Friday☕️

Trending:

- U.S. Military Budget

- Argentina‘s Financial Reforms

Markets:

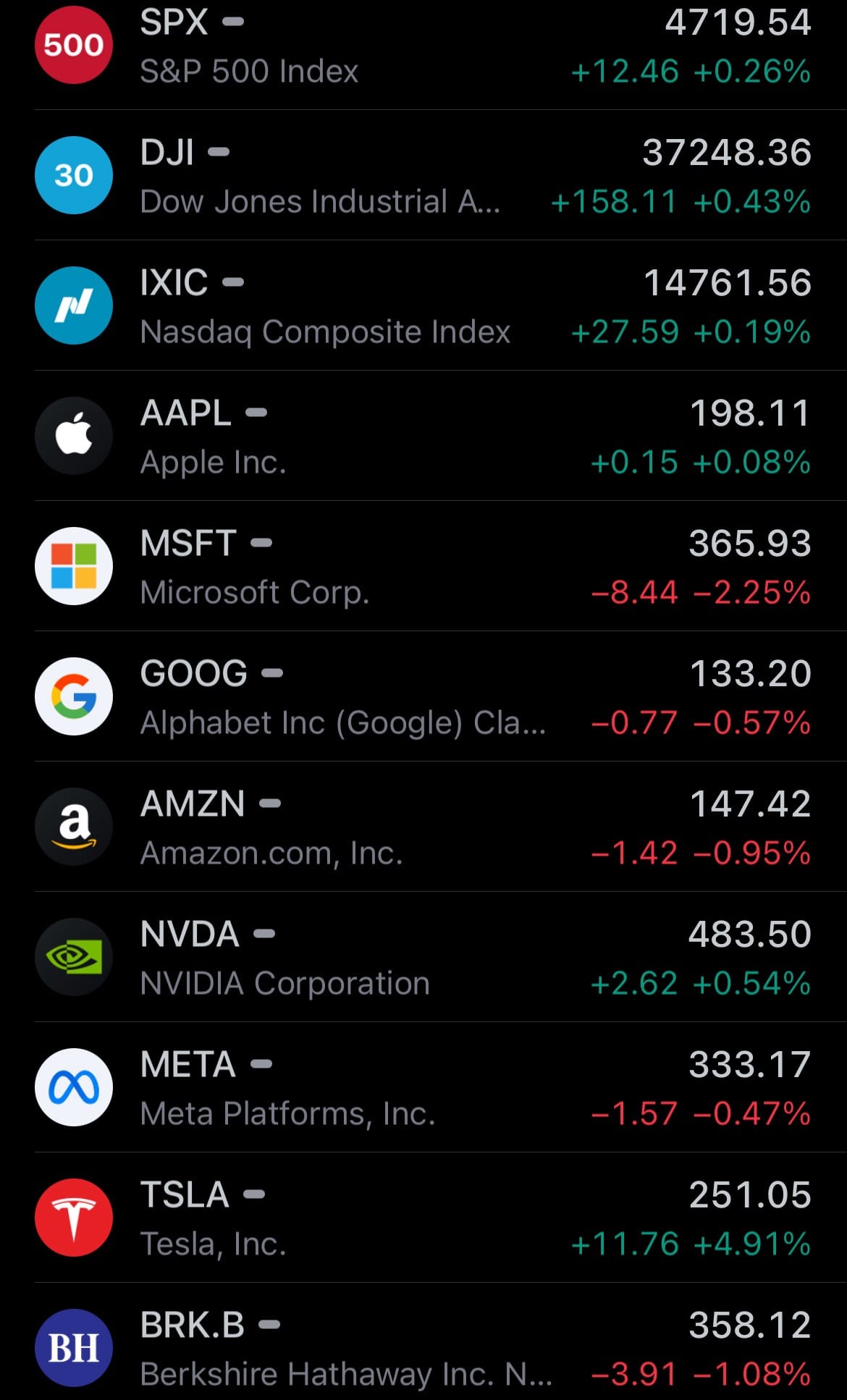

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

U.S. Military Budget:

- The U.S. House of Representatives has passed the National Defense Authorization Act (NDAA), allocating a historic $886 billion for military spending. This bipartisan decision, with a 310 to 118 vote, demonstrates strong cross-party support. The NDAA is key legislation that shapes U.S. defense policy, including troop welfare and military equipment procurement.

- This year's NDAA, a comprehensive document of nearly 3,100 pages, focuses on policies including aid to Ukraine and measures to counter China's influence in the Indo-Pacific. This aligns with the U.S.'s evolving geopolitical strategy and defense priorities.

- The passing of the NDAA for the 63rd consecutive year is significant for both the military and defense contractors like Lockheed Martin and RTX Corp. This consistent approval underscores the Act's importance in shaping U.S. defense capabilities and maintaining global military dominance.

Argentina’s Financial Reforms:

- Argentina's new President Javier Milei, addressing the country's economic crisis, has announced significant financial reforms. Economy Minister Luis Caputo declared a 50% devaluation of the Argentine peso, now 800 pesos to the U.S. dollar. This move comes as Argentina grapples with 143% annual inflation and widespread poverty.

- The reforms also include reductions in energy and transportation subsidies, though specifics were not detailed. Additionally, the government plans to halt public works projects and cut state jobs to minimize government expenditure. These austerity measures aim to address Argentina's fiscal challenges, including a substantial debt to the IMF.

Statistic:

Largest companies by market capitalization:

- 🇺🇸 Apple: $3.081T

- 🇺🇸 Microsoft: $2.719T

- 🇸🇦 Saudi Aramco: $2.122T

- 🇺🇸 Alphabet (Google): $1.657T

- 🇺🇸 Amazon: $1.523T

- 🇺🇸 NVIDIA: $1.194T

- 🇺🇸 Meta Platforms: $856.20B

- 🇺🇸 Tesla: $798.06B

- 🇺🇸 Berkshire Hathaway: $782.90B

- 🇺🇸 Eli Lilly: $544.58B

- 🇹🇼 TSMC: $536.53B

- 🇺🇸 Visa: $531.73B

- 🇺🇸 UnitedHealth: $494.13B

- 🇺🇸 JPMorgan Chase: $474.09B

- 🇺🇸 Broadcom: $456.98B

- 🇩🇰 Novo Nordisk: $437.01B

- 🇫🇷 LVMH: $410.14B

- 🇺🇸 Walmart: $409.67B

- 🇺🇸 Exxon Mobil: $405.99B

- 🇺🇸 Mastercard: $392.51B

- 🇨🇳 Tencent: $379.80B

- 🇺🇸 Johnson & Johnson: $377.63B

- 🇰🇷 Samsung: $376.39B

- 🇺🇸 Home Depot: $350.14B

- 🇺🇸 Procter & Gamble: $340.94B

- 🇨🇭 Nestlé: $301.02B

- 🇳🇱 ASML: $297.40B

- 🇨🇳 Kweichow Moutai: $289.10B

- 🇺🇸 Chevron: $283.03B

- 🇺🇸 Costco: $279.95B

- 🇺🇸 Oracle: $275.74B

- 🇺🇸 AbbVie: $273.44B

- 🇺🇸 Bank of America: $268.59B

- 🇺🇸 Merck: $268.30B

- 🇺🇸 Adobe: $266.18B

- 🇫🇷 L'Oréal: $260.77B

- 🇺🇸 Coca-Cola: $255.25B

- 🇺🇸 Salesforce: $248.97B

- 🇯🇵 Toyota: $247.53B

- 🇦🇪 International Holding Company: $238.62B

- 🇫🇷 Hermès: $232.25B

- 🇺🇸 Pepsico: $231.32B

- 🇨🇭 Roche: $228.87B

- 🇺🇸 AMD: $222.93B

- 🇨🇳 ICBC: $220.82B

- 🇮🇪 Accenture: $215.27B

- 🇬🇧 Shell: $214.34B

- 🇺🇸 McDonald: $210.36B

- 🇬🇧 AstraZeneca: $205.67B

- 🇺🇸 Netflix: $205.63B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news