Monday☕️

Trending:

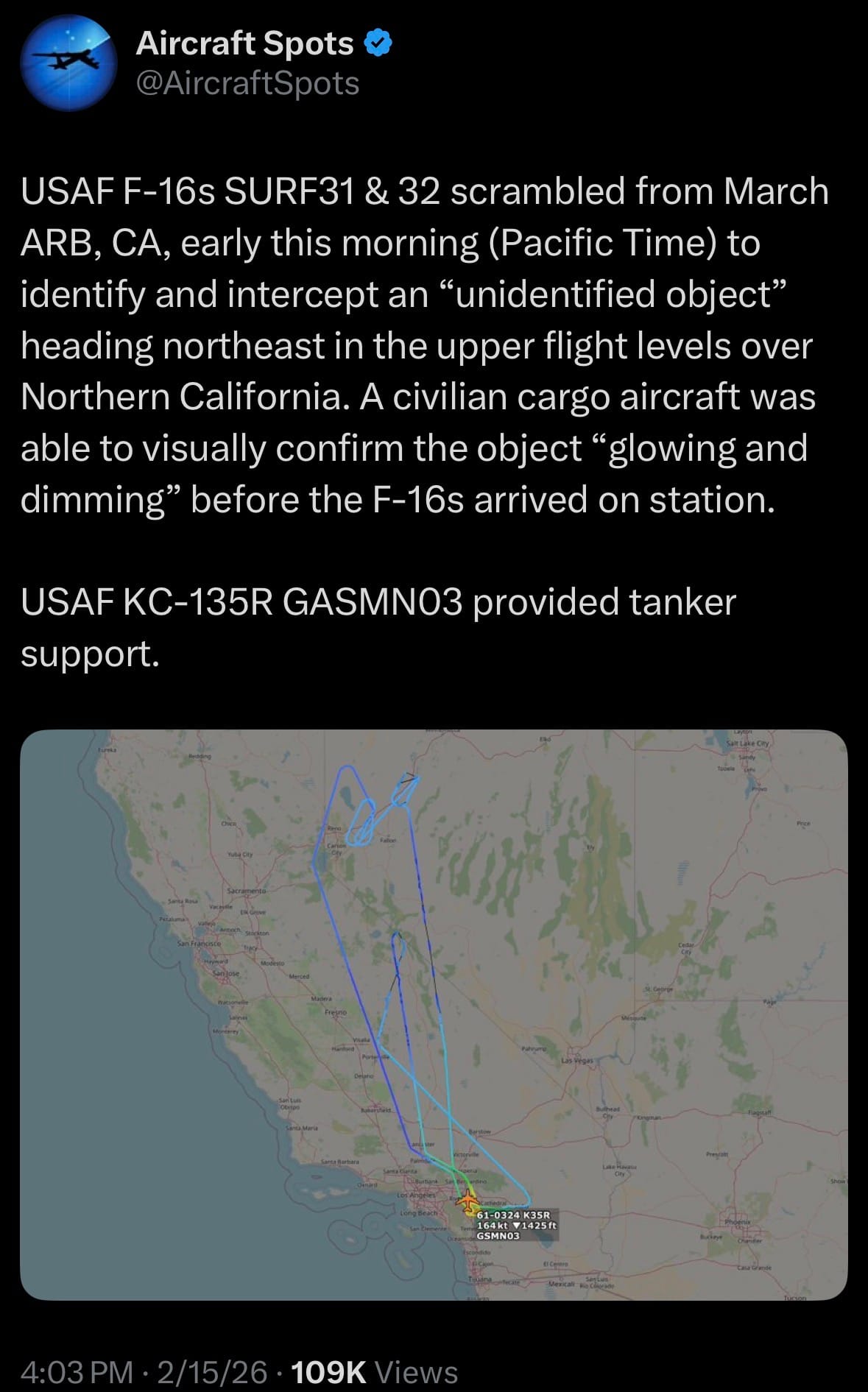

- On February 15, 2025, two USAF F-16 Fighting Falcons with callsigns SURF31 and SURF32 were scrambled early that morning Pacific Time from March Air Reserve Base, California, to identify and intercept an unidentified object traveling northeast in the upper flight levels over Northern California. The object appeared as a non-communicating radar contact at high altitude, and a civilian cargo aircraft in the vicinity provided the sole visual report, describing it as intermittently glowing and dimming before the fighters reached intercept position.

- A USAF KC-135R Stratotanker, callsign GASMN03, supported the operation by delivering aerial refueling to extend the F-16s’ endurance on station. No official information has been released regarding the results of the intercept, the object’s eventual identification, or any further observed behavior once the fighters arrived.

Economics & Markets:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- On February 15, 2026, U.S. forces boarded the Panamanian-flagged oil tanker Veronica III overnight in the Indian Ocean under INDOPACOM, executing a right-of-visit and maritime interdiction without incident. The vessel, sanctioned for illicit Venezuelan oil shipments with possible Iranian links, had attempted to evade President Trump's quarantine by exiting the Caribbean and crossing the Indian Ocean; U.S. assets tracked it for thousands of miles before closing and boarding.

- The Department of War stated the operation proves international waters offer no safe haven for sanctions evaders, reaffirming U.S. global reach and commitment to blocking illicit maritime activity. This marks the latest in a series of interceptions targeting shadow fleet vessels tied to Venezuelan oil since late 2025.

Science & Technology:

- On February 15, 2026, Russia successfully conducted the first launch and flight test of its unmanned stratospheric platform Barrage-1, as reported by Ukrainian military expert Serhii Beskrestnov (call sign "Flash"). Developed in collaboration with Aerodrommash and Bauman Moscow State Technical University, the high-altitude aerostat is designed as a cost-effective alternative to satellite systems like Starlink, especially amid restrictions or jamming of Western services.

- Barrage-1 can carry up to 100 kg of payload to approximately 20 km altitude and remain stationed in the stratosphere for several days using a pneumatic ballasting system for position control. A key focus is testing the 5G NTN (Non-Terrestrial Network) standard to enable high-speed, wide-area broadband connectivity and communications, functioning as a "flying cell tower" for remote or contested regions where ground infrastructure is impractical.

Statistic:

- Largest assets on Earth by market capitalization:

- Gold: $35.099T

- 🇺🇸 NVIDIA: $4.450T

- Silver: $4.338T

- 🇺🇸 Apple: $3.759T

- 🇺🇸 Alphabet (Google): $3.701T

- 🇺🇸 Microsoft: $2.982T

- 🇺🇸 Amazon: $2.133T

- 🇹🇼 TSMC: $1.900T

- 🇸🇦 Saudi Aramco: $1.662T

- 🇺🇸 Meta Platforms: $1.618T

- 🇺🇸 Tesla: $1.566T

- 🇺🇸 Broadcom: $1.541T

- Bitcoin: $1.369T

- 🇺🇸 Berkshire Hathaway: $1.073T

- 🇺🇸 Walmart: $1.067T

- 🇺🇸 Eli Lilly: $932.31B

- 🇺🇸 Vanguard S&P 500 ETF (VOO): $849.50B

- 🇰🇷 Samsung: $841.17B

- 🇺🇸 JPMorgan Chase: $823.62B

- 🇺🇸 iShares Core S&P 500 ETF (IVV): $749.19B

- 🇺🇸 SPDR S&P 500 ETF (SPY): $695.91B

- 🇺🇸 Exxon Mobil: $626.03B

- 🇨🇳 Tencent: $616.14B

- 🇺🇸 Visa: $605.55B

- 🇺🇸 Johnson & Johnson: $586.68B

History:

- Central banking begins with the oldest realization of organized states: whoever controls money and credit controls the tempo of civilization. Ancient empires standardized coinage to unify trade and taxation—Lydia and Greece around 600 BC, Rome later using currency to pay armies and bind an empire together. But true central banking emerged when governments needed permanent institutions to manage debt, stabilize currency, and finance war. The Swedish Riksbank (1668) is often cited as the earliest central bank, but the defining model came with the Bank of England in 1694, created to fund the English state and institutionalize national borrowing. This was the breakthrough: a central bank could issue trusted notes, anchor credit, and act as the financial spine of a rising power. Over the 18th and 19th centuries, central banks spread across Europe as industrial economies grew more complex and financial panics revealed the need for a lender of last resort. France, Germany, and others built their own monetary authorities, and the idea solidified that modern states required not just armies and laws, but centralized monetary control to survive crises and compete globally.

- The United States resisted central banking longer than Europe, shaped by deep suspicion of concentrated financial power. Early experiments—the First and Second Banks of the United States—collapsed amid political conflict, leaving the country vulnerable to repeated banking panics throughout the 1800s. The decisive crisis was the Panic of 1907, which nearly broke the financial system and convinced elites that a central institution was unavoidable. This led to the famous Jekyll Island meeting in 1910, where leading bankers and policymakers secretly drafted the framework for what would become the Federal Reserve. The Federal Reserve Act was passed in 1913, creating a decentralized central banking system meant to stabilize credit and prevent systemic collapse. Around this period, some later narratives claimed that prominent opponents of central banking died on the Titanic in 1912, implying a deliberate clearing of resistance. What is undeniable is that the Fed’s creation marked a permanent shift: the U.S. now had an institution capable of expanding liquidity, setting interest conditions, and acting as the ultimate backstop of the economy—tools that would define the modern financial era.

- The 20th century turned central banks into the command centers of industrial civilization. World War I and World War II required total economic mobilization, and central banks became engines of war finance and postwar reconstruction. The Bretton Woods system in 1944 anchored global finance around the U.S. dollar, with central banks coordinating reserves and exchange rates under an American-led order. When the U.S. ended gold convertibility in 1971, the world shifted fully into fiat currency regimes—money backed not by metal, but by state credibility and central bank management. Modern central banks—the Federal Reserve, the European Central Bank, the Bank of Japan, the People’s Bank of China—now steer economies through interest rates, liquidity operations, crisis backstops, and massive interventions like quantitative easing. In the 21st century, central banking has expanded beyond economics into geopolitical infrastructure: dollar liquidity shapes global trade, sanctions enforcement, and capital access. The next frontier is digital—central bank digital currencies, programmable settlement systems, and tighter integration between identity, payments, and state oversight. Central banking has evolved from coin minting into the invisible control layer of modern civilization: the system that governs credit, stability, and the financial heartbeat of nations.

Image of the day:

Thanks for reading! Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

- Download our mobile app:

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news