Thursday☕️

Trending:

- Social Media Hearings

- Chinese Markets

Markets:

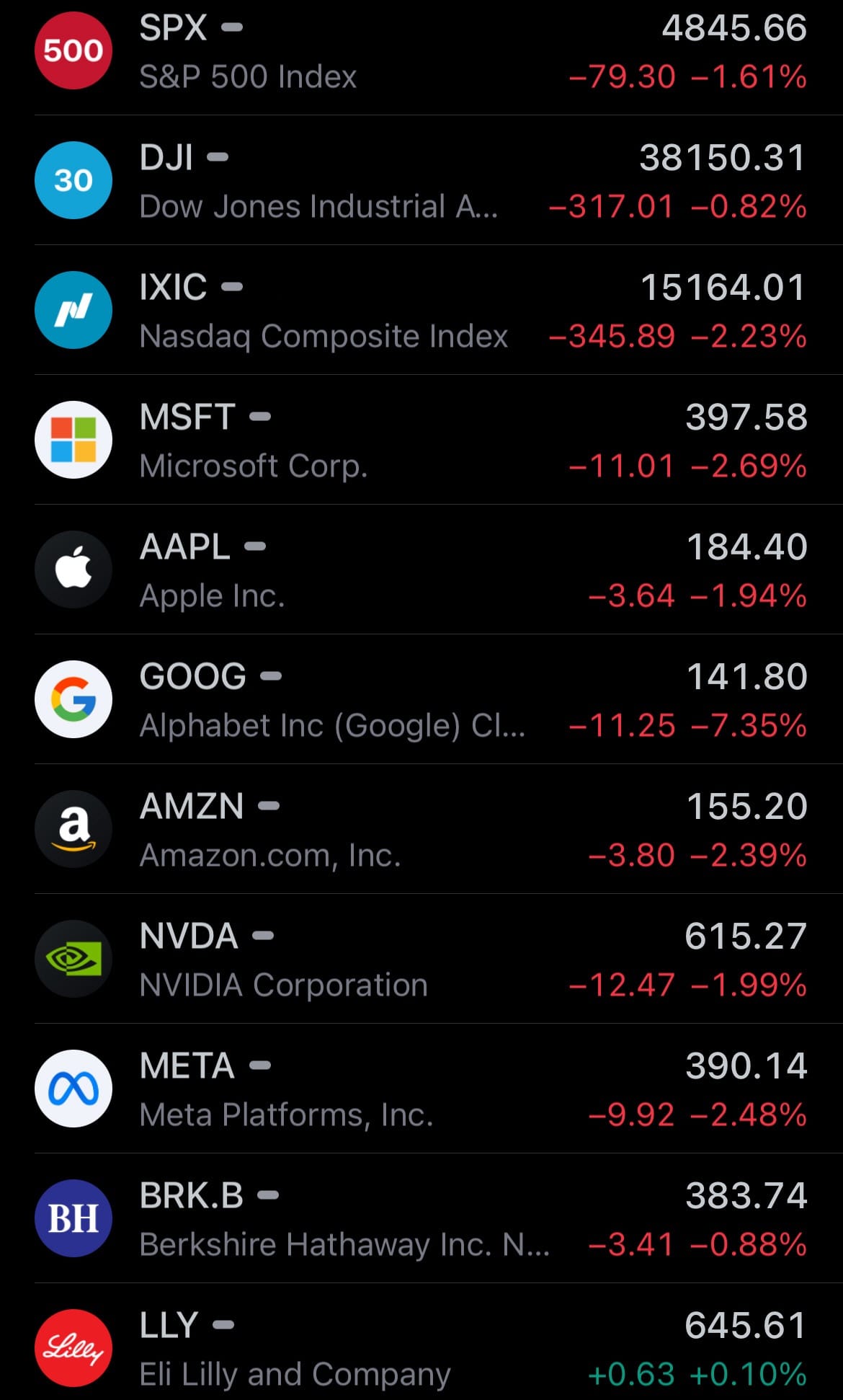

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Social Media Hearings:

- During a Senate hearing on child safety, bipartisan support emerged for the stricter regulation of social media platforms like Meta, TikTok, X (formerly Twitter), Snap, and Discord, highlighting the growing concern over the impact of these platforms on young users. Lawmakers, expressing frustration with the executives of these companies, warned of the potential for legislative action that could significantly impact their operations.

- The hearing, charged with emotional testimonies from parents of children affected by online predators, underscored the urgency of addressing child safety on social media. However, despite the tense atmosphere, there was little indication that immediate regulatory changes were on the horizon. Meta, in particular, faced intense scrutiny due to its vast user base and history of privacy controversies.

- With recent lawsuits alleging insufficient protection of young users from sexual predators, the potential financial repercussions for Meta are significant. Yet, the company's advertising revenue has shown signs of recovery, partly thanks to Chinese retailers, amidst ongoing concerns over the influence of Chinese companies in the U.S. market. Senators also questioned TikTok's CEO about the app's ties to its Chinese parent company, ByteDance, highlighting broader geopolitical tensions.

- This hearing signals a clear intent among U.S. senators to hold social media companies accountable for their role in safeguarding young users from harm. As debates continue, the impact of these discussions on the future of social media and its regulation will be closely watched, with the wellbeing of young users at the forefront of lawmakers' concerns.

Chinese Markets:

- Despite Beijing's initiatives to support the stock market, foreign investors pulled out a net 14.5 billion yuan ($2 billion) from mainland Chinese shares in January, extending a trend of withdrawals that began in August 2023. This marks the most significant and prolonged net outflow since the Stock Connect trading link's inception in 2014.

- In response, Beijing has implemented several measures to stabilize the market, including reducing the bank reserve ratio and suspending stock borrowing for short selling. Additionally, the challenges faced by China's real estate sector, exemplified by China Evergrande Group's liquidation order due to its $300 billion debt, underscore the broader economic pressures. Evergrande's failure highlights the issue of surging debt within China's property industry, which has prompted regulatory crackdowns but has also led to economic strain.

- The government's attempts to curb excessive borrowing and stabilize the property market have been met with mixed outcomes, contributing to the overall turbulence in the Chinese financial markets. These developments, from stock market outflows to real estate sector liquidations, reflect the complex economic challenges confronting China. They underscore the delicate balance Beijing seeks to maintain between fostering economic growth and managing the risks associated with high levels of corporate debt and investor skepticism.

Statistic:

Largest tech companies by market cap:

- 🇺🇸 Microsoft: $2.954T

- 🇺🇸 Apple: $2.851T

- 🇺🇸 Alphabet (Google): $1.756T

- 🇺🇸 Amazon: $1.603T

- 🇺🇸 NVIDIA: $1.519T

- 🇺🇸 Meta Platforms: $1.002T

- 🇺🇸 Tesla: $596.47B

- 🇹🇼 TSMC: $585.85B

- 🇺🇸 Broadcom: $552.40B

- 🇰🇷 Samsung: $370.51B

- 🇳🇱 ASML: $345.02B

- 🇨🇳 Tencent: $329.92B

- 🇺🇸 Oracle: $307.05B

- 🇺🇸 Adobe: $279.23B

- 🇺🇸 Salesforce: $272.09B

- 🇺🇸 AMD: $270.90B

- 🇺🇸 Netflix: $244.12B

- 🇺🇸 Cisco: $203.90B

- 🇩🇪 SAP: $202.47B

- 🇺🇸 Intel: $182.14B

- 🇨🇳 Alibaba: $181.73B

- 🇺🇸 Intuit: $176.73B

- 🇨🇳 Pinduoduo: $168.55B

- 🇺🇸 IBM: $167.70B

- 🇺🇸 QUALCOMM: $165.86B

- 🇺🇸 ServiceNow: $156.90B

- 🇺🇸 Texas Instruments: $145.54B

- 🇺🇸 Applied Materials: $136.70B

- 🇺🇸 Uber: $134.31B

- 🇺🇸 Booking Holdings: $122.37B

- 🇯🇵 Sony: $121.23B

- 🇯🇵 Keyence: $111.16B

- 🇫🇷 Schneider Electric: $110.53B

- 🇺🇸 Lam Research: $108.18B

- 🇺🇸 Palo Alto Networks: $106.73B

- 🇨🇦 Shopify: $102.83B

- 🇺🇸 Automatic Data Processing: $101.09B

- 🇺🇸 Micron Technology: $97.85B

- 🇺🇸 Analog Devices: $95.38B

- 🇺🇸 Airbnb: $92.38B

- 🇯🇵 Tokyo Electron: $88.19B

- 🇦🇷 MercadoLibre: $86.54B

- 🇺🇸 Fiserv: $85.14B

- 🇺🇸 Synopsys: $81.34B

- 🇺🇸 Arista Networks: $80.47B

- 🇺🇸 KLA: $80.33B

- 🇺🇸 Cadence Design Systems: $78.47B

- 🇺🇸 Equinix: $77.90B

- 🇺🇸 Workday: $76.55B

- 🇬🇧 Arm Holdings: $72.45B

- 🇺🇸 CrowdStrike: $70.24B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news