Saturday☕️

Trending:

- Yesterday, April 4, 2025, President Donald Trump issued an executive order extending the deadline for ByteDance, the Chinese parent company of TikTok, to divest its U.S. operations by an additional 75 days, moving the deadline from April 5 to mid-June. This action followed a previous extension Trump granted on January 20, 2025, his first day in office, which had already delayed a national security law signed by former President Joe Biden in April 2024. That law required ByteDance to sell TikTok’s U.S. assets or face a ban, citing concerns over data privacy and potential influence from the Chinese government. The White House stated that the latest extension was intended to allow more time to finalize a deal ensuring TikTok could continue operating in the U.S. under American oversight, with ongoing discussions involving multiple stakeholders.

- The decision came after a proposed deal to transfer TikTok’s U.S. operations to American investors, including companies like Oracle and Blackstone, encountered setbacks earlier in the week. On April 2, Trump announced new tariffs on China, including a 34% rate, which coincided with reports that Chinese regulators paused the divestiture process, linking it to broader trade negotiations. The extension reflects efforts to balance national security considerations with economic and diplomatic factors, as the administration navigates complex talks with ByteDance and Chinese authorities.

Economics & Markets:

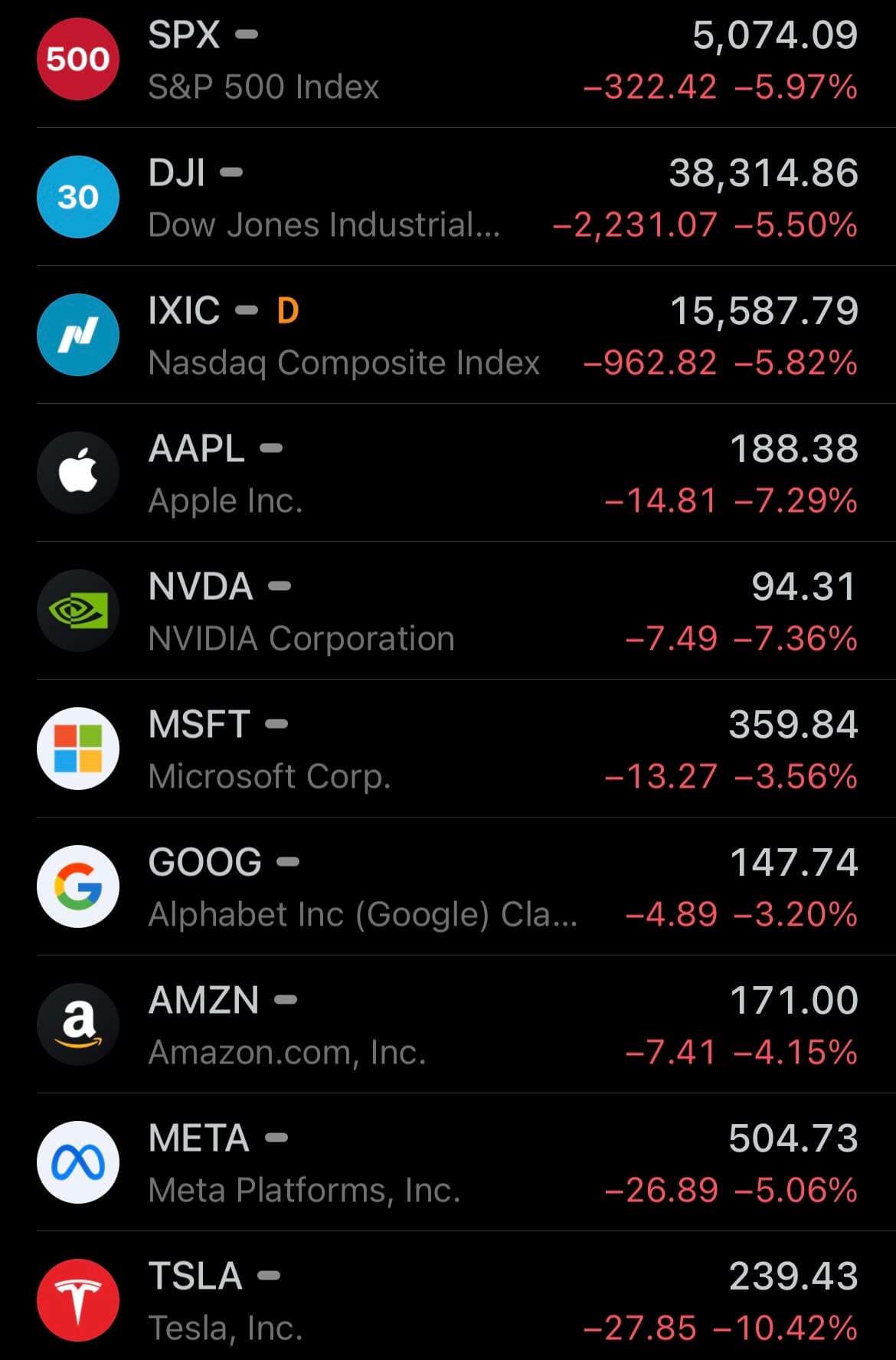

- Yesterday’s U.S. stock market:

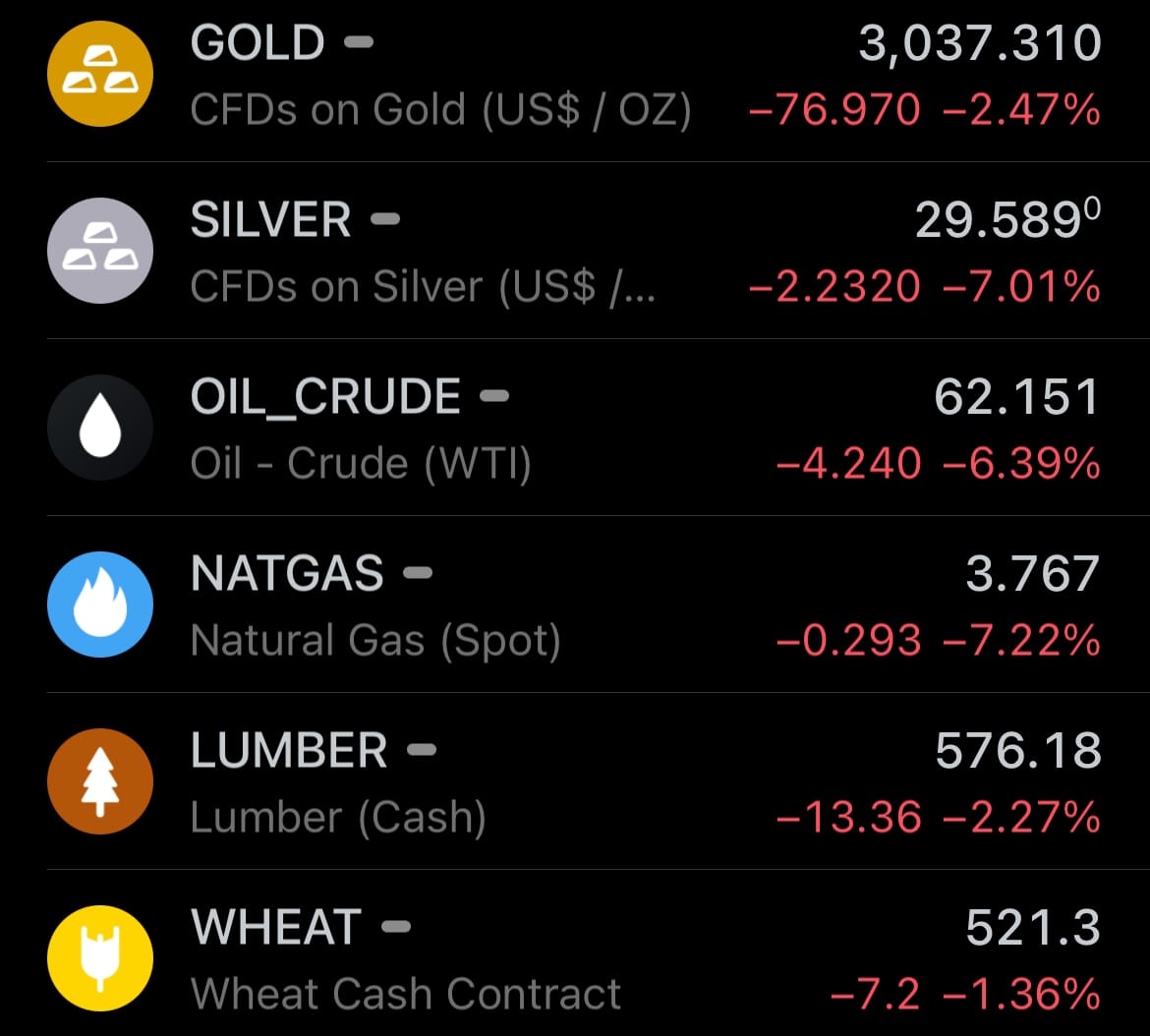

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

Environment & Weather:

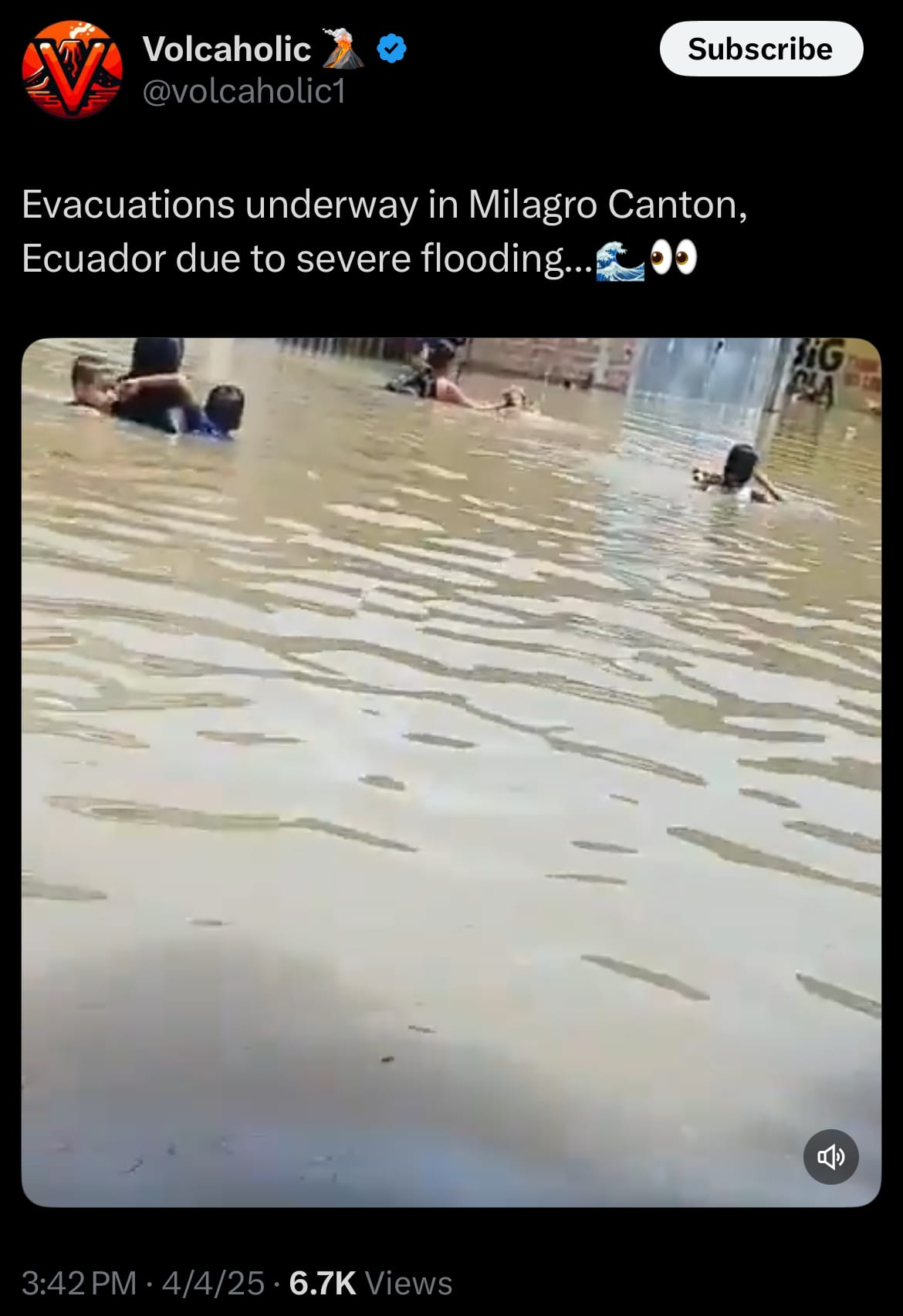

- As of April 5, 2025, Milagro Canton in Ecuador’s Guayas Province is experiencing flooding due to heavy rainfall and the overflow of the Milagro River and Estero Los Monos. This is the second notable flooding event in the area within a week, affecting a substantial portion of the canton. Reports indicate that urban neighborhoods such as 24 de Mayo, UE Simón Bolívar, and Ciudadela 22 de, along with rural areas like Chobo parish, have seen water enter streets and homes. The Secretaría de Gestión de Riesgos has documented impacts on over 1,050 families, with key streets including Río Napo, Av. Paquisha, and Quito y Carlos Julio Arosemena among the affected zones.

- Local authorities, including the Milagro Municipality, are responding with emergency measures, including evacuations and damage assessments. The Secretaría de Gestión de Riesgos is overseeing coordination efforts, while rescue teams are assisting residents. Social media posts on X have highlighted the extent of the flooding, with some suggesting a large percentage of the city was underwater at its peak, though exact figures vary. The floods follow a pattern of heavy rain in the region this year, prompting ongoing efforts to manage the situation and support the population as conditions develop.

Space:

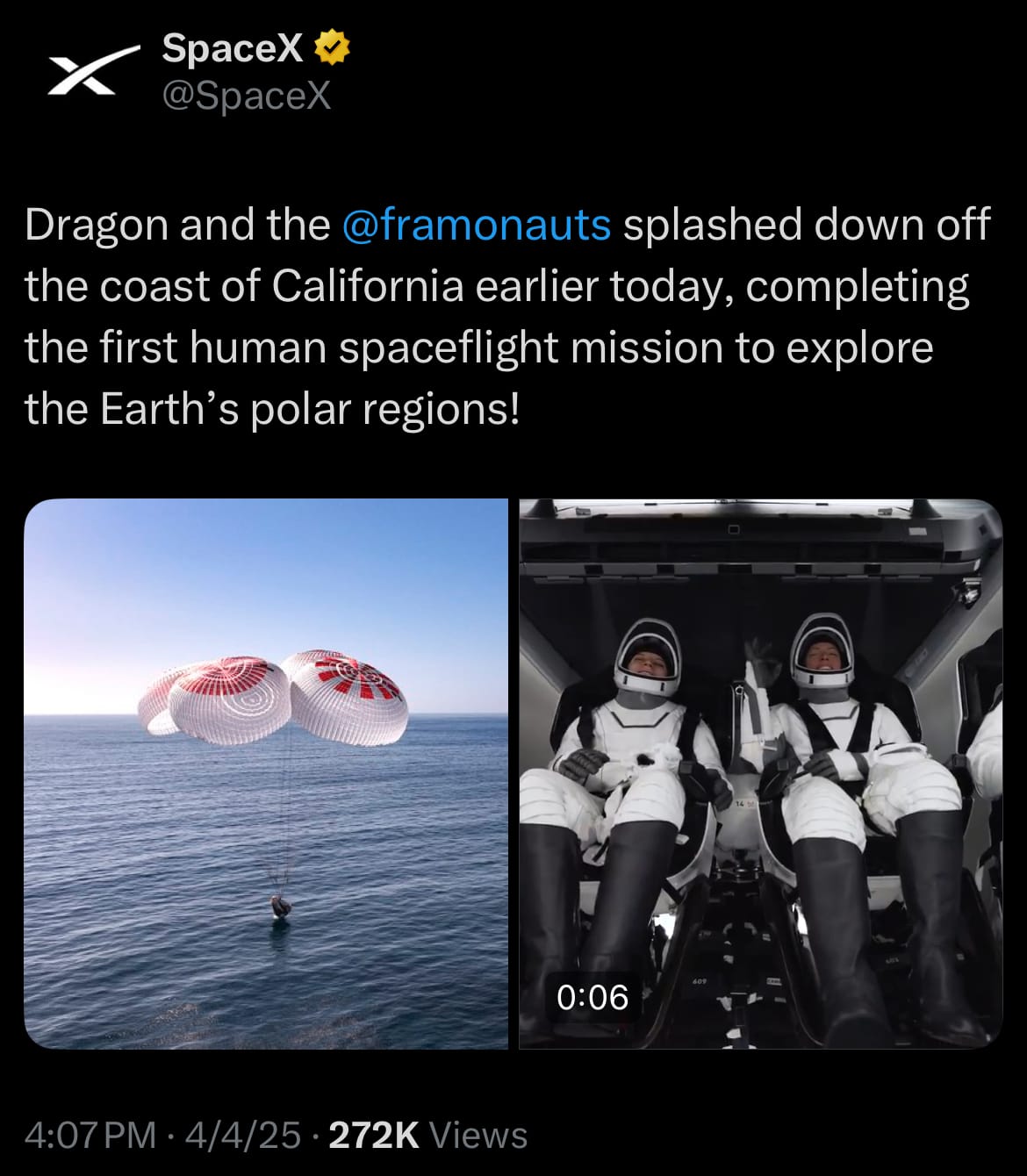

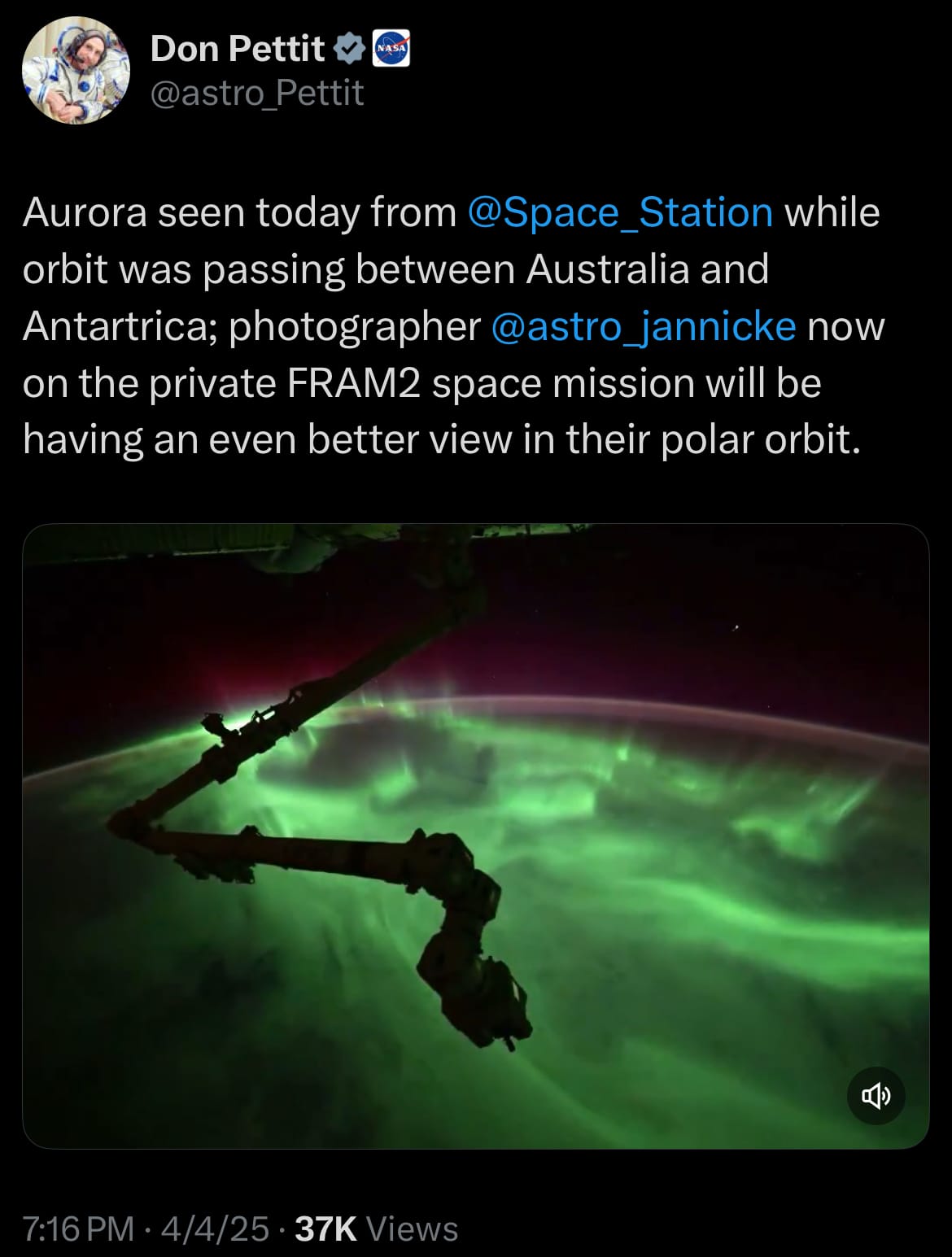

- Yesterday, April 4, 2025, a SpaceX Dragon capsule landed in the Pacific Ocean near Oceanside, California, at 12:18 p.m. ET (1618 GMT), completing the Fram2 mission. The capsule brought back four private astronauts—Eric Philips, Rabea Rogge, Jannicke Mikkelsen, and Chun Wang—after they spent about 3.5 days in space. Unlike SpaceX’s usual landings in the Atlantic Ocean or Gulf of Mexico, this splashdown occurred in the Pacific to reduce the chance of debris from the capsule’s trunk falling over land. The capsule used drogue and main parachutes to slow its descent, and a recovery team quickly picked it up from the water along with the crew.

- The Fram2 mission started on March 31, 2025, when the crew launched from NASA’s Kennedy Space Center in Florida on a Falcon 9 rocket. They entered a polar orbit, traveling north to south at an altitude of around 271 miles (437 kilometers), passing over the North and South Poles for just over three days. This was the first time a crewed mission followed this path, organized and paid for privately through SpaceX. The astronauts, linked by their connection to Svalbard, a Norwegian island group, wanted to view Earth’s polar areas from space, and their trip ended with the Pacific landing on April 4.

- On April 4, 2025, the U.S. Space Force’s Space Systems Command announced the awarding of National Security Space Launch (NSSL) Phase 3 Lane 2 contracts to three major aerospace companies: SpaceX, United Launch Alliance (ULA), and Blue Origin. These contracts, totaling approximately $13.7 billion, cover 54 launches scheduled between fiscal years 2025 and 2029, aimed at deploying critical military and intelligence payloads into orbit. SpaceX secured the largest share with $5.9 billion for 28 missions, followed by ULA with $5.4 billion for 19 missions, and Blue Origin with $2.4 billion for 7 missions.

- The NSSL Phase 3 Lane 2 contracts focus on the most demanding and risk-averse missions, requiring high-performance rockets and stringent mission assurance standards. SpaceX will utilize its Falcon 9 and Falcon Heavy rockets, ULA will deploy its recently certified Vulcan rocket, and Blue Origin will rely on its New Glenn rocket, which is still pending full certification but expected to be ready by late 2026. These awards build on the Space Force’s dual-lane approach, with Lane 2 dedicated to complex orbits and heavy-lift requirements, distinguishing it from the more commercial-oriented Lane 1 contracts awarded earlier. The contracts underscore the Pentagon’s confidence in these companies to support vital defense operations, while also highlighting SpaceX’s dominant position in the military launch market, tempered by growing roles for ULA and Blue Origin.

Statistic:

- Largest public semiconductor companies by market capitalization:

- 🇺🇸 NVIDIA: $2.301T

- 🇹🇼 TSMC: $761.38B

- 🇺🇸 Broadcom: $687.84B

- 🇳🇱 ASML: $254.17B

- 🇰🇷 Samsung: $253.30B

- 🇺🇸 QUALCOMM: $140.97B

- 🇺🇸 AMD: $139.32B

- 🇺🇸 Texas Instruments: $137.75B

- 🇺🇸 Applied Materials: $103.13B

- 🇬🇧 Arm Holdings: $92.44B

- 🇰🇷 SK Hynix: $92.11B

- 🇺🇸 Intel: $86.55B

- 🇺🇸 Analog Devices: $81.63B

- 🇺🇸 KLA: $76.61B

- 🇺🇸 Lam Research: $75.85B

- 🇺🇸 Micron Technology: $72.32B

- 🇹🇼 MediaTek: $68.89B

- 🇺🇸 Synopsys: $60.01B

- 🇯🇵 Tokyo Electron: $58.95B

- 🇨🇳 SMIC: $58.85B

- 🇺🇸 Marvell Technology Group: $42.80B

- 🇳🇱 NXP Semiconductors: $40.78B

- 🇩🇪 Infineon: $37.21B

- 🇯🇵 Advantest: $28.16B

- 🇺🇸 Monolithic Power Systems: $22.85B

History:

- Early market crashes reveal the depth of downturns and subsequent recoveries. The Panic of 1873, tied to Jay Cooke & Company’s collapse and railroad overinvestment, caused a 40-50% stock price drop and a 10-day NYSE closure; recovery stretched into the 1880s, with industrial expansion driving a gradual upswing. The Panic of 1907 saw the DJIA fall 50% (103 to 53) after a copper market scheme failed, stabilizing by 1911 with banker-led efforts, followed by growth in the pre-World War I economy. The 1929 Crash saw the DJIA plummet 89% (381 to 41 by 1932) due to speculation and debt; it reached its pre-crash level by 1954, then surged in the post-war boom, with the DJIA tripling to over 1,000 by the early 1970s. Black Monday in 1987 marked a 22.6% single-day DJIA drop (508 points) linked to automated trading, recovering by 1989; a robust bull market followed, pushing the DJIA from 2,000 to nearly 11,000 by 2000.

- Later crashes show quicker rebounds and notable upswings. The Dot-Com Bubble (2000-2002) saw the NASDAQ fall 78% from 5,048 due to tech overvaluation, while the S&P 500 dropped 49%; the S&P recovered by 2007, followed by a housing-fueled rise until the next crash. The 2008 Financial Crisis, triggered by housing and banking failures, led to a 54% DJIA decline (14,164 to 6,547) by March 2009; it regained its peak by 2013 with government intervention, then soared to over 30,000 by 2020 in a decade-long bull run. The 2020 COVID-19 Crash saw the DJIA fall 37% in weeks amid global disruptions, with the S&P 500 back to its pre-crash level by August 2020 due to stimulus; markets then climbed sharply, with the DJIA surpassing 30,000 by November and the S&P 500 gaining over 70% from its March low by late 2020. These patterns show crashes followed by recoveries and often significant growth, shaped by economic and policy factors.

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

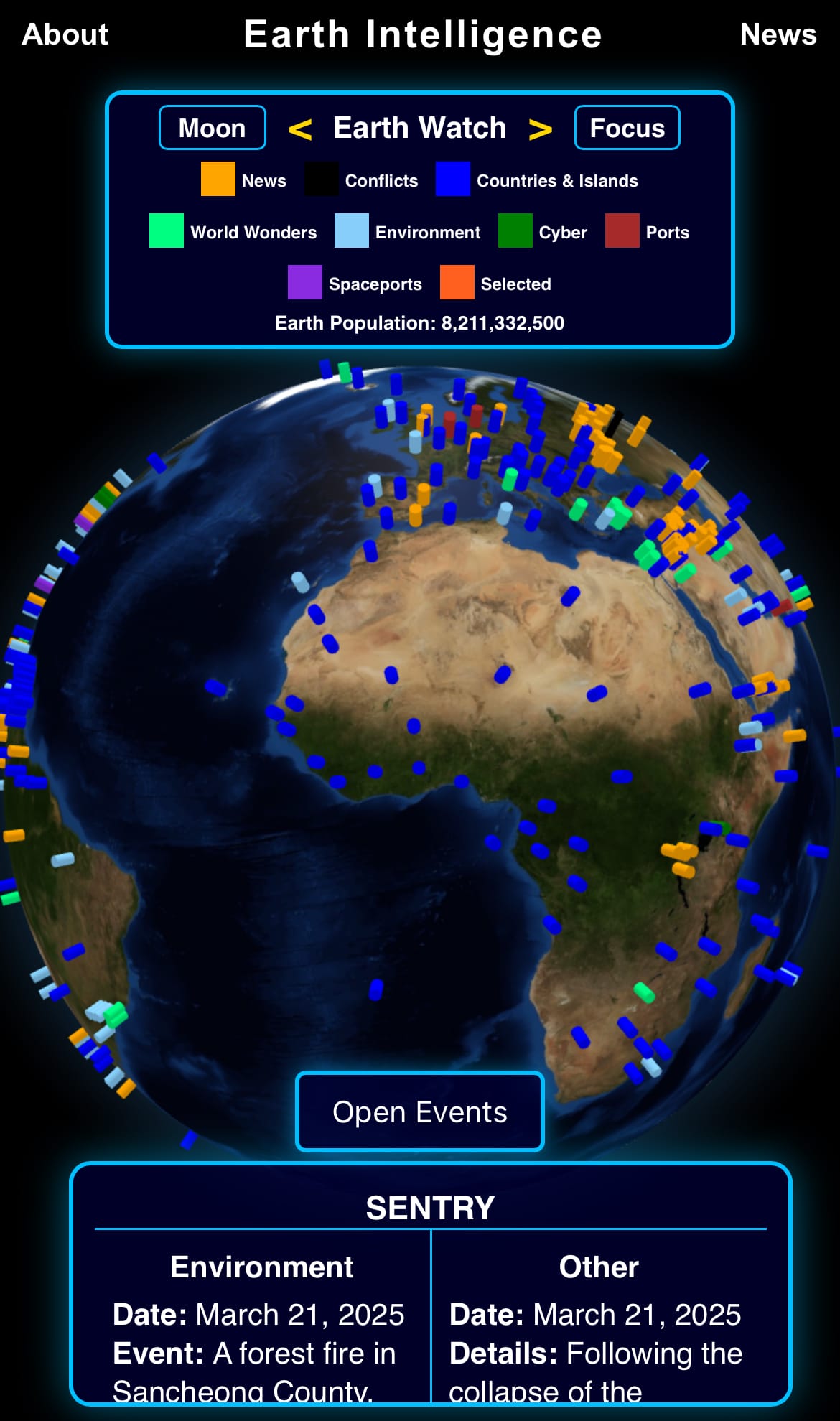

Click image to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news