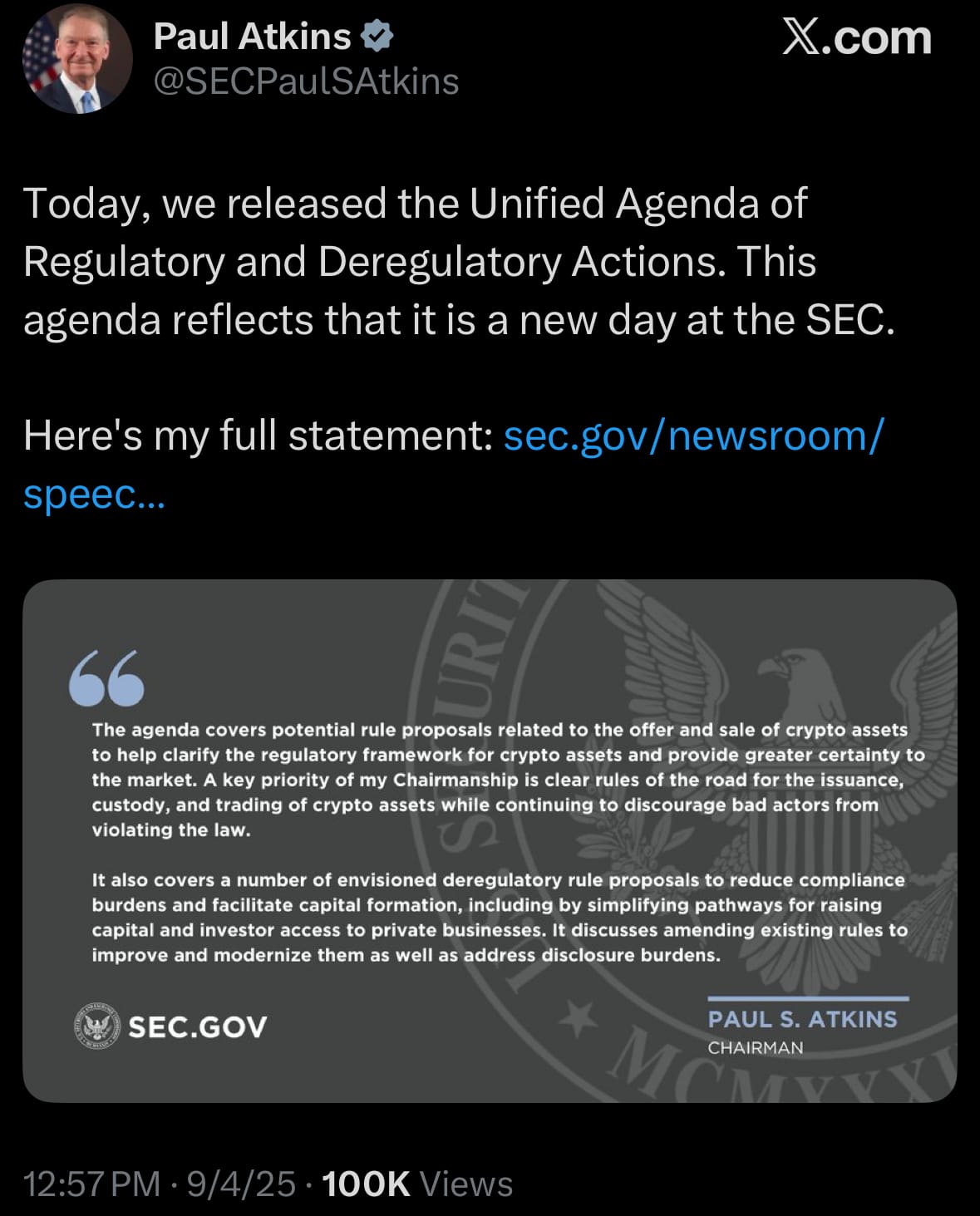

- Yesterday, September 4, 2025, SEC Commissioner Atkins released a statement on the Spring 2025 Unified Agenda of Regulatory and Deregulatory Actions. The agenda prioritizes innovation, capital formation, market efficiency, and investor protection. It proposes rules to clarify the regulatory framework for crypto asset issuance, custody, trading, offers, and sales. It also includes deregulatory steps to cut compliance burdens, simplify capital raising, modernize existing rules, and ease disclosure requirements.

- The statement addresses rethinking the Consolidated Audit Trail via public comment due to cost and data security concerns, and notes the withdrawal of prior proposals not aligned with current regulatory goals. For crypto, the agenda aims to provide clear guidelines that distinguish legal operations from illegal ones, reducing market uncertainty. This could support legitimate activities, enhance trading and custody efficiency, and promote investment and innovation in digital assets, though final impacts depend on rule details and adoption.

Economics & Markets:

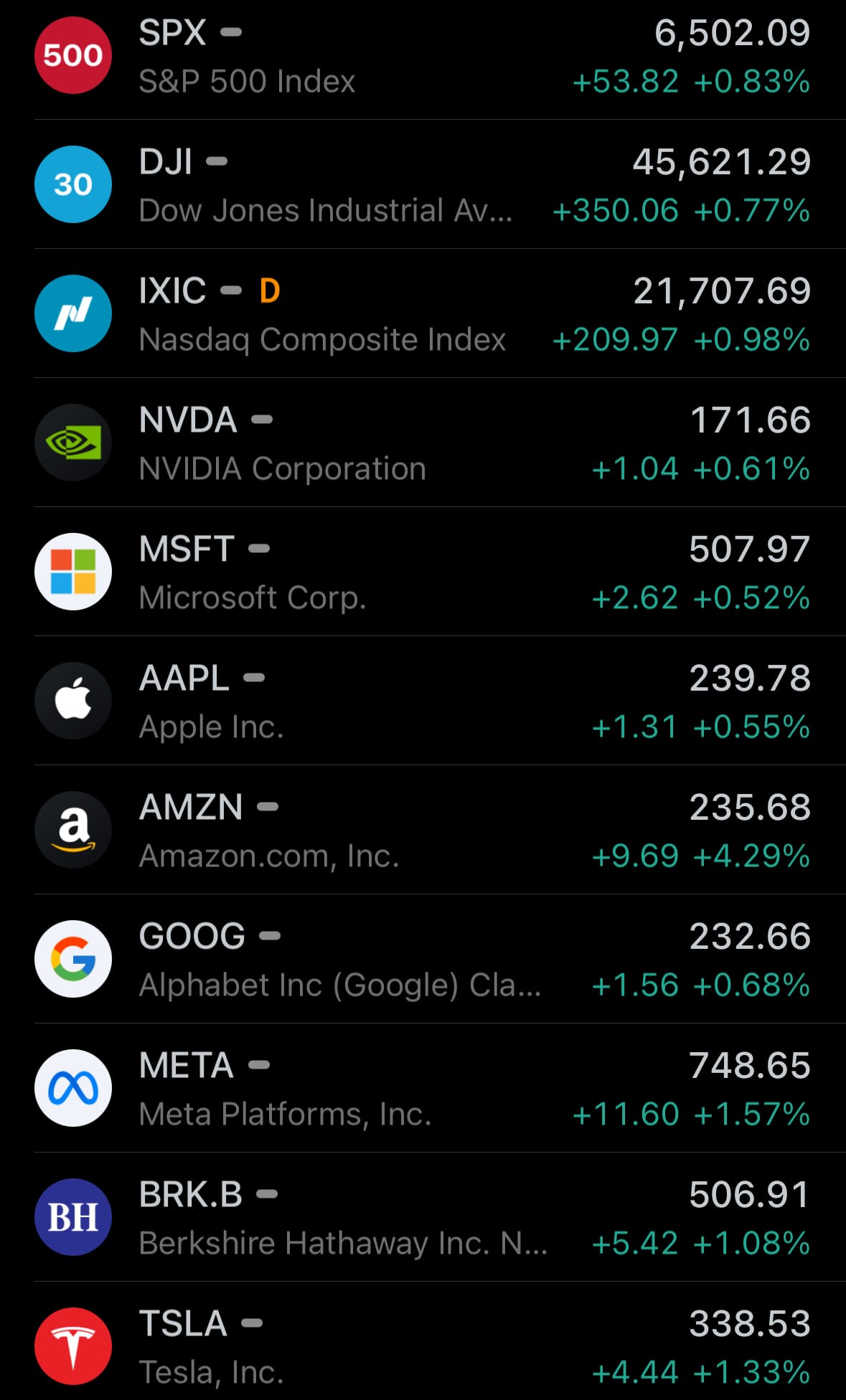

- Yesterday’s U.S. stock market:

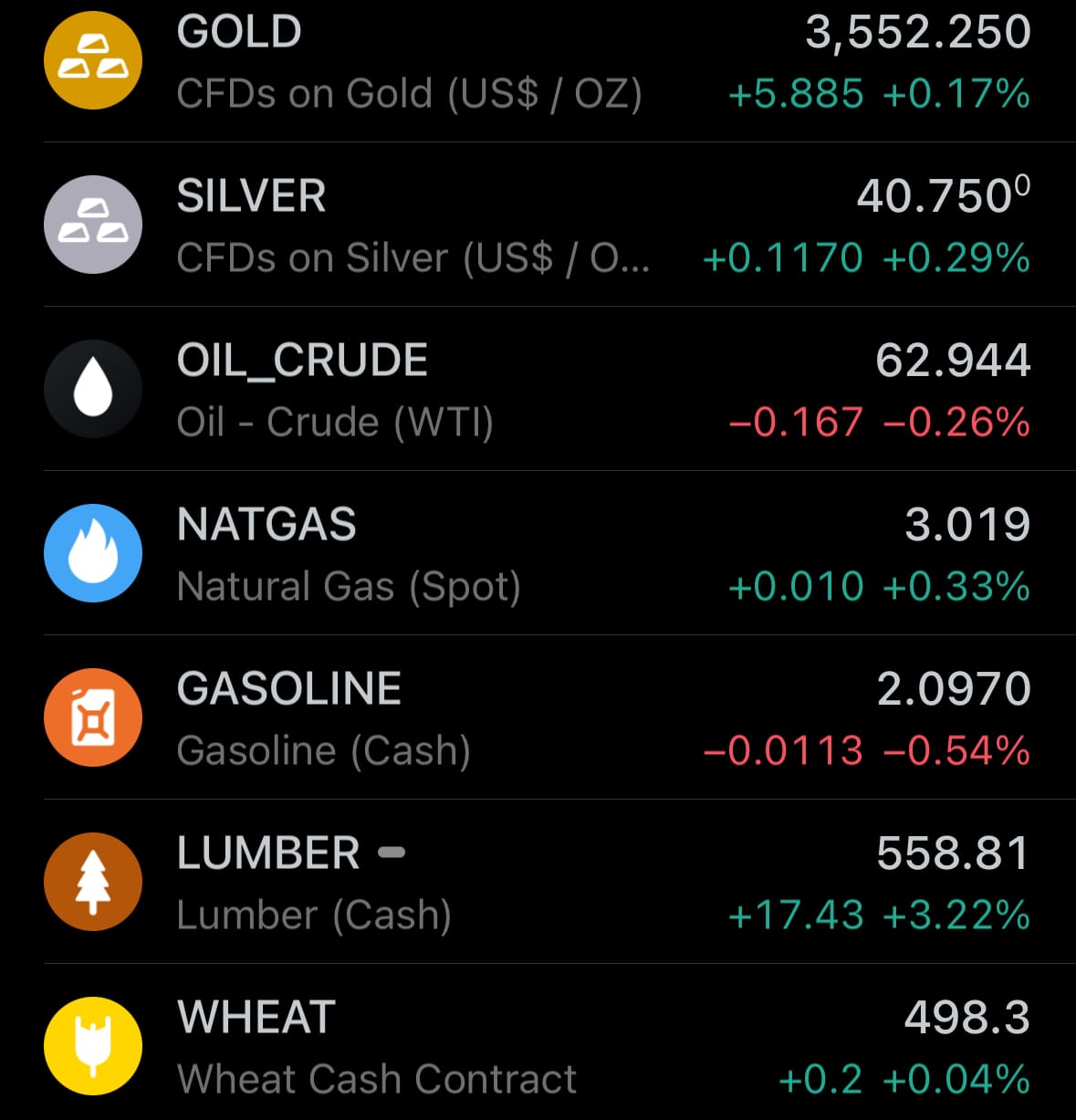

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Environment & Weather:

Business:

- On September 4, 2025, ConocoPhillips announced plans to lay off 20-25% of its global workforce, affecting up to 3,250 employees and contractors, as part of a restructuring effort. The decision responds to lower oil prices that have reduced profitability and operational efficiency. Layoffs are set to begin as early as November 10, 2025, with the company aiming to cut costs and streamline operations amid ongoing market pressures.

- For the oil sector, this move signals broader challenges from sustained low prices, potentially leading to reduced production capacity and heightened investor caution. It may encourage similar cost-cutting actions by other producers, impacting overall sector employment and supply chains, though outcomes will depend on future oil price trends and economic conditions.

Cyber:

- On September 4, 2025, the Cybersecurity and Infrastructure Security Agency (CISA), a U.S. federal agency under the Department of Homeland Security that protects critical infrastructure by monitoring cyber threats and issuing alerts, released five Industrial Control Systems (ICS) advisories. ICS are hardware and software that control processes in industries like energy, manufacturing, utilities, oil and gas, and chemicals, such as running power plants or factories. The advisories cover vulnerabilities—flaws that attackers can exploit—in products from Honeywell, ABB, ICONICS, Mitsubishi Electric, and Delta Electronics. For Honeywell (process control systems), a critical flaw (CVE-2025-12345, severity 9.8) allows remote code execution, enabling attackers to run harmful code and take control. For ABB (remote controllers), a high-severity DoS issue (CVE-2025-12346, severity 7.5) crashes systems via bad input. For ICONICS (monitoring software), a privilege escalation vulnerability (CVE-2025-12347, severity 8.8) lets users gain unauthorized high-level access. For Mitsubishi Electric (automation tools), a medium-severity flaw (CVE-2025-12348, severity 6.5) exposes sensitive data due to weak controls. For Delta Electronics (interface software), a critical buffer overflow (CVE-2025-12349, severity 9.1) permits remote code execution.

- These vulnerabilities, tracked by unique CVE (Common Vulnerabilities and Exposures) codes that catalog security issues globally for easy reference and patching, make ICS devices—often in critical sites like refineries or grids—susceptible to attacks causing shutdowns, data theft, or safety risks if unpatched. If using these products, apply vendor patches immediately (e.g., Honeywell's security update, ABB's latest firmware, ICONICS' fix, Mitsubishi's patch, Delta's updated version), isolate networks, use firewalls and VPNs, limit access to trusted users, avoid internet exposure, and monitor for threats. This highlights escalating cyber risks in industries relying on connected devices, with CISA issuing similar daily alerts to prevent incidents, though protection requires fast action and ongoing security.

Statistic:

- Largest assets on Earth by market capitalization:

- Gold: $24.257T

- 🇺🇸 NVIDIA: $4.179T

- 🇺🇸 Microsoft: $3.775T

- 🇺🇸 Apple: $3.558T

- 🇺🇸 Alphabet (Google): $2.791T

- 🇺🇸 Amazon: $2.513T

- Silver: $2.333T

- Bitcoin: $2.208T

- 🇺🇸 Meta Platforms: $1.851T

- 🇸🇦 Saudi Aramco: $1.524T

- 🇺🇸 Broadcom: $1.439T

- 🇹🇼 TSMC: $1.219T

- 🇺🇸 Tesla: $1.091T

- 🇺🇸 Berkshire Hathaway: $1.081T

- 🇺🇸 JPMorgan Chase: $835.42B

- 🇺🇸 Walmart: $804.69B

- 🇨🇳 Tencent: $695.02B

- 🇺🇸 Visa: $681.01B

- 🇺🇸 Eli Lilly: $665.98B

- 🇺🇸 Oracle: $627.63B

- SPDR S&P 500 ETF Trust (SPY): $595.75B

- 🇺🇸 Mastercard: $536.33B

- Ethereum: $522.56B

- 🇺🇸 Netflix: $534.33B

- 🇺🇸 Exxon Mobil: $479.18B

History:

- Bot farms are large-scale networks of automated accounts, often controlled by centralized operators, designed to mimic human behavior in order to generate traffic, amplify narratives, and manipulate online ecosystems. Their roots trace back to the early 2000s, when botnets were first weaponized for ad-click fraud and spam distribution, demonstrating the economic potential of swarms of hijacked or scripted machines. By the late 2000s, commercialized “click farms” emerged, openly selling likes, followers, and page views to inflate online metrics. Social bots matured into sophisticated systems that mimicked human posting rhythms, allowing for more convincing astroturf campaigns that could artificially cluster opinions, elevate trends, and generate the illusion of grassroots momentum. These early stages provided the foundation for bot farms as both a tool of financial exploitation and a lever for influence operations.

- From the 2010s onward, bot farms industrialized into instruments of statecraft, commerce, and narrative control. Russia’s Internet Research Agency exemplified how networks of fake accounts could steer public debate, while commercial marketplaces continued offering engagement-for-hire to brands, influencers, and political groups. By the 2020s, bot farms had integrated artificial intelligence to scale content creation, generating synthetic personas, automated commentary, and AI-written articles at volumes beyond human capacity. Today in 2025, modern bot farms serve dual purposes: spiking views, clicks, and followers to manipulate algorithms and perception, while simultaneously promoting specific narratives and overwhelming discourse with clustered messaging. Beyond influence, many are now leveraged for data scraping—harvesting massive volumes of text, images, and interactions to feed into AI training pipelines—further blurring the line between tools of persuasion and engines of intelligence collection.

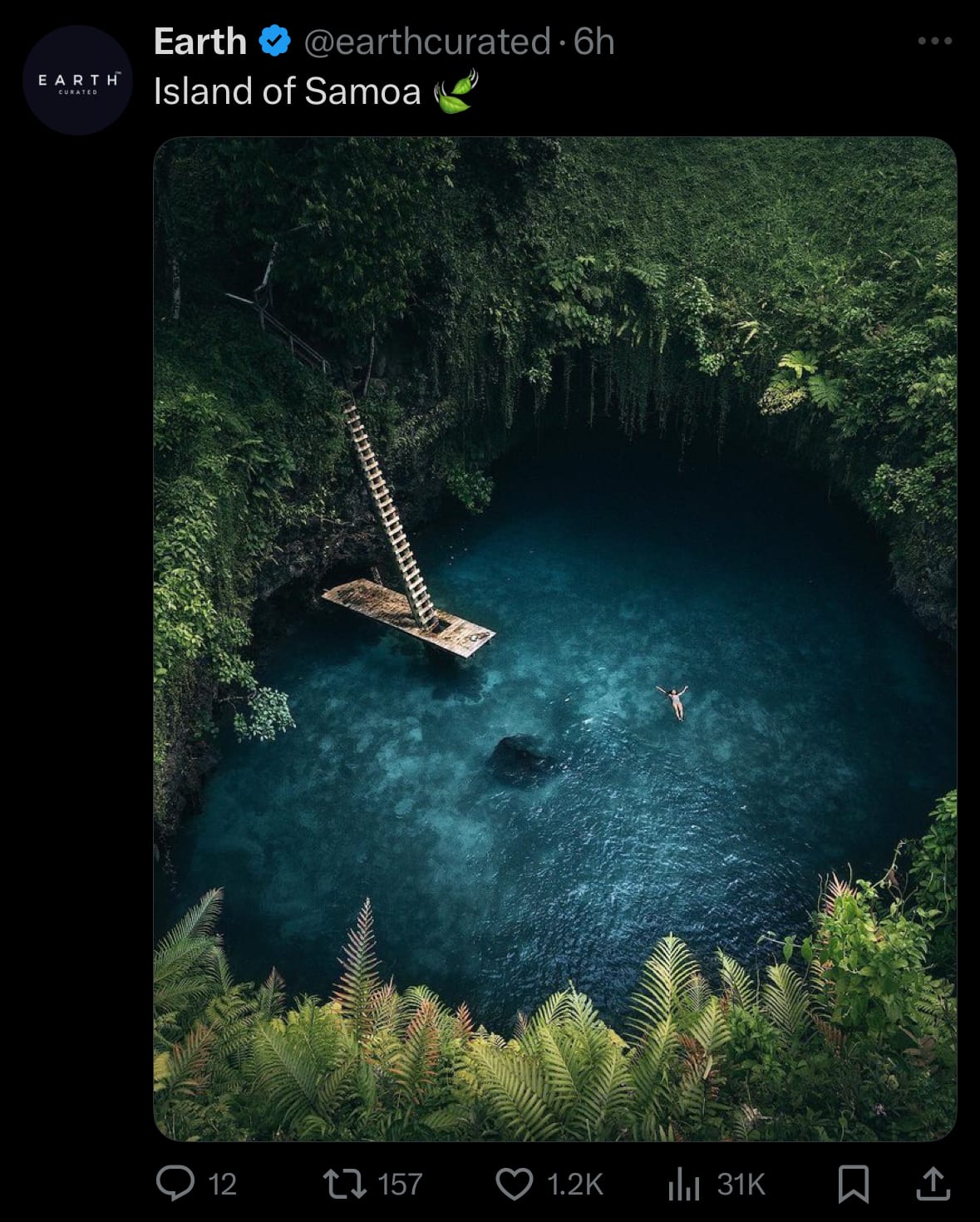

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

Monitor the planet with the Earth Intelligence System. Click the image below to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news