Friday☕️

Trending:

- Boeing Senate Hearing

- Netflix Earnings

Markets:

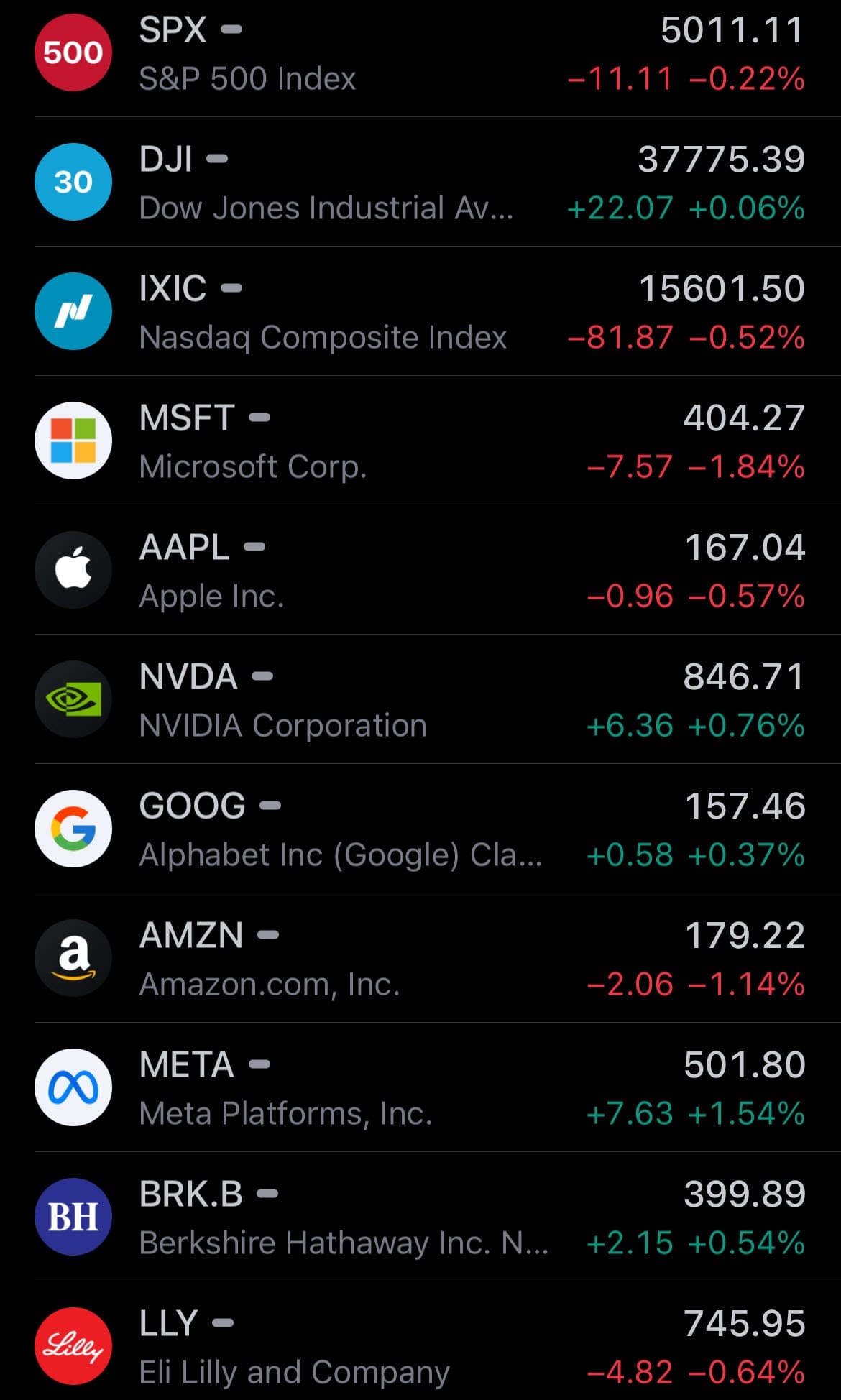

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Boeing Senate Hearing:

- During a Senate hearing on Wednesday, Boeing quality engineer Sam Salehpour testified that he experienced retaliation from Boeing for raising safety concerns. Over three years, Salehpour reported that his safety warnings were dismissed, and he was even told to remain silent to avoid causing delays. He also alleged receiving a physical threat from his boss, who reportedly said he would have killed someone expressing such concerns in a meeting.

- Boeing, however, has consistently denied such accusations, asserting that retaliation against employees is strictly prohibited. This testimony coincides with significant changes in Boeing’s leadership, prompted by ongoing safety issues. CEO Dave Calhoun announced he will resign by the end of 2024 but will continue to lead the company through its current challenges. Stan Deal, the head of Boeing Commercial Airplanes, has already retired, and board chair Larry Kellner will not seek reelection, with former Qualcomm CEO Steve Mollenkopf poised to succeed him.

- These changes follow a string of safety incidents, including a January event where a door panel fell off a Boeing 737 Max during an Alaska Airlines flight. Additionally, the recent death of John Barnett, a former Boeing inspector who had expressed concerns about potential catastrophic safety defects, adds to the challenges facing the company as it navigates this situation.

Netflix Earnings:

- Netflix announced its first-quarter results on Thursday, surpassing expectations with significant subscriber growth. In the first quarter, Netflix achieved earnings of $5.28 per share with a revenue of $9.37 billion, exceeding the anticipated figures of $4.51 per share on $9.27 billion in revenue. This performance was bolstered by a substantial increase in subscribers, with 9.33 million new users joining, far above the expected 4.8 million.

- Despite this success, Netflix's stock dropped nearly 4% in after-hours trading following the announcement. The company attributes this growth to its ad-tier streaming service, which saw a 65% increase in membership quarter-over-quarter, highlighting strides in expanding its advertising revenue. For the upcoming quarter, Netflix predicts earnings per share of $4.68 on revenues of $9.49 billion, slightly below Wall Street's revenue expectations of $9.5 billion.

- However, it anticipates a slowdown in net subscriber additions due to typical seasonal trends, projecting a decrease from the first quarter. Despite this, Netflix expects a year-over-year increase in average revenue per membership for Q2. Looking ahead, Netflix forecasts a 13% to 15% revenue growth and aims to improve its operating margin to 25%, up from the previously forecasted 24%.

Statistic:

- Largest semiconductor companies by market capitalization:

- 🇺🇸 NVIDIA: $2.116T

- 🇹🇼 TSMC: $686.08B

- 🇺🇸 Broadcom: $583.44B

- 🇰🇷 Samsung: $373.08B

- 🇳🇱 ASML: $357.59B

- 🇺🇸 AMD: $250.63B

- 🇺🇸 QUALCOMM: $180.16B

- 🇺🇸 Applied Materials: $161.45B

- 🇺🇸 Intel: $149.16B

- 🇺🇸 Texas Instruments: $148.94B

- 🇺🇸 Micron Technology: $123.94B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news