Thursday

Trending:

- On December 10, 2025, U.S. forces seized the oil tanker Skipper in international waters about 20 nautical miles off Venezuela's coast, shortly after it left Jose port carrying roughly 1.1 million barrels of Venezuelan Merey crude oil from state-owned PDVSA. The operation involved FBI, Homeland Security Investigations, Coast Guard, and Marine personnel who boarded via helicopters; no injuries occurred. President Trump confirmed the seizure, calling it the largest of its kind, and Attorney General Pam Bondi released video of the boarding. The tanker was heading to Cuba and had its AIS transponder turned off.

- The seizure was based on a federal warrant issued around November 25, tied to the tanker's past role in smuggling sanctioned Iranian oil, not its current Venezuelan cargo. Previously named Adisa and Toyo, it was owned by a Marshall Islands company sanctioned in 2022 for links to Iranian oil networks. Venezuela called the action "international piracy," while Cuba condemned it as an illegal blockade worsening its energy shortages. This was the 22nd such operation since September, briefly pushing global oil prices up about 2%, with U.S. officials stating the oil will be sold in compliant markets.

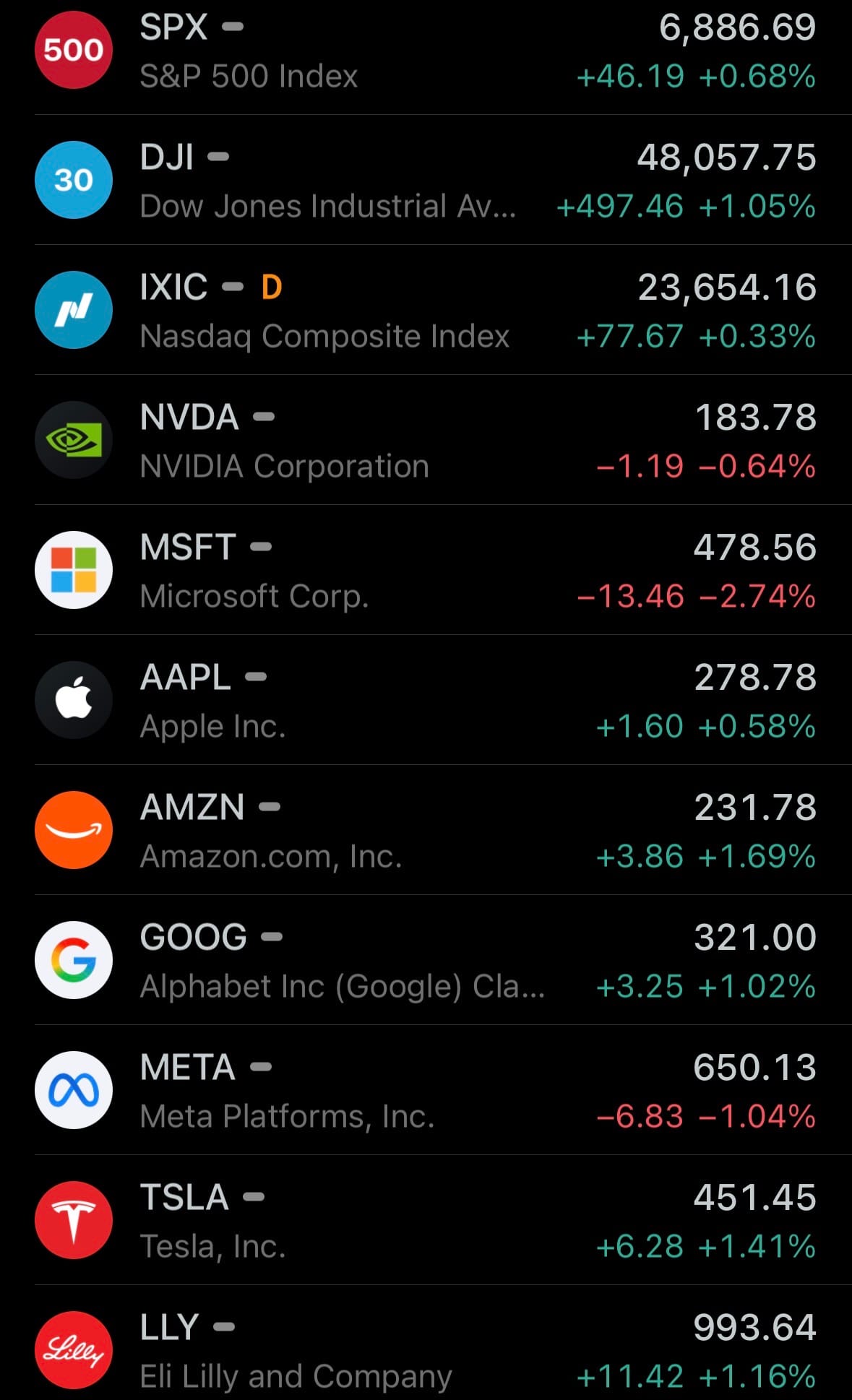

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- On December 10, 2025, heavy fighting between Thai and Cambodian forces entered its third day along their disputed border, involving artillery, airstrikes, and small-arms fire at multiple sites in Preah Vihear, Oddar Meanchey, and Trat provinces. Thailand shelled Cambodian positions near Ban Nong Chan and advanced into areas like Boeung Trakoun village, destroying a Cambodian building in a drone-recorded strike, while capturing outposts near Khnea temple using infantry, armored vehicles, and F-16 jets. Thailand claims Cambodia started the clash on December 7 with rockets and drones, killing one Thai soldier and wounding eight; Cambodia says Thailand launched a surprise attack while its troops were mobilizing under the October ceasefire.

- Casualties reached at least 13 dead (including three Thai soldiers and four Cambodian civilians) and over 80 wounded. More than 500,000 civilians have been evacuated to shelters in affected provinces on both sides. Both countries accuse each other of violating the October ceasefire (brokered by the U.S. and Malaysia after a July clash that killed 48), with some Cambodian-released images proven fake or from earlier fighting. President Trump plans calls with Thai and Cambodian leaders on December 11 to de-escalate, while the UN, ASEAN, and Malaysia urge restraint to avoid wider instability.

Environment & Weather:

Science & Technology:

- On December 10, 2025, NetJets, the world's largest provider of fractional private jet ownership and charter services, announced a multi-year service-level agreement with SpaceX's Starlink to equip approximately 600 aircraft in its global fleet with high-speed in-flight Wi-Fi connectivity. Installations will begin as early as December 2025, with full rollout targeted by the end of 2026 across U.S. and European operations, covering midsize and larger jets including Cessna Citation Latitudes and Longitudes, Embraer Praetor 500s, Bombardier Challenger 350s and 650s, and the entire Bombardier Global fleet. NetJets President Patrick Gallagher stated the upgrade will enable seamless video calls, streaming, online gaming, and real-time work even over oceans or remote areas, enhancing both business productivity and leisure experiences at 40,000 feet.

- Starlink Aviation promises download speeds up to 500 Mbps with low latency, outperforming traditional geostationary systems and providing reliable global coverage. This partnership is one of the largest LEO satellite adoptions in business aviation, aligning with Starlink's deals with over 20 commercial airlines including Korean Air, JSX, and airBaltic. SpaceX's Starlink dominates the satellite internet market worldwide, with over 10,000 satellites in orbit as of December 2025—more than 65% of all active satellites—and plans for up to 42,000 more, enabling unmatched low-latency service for over 8 million users and outpacing rivals like Amazon's Kuiper or OneWeb.

Statistic:

- Largest assets on Earth by market capitalization:

- Gold: $29.607T

- 🇺🇸 NVIDIA: $4.474T

- 🇺🇸 Apple: $4.137T

- 🇺🇸 Alphabet (Google): $3.875T

- 🇺🇸 Microsoft: $3.557T

- Silver: $3.463T

- 🇺🇸 Amazon: $2.477T

- 🇺🇸 Broadcom: $1.950T

- Bitcoin: $1.846T

- 🇺🇸 Meta Platforms: $1.638T

- 🇹🇼 TSMC: $1.608T

- 🇸🇦 Saudi Aramco: $1.567T

- 🇺🇸 Tesla: $1.501T

- 🇺🇸 Berkshire Hathaway: $1.058T

- 🇺🇸 Walmart: $902.36B

- 🇺🇸 Eli Lilly: $890.75B

- 🇺🇸 JPMorgan Chase: $852.72B

- 🇺🇸 Vanguard S&P 500 ETF: $828.58B

- 🇺🇸 iShares Core S&P 500 ETF: $738.28B

- 🇺🇸 SPDR S&P 500 ETF: $710.41B

- 🇨🇳 Tencent: $700.46B

- 🇺🇸 Oracle: $635.75B

- 🇺🇸 Visa: $628.62B

- Vanguard Total Stock Market Index Fund ETF Shares: $571.43B

- 🇺🇸 Exxon Mobil: $509.62B

History:

- The origins of the S&P 500 trace back to the early 20th century, when financial markets were becoming more complex and investors needed reliable measures of overall economic performance. The company that would later become Standard & Poor’s began publishing market data in the 1860s, and by 1923, it introduced its first composite stock index covering 233 U.S. companies across several industries. This early index was expanded and reorganized in 1926 into a broader 90-stock composite, which included daily price calculations—a major advancement for the time. Following decades of economic transformation, including the Great Depression and World War II, Standard & Poor’s launched a groundbreaking new index on March 4, 1957: the S&P 500, which used a market-cap-weighted method and modern computing to aggregate the performance of 500 large U.S. companies. This model provided a far more accurate picture of American corporate health than earlier price-weighted indices like the Dow. As the U.S. economy moved through industrialization, postwar expansion, stagflation, and deregulation, the S&P 500 gradually became the benchmark of choice for mutual funds, pension funds, economists, and government agencies. By the 1970s, it was already widely used as a measure of broad market performance; by 1976, the first index fund tracking the S&P 500—created by Vanguard—launched the modern era of passive investing.

- From the 1980s through today, the S&P 500 has grown into one of the most influential financial instruments on Earth. It expanded beyond a simple market indicator into the core benchmark for trillions of dollars in assets, driving the explosive rise of index funds, ETFs, and algorithmic strategies tied directly to its movements. During periods like the dot-com boom (1990s), the 2008 financial crisis, and the tech-driven 2010s–2020s, the index served as a real-time pulse of the U.S. economy’s evolution—shifting from manufacturing-heavy to technology-dominated. Companies such as Apple, Microsoft, Amazon, Nvidia, and Alphabet grew to represent an outsized share of the index, reflecting the concentration of U.S. corporate value. Today, funds tied to the S&P 500 influence global capital flows, portfolio construction, retirement savings, and corporate governance across virtually every sector. With more than $15 trillion benchmarked to it, the S&P 500 is arguably the single most important financial gauge in the world. Its rise from a simple 1920s market-tracking tool to a central backbone of modern investing mirrors the evolution of the U.S. economy itself—broad, diversified, innovation-driven, and deeply interconnected with global finance.

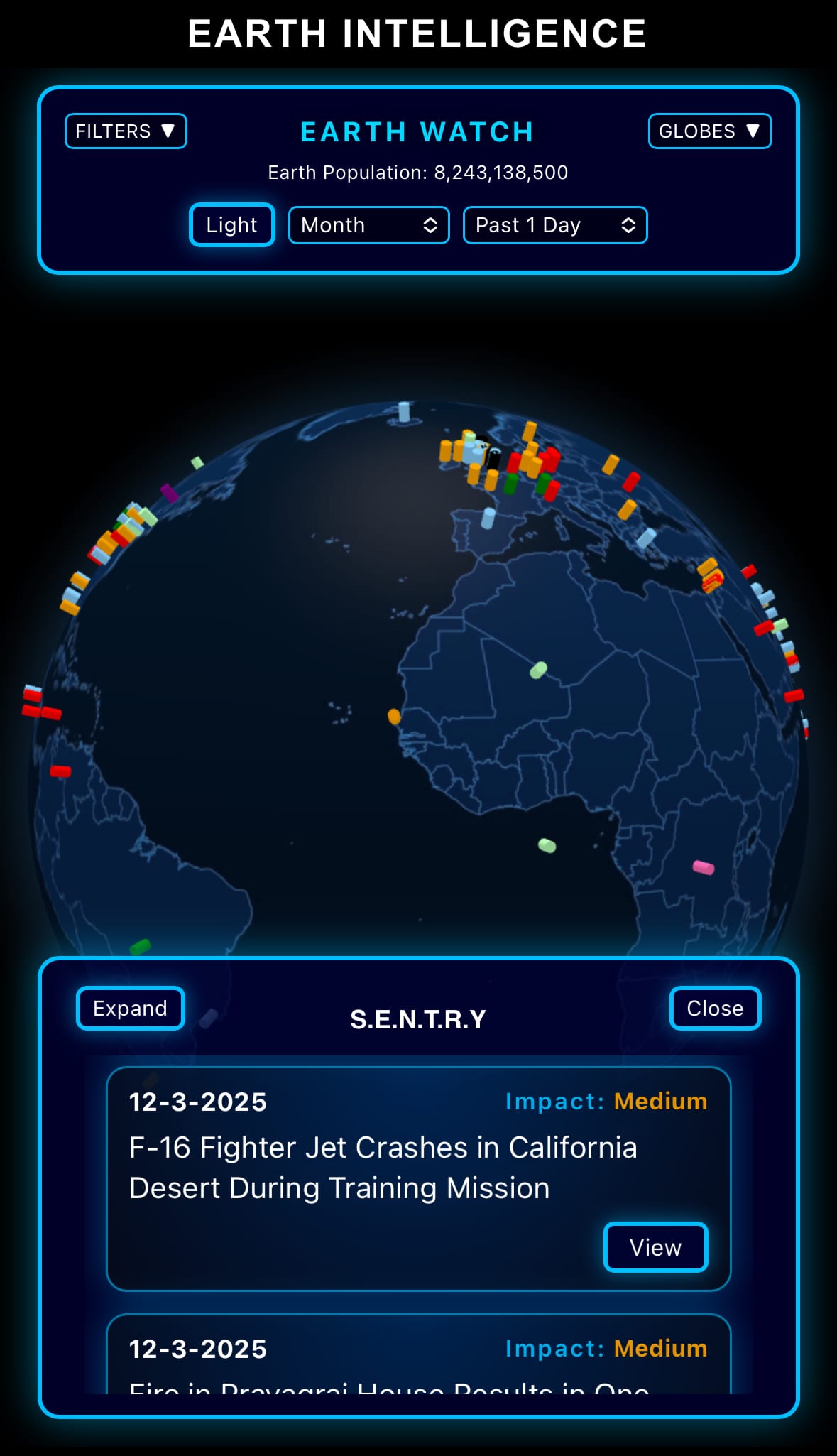

Image of the day:

Thanks for reading! Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

- Download our mobile app on the Apple App Store (Android coming soon):

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news