Friday☕️

Trending:

- U.S. Missile Tests

- Hertz Sells EV’s

Markets:

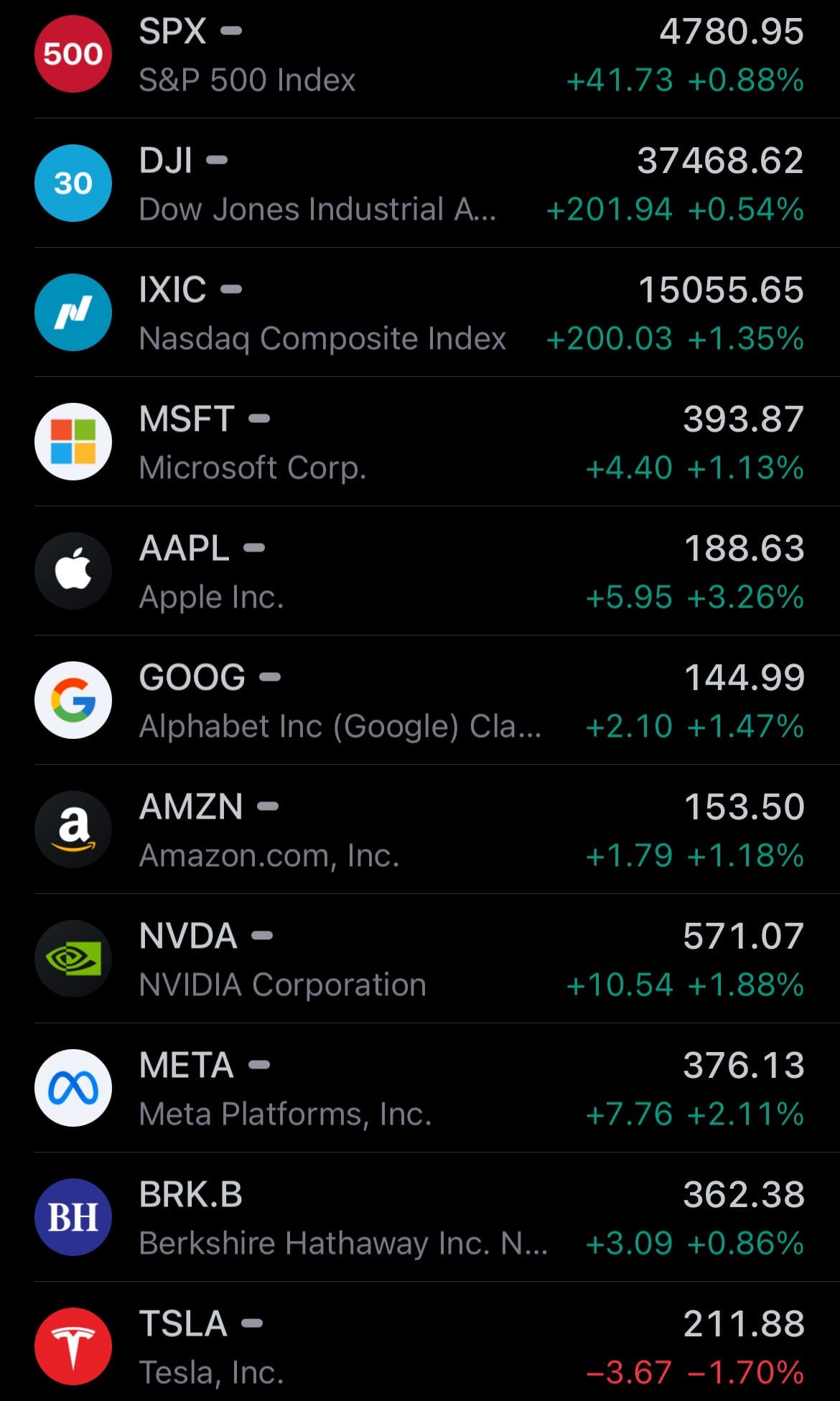

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

U.S. Missile Tests:

- Lockheed Martin is gearing up for a crucial test in the spring, aiming to integrate the U.S. Military's advanced Patriot missile variant, PAC-3 MSE, with the U.S. Navy’s Aegis Combat System. Tom Copeman, the company’s Vice President of Naval Systems, revealed that approximately $100 million has been spent on this project. The PAC-3 MSE missile, currently in production in Camden, Arkansas, is expected to ramp up to 550 units per year.

- This integration is part of an effort to replenish the U.S. missile stockpile and enhance the Navy's capability against advanced threats, particularly in the maritime domain. Lockheed's efforts have extended beyond the land-based Aegis Ashore system, focusing on integrating the PAC-3 MSE with the Aegis ships. In summer 2023, Lockheed successfully tested the missile's compatibility with the Aegis SPY-1 radar, a critical component of the Aegis Combat System found on nearly 100 cruisers and destroyers.

- The upcoming spring test, using a ground-based vertical launch system, aims to demonstrate this integration with the complete Aegis system. The success of this test could pave the way for further operational deployment on Navy ships, pending additional funding from the Department of Defense. The Aegis Combat System, used by the U.S. Navy, is a sophisticated collection of radar systems, computers, and missiles.

- It's designed to track and guide weapons to destroy enemy targets. The system is renowned for its capability to defend against a wide range of threats in the air, on the water, and underwater, including enemy aircraft, cruise missiles, and ballistic missiles. Integrating the PAC-3 MSE into this system represents a significant enhancement in the Navy's defensive capabilities, allowing for a more comprehensive approach to maritime security and defense.

Hertz Sells EV’s:

- Hertz, a prominent rental car company, has initiated the sale of one third of its electric vehicle (EV) fleet, which totals around 20,000 vehicles globally. This move is part of the company's strategy to fund the acquisition of new internal combustion engine vehicles, for which demand continues to be strong. Originally, Hertz had set a goal to transition 25% of its fleet to electric vehicles by the end of 2024. However, the company has now indicated that its expansion into EVs will proceed at a slower pace than initially planned.

- The decision to scale back on EVs and refocus on internal combustion engine vehicles is influenced by several factors. One significant consideration is the higher damage costs associated with electric vehicles compared to traditional cars. This financial aspect has led Hertz to reassess its approach to incorporating EVs into its fleet. As a result, the company is adjusting its strategy to better align with current market demands and operational costs.

Statistic:

- Largest companies by market capitalization:

- 🇺🇸 Microsoft: $2.927T

- 🇺🇸 Apple: $2.916T

- 🇸🇦 Saudi Aramco: $2.058T

- 🇺🇸 Alphabet (Google): $1.804T

- 🇺🇸 Amazon: $1.586T

- 🇺🇸 NVIDIA: $1.410T

- 🇺🇸 Meta Platforms: $966.60B

- 🇺🇸 Berkshire Hathaway: $788.55B

- 🇺🇸 Tesla: $673.54B

- 🇺🇸 Eli Lilly: $591.75B

- 🇹🇼 TSMC: $586.21B

- 🇺🇸 Visa: $551.07B

- 🇺🇸 Broadcom: $535.51B

- 🇺🇸 JPMorgan Chase: $481.61B

- 🇩🇰 Novo Nordisk: $479.99B

- 🇺🇸 UnitedHealth: $477.57B

- 🇺🇸 Walmart: $439.47B

- 🇺🇸 Mastercard: $403.91B

- 🇺🇸 Johnson & Johnson: $388.07B

- 🇺🇸 Exxon Mobil: $386.88B

- 🇫🇷 LVMH: $371.15B

- 🇰🇷 Samsung: $367.34B

- 🇺🇸 Home Depot: $356.20B

- 🇺🇸 Procter & Gamble: $349.14B

- 🇨🇳 Tencent: $334.86B

- 🇺🇸 Costco: $304.97B

- 🇺🇸 Merck: $300.38B

- 🇨🇭 Nestlé: $299.97B

- 🇺🇸 Oracle: $299.20B

- 🇳🇱 ASML: $294.46B

- 🇺🇸 AbbVie: $288.31B

- 🇨🇳 Kweichow Moutai: $281.22B

- 🇺🇸 Adobe: $271.02B

- 🇯🇵 Toyota: $269.82B

- 🇺🇸 Chevron: $267.72B

- 🇺🇸 Salesforce: $265.67B

- 🇺🇸 AMD: $262.79B

- 🇺🇸 Coca-Cola: $260.09B

- 🇺🇸 Bank of America: $250.52B

- 🇫🇷 L'Oréal: $249.60B

- 🇦🇪 International Holding Company: $243.09B

- 🇺🇸 Pepsico: $229.83B

- 🇨🇭 Roche: $228.59B

- 🇮🇪 Accenture: $225.43B

- 🇨🇭 Novartis: $222.93B

- 🇨🇳 ICBC: $222.93B

- 🇮🇳 Reliance Industries: $222.65B

- 🇺🇸 McDonald: $213.51B

- 🇺🇸 Netflix: $212.41B

- 🇫🇷 Hermès: $211.70B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news