Monday☕️

Economics & Markets:

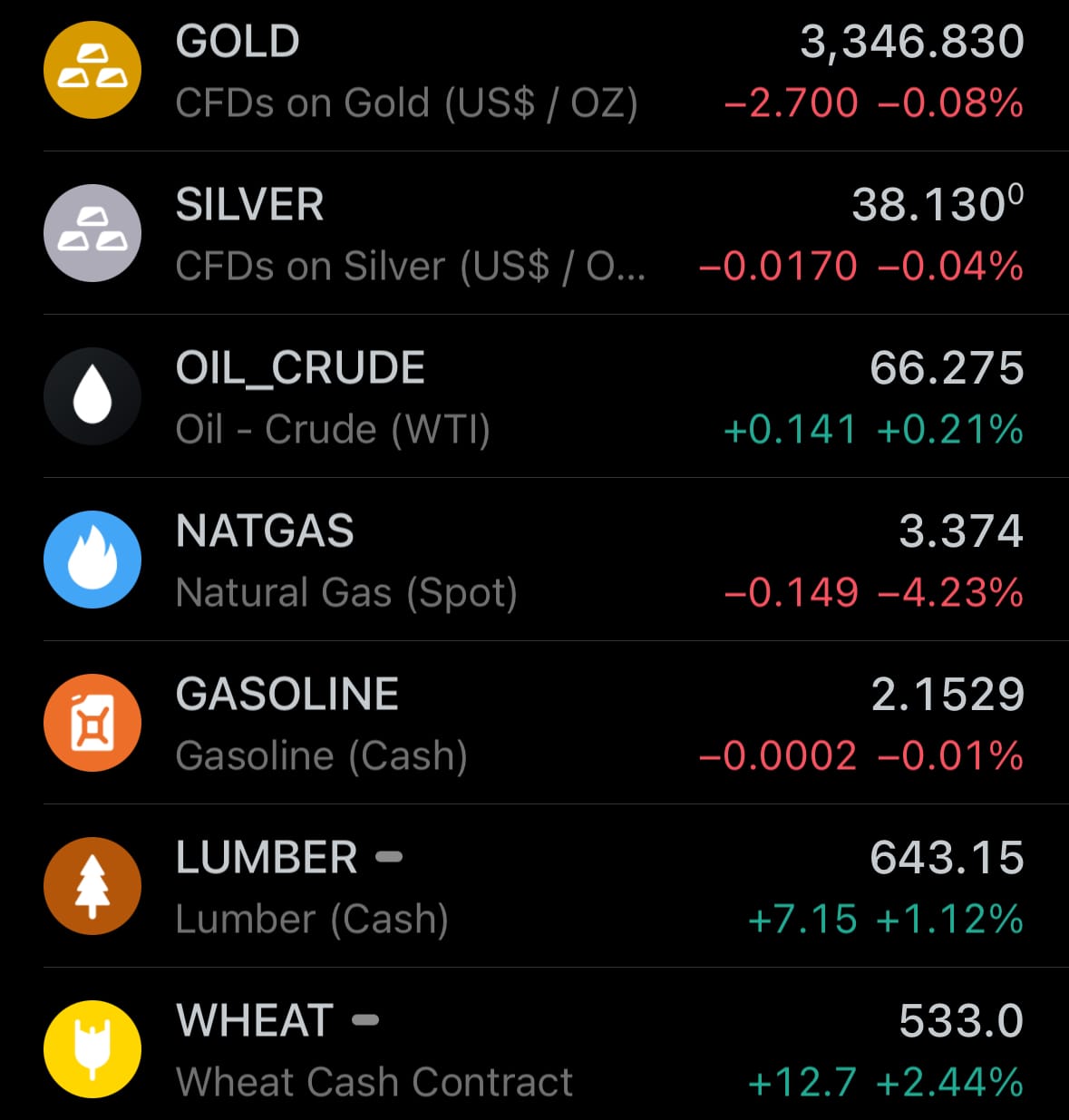

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- As of today, July 21, 2025, Ukraine has launched over 230 drones targeting Russian cities and regions, including Moscow, Bryansk, and Rostov, causing temporary airport closures, cancellation of over 140 flights, and air raid alerts, with Russian defenses intercepting many drones and reporting limited damage like urban fires. These strikes aim to disrupt Russia’s military operations and highlight defensive weaknesses using advanced long-range drones. Meanwhile, Russia has responded with over 300 drones and missiles striking Ukrainian cities such as Kyiv, Odesa, Kharkiv, and Pavlograd, resulting in at least seven deaths, dozens of injuries, and damage to homes, power grids, and civilian buildings like kindergartens, with Moscow claiming to target military sites.

- This back-and-forth escalation sees both sides leveraging technological strengths—Ukraine’s agile drones to challenge Russian infrastructure and Russia’s high-volume drone and missile barrages to strain Ukrainian defenses, which have downed many incoming threats but struggle to prevent widespread disruption, prompting Kyiv to request more Western aid. The mutual attacks cause significant setbacks, including blackouts in Ukraine and defensive scrambles in Russia, sustaining a conflict with heavy humanitarian costs and no immediate signs of de-escalation.

Environment & Weather:

- As of July 21, 2025, a sequence of earthquakes affected areas off Russia's Kamchatka Peninsula, starting with smaller foreshocks of magnitude 5.0 at 06:02 UTC and magnitude 6.7 at 06:28 UTC, followed by the main event of magnitude 7.4 at 06:49 UTC, located roughly 144 km east-southeast of Petropavlovsk-Kamchatsky at a depth of 20 km. Subsequent aftershocks included another magnitude 6.7 at 07:07 UTC, magnitude 6.6 at 07:22 UTC, magnitude 6.0 at 07:26 UTC, and further activity throughout the day, with at least 10 events in the magnitude 5 range and 14 in the magnitude 4 range by mid-morning, plus additional quakes such as magnitude 5.2 at 10:03 UTC and two magnitude 5.1 events at 09:30 UTC and 15:43 UTC, all occurring along the peninsula's east coast. This activity aligns with the region's location in the Pacific Ring of Fire, where the Pacific and North American tectonic plates interact, contributing to frequent seismic events.

- The earthquakes led to tsunami warnings for Kamchatka's coastal zones, with authorities advising residents to steer clear of beaches, and brief tsunami watches issued for areas including Hawaii, Japan, and the Midway Atoll, anticipating possible waves up to 1 meter. These warnings were canceled soon after, with no confirmed reports of notable waves, evacuations, injuries, or structural damage. Local accounts from places like Petropavlovsk-Kamchatsky described noticeable shaking, but the area's earthquake-prepared infrastructure and low population density appear to have minimized impacts. Seismic monitoring agencies continue to observe the region for potential additional aftershocks.

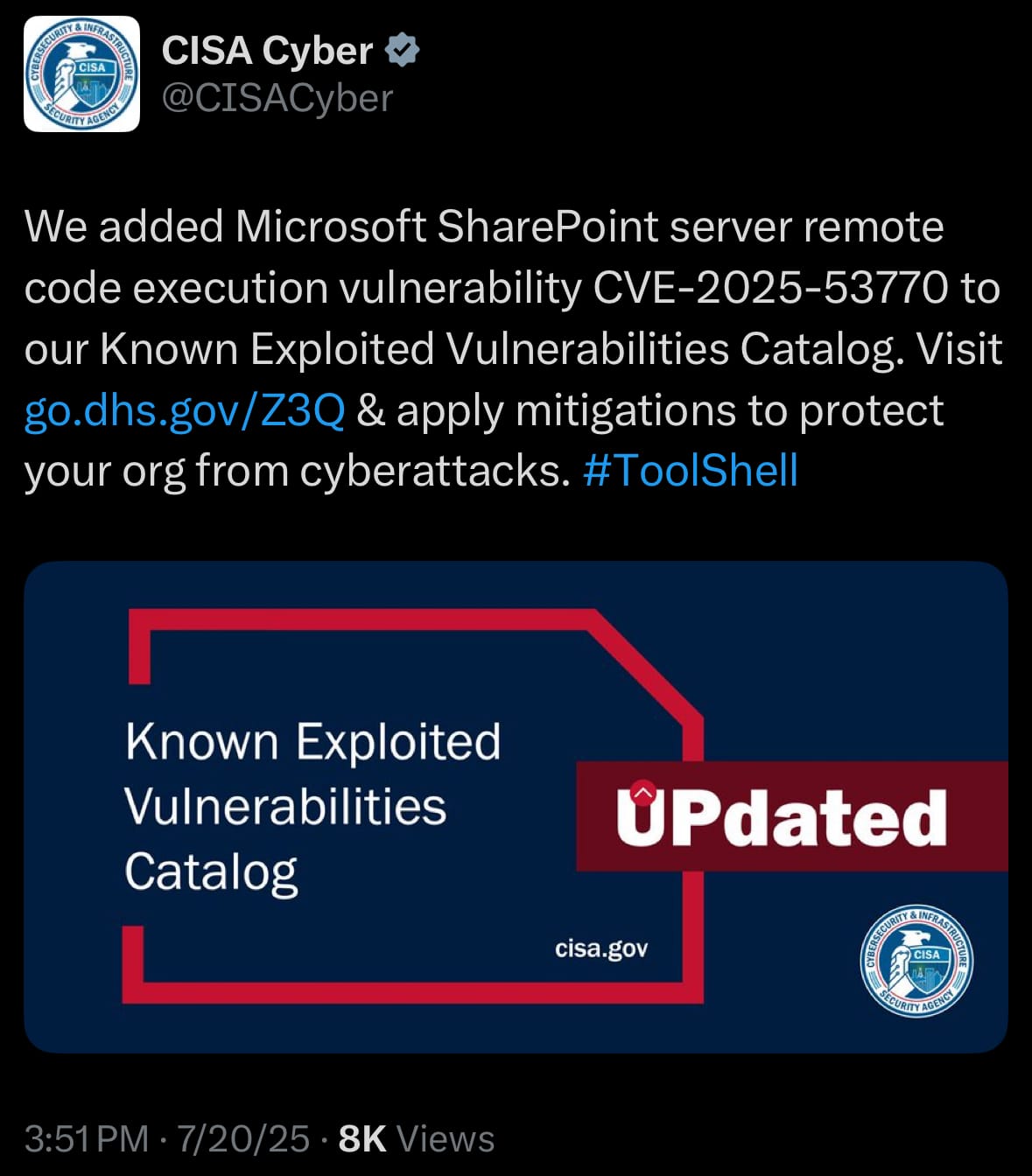

Cyber:

- On July 20, 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) listed CVE-2025-53770 in its Known Exploited Vulnerabilities Catalog. This is a dangerous flaw in on-premises Microsoft SharePoint Servers that lets hackers run harmful code from anywhere without needing a password or user action. It happens because the software mishandles unsafe data. It affects SharePoint Server Subscription Edition, 2019, and 2016, but not the cloud-based SharePoint Online. Found on July 19, 2025, hackers are using this in "ToolShell" attacks to sneak in backdoors like 'spinstall0.aspx' files, steal key data, and take over systems. Over 75 organizations have been hit. Rated 9.8/10 for severity, it’s easy to exploit and linked to past issues like CVE-2024-49706.

- CISA tracks these threats by collecting evidence from security reports and experts, adding them to the catalog to warn everyone about active dangers and push for quick fixes. To protect your systems, install Microsoft’s latest patches immediately, though a full fix isn’t out yet for all versions. Check for red flags like odd files in SharePoint folders or 'w3wp.exe' running strange PowerShell commands. Simple steps include blocking external access to SharePoint servers, adding multi-factor authentication for logins, checking logs for weird activity, and using antivirus tools to spot threats.

Statistic:

- Largest assets by market capitalization:

- Gold: $22.510T

- 🇺🇸 NVIDIA: $4.204T

- 🇺🇸 Microsoft: $3.790T

- 🇺🇸 Apple: $3.154T

- 🇺🇸 Amazon: $2.400T

- Bitcoin: $2.334T

- 🇺🇸 Alphabet (Google): $2.250T

- Silver: $2.162T

- 🇺🇸 Meta Platforms: $1.770T

- 🇸🇦 Saudi Aramco: $1.596T

- 🇺🇸 Broadcom: $1.332T

- 🇹🇼 Taiwan Semiconductor Manufacturing Company (TSMC): $1.246T

- 🇺🇸 Tesla: $1.061T

- 🇺🇸 Berkshire Hathaway: $1.022T

- 🇺🇸 JPMorgan Chase: $800.89B

- 🇺🇸 Walmart: $758.53B

- 🇺🇸 Eli Lilly: $692.79B

- 🇺🇸 Oracle: $689.42B

- 🇺🇸 Visa: $681.86B

- 🇨🇳 Tencent: $598.95B

- 🇺🇸 SPDR S&P 500 ETF Trust: $575.98B

- 🇺🇸 Netflix: $514.61B

- 🇺🇸 Mastercard: $501.86B

- 🇺🇸 Exxon Mobil: $464.44B

- Ethereum: $452.48B

History:

- Taiwan Semiconductor Manufacturing Company (TSMC), founded on February 21, 1987, by Morris Chang in Hsinchu, Taiwan, pioneered the pure-play foundry model, manufacturing chips for companies without designing its own. Supported by the Taiwanese government (48% stake), Philips (27.5%), and local investors, TSMC leveraged Philips' technology to grow rapidly. Under Chang’s leadership (CEO from 1988 to 2018), it listed on the Taiwan Stock Exchange in 1993 and the NYSE in 1997, while acquiring WaferTech in the U.S. in 2000. With a revenue growth rate of 17.4% annually since 1994, TSMC invested heavily in R&D and capacity, mastering advanced process nodes from 2-micron in the 1980s to 7nm and 5nm by the late 2010s, establishing itself as a global leader in semiconductor manufacturing.

- Today, TSMC dominates over 67% of the global foundry market, serving giants like Apple, Nvidia, and AMD with chips for AI, smartphones, and high-performance computing. It pioneered extreme ultraviolet lithography and began 3nm production in 2022, with 2nm chips planned for 2025, offering up to 15% speed gains or 30% power savings. Facing geopolitical pressures, TSMC expanded globally, opening a fab in Japan in 2024, building three new U.S. fabs in Arizona with $165 billion investment (supported by $6.6 billion in CHIPS Act funding), and planning a German plant by 2029. In 2025, TSMC announced $42 billion for nine new facilities, including four 1.4nm plants in Taiwan. With 2024 revenue at $90.08 billion and a projected 30% growth in 2025, TSMC’s leadership in AI-driven chip demand remains unmatched.

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

Click image to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news