Friday☕️

Trending:

- CENTCOM Activity

- Chinese Commodity Imports

Markets:

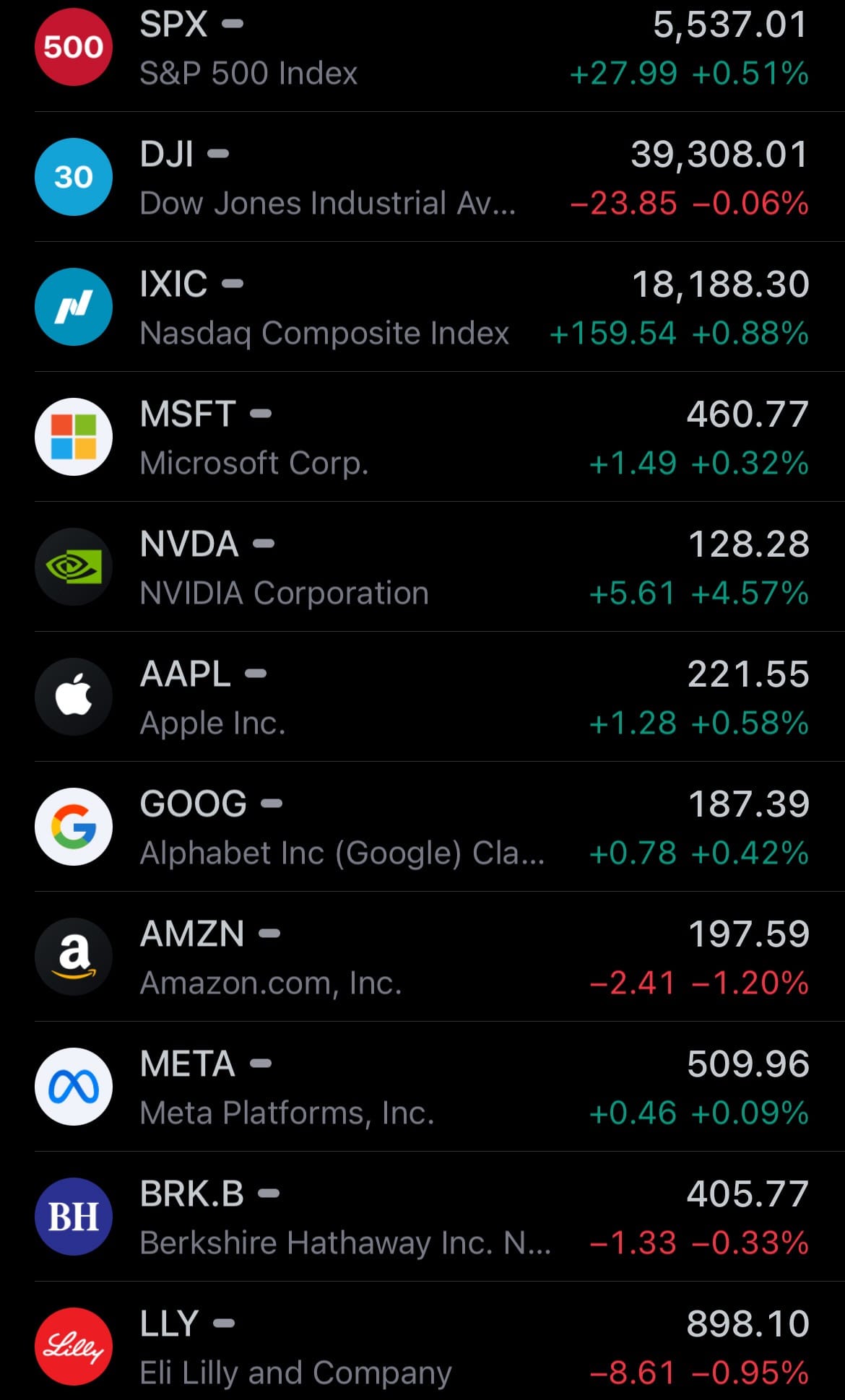

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

CENTCOM Activity:

- Over the past 24 hours, U.S. Central Command forces successfully neutralized two Iranian-backed Houthi radar sites in Houthi-controlled areas of Yemen and two uncrewed surface vessels (USVs) in the Red Sea. These radar sites and USVs were identified as posing imminent threats to U.S., coalition forces, and merchant vessels operating in the region. This proactive action was aimed at ensuring the safety and security of international waters and protecting freedom of navigation.

- In the subsequent 24-hour period, U.S. Central Command (USCENTCOM) forces destroyed two more Iranian-backed Houthi uncrewed surface vessels (USVs) in the Red Sea and one additional Houthi radar site in Yemen. The USVs and radar site were similarly assessed as imminent threats to U.S. and coalition forces, as well as merchant vessels. These defensive measures were undertaken to enhance the security of international waters and safeguard navigation routes.

- The significance of these actions lies in their impact on maintaining regional stability and ensuring the free flow of maritime traffic. By eliminating these threats, USCENTCOM helps to prevent potential disruptions to international shipping routes, which are vital for global trade. These measures also demonstrate the U.S. commitment to protecting its interests and those of its allies in a volatile region.

Chinese Commodity Imports:

- China's demand for commodities remains strong despite its economic slowdown and property slump, driven by geopolitical factors and a push for self-reliance. Increased U.S.-China tensions and the impact of Russia’s war in Ukraine have boosted China’s commodity imports to record levels, with the iShare S&P GSCI Commodity-Indexed Trust (GSG) rising 15%.

- China now consumes 40% of the world's commodities, up from 20% in 2006. In 2023, imports of iron ore, agricultural products, and metals grew by 16%, with an additional 6% increase in early 2024. While China is rich in coal and rare earth elements, it lacks sufficient fresh water and arable land. This scarcity has driven efforts to improve domestic resource efficiency and secure resources from abroad.

- Heavily reliant on imports for critical resources like 70% of its crude oil and 40% of its natural gas, China faces vulnerability due to its dependence on sensitive maritime routes such as the Strait of Malacca. In response to global sanctions and export restrictions, China is diversifying its supply chains by investing in genetically modified crops, acquiring land overseas, and establishing new trade routes with Russia and Central Asia. These strategies aim to reduce dependency on maritime routes and ensure resource stability amid geopolitical tensions.

- China's strategic shift towards securing and diversifying its resource supply chains means it is taking significant steps to ensure long-term stability and self-reliance. By investing in domestic resource efficiency, acquiring foreign land, and creating overland trade routes with countries like Russia and Central Asia, China aims to reduce its vulnerability to geopolitical disruptions. This approach not only safeguards its economic interests but also helps stabilize global commodity markets, as China's consistent demand can act as a buffer against price fluctuations. As a result, China’s actions will likely continue to have a profound impact on global trade dynamics and resource distribution.

Statistic:

- Largest banks and bank holding companies by market capitalization:

- 🇺🇸 JPMorgan Chase - $599.28B

- 🇺🇸 Bank of America - $319.85B

- 🇨🇳 ICBC - $271.32B

- 🇺🇸 Wells Fargo - $211.48B

- 🇨🇳 Agricultural Bank of China - $209.91B

- 🇨🇳 China Construction Bank - $178.43B

- 🇨🇳 Bank of China - $176.03B

- 🇮🇳 HDFC Bank - $169.00B

- 🇬🇧 HSBC - $163.04B

- 🇺🇸 Morgan Stanley - $162.84B

- 🇨🇦 Royal Bank Of Canada - $154.37B

- 🇺🇸 Goldman Sachs - $150.88B

- 🇦🇺 Commonwealth Bank - $143.35B

- 🇺🇸 Charles Schwab - $135.52B

- 🇯🇵 Mitsubishi UFJ Financial - $130.46B

- 🇺🇸 Citigroup - $122.95B

- 🇨🇳 CM Bank - $116.32B

- 🇮🇳 ICICI Bank - $101.48B

- 🇨🇦 Toronto Dominion Bank - $97.99B

- 🇨🇭 UBS - $97.28B

- 🇮🇳 State Bank of India - $89.80B

- 🇯🇵 Sumitomo Mitsui Financial Group - $89.54B

- 🇸🇦 Al Rajhi Bank - $84.94B

- 🇷🇺 Sberbank - $79.41B

- 🇸🇬 DBS Group - $79.35B

- 🇫🇷 BNP Paribas - $78.17B

- 🇮🇩 Bank Central Asia - $75.32B

- 🇦🇺 National Australia Bank - $73.76B

- 🇪🇸 Santander - $73.56B

- 🇮🇹 Intesa Sanpaolo - $69.91B

- 🇨🇳 Bank of Communications - $66.32B

- 🇨🇳 Postal Savings Bank of China - $65.92B

- 🇮🇹 UniCredit - $64.90B

- 🇦🇺 Westpac Banking - $63.46B

- 🇺🇸 PNC Financial Services - $62.78B

- 🇨🇦 Bank of Montreal - $61.96B

- 🇺🇸 U.S. Bancorp - $61.65B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria - $59.70B

- 🇧🇷 Nu Holdings - $59.42B

- 🇧🇷 Itaú Unibanco - $58.75B

- 🇦🇺 ANZ Bank - $57.77B

- 🇳🇱 ING - $57.56B

- 🇸🇦 The Saudi National Bank - $56.46B

- 🇨🇦 Scotiabank - $55.95B

- 🇯🇵 Mizuho Financial Group - $54.74B

- 🇦🇺 Macquarie - $53.06B

- 🇺🇸 Capital One - $52.86B

- 🇺🇸 Truist Financial - $52.01B

- 🇸🇬 OCBC Bank - $49.95B

- 🇨🇳 Industrial Bank - $49.14B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news