Friday☕️

Trending:

- U.S. Mexican Border Crossings

- Chuck E. Cheese Acquisition

Markets:

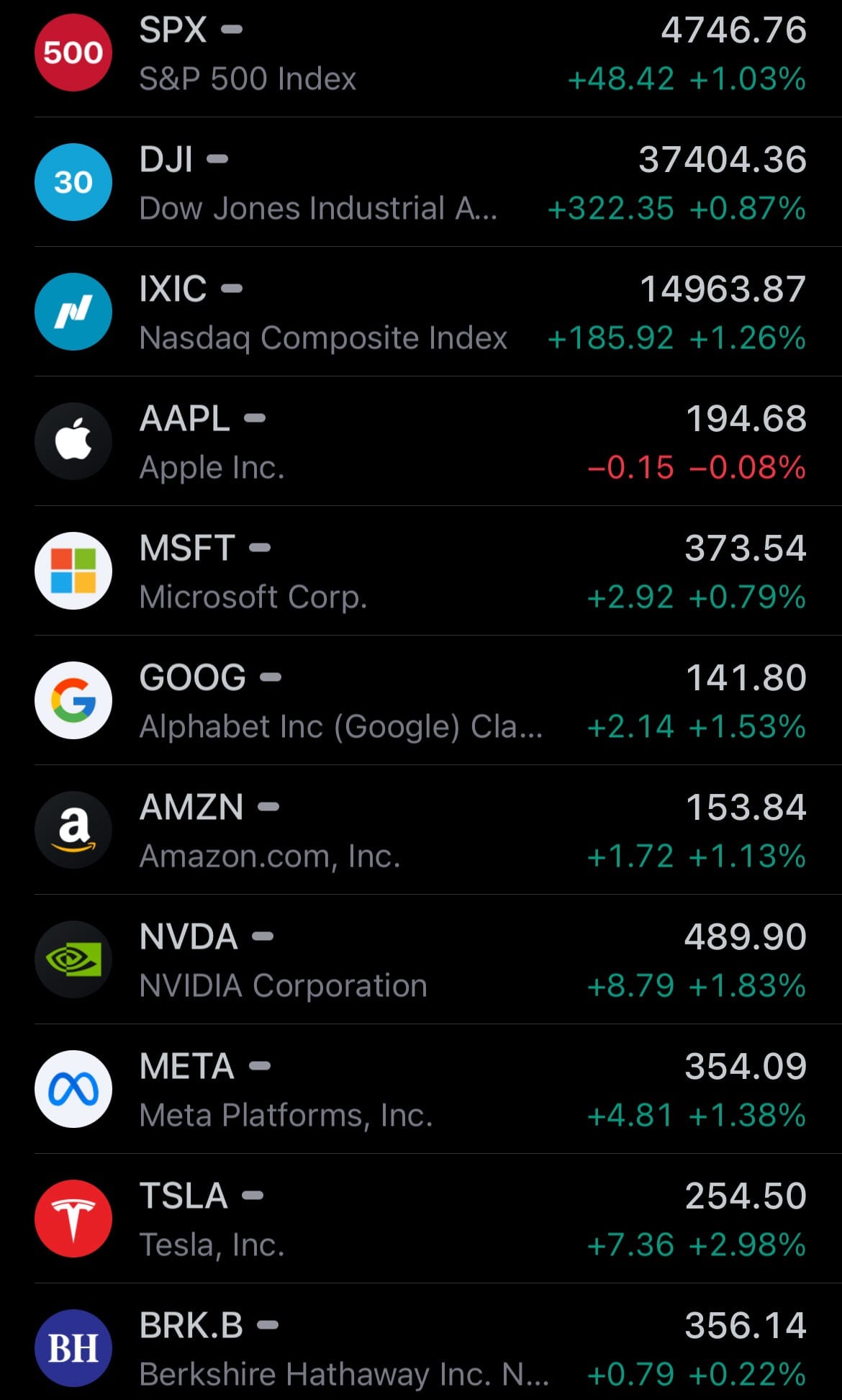

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

U.S. Mexican Border Crossings:

- On Monday, U.S. Customs and Border Protection (CBP) officers faced an unprecedented number of migrants at the U.S.-Mexico border, with encounters reaching 12,600. This figure sets a new record for daily migrant encounters. Contrary to the usual decrease in migration during the colder months of November and December, there has been a notable surge in recent weeks. The record-breaking encounters on Monday reflect this trend.

- The surge has particularly impacted Eagle Pass, Texas, leading to partial closures of the border in an attempt to manage the situation. This increase in migrant encounters is posing significant challenges for border authorities. The fiscal year 2023, spanning from October 2022 to September 2023, has already seen CBP officials encounter a staggering 2.48 million migrants at the southern border, marking a significant increase in migration patterns.

Chuck E. Cheese Acquisition:

- Chuck E. Cheese, a popular entertainment chain, is exploring potential acquisition opportunities that could value the company at over $1 billion. Three years after successfully navigating Chapter 11 bankruptcy, the company, owned by CEC Entertainment, is said to be working with Goldman Sachs to prepare for this significant financial move.

- The aim is to make the company attractive to potential buyers, which could include private equity firms and other entertainment businesses like Dave & Busters. According to sources, Chuck E. Cheese is on track to achieve $1.2 billion in revenue and $195 million in EBITDA. Currently, Chuck E. Cheese operates 557 locations across 47 U.S. states and 10 countries.

- This potential acquisition marks a significant turnaround from 2014, when Apollo Global Management acquired the chain for $1.3 billion, and from 2020, when Chuck E. Cheese emerged from bankruptcy after clearing $705 million of debt. The chain's CEO, David McKillips, has expressed enthusiasm about continuing to provide entertainment and dining experiences to families globally.

Statistic:

Top 50 semiconductor companies by market capitalization:

- 🇺🇸 NVIDIA - $1.210T

- 🇹🇼 TSMC - $531.86B

- 🇺🇸 Broadcom - $465.57B

- 🇰🇷 Samsung - $387.43B

- 🇳🇱 ASML - $301.95B

- 🇺🇸 AMD - $226.02B

- 🇺🇸 Intel - $198.48B

- 🇺🇸 QUALCOMM - $158.53B

- 🇺🇸 Texas Instruments - $151.49B

- 🇺🇸 Applied Materials - $134.12B

- 🇺🇸 Lam Research - $102.39B

- 🇺🇸 Analog Devices - $97.40B

- 🇺🇸 Micron Technology - $94.34B

- 🇺🇸 Synopsys - $85.10B

- 🇯🇵 Tokyo Electron - $80.37B

- 🇺🇸 KLA - $78.90B

- 🇰🇷 SK Hynix - $76.68B

- 🇬🇧 Arm Holdings - $72.99B

- 🇳🇱 NXP Semiconductors - $59.09B

- 🇩🇪 Infineon - $54.30B

- 🇺🇸 Marvell Technology Group - $52.08B

- 🇹🇼 MediaTek - $49.79B

- 🇺🇸 Microchip Technology - $48.62B

- 🇨🇭 STMicroelectronics - $46.25B

- 🇺🇸 ON Semiconductor - $36.02B

- 🇺🇸 GlobalFoundries - $33.08B

- 🇯🇵 Renesas Electronics - $30.79B

- 🇨🇳 SMIC - $30.75B

- 🇺🇸 Monolithic Power Systems - $29.78B

- 🇳🇱 ASM International - $25.79B

- 🇯🇵 Disco Corp. - $25.25B

- 🇯🇵 Advantest - $25.22B

- 🇯🇵 Lasertec - $22.43B

- 🇹🇼 United Microelectronics - $20.16B

- 🇹🇼 ASE Group - $19.55B

- 🇺🇸 Entegris - $17.96B

- 🇺🇸 Skyworks Solutions - $17.94B

- 🇨🇳 AMEC - $13.44B

- 🇳🇱 BE Semiconductor - $11.71B

- 🇺🇸 Qorvo - $10.82B

- 🇺🇸 Lattice Semiconductor - $9.72B

- 🇹🇼 Novatek Microelectronics - $9.64B

- 🇹🇼 GlobalWafers - $8.58B

- 🇹🇼 Alchip Technologies - $7.93B

- 🇺🇸 Onto Innovation - $7.56B

- 🇹🇼 Realtek - $7.54B

- 🇯🇵 Rohm - $7.51B

- 🇹🇼 Nanya Technology - $7.48B

- 🇹🇼 Global Unichip Corp. - $7.28B

- 🇺🇸 MACOM - $6.76B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news