Thursday☕️

Trending:

- Idalia Aftermath

- ESG Investments

- Salesforce Earnings

Markets:

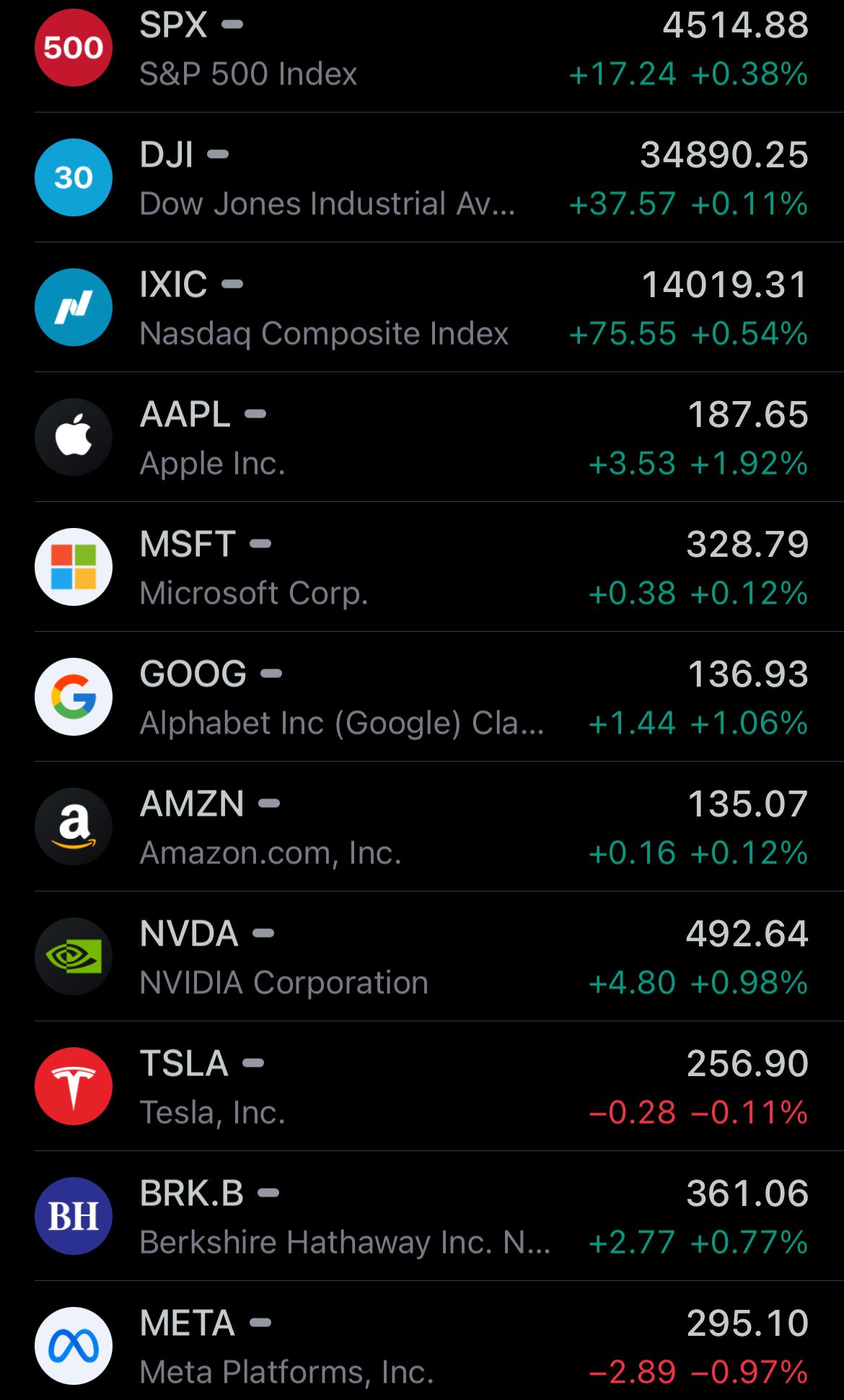

- Yesterday's U.S. stock market:

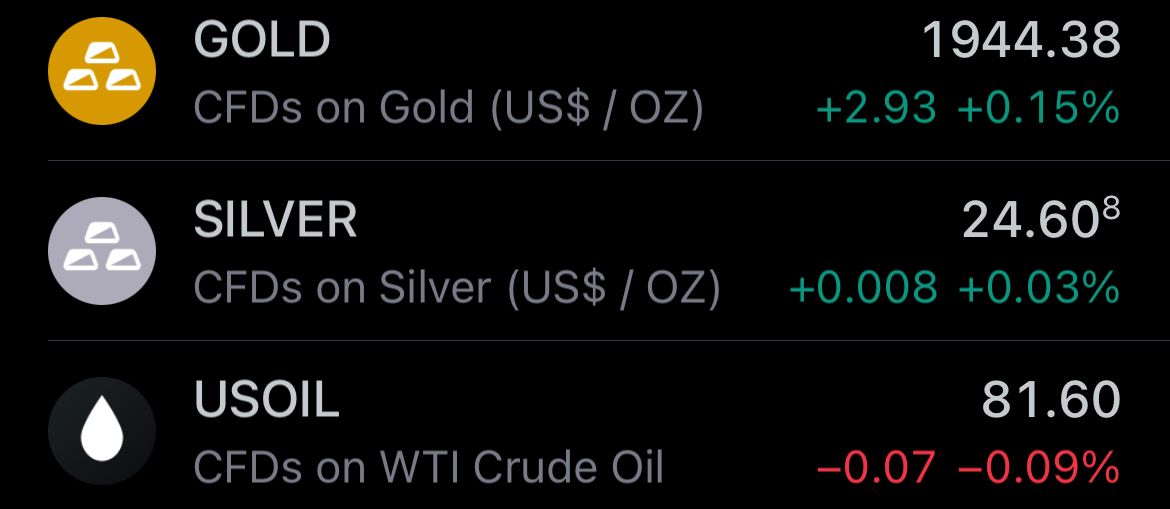

- Yesterday's commodity market:

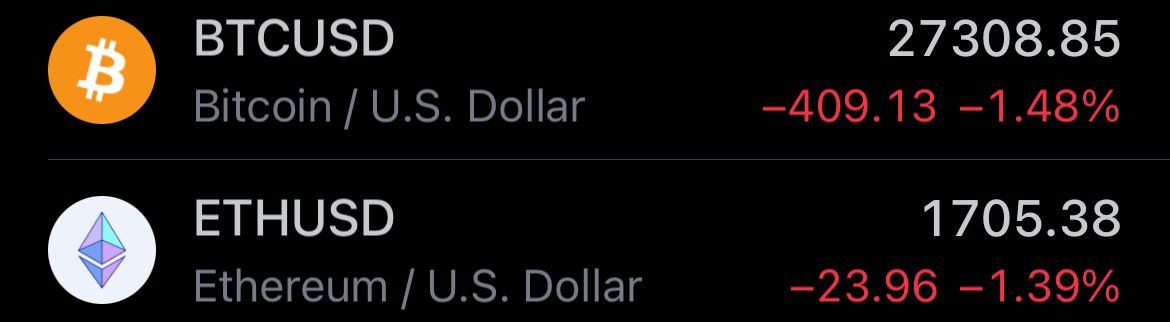

- Yesterday's crypto market:

Idalia Aftermath:

- Hurricane Idalia, a Category 3 storm, struck Florida's coastline on Wednesday morning. The hurricane, carried winds at a sustained speed of 125 mph and caused a storm surge that reached heights of 16 feet in some locations.

- This event marked the first time a major storm has landed on the 'Big Bend,' a region with a sparse population where the Florida panhandle connects with its peninsula. In preparation for Idalia's arrival, thousands of residents fled their homes.

- The governor of Florida declared a state of emergency in numerous northern counties and activated the National Guard. Due to the hurricane, roughly +100,000 individuals are now without electricity.

ESG Investments:

- The Vanguard Group revealed that it only approved 2% of the environmental and social resolutions proposed by shareholders in 2023, a significant decrease from 12% the previous year.

- This move mirrors BlackRock's decision to reject many climate and social matters, indicating a broader resistance against the environmental, social, and governance (ESG) movement, which both investment giants had previously supported.

- The reasons for this change could be multifaceted, including reactions from investors, concerns about profitability, and public relations considerations. Vanguard received more environmental and social proposals this proxy season compared to 2022, with a 50% increase in environmental-related proposals alone.

- The company noted that the most common subject was setting targets for greenhouse gas emissions, but also received several notable proposals concerning unionization and worker safety in the consumer sector. Despite this, Vanguard stated that the decline in support for such measures was mainly due to the volume and nature of the proposals, as well as improvements in company disclosures, which rendered many resolutions unnecessary.

Salesforce Earnings:

- Salesforce, a cloud-based software company, recently announced its quarterly results, revealing an impressive performance that exceeded Wall Street's expectations. The company reported adjusted earnings of $2.12 per share and a revenue of $8.60 billion, compared to the anticipated $1.90 per share and $8.53 billion.

- This represents an 11% increase in revenue compared to the same quarter last year. Additionally, the net income surged to $1.27 billion, or $1.28 per share, a significant increase from the $68 million, or 7 cents per share, reported in the same quarter of the previous year.

- Looking ahead, Salesforce projected an adjusted earnings per share of $2.05 to $2.06 and revenue in the range of $8.7 billion to $8.72 billion for the upcoming quarter. The company experienced growth across all five of its product segments, and CEO Marc Benioff expressed optimism about future expansion through the utilization of artificial intelligence.

Statistic:

Top 25 hotel companies by market cap:

- 🇺🇸 Marriott International: $62.29B

- 🇯🇵 Oriental Land: $57.30B

- 🇺🇸 Las Vegas Sands: $41.97B

- 🇺🇸 Hilton Worldwide: $39.33B

- 🇭🇰 Galaxy Entertainment: $28.81B

- 🇺🇸 MGM Resorts: $16.01B

- 🇨🇳 Huazhu Hotels: $13.06B

- 🇬🇧 InterContinental Hotels Group: $12.88B

- 🇺🇸 Hyatt Hotels: $12.08B

- 🇺🇸 Host Hotels & Resorts: $11.54B

- 🇺🇸 Wynn Resorts: $11.32B

- 🇫🇷 Accor: $9.49B

- 🇺🇸 Vail Resorts: $8.74B

- 🇬🇧 Whitbread: $8.69B

- 🇮🇳 Indian Hotels Company: $7.17B

- 🇺🇸 Choice Hotels International: $6.47B

- 🇺🇸 Wyndham Hotels & Resorts: $6.41B

- 🇹🇭 Minor International: $5.36B

- 🇲🇴 Wynn Macau: $5.12B

- 🇺🇸 Ryman Hospitality Properties: $5.10B

- 🇺🇸 Hilton Grand Vacations: $4.97B

- 🇭🇰 Melco Resorts & Entertainment: $4.80B

- 🇲🇴 MGM China Holdings: $4.75B

- 🇭🇰 SJM Holdings: $2.88B

- 🇫🇷 Covivio Hotels: $2.79B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Any Article Ideas? Email us.

Support/Suggestions email:

timeismoney@timeismon.com