Saturday☕️

Trending:

- Republic First Bank Failure

- U.S. Birth Rates

Markets:

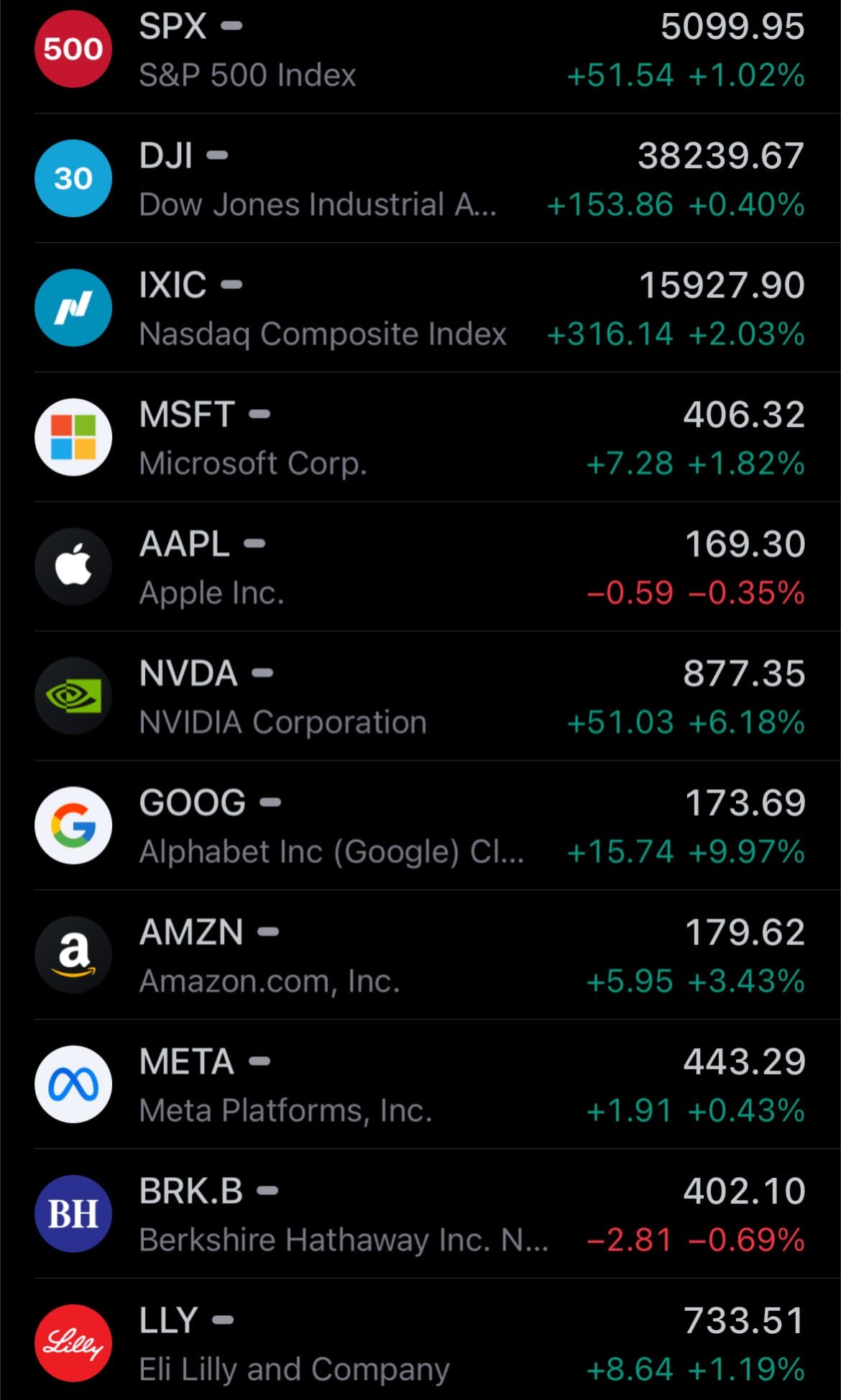

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Republic First Bank Failure:

- Regulators have taken control of Republic First Bank, marking it as the first U.S. bank failure of the year. Announced by the FDIC on Friday, the bank, also operating as Republic Bank and headquartered in Philadelphia, was closed by the Pennsylvania Department of Banking and Securities. The FDIC, serving as the receiver, arranged for Fulton Bank, National Association, from Lancaster, Pennsylvania, to take over almost all deposits and purchase most of the assets of Republic Bank.

- Additionally, the FDIC outlined the future steps for Republic First Bank’s 32 branches across New Jersey, Pennsylvania, and New York, which will start operations as Fulton Bank branches the following Saturday and Monday, based on local branch hours. The bank’s failure was due to a mix of internal issues and wider market instability, notably influenced by a rapid outflow of deposits and a general loss of confidence from investors and depositors. This was further aggravated by the banking sector's broader issues following significant withdrawals at other banks such as Silicon Valley Bank and Signature Bank, leading to a contagion effect that also impacted Republic First Bank.

- Former CEO Michael Roffler noted that the bank was in a stable financial condition before these events, but the swift withdrawal of deposits, fueled by market fears and possibly accelerated by social media, overwhelmed the bank's capabilities. Despite receiving a significant capital injection from major banks to stabilize, confidence was not restored among its clientele. This series of events highlights how quickly confidence can erode in the financial sector and the profound impact of market perceptions on a bank’s stability.

U.S. Birth Rates:

- In 2022, the U.S. saw a slight increase in births, reversing a five-year trend of declining birth rates. Approximately 3.7 million babies were born, translating to a fertility rate of about 1.67 births per woman. This was a marginal increase from the 1.66 rate reported in 2021, reflecting a temporary boost in birth rates likely influenced by pandemic-related delays. However, this figure still reflects the broader, long-term trend of declining birth rates across the nation.

- In 2023, the United States recorded a fertility rate of 1.62 births per woman, marking the lowest level since the 1930s when such statistics were first tracked. Last year, about 3.6 million babies were born in the U.S., a 2% decrease from the previous year and the smallest number since 1979. The teen pregnancy rate also hit a historic low, with only 13.2 births per 1,000 women aged 15-19, representing a 79% decline from 1991. Meanwhile, women aged 30-34 had the highest birth rate of any age group at 95.1 births per 1,000 women, followed by those aged 25-29.

Statistic:

- Largest Dow Jones companies by market capitalization:

- 🇺🇸 Microsoft - $3.019T

- 🇺🇸 Apple - $2.614T

- 🇺🇸 Amazon - $1.868T

- 🇺🇸 Visa - $561.69B

- 🇺🇸 JPMorgan Chase - $555.72B

- 🇺🇸 Walmart - $484.77B

- 🇺🇸 UnitedHealth - $455.76B

- 🇺🇸 Procter & Gamble - $380.66B

- 🇺🇸 Johnson & Johnson - $352.16B

- 🇺🇸 Merck - $332.33B

- 🇺🇸 Home Depot - $332.08B

- 🇺🇸 Chevron - $306.25B

- 🇺🇸 Coca-Cola - $266.17B

- 🇺🇸 Salesforce - $266.06B

- 🇺🇸 Walt Disney - $206.78B

- 🇺🇸 McDonald's - $196.89B

- 🇺🇸 Cisco - $193.79B

- 🇺🇸 Caterpillar - $171.47B

- 🇺🇸 American Express - $169.49B

- 🇺🇸 Verizon - $167.02B

- 🇺🇸 IBM - $153.21B

- 🇺🇸 Amgen - $144.81B

- 🇺🇸 Nike - $142.06B

- 🇺🇸 Goldman Sachs - $138.75B

- 🇺🇸 Intel - $135.70B

- 🇺🇸 Honeywell - $125.97B

- 🇺🇸 Boeing - $102.65B

- 🇺🇸 3M - $50.81B

- 🇺🇸 The Travelers Companies - $48.87B

- 🇺🇸 Dow - $40.56B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news