Thursday☕️

Trending:

- Sam Altman Returns To OpenAI

- Nvidia Earnings

Markets:

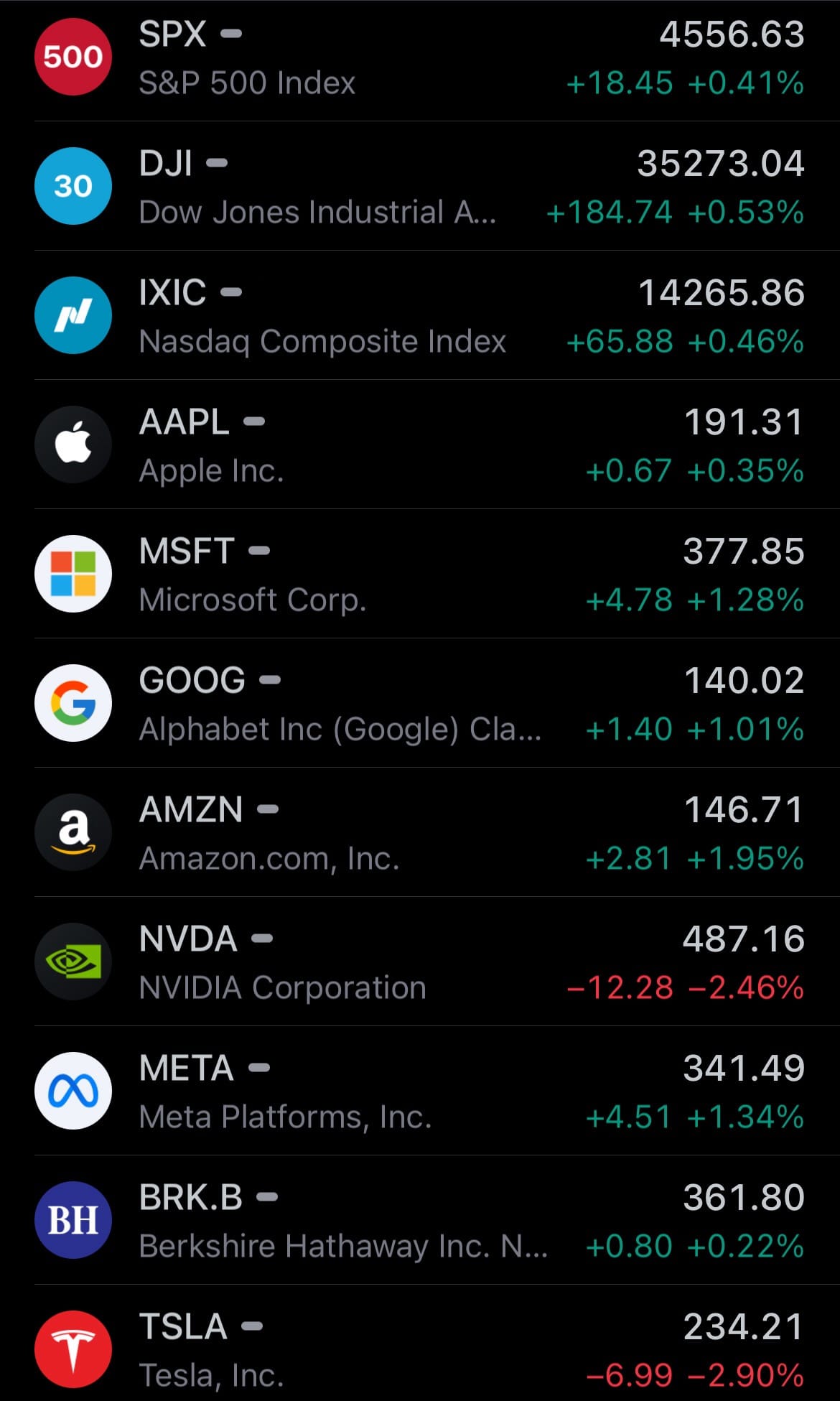

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Sam Altman Returns To OpenAI:

- Sam Altman will return as the CEO of OpenAI following a significant shakeup within the organization. Last week, Altman was unexpectedly ousted from his role by the board of OpenAI, a decision that led him to join Microsoft briefly.

- This move came as a shock to OpenAI's staff and investors, sparking a strong demand for his reinstatement. In response to the widespread discontent, with 95% of OpenAI's staff threatening to resign unless Altman was brought back, the company decided to reinstate him. Alongside Altman's return, OpenAI will undergo a major board restructuring.

- Out of the four board members who were involved in the decision to dismiss Altman, only one will remain. The new board will see the inclusion of notable figures such as former U.S. Treasury Secretary Larry Summers and former co-CEO of Salesforce, signaling a new direction for OpenAI's governance and leadership.

Nvidia Earnings:

- Nvidia reported fiscal third-quarter results surpassing Wall Street predictions. Despite these strong results, Nvidia is anticipating a decrease in sales for the next quarter due to export restrictions affecting business in China and other regions.

- Colette Kress, Nvidia's finance chief, indicated in a letter to shareholders that while sales in these affected areas might decline, they expect strong growth in other regions to compensate. For the quarter, Nvidia's revenue saw a significant increase, reaching $18.12 billion.

- The company's net income also rose notably to $9.24 billion. A major contributor to this growth was the data center revenue, which accounted for $14.51 billion, driven by demand from cloud infrastructure providers and consumer internet companies like Amazon, Microsoft, and Meta. The gaming segment also contributed $2.86 billion to the overall revenue.

Statistic:

Top 50 airlines by market cap:

- 🇮🇪 Ryanair: $26.77B

- 🇺🇸 Delta Air Lines: $23.13B

- 🇨🇳 Air China: $16.56B

- 🇺🇸 Southwest Airlines: $14.73B

- 🇸🇬 Singapore Airlines: $14.02B

- 🇨🇳 China Southern Airlines: $14.00B

- 🇺🇸 United Airlines Holdings: $13.05B

- 🇹🇷 Turkish Airlines: $12.84B

- 🇮🇳 InterGlobe Aviation: $12.07B

- 🇨🇳 China Eastern Airlines: $11.97B

- 🇩🇪 Lufthansa: $10.39B

- 🇪🇸 International Consolidated Airlines: $10.22B

- 🇯🇵 ANA Holdings: $9.80B

- 🇨🇳 Hainan Airlines: $8.92B

- 🇯🇵 Japan Airlines: $8.44B

- 🇺🇸 American Airlines: $8.04B

- 🇨🇳 Spring Airlines: $7.25B

- 🇭🇰 Cathay Pacific: $6.67B

- 🇰🇷 Korean Air Lines: $6.37B

- 🇧🇷 GOL Airlines: $6.01B

- 🇦🇺 Qantas Airways: $5.98B

- 🇨🇱 LATAM Airlines: $5.70B

- 🇹🇼 EVA Air: $5.40B

- 🇺🇸 Alaska Airlines: $4.72B

- 🇨🇦 Air Canada: $4.65B

- 🇹🇼 China Airlines: $4.10B

- 🇬🇧 easyJet: $4.10B

- 🇵🇦 Copa Holdings: $3.96B

- 🇫🇷 Air France-KLM: $3.53B

- 🇬🇧 Jet2: $3.15B

- 🇹🇷 Pegasus Airlines: $2.61B

- 🇬🇧 Wizz Air: $2.48B

- 🇺🇸 SkyWest: $1.89B

- 🇨🇦 Exchange Income Corporation: $1.52B

- 🇺🇸 Spirit Airlines: $1.41B

- 🇺🇸 Jetblue Airways: $1.40B

- 🇳🇿 Air New Zealand: $1.38B

- 🇧🇷 Azul: $1.25B

- 🇺🇸 Allegiant Air: $1.24B

- 🇨🇦 Cargojet: $1.17B

- 🇺🇸 Air Transport Services Group: $1.02B

- 🇹🇭 Bangkok Airways: $0.90B

- 🇰🇼 Jazeera Airways: $0.89B

- 🇳🇴 Norwegian Air Shuttle: $0.89B

- 🇺🇸 Frontier Airlines: $0.86B

- 🇺🇸 Sun Country Airlines: $0.79B

- 🇲🇽 Volaris: $0.79B

- 🇰🇷 Jeju Air: $0.67B

- 🇰🇷 Asiana Airlines: $0.61B

- 🇰🇷 Jin Air: $0.48B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news