Monday☕️

Trending:

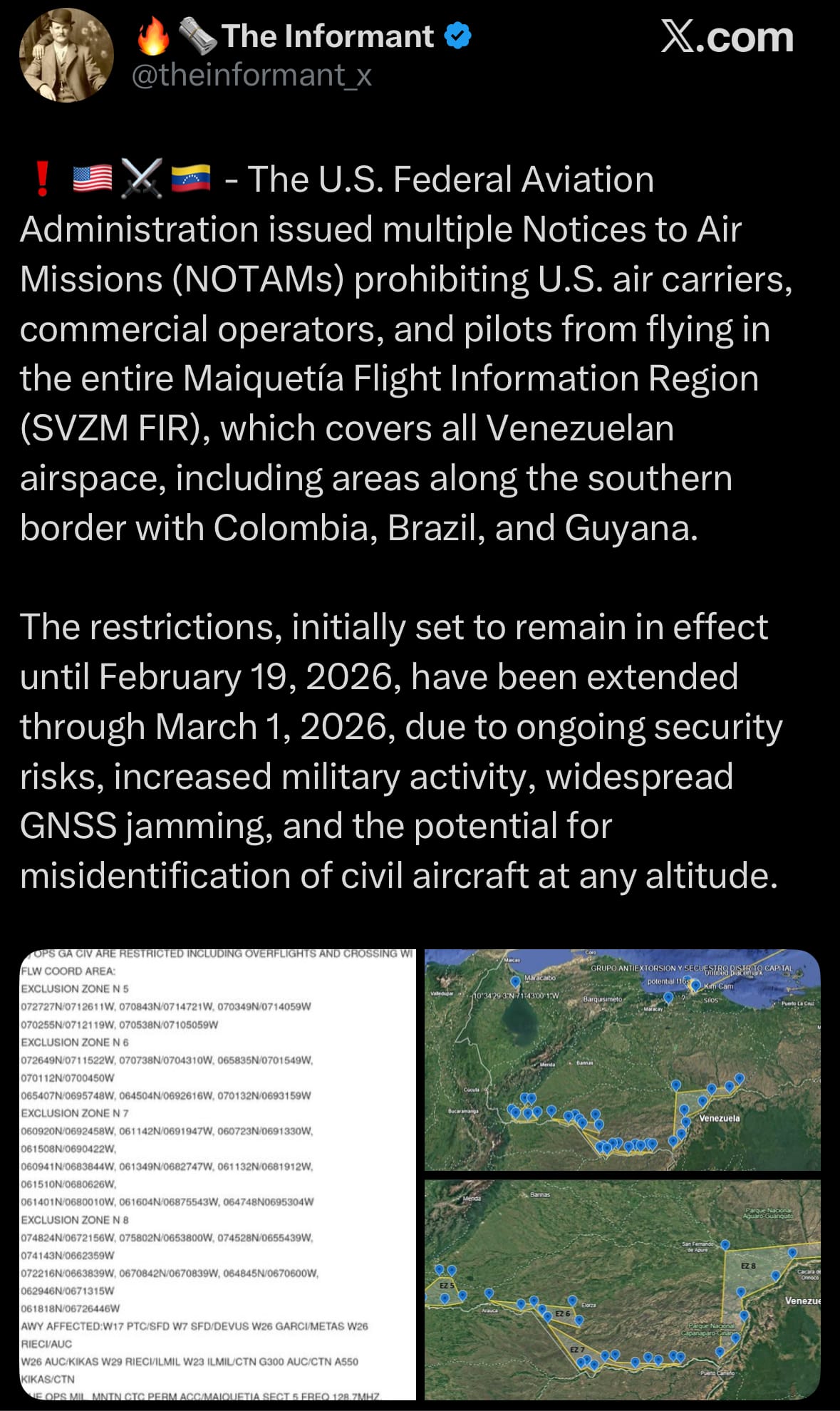

- On November 30, 2025, the U.S. Federal Aviation Administration extended its existing flight prohibition for U.S. civil aviation in the entire Maiquetía Flight Information Region (SVZM FIR), covering all Venezuelan airspace and adjacent border areas with Colombia, Brazil, and Guyana. The original NOTAM (KICZ A0012/25), originally issued on November 21, 2025, and set to expire February 19, 2026, was amended to remain in effect through March 1, 2026. The FAA cited ongoing security concerns including increased military activity, widespread GNSS (GPS) jamming and spoofing affecting aircraft up to 250 nautical miles from Venezuelan territory, and the risk of misidentification of civilian aircraft at any altitude.

- The extension followed a November 29, 2025, statement from President Trump urging the FAA to treat Venezuelan airspace as fully closed, part of broader U.S. pressure on the Maduro government over drug trafficking and regional security issues. The FAA action applies to all U.S.-registered aircraft and U.S.-licensed operators, with any requested overflights requiring 72-hour prior approval from the agency’s Washington Operations Center. Several international carriers have suspended or rerouted flights to and from Caracas in response, and Venezuela has revoked operating permits for some airlines that complied with the U.S. restrictions. The measures remain in force until at least March 1, 2026, unless further modified by the FAA.

Geopolitics & Military Activity:

- On November 30, 2025, the Panamanian-flagged oil tanker M/T Mersin (59,000 DWT), owned by a Turkish company and managed by Beşiktaş Denizcilik, partially sank approximately 24 km off Dakar, Senegal, after suffering a major hull breach during the night of November 27–28. The 2009-built vessel had been carrying roughly 50,000 tons of Russian petroleum products loaded in Taman, Russia, and was stationary in the area for several days prior to the incident. Senegalese maritime authorities reported water ingress in the engine room leading to heavy listing, prompting the crew of 22 to abandon ship; all were rescued without injury.

- Senegal’s Navy and High Authority for Maritime Affairs deployed tugs, anti-pollution equipment, and response teams to contain any spill and attempt cargo transfer. While official Senegalese statements attribute the damage to a technical failure, some maritime security analysts and open-source reports have raised the possibility of an uncrewed surface vessel (USV) attack, citing the location and pattern of the breach. If confirmed as deliberate, it would be the third such incident targeting Russia-linked tankers in recent days, following strikes on November 28 against the Gambian-flagged Kairos and Virat in the Black Sea. Investigations into the exact cause are ongoing, and no party has officially claimed responsibility.

CENTCOM Strikes:

- On November 29, 2025, U.S. Central Command (CENTCOM) announced a joint operation with the Syrian Ministry of Interior that located and destroyed more than 15 ISIS weapons caches in southern Syria's Rif Dimashq province between November 24 and 27. U.S. personnel from Combined Joint Task Force – Operation Inherent Resolve collaborated with Syrian forces to identify the sites through intelligence gathering, followed by multiple airstrikes and ground detonations to neutralize the threats. The operation targeted hidden storage facilities amid ongoing concerns over ISIS regrouping efforts in the region, with no reported casualties among coalition or Syrian personnel.

- The destroyed caches contained over 130 mortars and rockets, multiple assault rifles, machine guns, anti-tank mines, and materials for assembling improvised explosive devices, significantly degrading ISIS's capacity to conduct attacks or regenerate. This action builds on prior U.S.-led coalition efforts to counter ISIS remnants in Syria, where the group has sought to rebuild since its territorial defeat in 2019, and aligns with recent Syrian pre-emptive operations against extremist cells ahead of diplomatic engagements in Washington.

Space:

- On November 30, 2025, China conducted its 75th orbital launch of the year, successfully placing the Shijian-28 experimental satellite into orbit using a modified Long March-7 rocket from the Wenchang Space Launch Center in Hainan. Liftoff occurred at 20:20 Beijing time (12:20 UTC), with the two-stage liquid-fueled rocket performing nominally and marking its 14th flight. The China Aerospace Science and Technology Corporation confirmed the satellite reached its intended orbit, continuing China's record-breaking launch cadence for 2025.

- Shijian-28 belongs to the long-running Shijian (Practice) series and is officially tasked with testing in-orbit satellite servicing, robotic rendezvous and proximity operations, and active space-debris mitigation technologies, including the use of a robotic arm to approach, dock with, or manipulate objects in space. While China describes these capabilities as supporting sustainable space operations and extending satellite lifespans, Western defense analysts assess the same technologies as dual-use, enabling potential military applications such as inspecting, repairing, refueling, or deliberately disabling adversary satellites in a conflict scenario. Earlier satellites in the series (Shijian-17 in 2016 and Shijian-21 in 2021) already demonstrated advanced grappling and orbital maneuvers, and Shijian-28 is regarded as a further maturation of these counterspace-relevant systems. Specific orbital parameters and equipment details remain classified.

Statistic:

- Largest assets on Earth by market capitalization:

- Gold: $29.583T

- 🇺🇸 NVIDIA: $4.301T

- 🇺🇸 Apple: $4.138T

- 🇺🇸 Alphabet (Google): $3.864T

- 🇺🇸 Microsoft: $3.657T

- Silver: $3.217T

- 🇺🇸 Amazon: $2.493T

- 🇺🇸 Broadcom: $1.902T

- Bitcoin: $1.815T

- 🇺🇸 Meta Platforms: $1.633T

- 🇸🇦 Saudi Aramco: $1.582T

- 🇹🇼 TSMC: $1.511T

- 🇺🇸 Tesla: $1.430T

- 🇺🇸 Berkshire Hathaway: $1.108T

- 🇺🇸 Eli Lilly: $964.11B

- 🇺🇸 Walmart: $881.91B

- 🇺🇸 JPMorgan Chase: $860.89B

- 🇺🇸 Vanguard S&P 500 ETF: $802.08B

- 🇺🇸 iShares Core S&P 500 ETF: $732.62B

- 🇨🇳 Tencent: $715.43B

- 🇺🇸 SPDR S&P 500 ETF: $701.93B

- 🇺🇸 Visa: $649.12B

- 🇺🇸 Oracle: $575.71B

- 🇺🇸 Vanguard Total Stock Market Index Fund ETF Shares: $564.61B

- 🇺🇸 Johnson & Johnson: $498.53B

History:

- Semiconductors begin as a scientific puzzle long before they become the backbone of modern civilization. Early-20th-century physicists studying crystals like germanium and silicon notice that these materials behave unpredictably—sometimes blocking electricity, sometimes letting it flow. This strange in-between behavior eventually becomes the foundation of the transistor. In 1947, Bell Labs builds the first working transistor, replacing the fragile, power-hungry vacuum tube with a tiny switching device that can run cooler, faster, and more reliably. By the 1950s, engineers discover that silicon—abundant, stable, and thermally resilient—is the perfect material for making these transistors at scale. This leads to the planar process, which allows entire circuits to be etched onto flat wafers instead of wired together by hand. By 1958–1959, Jack Kilby and Robert Noyce independently create the first integrated circuits, proving you can put multiple transistors, resistors, and connections on a single slice of silicon. From here, the semiconductor revolution detonates. Companies like Fairchild, Intel, Texas Instruments, and Motorola become “integrated device manufacturers” (IDMs), controlling the entire pipeline: designing chips, fabricating them in their own cleanrooms, packaging them, and selling them. Moore’s Law—Gordon Moore’s 1965 prediction that transistor density would double every couple of years—becomes the self-fulfilling roadmap that pushes the industry from thousands of transistors per chip to billions.

- Through the 1970s, 80s, and 90s, the semiconductor industry grows into a global network, but fabrication remains brutally difficult and astronomically expensive. As chips shrink into the nanometer scale, building advanced fabs requires extreme precision, exotic chemicals, vacuum chambers, plasma etching equipment, and increasingly specialized lithography machines. By the early 2000s, the cost of building a leading-edge fab crosses $10 billion and continues climbing. This is where everything changes: in 1987, Morris Chang founds Taiwan Semiconductor Manufacturing Company (TSMC) as the world’s first “pure-play foundry”—a company that only fabricates chips and does not design them. This frees new companies from the burden of building their own fabs and triggers the rise of the “fabless” model: firms like Qualcomm, Nvidia, AMD, Apple, Broadcom, and nearly every modern AI chip startup focus purely on design while outsourcing manufacturing to TSMC. Over time, this system concentrates manufacturing expertise in Taiwan. As nodes shrink from 90 nm to 65 nm to 28 nm to 7 nm and beyond, the world divides into two groups: companies that use cutting-edge chips and companies able to manufacture them. Only three players remain competitive at the bleeding edge: Intel, Samsung, and TSMC. Intel struggles through repeated delays. Samsung invests heavily but cannot match consistent yields. Meanwhile, TSMC moves steadily through 7 nm, 5 nm, 3 nm, and the coming 2 nm generation—delivering reliable high-volume chips used in iPhones, data centers, supercomputers, fighter jets, satellites, missiles, and frontier AI systems. The tools required—especially ASML’s extreme ultraviolet (EUV) lithography machines—are so complex and expensive that only a few companies on Earth can operate them at scale. As a result, TSMC now manufactures around 65–70% of the world’s outsourced chips and an overwhelming majority of the world’s most advanced processors. Everyone else—GlobalFoundries, UMC, SMIC, and dozens of national champions—primarily produce older, “mature node” chips for cars, power electronics, and everyday devices. Today, despite global efforts to diversify manufacturing, the cutting edge of semiconductor technology rests overwhelmingly on one company: Taiwan Semiconductor Manufacturing Company (TSMC), the foundry at the center of the world’s most important—and most difficult—manufacturing ecosystem.

Image of the day:

Thanks for reading! Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

- Download our mobile app on the Apple App Store (Android coming soon):

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news