Friday☕️

Trending:

- Ethereum ETF Approval

- OpenAI News Corp Partnership

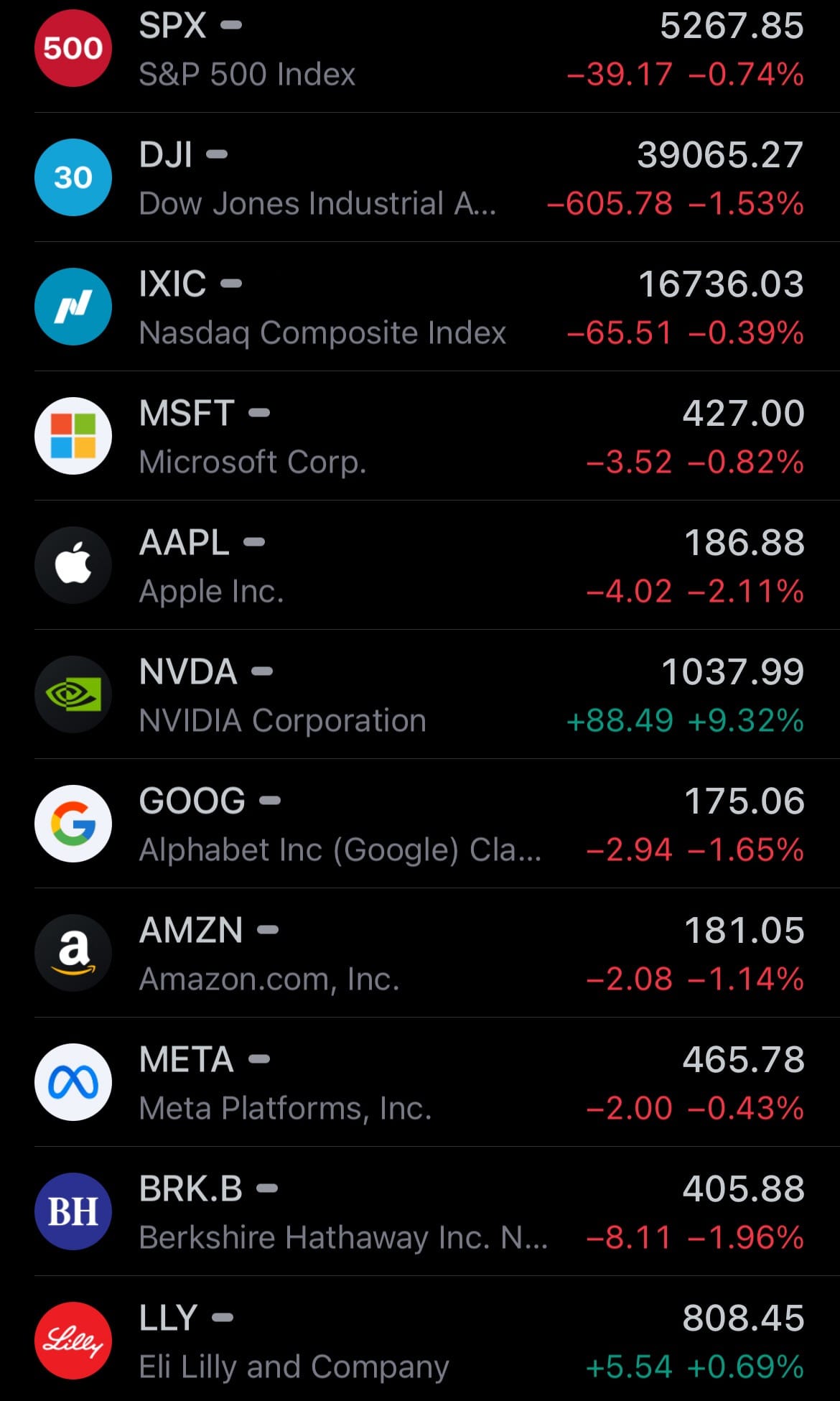

Markets:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Ethereum ETF Approval:

- The U.S. Securities and Exchange Commission (SEC) has recently approved eight spot Ethereum ETFs, marking a significant shift in its stance. The approvals include ETFs from major financial firms such as BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton. Although the SEC has approved the 19b-4 forms for these ETFs, the issuers still await the effectiveness of their S-1 registration statements before they can commence trading.

- This approval process seemed unlikely until earlier this week, as there had been minimal engagement between the SEC and the ETF issuers. However, the situation rapidly changed when the SEC requested the 19b-4 forms be expedited, catching some within the SEC off guard and leading to speculation about the sudden change. Some insiders suggest the shift was politically motivated, citing recent bipartisan calls from House lawmakers for the SEC to approve these ETFs.

- While the forms have been approved, the timeline for when the S-1 registration statements will become effective remains uncertain. Conversations between the SEC and issuers about the S-1 forms have only just begun. According to Bloomberg ETF analyst James Seyffart, while the process could be expedited to a couple of weeks with significant effort, historically, it has taken three months or more.

OpenAI News Corp Partnership:

- News Corp and OpenAI unveiled a multi-year partnership that grants OpenAI access to an extensive array of News Corp’s news content. This collaboration aims to enrich OpenAI's responses to user inquiries by integrating content from notable News Corp publications such as The Wall Street Journal, The Times, The Australian, and several others, spanning both current and archived material. Notably, the agreement is exclusive to News Corp's news outlets and does not extend to its other business units.

- The deal also includes a commitment from News Corp to provide OpenAI with journalistic expertise, ensuring that the highest standards of journalism are maintained within OpenAI’s offerings. The partnership between News Corp and OpenAI underscores the significant value of integrating reputable news sources into AI models, enhancing their ability to deliver accurate and insightful information.

Statistic:

- Largest assets by market cap:

- Gold: $15.650T

- 🇺🇸 Microsoft: $3.199T

- 🇺🇸 Apple: $2.927T

- 🇺🇸 NVIDIA: $2.553T

- 🇺🇸 Alphabet (Google): $2.188T

- 🇸🇦 Saudi Aramco: $1.940T

- 🇺🇸 Amazon: $1.905T

- Silver: $1.718T

- Bitcoin: $1.335T

- 🇺🇸 Meta Platforms: $1.186T

- 🇺🇸 Berkshire Hathaway: $894.54B

- 🇹🇼 TSMC: $814.78B

- 🇺🇸 Eli Lilly: $768.35B

- 🇺🇸 Broadcom: $645.67B

- 🇩🇰 Novo Nordisk: $603.91B

- 🇺🇸 Tesla: $574.40B

- 🇺🇸 JPMorgan Chase: $569.48B

- 🇺🇸 Visa: $563.86B

- 🇺🇸 Walmart: $525.90B

- 🇺🇸 Exxon Mobil: $518.03B

- SPDR S&P 500 ETF Trust: $482.71B

- 🇺🇸 UnitedHealth: $479.84B

- 🇨🇳 Tencent: $463.51B

- Ethereum: $456.58B

- 🇺🇸 Mastercard: $424.38B

- 🇫🇷 LVMH: $406.64B

- 🇺🇸 Procter & Gamble: $396.05B

- 🇰🇷 Samsung: $371.24B

- 🇺🇸 Johnson & Johnson: $369.42B

- 🇳🇱 ASML: $368.64B

- 🇺🇸 Costco: $355.62B

- 🇺🇸 Oracle: $342.46B

- 🇺🇸 Merck: $332.05B

- 🇺🇸 Home Depot: $327.81B

- 🇺🇸 Bank of America: $310.93B

- 🇯🇵 Toyota: $292.01B

- 🇨🇳 Kweichow Moutai: $291.76B

- 🇺🇸 Chevron: $290.39B

- 🇺🇸 AbbVie: $281.84B

- 🇺🇸 Netflix: $275.97B

- 🇺🇸 Salesforce: $275.66B

- 🇺🇸 Coca-Cola: $271.40B

- Platinum: $269.65B

- 🇫🇷 L'Oréal: $263.41B

- 🇺🇸 Netflix: $263.07B

- 🇺🇸 AMD: $262.84B

- 🇫🇷 Hermès: $259.72B

- 🇨🇳 ICBC: $253.01B

- 🇺🇸 PepsiCo: $251.73B

- 🇨🇳 PetroChina: $242.15B

- 🇬🇧 AstraZeneca: $238.86B

- 🇦🇪 International Holding Company: $238.59B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news