Saturday☕️

Trending:

- Twilio Data Breach

- Neiman Marcus Acquisition

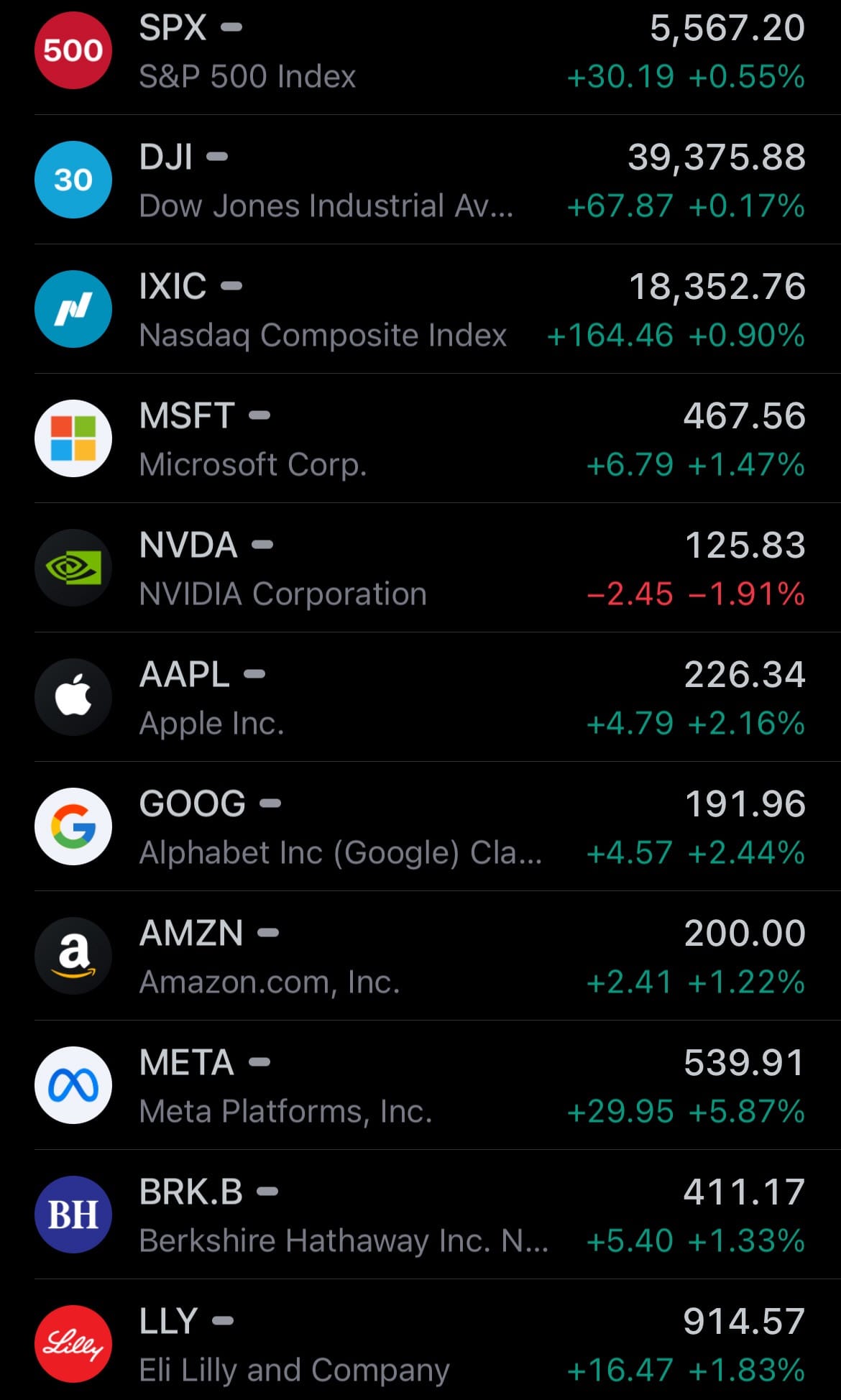

Markets:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Twilio Data Breach:

- In June, the ShinyHunters hacking group announced on the relaunched BreachForums website that they had leaked 33 million random phone numbers linked to Twilio’s two-factor authentication app, Authy. This data leak also included account IDs and other non-personal information of Authy users. Twilio confirmed the breach in a security alert posted on its website.

- The company revealed that threat actors accessed data associated with Authy accounts, including phone numbers, through an unauthenticated endpoint. This vulnerability allowed unauthorized access to the data without needing to bypass security protocols. Twilio has since secured this endpoint to prevent further breaches. Although there is no evidence suggesting that the hackers accessed Twilio's broader systems or obtained more sensitive data, the company advised Authy users to update their Android and iOS security measures as a precaution.

Neiman Marcus Acquisition:

- Several North American department stores are set to merge as Hudson's Bay Co. (HBC) acquires Neiman Marcus for $2.65 billion, integrating it into a larger business with other upscale retailers. Announced on Thursday, this deal grants HBC control of the Dallas-based Neiman Marcus Group, which operates 38 luxury stores under the Neiman Marcus and Bergdorf Goodman brands, both known for their high-end apparel, accessories, and home goods.

- As part of the acquisition, HBC will for a new entity called Saks Global, which will include Neiman Marcus, Bergdorf Goodman, Saks Fifth Avenue, and Saks Off 5th. HBC has owned Saks Fifth Avenue and Saks Off 5th since 2013. Saks Global will be led by Marc Metrick, the current CEO of Saks.com. This merger aims to consolidate the operations and resources of these brands under one umbrella. Neiman Marcus, which filed for bankruptcy protection in May 2020, will be part of this new entity. This move by HBC seeks to enhance the positioning and performance of these luxury brands in a changing market.

Statistic:

- Largest biotech companies by market capitalization:

- 🇺🇸 Eli Lilly - $823.48B

- 🇩🇰 Novo Nordisk - $640.66B

- 🇺🇸 Johnson & Johnson - $352.53B

- 🇺🇸 Merck - $320.27B

- 🇺🇸 AbbVie - $295.34B

- 🇬🇧 AstraZeneca - $239.79B

- 🇨🇭 Novartis - $222.96B

- 🇨🇭 Roche - $219.63B

- 🇺🇸 Thermo Fisher Scientific - $206.16B

- 🇺🇸 Amgen - $166.76B

- 🇺🇸 Pfizer - $158.94B

- 🇫🇷 Sanofi - $124.25B

- 🇺🇸 Vertex Pharmaceuticals - $122.46B

- 🇺🇸 Regeneron Pharmaceuticals - $113.95B

- 🇦🇺 CSL - $97.80B

- 🇺🇸 Gilead Sciences - $83.08B

- 🇺🇸 Bristol-Myers Squibb - $80.39B

- 🇺🇸 Zoetis - $79.83B

- 🇬🇧 GlaxoSmithKline - $79.19B

- 🇯🇵 Daiichi Sankyō - $68.40B

- 🇯🇵 Chugai Pharmaceutical - $63.47B

- 🇺🇸 Moderna - $45.34B

- 🇺🇸 DexCom - $45.21B

- 🇮🇳 Sun Pharmaceutical - $45.07B

- 🇰🇷 Samsung Biologics - $41.51B

- 🇯🇵 Takeda Pharmaceutical - $41.49B

- 🇨🇭 Lonza - $40.46B

- 🇺🇸 Agilent Technologies - $36.86B

- 🇨🇳 Jiangsu Hengrui Medicine - $35.13B

- 🇺🇸 Biogen - $32.85B

- 🇺🇸 Alnylam Pharmaceuticals - $31.75B

- 🇧🇪 UCB - $30.20B

- 🇩🇰 Novozymes - $29.45B

- 🇰🇷 Celltrion - $28.01B

- 🇩🇪 Bayer - $27.87B

- 🇮🇪 ICON plc - $26.55B

- 🇳🇱 Argenx - $25.90B

- 🇯🇵 Otsuka Holdings - $23.38B

- 🇩🇪 BioNTech - $19.30B

- 🇮🇱 Teva Pharmaceutical Industries - $18.57B

- 🇯🇵 Astellas Pharma - $18.03B

- 🇺🇸 Baxter - $17.78B

- 🇺🇸 Illumina - $17.28B

- 🇺🇸 LabCorp - $17.24B

- 🇩🇰 Genmab - $16.20B

- 🇨🇭 Sandoz Group - $16.13B

- 🇨🇳 BeiGene - $15.60B

- 🇺🇸 BioMarin Pharmaceutical - $15.46B

- 🇬🇧 Royalty Pharma - $15.33B

- 🇮🇳 Divis Laboratories - $14.72B

- 🇮🇳 Cipla - $14.61B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news