Monday☕️

Trending:

- Yesterday, a massive fire swept through the Isla Puting Bato district in Manila, Philippines, destroying around 1,000 homes and displacing over 0 families. The fire started on the second floor of a home in Purok Tres and spread quickly due to the tightly packed, lightweight structures. Firefighters raised the alarm to Task Force Charlie before bringing the blaze under control by 2:07 p.m.

- Drone footage showed the widespread damage, but no casualties were immediately reported. Several firefighters were injured while battling the flames. Authorities believe the fire may have been caused by an unattended stove, though investigations are ongoing. Manila Mayor Honey Lacuna has pledged aid for affected families, including financial support, food, and materials to rebuild.

Economic & Markets:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Conflicts:

- Yesterday, an unmanned aerial vehicle (UAV) crashed into an industrial enterprise in Russia’s Kaluga region, over 300 kilometers from the Ukrainian border, igniting a fire. Emergency crews quickly extinguished the blaze, and no injuries were reported. Investigations are underway to determine the origin of the drone and how the incident occurred.

- This reflects Ukraine’s growing ability to strike deep into Russian territory, aided by advanced Western technology. UAVs, commonly known as drones, have become a key tool in these operations. With long-range drones and precision-guided systems, Ukraine has intensified attacks on critical Russian infrastructure, aiming to disrupt operations and increase pressure far from the front lines.

Security:

- In recent weeks, cyberattacks have been on the rise, targeting companies with valuable data like customer information, financial records, and intellectual property. Hackers use this data to launch phishing scams, infiltrate networks, or sell it on the dark web. These attacks aim to exploit weaknesses in security systems, making businesses vulnerable to financial losses and reputational damage.

- To protect against these threats, companies need a multi-layered security approach tailored to their unique needs. Role-Based Access Control (RBAC) limits access to sensitive data, reducing insider risks. Dark web monitoring helps detect compromised data early, so action can be taken quickly.

- Strong endpoint and network security, such as firewalls, intrusion detection, and zero-trust frameworks, can block external threats. Operational security (OpSec) is also critical, ensuring employees follow best practices to prevent leaks and mistakes. By combining these layers, businesses can build a stronger defense against growing cyber threats.

Environment & Weather:

- Storm Bert has brought severe weather to the UK and Ireland since arriving on November 23, 2024. The storm has caused heavy snow, rain, and strong winds, resulting in one confirmed death. In Ireland, flooding along the west coast has submerged roads, damaged infrastructure, and left 60,000 homes and businesses without power, with counties like Cork and Galway hit the hardest.

- The affected regions have experienced similar disruptions from past storms, such as Ophelia in 2017 and Arwen in 2021, making Bert one of the more significant events in recent years. Snow forced the closure of Newcastle Airport and stopped train services in Scotland, while high winds shut down the Severn Bridge between Wales and England. Residents are urged to stay cautious and follow weather updates as the storm continues.

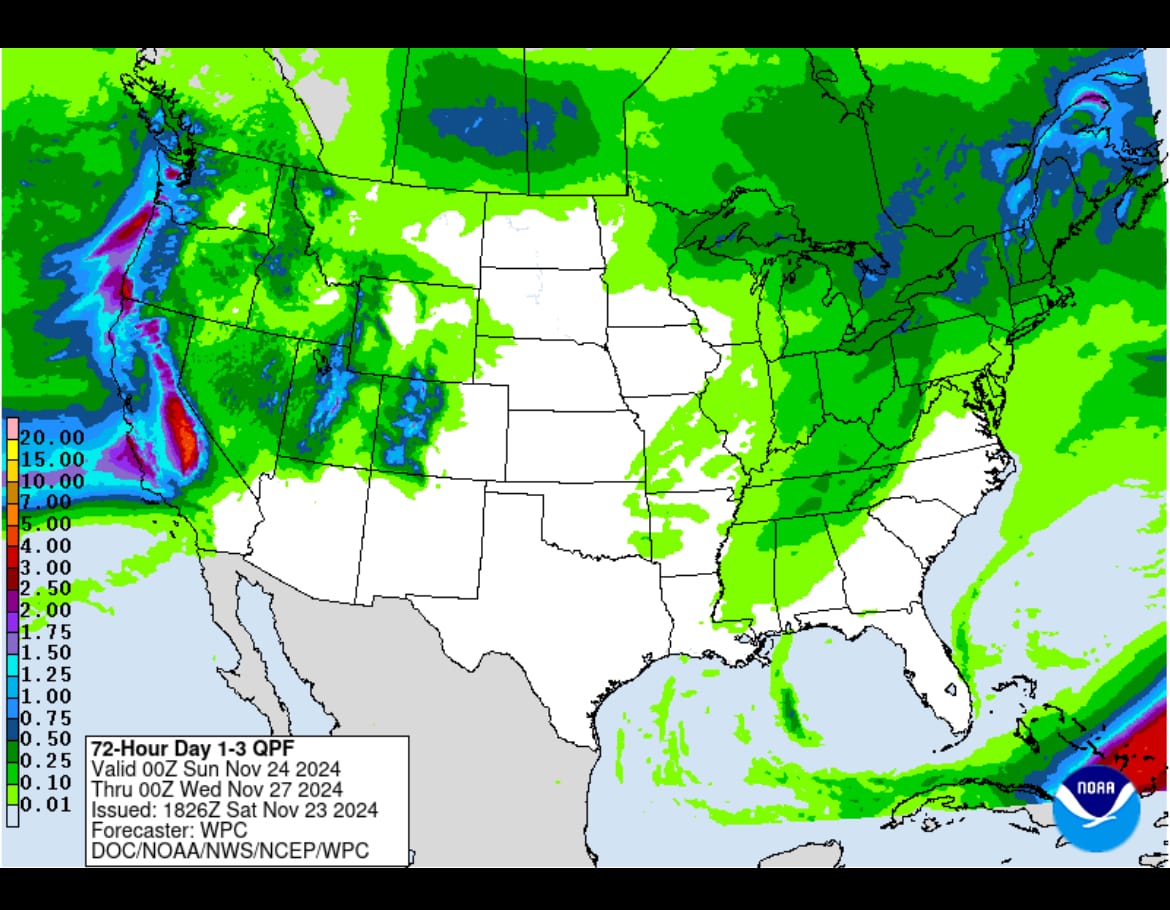

- Between November 19 and 24, 2024, Northern California endured a powerful atmospheric river and bomb cyclone, causing severe flooding, landslides, and power outages. Some areas received up to 20 inches of rain, while the Sierra Nevada saw several feet of snow, leading to dangerous travel conditions and road closures. High winds further damaged trees and power lines across the region.

- As of today, the storm has weakened, but its impacts remain. Power restoration is ongoing, and localized flooding continues to be an issue. Heavy snow and strong winds are still expected in the Sierra Nevada through November 26. Meanwhile, rain and snow will hit the Midwest and Great Lakes on November 25, with the East Coast possibly seeing rain and wind near Thanksgiving. Residents are advised to stay cautious and monitor updates.

- A recent image of a storm over the grand canyon:

Space:

- In the past few days, several major rocket launches have taken place, showcasing advancements in space exploration and technology. On November 22, 2024, Blue Origin launched its New Shepard rocket from West Texas on the NS-28 mission.

- This suborbital flight carried scientific experiments and payloads to the edge of space, contributing to microgravity research and technology development. The next day, November 23, Rocket Lab launched its Electron rocket from Māhia Peninsula, New Zealand. This mission, named “Ice AIS Baby,” deployed satellites designed to enhance maritime tracking capabilities using an advanced Automatic Identification System.

- Most recently, on November 24, the China Aerospace Science and Technology Corporation (CASC) launched a Long March 2C rocket from the Jiuquan Satellite Launch Center in China. The rocket carried an undisclosed payload into orbit, continuing China’s satellite deployment efforts. These launches underline the diverse contributions from various nations and organizations to space technology, from improving Earth-based systems to advancing scientific research in microgravity.

Statistic:

- Largest oil and gas companies by market capitalization:

- 🇸🇦 Saudi Aramco: $1.808T

- 🇺🇸 Exxon Mobil: $535.27B

- 🇺🇸 Chevron: $289.47B

- 🇬🇧 Shell: $202.20B

- 🇨🇳 PetroChina: $194.30B

- 🇫🇷 TotalEnergies: $136.91B

- 🇺🇸 ConocoPhillips: $128.61B

- 🇨🇳 CNOOC: $108.43B

- 🇨🇳 Sinopec: $96.89B

- 🇺🇸 Southern Company: $95.98B

- 🇨🇦 Enbridge: $94.24B

- 🇧🇷 Petrobras: $93.61B

- 🇺🇸 Duke Energy: $88.60B

- 🇦🇪 TAQA: $86.63B

- 🇬🇧 BP: $77.80B

- 🇺🇸 EOG Resources: $76.69B

- 🇨🇦 Canadian Natural Resources: $73.65B

- 🇦🇪 ADNOC Gas: $72.72B

- 🇺🇸 Williams Companies: $72.71B

- 🇺🇸 Enterprise Products: $71.13B

- 🇺🇸 Oneok: $68.37B

- 🇳🇴 Equinor: $68.07B

- 🇺🇸 Energy Transfer Partners: $65.29B

- 🇺🇸 Kinder Morgan: $63.29B

- 🇺🇸 Schlumberger: $62.45B

- 🇺🇸 Sempra Energy: $59.71B

- 🇺🇸 Pacific Gas and Electric: $55.88B

- 🇺🇸 Phillips 66: $55.03B

- 🇺🇸 Diamondback Energy: $54.10B

- 🇨🇦 Suncor Energy: $52.22B

- 🇨🇦 TC Energy: $51.74B

- 🇺🇸 Marathon Petroleum: $50.93B

- 🇺🇸 MPLX: $50.43B

- 🇺🇸 Cheniere Energy: $49.94B

- 🇺🇸 Occidental Petroleum: $48.72B

- 🇷🇺 Rosneft: $46.89B

- 🇷🇺 Lukoil: $46.55B

- 🇺🇸 Hess: $45.80B

- 🇮🇹 ENI: $45.61B

- 🇺🇸 Targa Resources: $45.20B

- 🇺🇸 Valero Energy: $44.60B

- 🇺🇸 Baker Hughes: $43.78B

- 🇨🇦 Imperial Oil: $40.42B

- 🇮🇳 Oil & Natural Gas: $36.60B

- 🇮🇩 Chandra Asri Petrochemical: $35.16B

- 🇦🇺 Woodside Energy: $31.04B

- 🇨🇦 Cenovus Energy: $29.57B

- 🇹🇭 PTT PCL: $28.10B

- 🇺🇸 Halliburton: $28.05B

- 🇷🇺 Gazprom: $27.43B

Thanks for reading!

Support/Suggestions Email:

earthintelligence@earthintel.news