Thursday☕️

Trending:

- Ethereum Regulation

- IBM NASA Partnership

Markets:

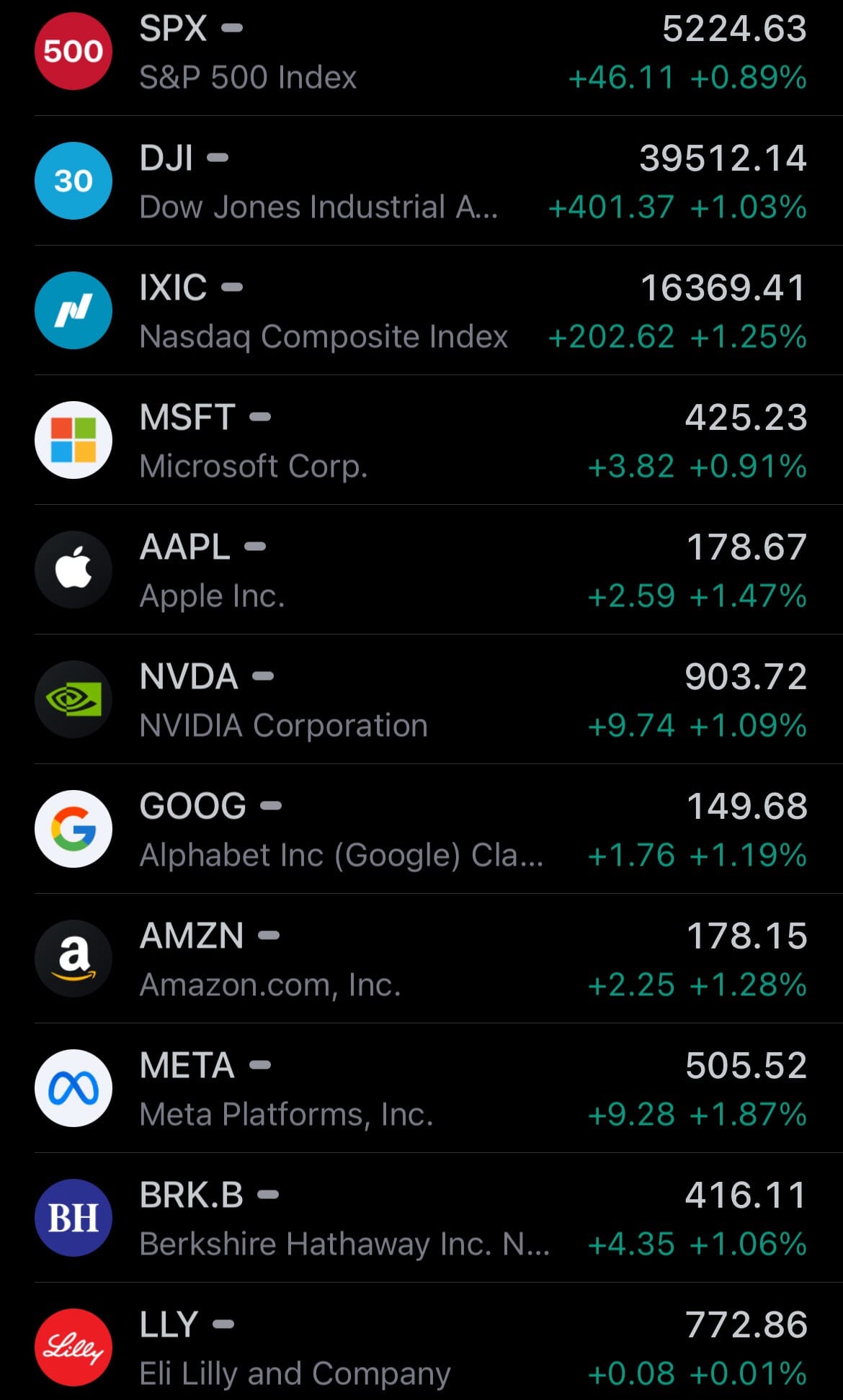

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

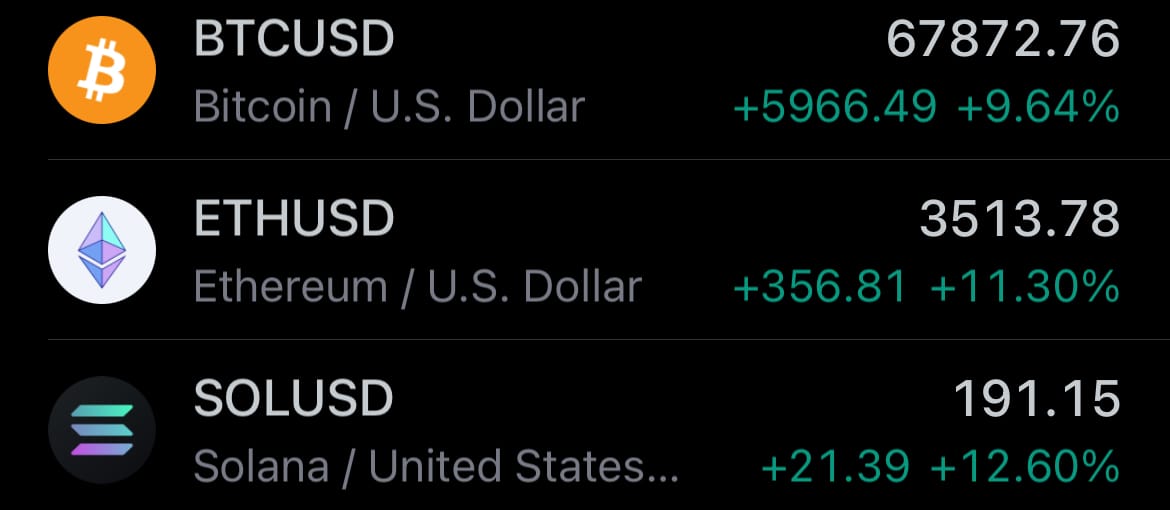

- Yesterday’s crypto market:

Ethereum Regulation:

- The SEC is examining the Ethereum Foundation and its connections to see if Ether (ETH) should be classified as a security. This investigation stems from Ethereum's recent switch to a proof-of-stake model, prompting the SEC to delve into the foundation's financial dealings and relationships with U.S. companies. Through these subpoenas, the SEC aims to gather enough information to potentially regulate ETH as a security, reflecting its broader goal to oversee the rapidly changing digital currency sector in alignment with current financial regulations.

- SEC Chair Gary Gensler has been hesitant to clearly label ETH as a security, a stance that contrasts with his previous comments in 2018 where he indicated that Bitcoin and Ether might not be securities. Despite this ambiguity, the SEC has shown interest in the cryptocurrency by approving ETFs related to Ether futures. However, the commission is still in the process of deciding on ETFs for direct ETH trading, with a decision expected soon. This ongoing evaluation by the SEC highlights the regulatory complexities surrounding cryptocurrencies like Ether.

- The situation is further complicated by actions from entities such as Prometheum, a crypto firm authorized by U.S. financial regulators to deal with digital asset securities, which plans to offer institutional custody services for Ether. This move has increased the urgency for the SEC to clarify its position on ETH to help companies manage potential legal and regulatory risks. Clear guidance from the SEC would benefit firms operating in the crypto space, ensuring they comply with U.S. regulations while fostering a more stable and secure cryptocurrency market.

- The SEC has approved several ETFs for Bitcoin, showing they're more comfortable with Bitcoin's role in the financial system, unlike Ether's current status. The main difference between Bitcoin and Ethereum is their purpose and technology. Bitcoin was made to be a digital currency, simplifying online transactions without needing a central authority. Its technology mainly records these transactions. Ethereum goes further by allowing developers to create and use applications that automatically execute transactions when conditions are met, due to its smart contracts. This makes Ethereum not just a currency but a platform for various applications, which could be why the SEC is taking a different approach in regulating Ethereum compared to Bitcoin.

IBM NASA Partnership:

- IBM and NASA have teamed up to develop new language models (AI) trained on scientific papers. These models, built with advanced technology called transformer architecture, are good at tasks like sorting text, pulling out key information, answering questions, and finding specific data. They're available for anyone to use on a platform called Hugging Face.

- What makes these models special is how they were trained using a large collection of scientific documents. This training helps them understand and use scientific terms that are usually complex. They're better than typical language models because they can recognize these specialized terms, thanks to a custom-built part of the model called a tokenizer. When tested, these models did better than others at understanding biomedical science, Earth science, and answering scientific questions.

- IBM and NASA didn't just stop there; they created two types of models. One, called an encoder model, is really good at understanding text. The other, a retriever model, is excellent at finding and pulling up relevant scientific documents quickly and accurately. These tools are meant to make it easier for people to get and understand scientific information. Now, these models are out there on Hugging Face (developer platform) for anyone to use and build upon.

Statistic:

- Largest insurance companies by market capitalization:

- 🇺🇸 UnitedHealth: $455.64B

- 🇺🇸 Progressive: $120.49B

- 🇺🇸 Elevance Health: $119.66B

- 🇩🇪 Allianz: $115.87B

- 🇨🇭 Chubb: $104.89B

- 🇺🇸 Marsh & McLennan Companies: $101.50B

- 🇺🇸 Cigna: $100.36B

- 🇨🇳 Ping An Insurance: $95.85B

- 🇨🇳 China Life Insurance: $93.07B

- 🇫🇷 AXA: $85.10B

- 🇭🇰 AIA: $80.63B

- 🇨🇭 Zurich Insurance Group: $79.25B

- 🇩🇪 Munich RE (Münchener Rück): $66.61B

- 🇮🇳 Life Insurance Corporation of India (LIC): $65.90B

- 🇬🇧 Aon: $64.65B

- 🇯🇵 Tokio Marine: $60.74B

- 🇺🇸 Arthur J. Gallagher & Co.: $55.47B

- 🇺🇸 MetLife: $53.04B

- 🇺🇸 American International Group: $52.25B

- 🇺🇸 The Travelers Companies: $51.55B

- 🇨🇦 Manulife Financial: $44.11B

- 🇺🇸 Allstate: $42.39B

- 🇺🇸 Humana: $41.97B

- 🇺🇸 Centene: $41.65B

- 🇺🇸 Prudential Financial: $41.42B

- 🇮🇹 Generali: $38.71B

- 🇨🇭 Swiss Re: $37.83B

- 🇧🇲 Arch Capital: $34.50B

- 🇩🇪 Hannover Rück: $33.41B

- 🇨🇦 Sun Life Financial: $32.24B

- 🇧🇪 KBC: $30.14B

- 🇺🇸 The Hartford: $30.06B

- 🇨🇦 Great-West Lifeco: $29.99B

- 🇨🇦 Intact Financial: $29.51B

- 🇬🇧 Willis Towers Watson: $28.15B

- 🇨🇳 The People's Insurance Company (PICC): $27.97B

- 🇯🇵 MS&AD Insurance: $27.10B

- 🇨🇳 China Pacific Insurance: $26.97B

- 🇨🇦 Fairfax Financial: $26.70B

- 🇬🇧 Prudential: $26.52B

- 🇺🇸 Brown & Brown: $24.77B

- 🇺🇸 Molina Healthcare: $24.30B

- 🇯🇵 Dai-ichi Life Holdings: $23.51B

- 🇺🇸 W. R. Berkley: $22.15B

- 🇫🇮 Sampo: $22.15B

- 🇹🇼 Cathay Financial Holding: $21.92B

- 🇺🇸 Erie Indemnity: $21.23B

- 🇨🇭 Swiss Life: $20.46B

- 🇯🇵 Sompo Holdings: $20.37B

- 🇩🇪 Talanx: $20.09B

- 🇺🇸 Markel: $19.85B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news