Monday☕️

Trending:

- Yesterday, January 26, 2025, a diplomatic dispute occurred between the Trump administration and Colombian President Gustavo Petro concerning the deportation of Colombian nationals. Colombia initially denied landing rights to two U.S. military aircraft transporting 80 deported Colombians, citing concerns over their treatment and proposing alternative arrangements. In response, the Trump administration swiftly imposed a 25% tariff on all Colombian imports, with a warning to escalate it to 50% within a week if Colombia did not comply.

- Additional measures included travel bans and visa revocations for Colombian government officials, as well as enhanced customs inspections on Colombian goods. Facing significant economic pressure, Colombia reversed its decision within hours, agreeing to accept the deportees and utilizing the presidential plane to facilitate their return. This incident underscores the substantial economic leverage the U.S. wields, demonstrating its readiness to employ such measures to achieve policy objectives.

Economics & Markets:

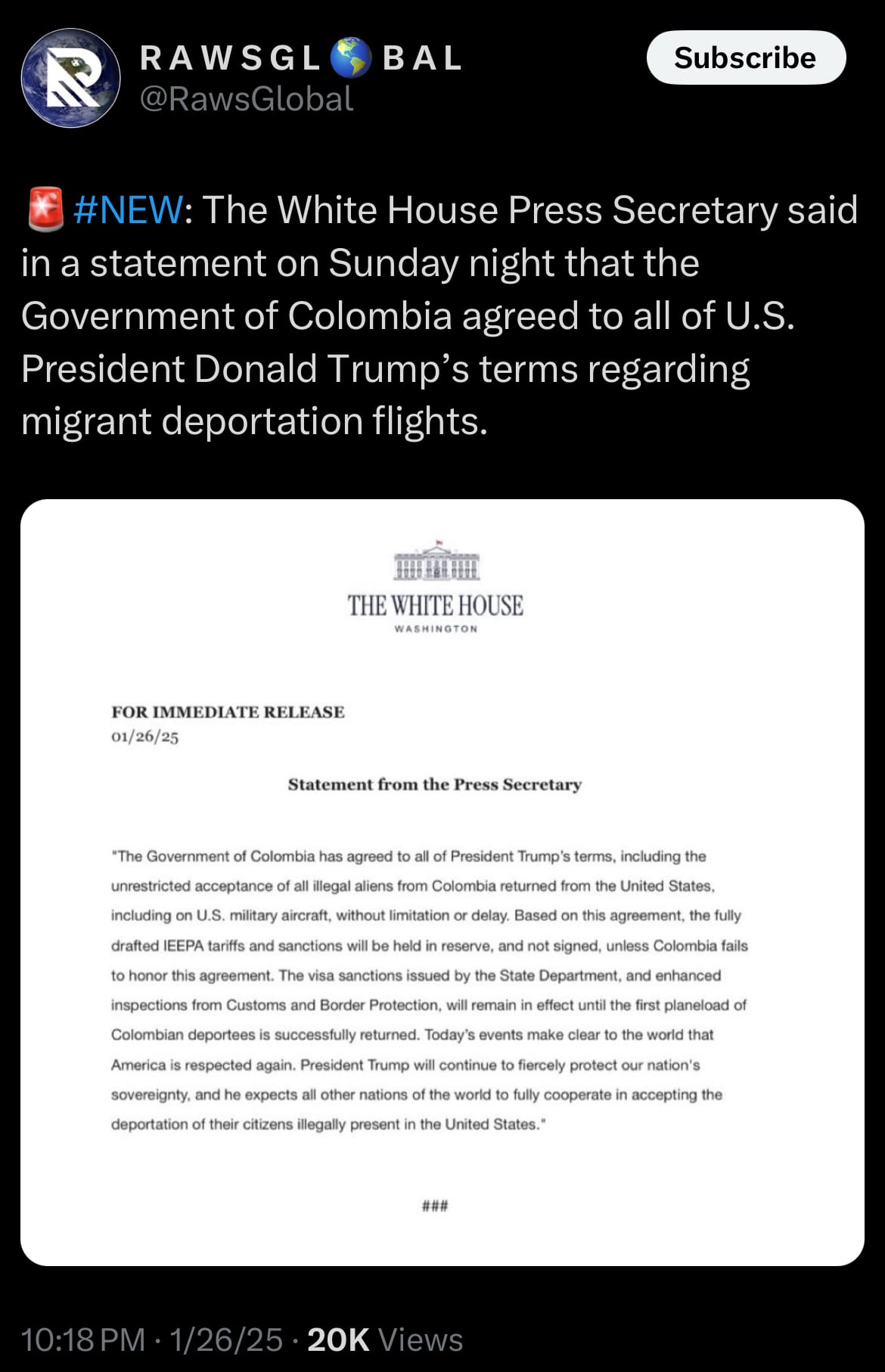

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- Yesterday, January 26, 2025, the United States announced that the ceasefire agreement between Lebanon and Israel will stay in place until February 18, 2025. This extension comes as Israel decided to keep its military forces in southern Lebanon longer than planned, saying that the Lebanese army hasn't fully taken control of the area to stop Hezbollah from coming back.

- The U.S. is urging both sides to stick to the agreement and is working on negotiations to return Lebanese prisoners. While the ceasefire is holding, tensions remain high, with a recent incident where Israeli forces fired on protesters in southern Lebanon, causing casualties. The U.S. and other nations are keeping a close watch, calling for calm and cooperation to maintain stability in the region.

Environment & Weather:

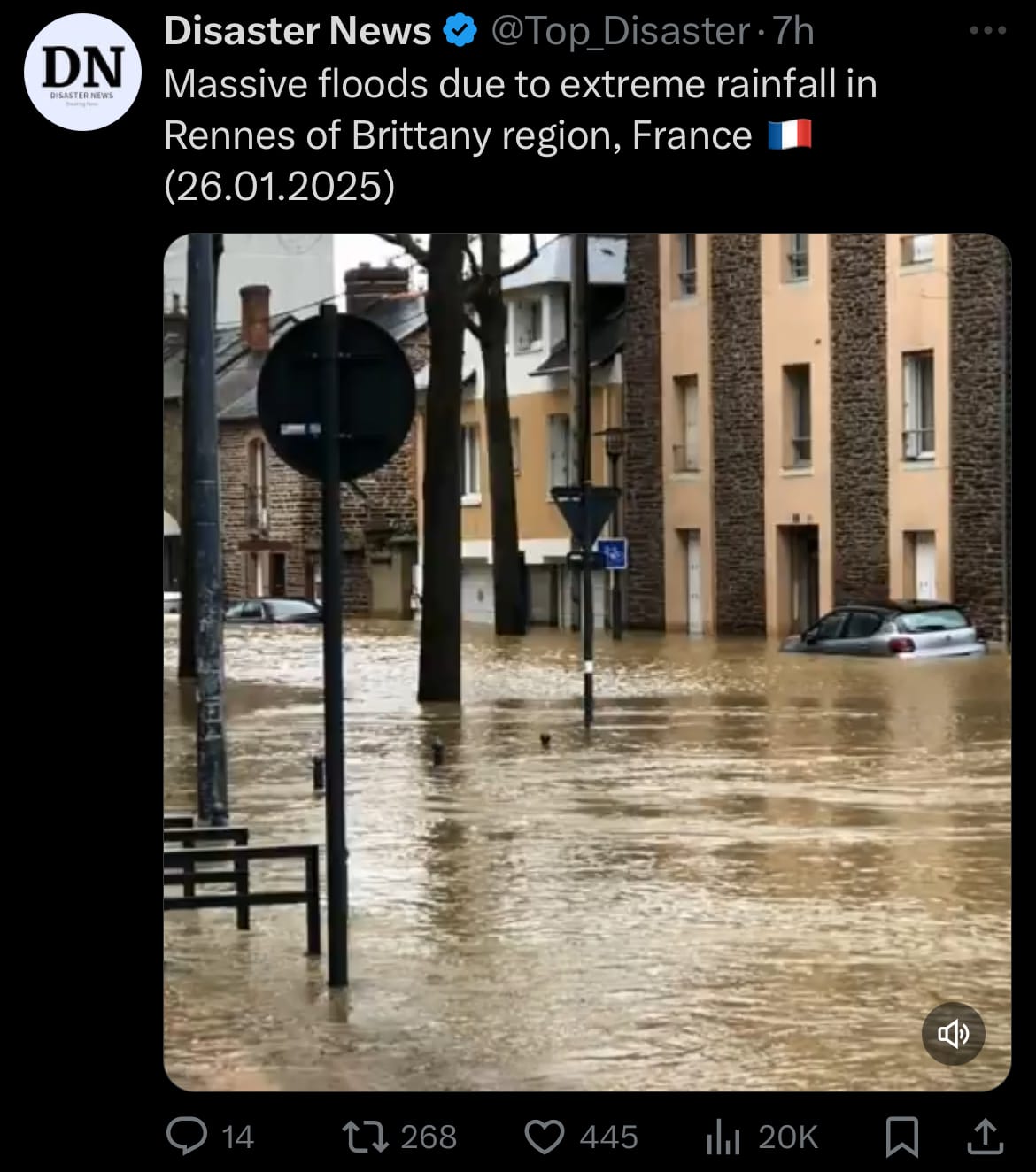

- Severe flooding is currently affecting parts of France due to heavy rainfall brought by Storm Herminia. The regions of Normandy and Brittany have been hit the hardest, with rivers and canals overflowing, leading to road closures and evacuations. In Rennes, water levels have risen up to a meter in some areas, marking the worst flooding the city has experienced in 40 years.

- Many families have been forced to leave their homes as ground floors become submerged. Emergency services are on the ground, assisting with evacuations and taking steps to reduce damage, while weather officials warn of more rain and possible further flooding in the days ahead. Residents are advised to stay informed and follow local safety updates.

Privacy & Security:

- In January 2025, UnitedHealth Group disclosed that 190 million people were impacted by the 2024 data breach involving its subsidiary, Change Healthcare. This ransomware attack, attributed to the ALPHV/BlackCat group, exploited weak credentials and the absence of multifactor authentication. It resulted in the exposure of sensitive data, including health insurance member IDs, patient diagnoses, treatment details, Social Security numbers, and financial information. The breach is now regarded as the largest healthcare data breach in U.S. history.

- UnitedHealth‘s handling of the breach has drawn scrutiny due to the staggered release of information. In April 2024, the company acknowledged the breach but withheld specific figures, describing it as affecting a significant portion of Americans. By October 2024, the affected number was updated to over 100 million, and in January 2025, the final total was revealed to be 190 million. This breach underscores the rising threat of cyberattacks, particularly in sectors managing critical and sensitive data. While the cybersecurity industry has expanded to counter these threats, companies often rely on temporary fixes rather than implementing robust, long-term security measures, leaving systems vulnerable to increasingly sophisticated attacks.

Science & Technology:

- The DeepSeek-R1 model, developed by the Chinese AI startup DeepSeek, has recently gained significant attention for its innovative and cost-effective approach to AI training. Using reinforcement learning without supervised fine-tuning, the model achieves performance benchmarks comparable to OpenAI‘s GPT-o1 while requiring only 3% of the training cost. DeepSeek-R1 is released under the MIT open-source license, making it freely accessible for commercial and non-commercial use. This openness allows developers to adapt and improve the model, offering a significant advantage in accessibility and fostering global collaboration in AI development.

- While the model is extremely powerful, its origins in China introduce some limitations. DeepSeek-R1 has been noted to provide misinformation or biased answers regarding topics involving the Chinese Communist Party (CCP) and avoids certain politically sensitive subjects due to the nature of its training data. Despite this, it still offers powerful performance and capabilities, particularly in logical reasoning, coding, and mathematical problem-solving. Unlike GPT-o1, which remains a proprietary, closed-source model, DeepSeek-R1‘s open-source nature provides transparency and flexibility. While GPT-o1 retains superior performance in high-stakes and complex tasks, DeepSeek-R1 stands out for its cost efficiency, performance, and accessibility, showing a clear shift toward more inclusive and collaborative AI development.

Statistic:

- Largest public semiconductor companies by market capitalization:

- 🇺🇸 NVIDIA: $3.492T

- 🇹🇼 TSMC: $1.150T

- 🇺🇸 Broadcom: $1.146T

- 🇳🇱 ASML: $292.73B

- 🇰🇷 Samsung: $249.80B

- 🇺🇸 AMD: $199.34B

- 🇺🇸 QUALCOMM: $190.24B

- 🇬🇧 Arm Holdings: $170.80B

- 🇺🇸 Texas Instruments: $169.23B

- 🇺🇸 Applied Materials: $151.77B

- 🇺🇸 Micron Technology: $114.97B

- 🇺🇸 Analog Devices: $107.88B

- 🇺🇸 Marvell Technology Group: $107.31B

- 🇰🇷 SK Hynix: $106.51B

- 🇺🇸 Lam Research: $102.52B

- 🇺🇸 KLA: $100.29B

- 🇺🇸 Intel: $89.83B

- 🇺🇸 Synopsys: $84.42B

- 🇯🇵 Tokyo Electron: $79.86B

- 🇹🇼 MediaTek: $71.36B

- 🇨🇳 SMIC: $56.49B

- 🇳🇱 NXP Semiconductors: $54.24B

- 🇯🇵 Advantest: $47.40B

- 🇩🇪 Infineon: $46.39B

- 🇺🇸 Monolithic Power Systems: $33.09B

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

Click image to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news