Thursday☕️

Economics & Markets:

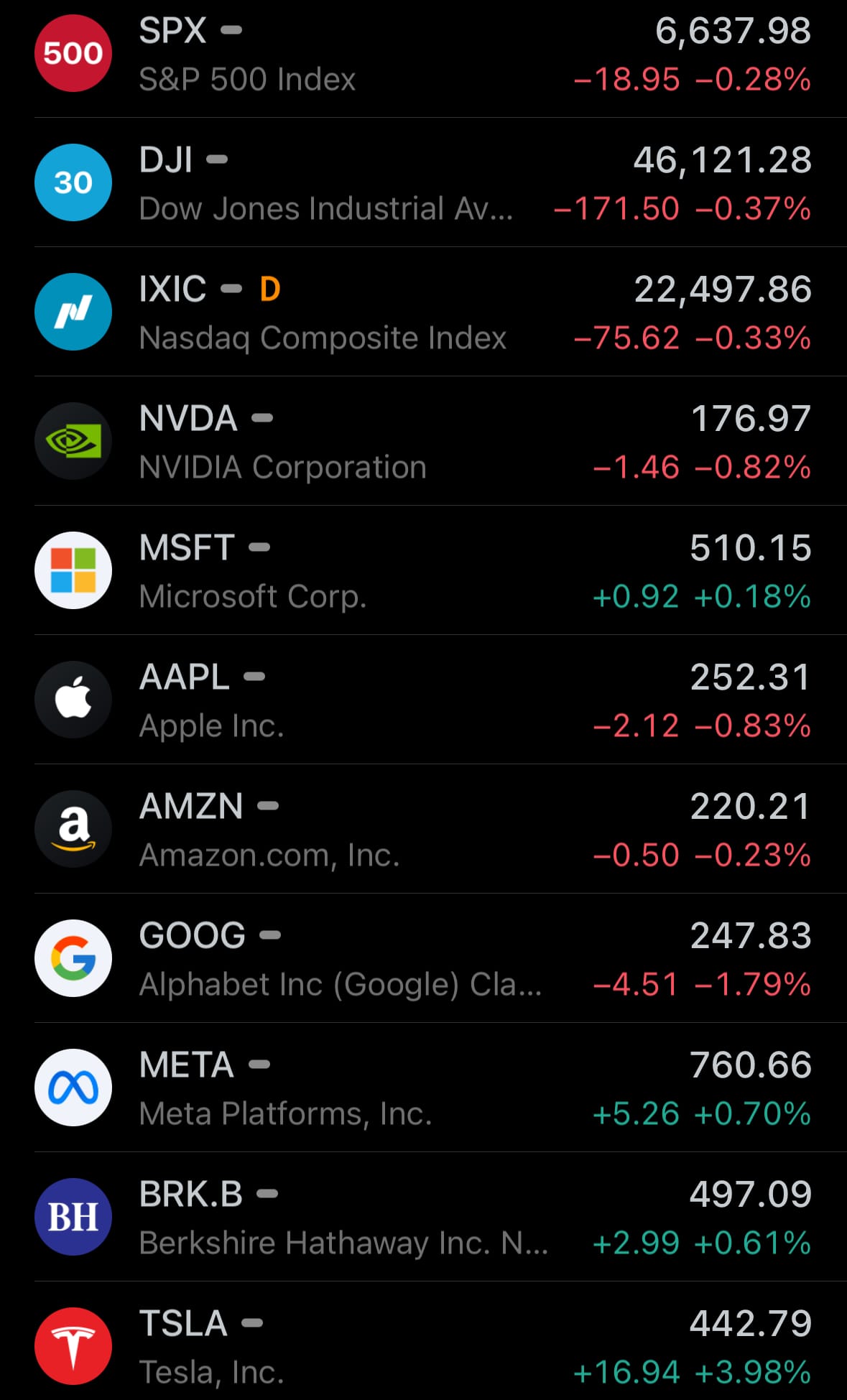

- Yesterday’s U.S. stock market:

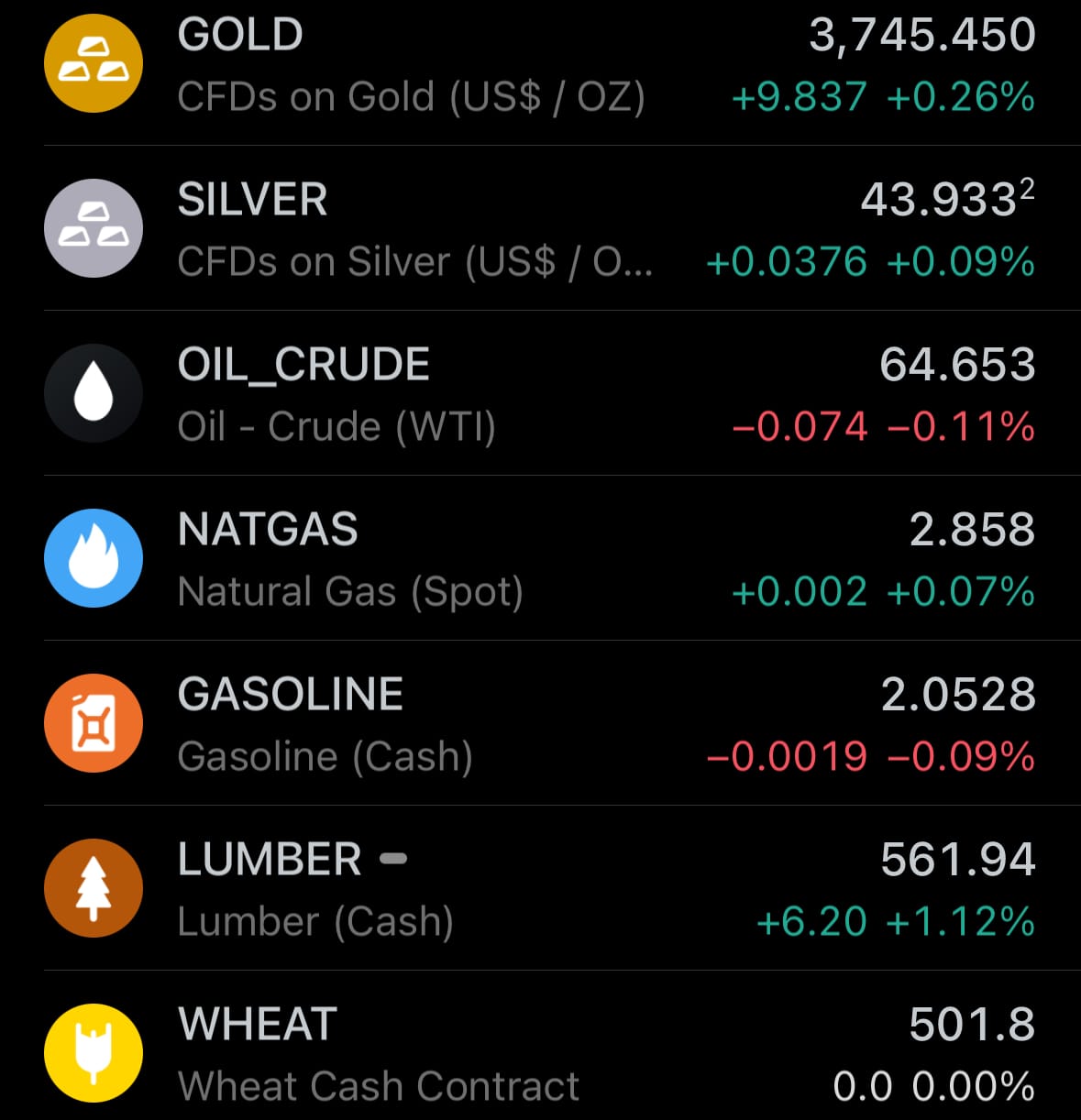

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- On September 24, 2025, Ukrainian forces carried out drone strikes on Russian Black Sea ports, including the Rosneft-operated oil export terminal in Tuapse using unmanned surface vehicles like the Magura V5 or Sea Baby drones, causing explosions at the oil loading pier that handles products such as fuel oil, vacuum gas oil, and high-sulfur diesel. Simultaneous strikes targeted Novorossiysk, resulting in two civilian deaths and six injuries, leading to a local state of emergency, evacuations along the Tuapse coast, and a temporary halt to oil shipments from both ports, which are essential for exporting millions of tons of crude oil each year.

- These actions are part of Ukraine's ongoing efforts since 2022 to target Russian energy and naval assets, which have reportedly impacted over a third of Russia's Black Sea Fleet and decreased refining capacity by up to 20% in 2025, with the goal of reducing Moscow's regional oil revenues above $15 billion and redirecting exports westward due to changing domestic needs.

Cyber:

- On September 24, 2025, the UK's National Crime Agency arrested a man in his 40s in West Sussex in connection with a ransomware attack that affected check-in systems at several European airports, including Heathrow in London, Berlin Brandenburg, and Brussels, resulting in extensive flight delays and cancellations over the weekend. The attack focused on RTX, a U.S.-based company providing aviation services like passenger processing, leading to disruptions for airlines and travelers across Europe without impacting flight safety mechanisms.

- The individual was held on suspicion of cybercrime involvement, with digital devices confiscated for examination, though details on any associated ransomware group or underlying motive remain undisclosed. This event points to persistent cybersecurity challenges in the aviation industry, especially involving third-party providers managing essential systems, which can lead to operational halts and financial impacts in the millions.

Space:

- On September 24, 2025, SpaceX successfully launched a Falcon 9 rocket from Launch Pad 39A at NASA's Kennedy Space Center in Florida at 7:30 a.m. Eastern Daylight Time (11:30 GMT), carrying NASA's Interstellar Mapping and Acceleration Probe spacecraft along with two secondary payloads: NASA's Tandem Reconnection and Cusp Electrodynamics Reconnaissance Satellites and NOAA's Space Weather Follow-On mission.

- The Interstellar Mapping and Acceleration Probe aims to study the heliosphere, the region of space influenced by the sun; the Tandem Reconnection and Cusp Electrodynamics Reconnaissance Satellites will examine interactions between solar wind and Earth's magnetic field; and the Space Weather Follow-On will monitor space weather from the L1 Lagrange point. The rocket's first-stage booster separated and landed on a droneship in the Atlantic Ocean, achieving another reuse milestone.

Science & Technology:

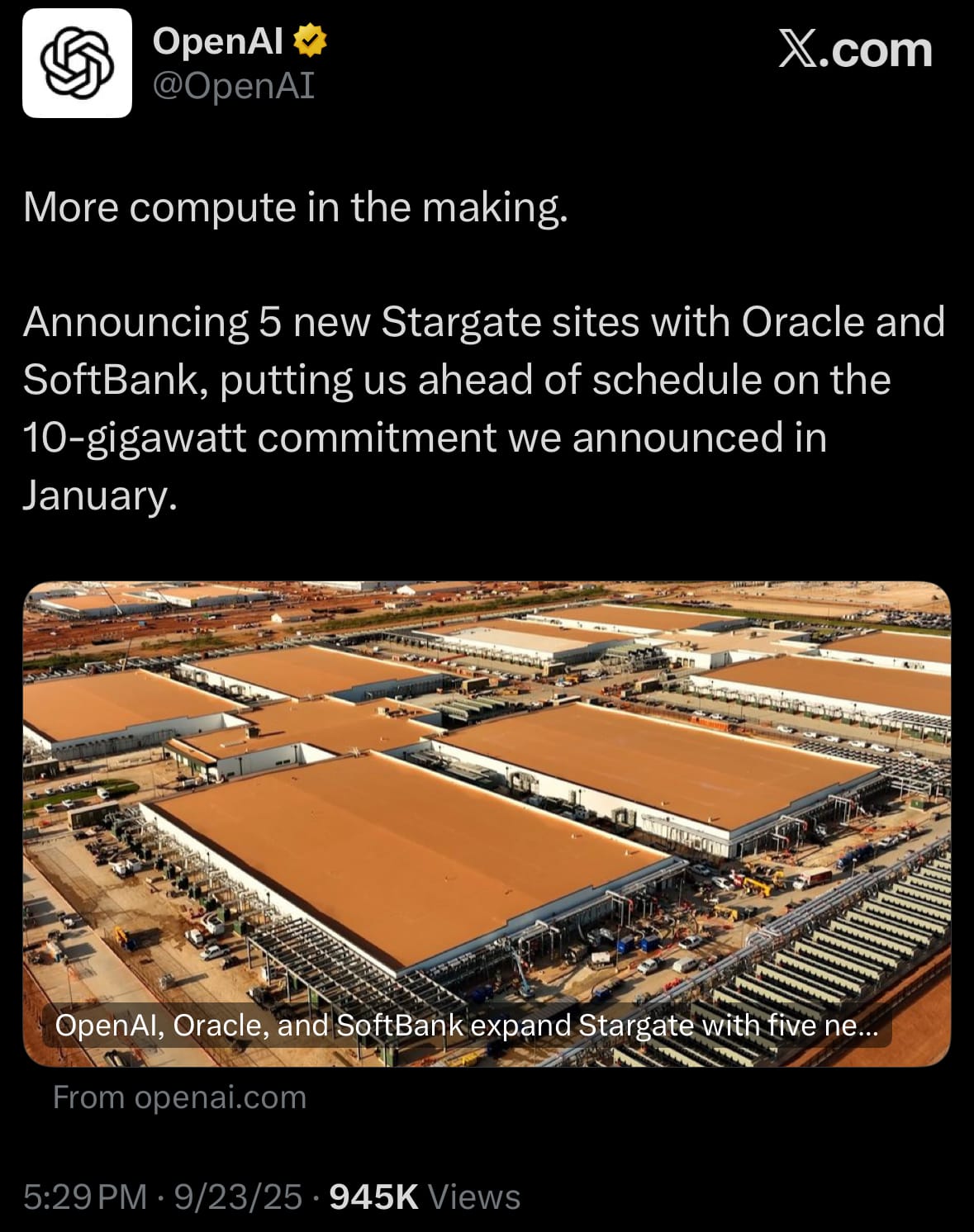

- On September 23, 2025, OpenAI, in partnership with Oracle and SoftBank, announced the addition of five new AI data center sites to the Stargate project, accelerating its ambitious infrastructure buildout across the United States. The new facilities include two in Texas—one in Shackelford County and a flagship 1,100-acre site in Abilene with eight large buildings—one in Doña Ana County, New Mexico, one in Ohio, and an undisclosed location in the Midwest. This expansion boosts the project's planned capacity to seven gigawatts, equivalent to the output of several nuclear reactors, and aligns with a $400 billion investment phase, putting Stargate on track to meet or exceed its full $500 billion, 10-gigawatt commitment by the end of 2025. The sites are designed to support advanced AI computing needs, with Oracle handling cloud infrastructure and SoftBank providing investment support.

- This development reflects the surging demand for high-scale AI resources amid rapid advancements in machine learning, positioning the collaboration as a key player in global tech infrastructure without favoring any specific competitive narrative. The move addresses bottlenecks in computational power for training next-generation models, potentially creating jobs and economic growth in the selected regions, while highlighting ongoing industry efforts to scale AI capabilities.

Statistic:

- Largest banking companies by market capitalization:

- 🇺🇸 JPMorgan Chase: $861.82B

- 🇺🇸 Bank of America: $382.93B

- 🇨🇳 ICBC: $347.89B

- 🇨🇳 Agricultural Bank of China: $314.71B

- 🇺🇸 Wells Fargo: $269.44B

- 🇨🇳 China Construction Bank: $256.36B

- 🇺🇸 Morgan Stanley: $252.02B

- 🇬🇧 HSBC: $241.43B

- 🇺🇸 Goldman Sachs: $239.88B

- 🇨🇳 Bank of China: $222.46B

- 🇨🇦 Royal Bank Of Canada: $208.01B

- 🇺🇸 Citigroup: $187.12B

- 🇯🇵 Mitsubishi UFJ Financial: $181.66B

- 🇦🇺 Commonwealth Bank: $180.30B

- 🇮🇳 HDFC Bank: $176.43B

- 🇺🇸 Charles Schwab: $167.67B

- 🇪🇸 Santander: $152.61B

- 🇨🇳 CM Bank: $147.15B

- 🇺🇸 Capital One: $143.46B

- 🇨🇦 Toronto Dominion Bank: $133.43B

- 🇨🇭 UBS: $132.33B

- 🇮🇹 UniCredit: $115.23B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria: $111.61B

- 🇮🇳 ICICI Bank: $111.42B

- 🇮🇹 Intesa Sanpaolo: $111.17B

History:

- The history of JPMorgan Chase begins in 1799 with the founding of The Manhattan Company, originally chartered to provide clean drinking water to New York City but soon pivoting into banking. This firm would later become Chase Manhattan Bank. In 1871, J. Pierpont Morgan co-founded Drexel, Morgan & Co., which became J.P. Morgan & Co. in 1895, cementing its reputation as a dominant force in American finance. By the late 1800s, J.P. Morgan’s firm was central to the financing of America’s industrial expansion, backing major corporations like U.S. Steel, General Electric, and railroads. During the Panic of 1907, Morgan personally intervened to stabilize the banking system, acting as a de facto central bank years before the Federal Reserve was established in 1913.

- Throughout the 20th century, a series of strategic mergers laid the groundwork for the modern bank. In 1955, Chase National Bank merged with The Bank of the Manhattan Company, creating Chase Manhattan Bank, one of the first U.S. banks to establish a global presence. Meanwhile, J.P. Morgan & Co. continued as a prestigious investment bank. In 1991, Chase Manhattan merged with Chemical Bank, which had already absorbed Manufacturers Hanover Trust in 1990, further expanding its retail and corporate banking operations. The turning point came in 2000, when Chase Manhattan merged with J.P. Morgan & Co., forming JPMorgan Chase & Co., combining retail banking with Wall Street expertise. The firm continued expanding through key acquisitions, notably Bank One in 2004 (bringing in future CEO Jamie Dimon), and Bear Stearns and Washington Mutual during the 2008 financial crisis, solidifying its position as the largest bank in the U.S. by assets. As of 2025, JPMorgan Chase remains a global financial leader with influence across consumer banking, investment banking, asset management, and fintech.

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

Monitor the planet with the Earth Intelligence System. Click the image below to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news