Monday☕️

Trending:

- On October 26, 2025, the Department of Government Efficiency (DOGE) announced via its official X account that federal agencies had terminated and descoped 97 wasteful contracts over the past five days. These actions targeted a total ceiling value of $2.3 billion, resulting in estimated savings of $160 million for taxpayers. The move aligns with DOGE's broader mission to streamline government operations and eliminate unnecessary spending.

Economics & Markets:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- On October 25, 2025, a Ukrainian strike on the dam of the Belgorod reservoir in Russia's Belgorod region, resulting in damage to a sluice gate and a partial breach. Sources from Russian officials and media indicated that the attack utilized HIMARS missiles and drones, causing water levels to drop by more than one meter and prompting alerts for possible flooding in adjacent border areas. Belgorod Governor Vyacheslav Gladkov confirmed the incident, emphasizing the extent of the damage while clarifying that no immediate evacuations were required for nearby residents.

- The event has sparked discussions regarding its effects on military operations, with indications that the water release might inundate border zones, potentially affecting troop movements and logistics near Vovchansk in Ukraine's Kharkiv region. Ukrainian military figures, such as officer Robert Brovdi, referred to as "Magyar," portrayed the action as a strategic move against infrastructure, whereas Russian media outlets reported the breach and claimed impacts on their positions.

Environment & Weather:

- Yesterday, October 26, 2025, the National Hurricane Center issued an advisory at 11:00 p.m. EDT stating that Major Hurricane Melissa remains a powerful Category 4 storm with maximum sustained winds of 145 mph and a minimum central pressure of 933 mb, located approximately at 16.3 degrees north latitude and 77.5 degrees west longitude in the Caribbean Sea. The hurricane is moving westward at a slow pace of 5 mph, positioning it south of Jamaica. Hurricane warnings are in effect for Jamaica and eastern Cuba, while tropical storm warnings cover Haiti, as outer rain bands already begin to affect these areas with increasing winds and precipitation.

- Forecast models indicate that Melissa is expected to intensify further, potentially reaching Category 5 status with winds up to 160 mph before making landfall along Jamaica's southwestern coast early Tuesday morning, leading to worsening conditions in Jamaica peaking from Monday night through Tuesday. Catastrophic impacts, including life-threatening flash flooding, mudslides, and storm surges of 9 to 13 feet, are anticipated in Jamaica and Haiti, with potentially severe landslides in eastern Cuba due to heavy rainfall up to 40 inches in some locations.

Space:

- On October 26, 2025, SpaceX successfully launched a Falcon 9 rocket carrying 28 Starlink satellites from Cape Canaveral Space Force Station in Florida at 11:00 a.m. EDT. The reusable first-stage booster, which had supported multiple prior missions, achieved a successful landing on a droneship in the Atlantic Ocean shortly after separation, demonstrating SpaceX's ongoing advancements in rocket reusability and frequent launch capabilities.

- This launch coincided with the fifth anniversary of Starlink connecting its first paying customer, during which the company highlighted reaching more than 7 million users worldwide across over 150 countries and territories. The milestone reflects rapid growth, with the service adding approximately one million subscribers in just two months earlier in the year, focusing on delivering high-speed, low-latency internet to underserved and remote areas where traditional connectivity options are limited or unavailable.

Statistic:

- Largest assets on Earth by market capitalization:

- Gold: $28.400T

- 🇺🇸 NVIDIA: $4.534T

- 🇺🇸 Apple: $3.900T

- 🇺🇸 Microsoft: $3.892T

- 🇺🇸 Alphabet (Google): $3.146T

- Silver: $2.710T

- 🇺🇸 Amazon: $2.391T

- Bitcoin: $2.290T

- 🇺🇸 Meta Platforms: $1.854T

- 🇺🇸 Broadcom: $1.672T

- 🇸🇦 Saudi Aramco: $1.667T

- 🇹🇼 TSMC: $1.529T

- 🇺🇸 Tesla: $1.442T

- 🇺🇸 Berkshire Hathaway: $1.061T

- 🇺🇸 Walmart: $846.47B

- 🇺🇸 JPMorgan Chase: $817.85B

- 🇺🇸 Oracle: $807.71B

- VOO: $774.70B

- 🇨🇳 Tencent: $744.31B

- 🇺🇸 Eli Lilly: $739.98B

- IVV: $714.03B

- 🇺🇸 SPY: $690.78B

- 🇺🇸 Visa: $674.24B

- VTI: $556.52B

- 🇺🇸 Mastercard: $518.60B

- Ethereum: $507.27B

History:

- In the early days of algorithmic trading, computers were mainly used to make financial markets faster and more efficient. The first real trading algorithms appeared in the 1970s and 1980s, when Wall Street began automating basic tasks like executing large orders or taking advantage of small price differences between exchanges. These early systems followed strict, pre-written rules — for example, “buy when this price hits X” or “sell if volume exceeds Y.” They had no real intelligence or adaptability; they were machines following instructions, not machines thinking. As computing power grew in the 1990s and early 2000s, traders began building more sophisticated “quant” systems that used statistical models and probability to predict short-term market movements. This gave rise to high-frequency trading (HFT), where algorithms executed thousands of trades per second, relying on speed, precision, and tiny profit margins. These systems dominated markets for decades, but they were still fundamentally limited — they reacted to numbers, not to meaning or context.

- That has changed entirely with the rise of large language models (LLMs) and modern artificial intelligence like ChatGPT and Grok. Instead of simply reacting to a fixed data point, these new AI-driven trading systems can interpret and reason about the world. They can read central bank reports, analyze global news sentiment, interpret a CEO’s tone in an earnings call, and even connect unrelated signals like weather data, shipping patterns, and social media trends. Where older algorithms were blind to nuance, LLM-based systems can understand intent, uncertainty, and narrative — the hidden forces that often move markets before numbers do. These systems learn and adapt on their own, refining their understanding of what drives market behavior. The competitive edge in trading has shifted from who can act fastest to who can think deepest. Finance is entering an era of cognitive trading, where machines no longer just process data — they comprehend it, reason through it, and make strategic decisions that resemble human judgment but operate on a global, real-time scale.

Image of the day:

Thanks for reading!

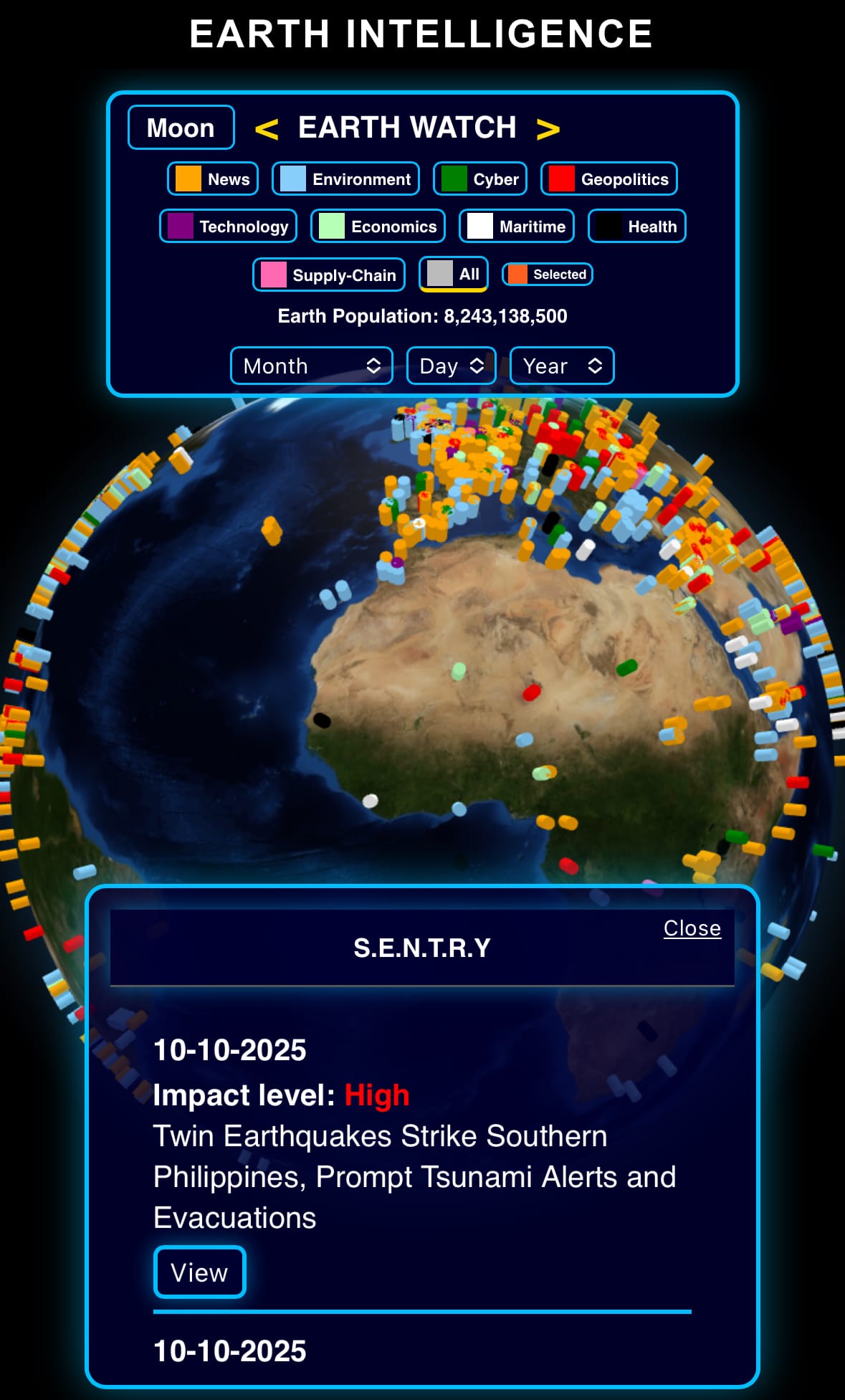

- EARTH INTELLIGENCE builds private intelligence systems for organizations — connecting their internal and external data with AI to create one interactive command center for real-time awareness, decision making, and predictions.

Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news