Thursday☕️

Trending:

- London Hospital Cyberattacks

- New Texas Stock Market

Markets:

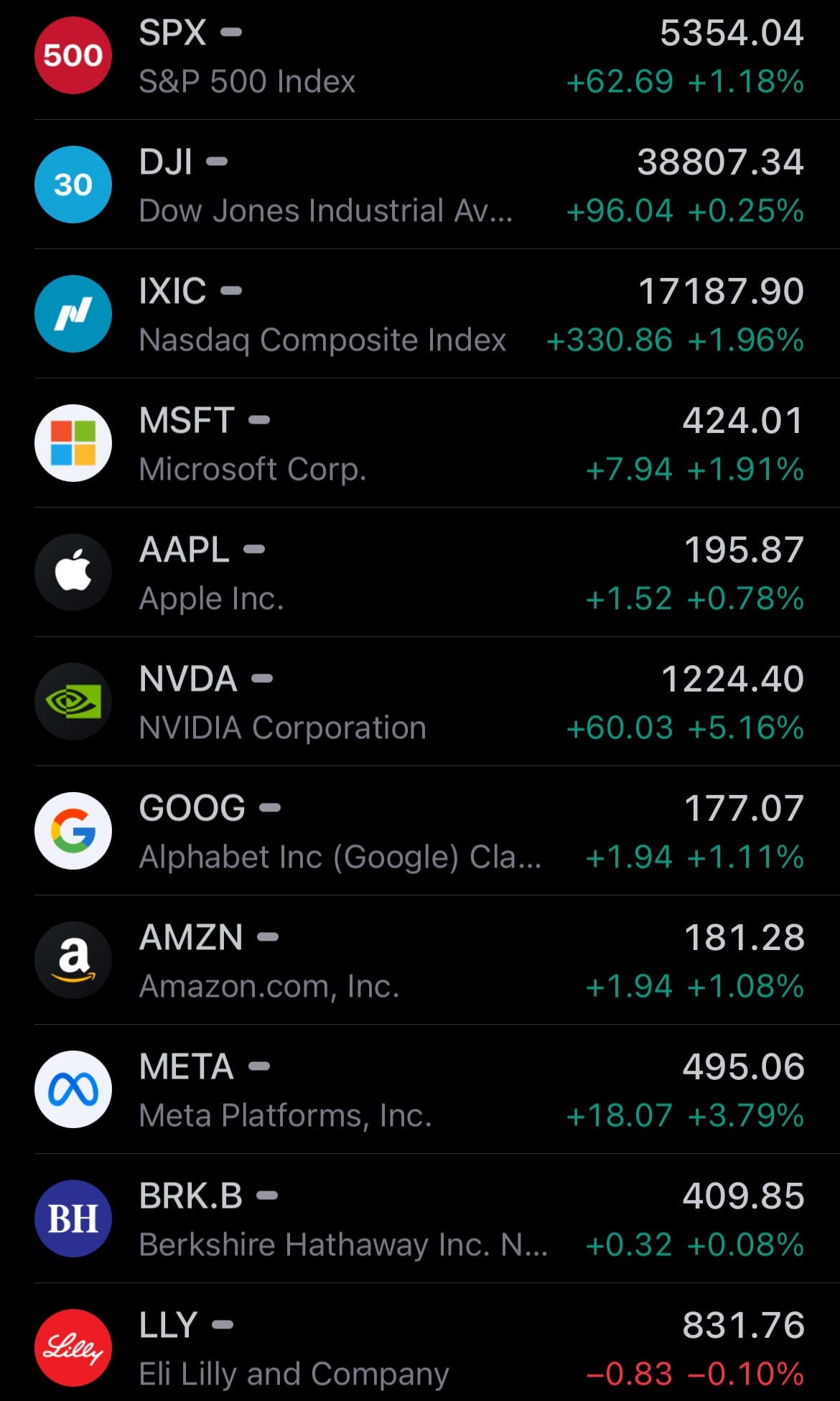

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

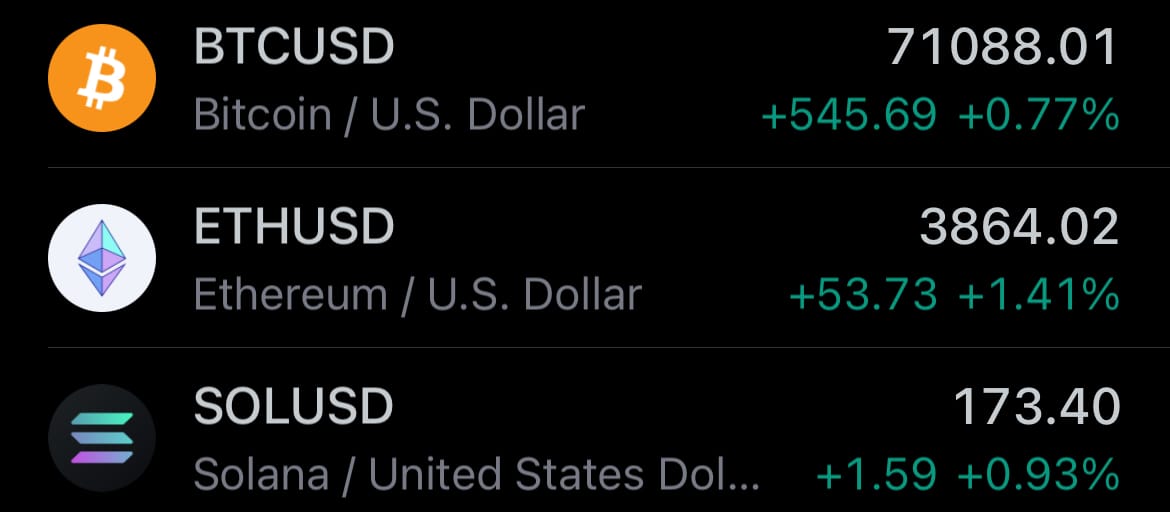

- Yesterday’s crypto market:

London Hospital Cyberattacks:

- Two major London hospital trusts, King’s College Hospital NHS Foundation Trust and Guy’s and St Thomas’ NHS Foundation Trust, have had to cancel all non-emergency procedures and blood tests due to a serious cyberattack. This attack hit their pathology systems and GP services across South London, disrupting medical services for thousands of patients.

- The company providing blood tests and other lab services, Synnovis, reported on Monday that it had been attacked by ransomware, a type of malware that locks up systems until a ransom is paid. This affected multiple hospitals, including Guy’s Hospital, King’s College Hospital, and St Thomas’ Hospital. As a result, doctors have been told to cancel all non-urgent blood test appointments and only request emergency blood samples for urgent cases.

- The National Cyber Security Centre is now helping to deal with the situation, and NHS England has declared a high-level emergency. Synnovis said the attack could take weeks or even months to fix. The incident has also affected transplant operations because necessary blood tests can't be performed. The government and law enforcement are involved, and efforts are being made to support the hospitals and ensure patient safety during this crisis.

New Texas Stock Market:

- BlackRock Inc., Citadel Securities, and other investors are backing a new Texas stock market, challenging the dominance of the New York Stock Exchange and Nasdaq Inc. This move signals a potential boost for Texas as it seeks to expand its financial services industry. The Texas Stock Exchange (TXSE) has raised $120 million and plans to file registration documents with the U.S. Securities and Exchange Commission, according to a LinkedIn post by James Lee, the exchange's CEO.

- The TXSE aims to attract companies looking to escape the rising compliance costs at NYSE and Nasdaq. Although it will be entirely electronic, the TXSE will be headquartered in Dallas, a city that has been attracting financial jobs from firms like Goldman Sachs Group Inc. and Charles Schwab Corp. Lee stated that the TXSE will focus on enabling U.S. and global companies to access U.S. equity capital markets, providing a venue to trade and list public companies and exchange-traded products.

- The TXSE plans to begin handling trades in 2025 and host its first listing in 2026. Citadel has confirmed its investment in the project, and BlackRock has stated that the new exchange will increase liquidity and improve market efficiency for its clients and other investors. This development represents a significant step in diversifying the financial landscape in the United States.

Statistic:

- Largest companies by market cap:

- 🇺🇸 Microsoft: $3.151T

- 🇺🇸 NVIDIA: $3.011T

- 🇺🇸 Apple: $3.003T

- 🇺🇸 Alphabet (Google): $2.179T

- 🇺🇸 Amazon: $1.886T

- 🇸🇦 Saudi Aramco: $1.820T

- 🇺🇸 Meta Platforms: $1.255T

- 🇺🇸 Berkshire Hathaway: $885.07B

- 🇹🇼 TSMC: $845.02B

- 🇺🇸 Eli Lilly: $790.50B

- 🇺🇸 Broadcom: $654.85B

- 🇩🇰 Novo Nordisk: $628.05B

- 🇺🇸 JPMorgan Chase: $566.46B

- 🇺🇸 Visa: $561.65B

- 🇺🇸 Tesla: $558.10B

- 🇺🇸 Walmart: $540.73B

- 🇺🇸 Exxon Mobil: $507.44B

- 🇺🇸 UnitedHealth: $463.06B

- 🇨🇳 Tencent: $460.80B

- 🇺🇸 Mastercard: $415.22B

- 🇳🇱 ASML: $412.94B

- 🇫🇷 LVMH: $408.96B

- 🇺🇸 Procter & Gamble: $391.90B

- 🇰🇷 Samsung: $375.23B

- 🇺🇸 Costco: $369.90B

- 🇺🇸 Johnson & Johnson: $351.30B

- 🇺🇸 Oracle: $337.04B

- 🇺🇸 Merck: $327.87B

- 🇺🇸 Home Depot: $327.49B

- 🇺🇸 Bank of America: $312.50B

- 🇺🇸 AbbVie: $292.14B

- 🇨🇭 Nestlé: $286.88B

- 🇨🇳 Kweichow Moutai: $284.96B

- 🇺🇸 Chevron: $283.42B

- 🇯🇵 Toyota: $281.81B

- 🇺🇸 Netflix: $280.20B

- 🇺🇸 Coca-Cola: $275.36B

- 🇺🇸 AMD: $268.58B

- 🇫🇷 L'Oréal: $265.00B

- 🇨🇳 ICBC: $256.24B

- 🇫🇷 Hermès: $252.57B

- 🇬🇧 AstraZeneca: $249.03B

- 🇦🇪 International Holding Company: $247.55B

- 🇨🇳 PetroChina: $238.78B

- 🇺🇸 Pepsico: $238.51B

- 🇺🇸 QUALCOMM: $236.48B

- 🇮🇳 Reliance Industries: $230.62B

- 🇺🇸 Salesforce: $229.19B

- 🇬🇧 Shell: $223.26B

- 🇩🇪 SAP: $220.31B

- 🇺🇸 Thermo Fisher Scientific: $219.59B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news