Thursday☕️

Trending:

- Federal Reserve Stress Test

- SpaceX NOAA Launch

Markets:

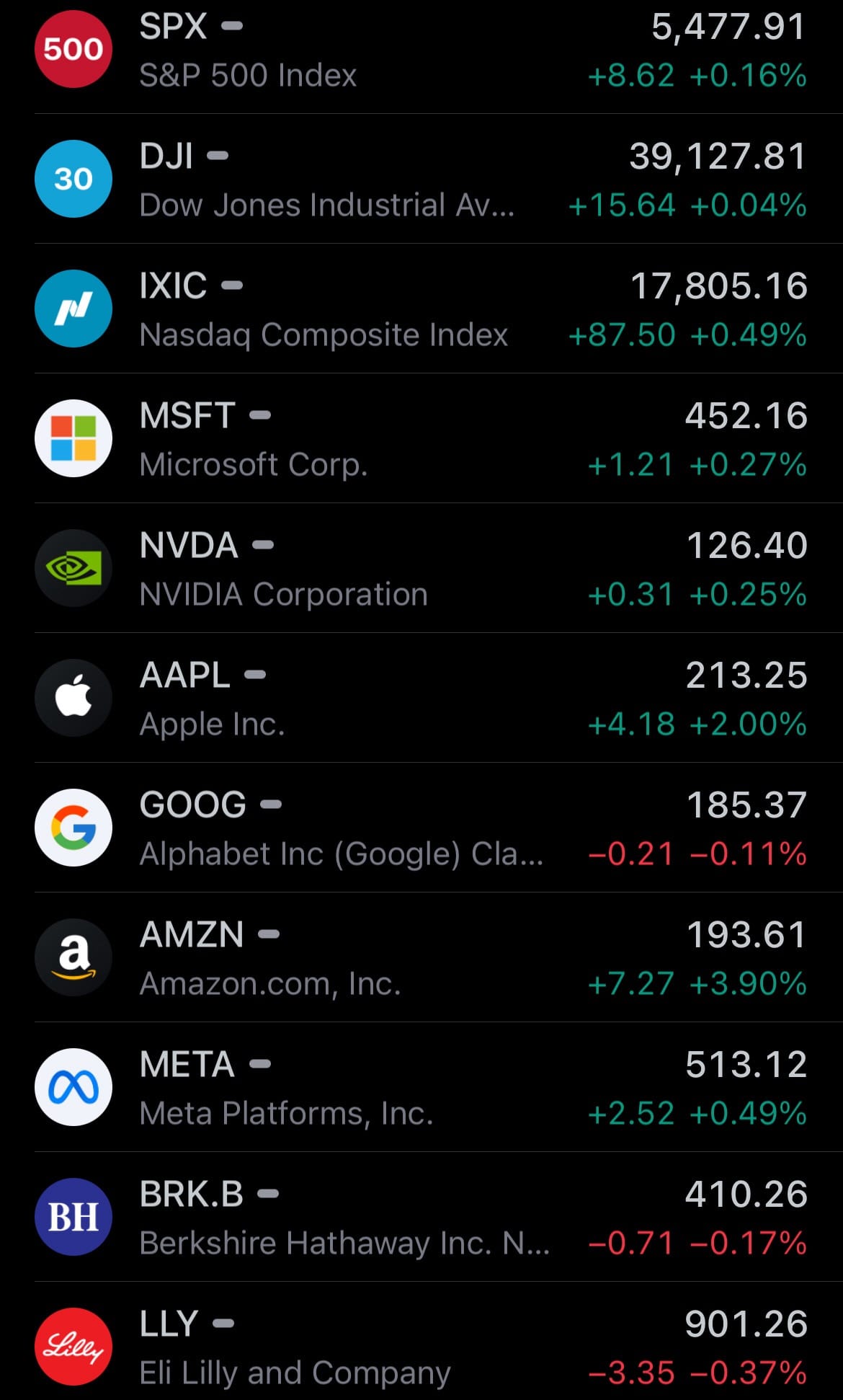

- Yesterday’s U.S. stock market:

- Today’s commodity market:

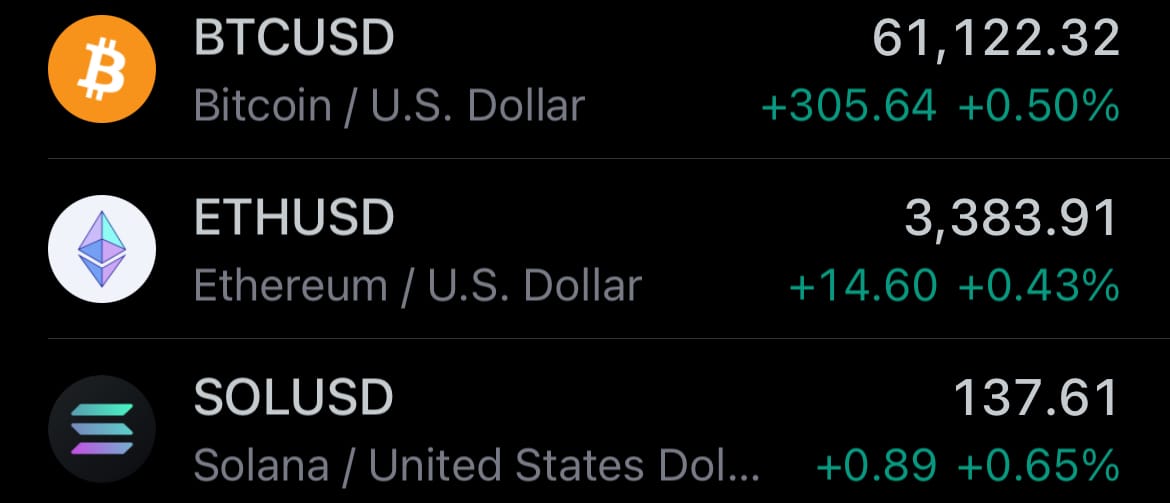

- Today’s crypto market:

Federal Reserve Stress Test:

- The Federal Reserve Board's annual bank stress test revealed that large banks would face greater losses than last year's test, but they are still well positioned to endure a severe recession and maintain capital above minimum requirements. This year's stress test results indicate that while banks' balance sheets are somewhat riskier and expenses are higher, they have enough capital to absorb losses in a highly stressful scenario.

- These stress tests are evaluations designed to ensure that large banks can withstand economic downturns and continue to operate effectively. They assess the resilience of banks by estimating their capital levels, potential losses, revenue, and expenses under hypothetical adverse economic scenarios. The goal is to ensure that banks have enough capital to absorb significant losses while still meeting minimum regulatory capital requirements, thus maintaining stability in the financial system.

- The test showed that all 31 banks tested remained above their minimum common equity tier 1 (CET1) capital requirements, even after absorbing nearly $685 billion in projected losses. The aggregate CET1 capital ratio is projected to decline from 12.7 percent to 9.9 percent, reflecting the higher risks and expenses banks are currently facing. The scenarios typically involve severe global recessions, significant declines in commercial real estate and housing prices, increased unemployment rates, and reduced economic output. This year, the test considered substantial increases in banks' credit card balances with higher delinquency rates, riskier corporate credit portfolios, and higher expenses with lower fee income.

- Additionally, the Federal Reserve conducted an exploratory analysis that did not impact capital requirements. This included two funding stresses and two trading book stresses. The results underscore the banks' ability to support the economy during downturns, ensuring stability in the financial system. This comprehensive approach helps regulators understand the potential impacts of adverse economic conditions on large banks and provides insight into the overall health and resilience of the banking sector.

SpaceX NOAA Launch:

- On Tuesday, at 5:26 p.m. est, SpaceX's Falcon Heavy rocket launched the National Oceanic and Atmospheric Administration's (NOAA) GOES-U mission from Launch Complex 39A (LC-39A) at NASA's Kennedy Space Center in Florida. This mission is designed to place the GOES-U satellite into a geostationary orbit approximately 35,700 km (22,236 mi) above the Earth's equator.

- The GOES-U satellite will monitor weather patterns across the contiguous United States, Central and South America, and the Atlantic Ocean. As part of NOAA's advanced Geostationary Operational Environmental Satellites (GOES) series, GOES-U will provide weather forecasters and climate researchers with real-time high-resolution imagery, enabling earlier detection of severe weather events, which can save lives. Additionally, it will improve tropical cyclone forecasts and carry a suite of instruments for detecting solar storms, aiding in early prediction and impact assessment.

- This launch marked the first flight for Falcon Heavy’s two side boosters. After completing their part of the mission, the boosters successfully separated and landed at SpaceX’s Landing Zones 1 and 2 (LZ-1 and LZ-2) at Cape Canaveral Space Force Station in Florida. This successful mission highlights the continued advancements in satellite technology and space launch capabilities, contributing to better weather forecasting and climate monitoring.

- The National Oceanic and Atmospheric Administration (NOAA) is a scientific agency within the United States Department of Commerce. NOAA's mission is to understand and predict changes in climate, weather, oceans, and coasts, and to share that knowledge and information with others. The agency also focuses on the conservation and management of coastal and marine ecosystems and resources. Through its various programs and initiatives, NOAA provides critical data and services that help protect lives, property, and the economy by monitoring and forecasting environmental changes and ensuring sustainable use of natural resources.

Statistic:

- Largest assets by market cap:

- Gold - $15.510T

- 🇺🇸 Microsoft - $3.360T

- 🇺🇸 Apple - $3.269T

- 🇺🇸 NVIDIA - $3.109T

- 🇺🇸 Alphabet (Google) - $2.280T

- 🇺🇸 Amazon - $2.014T

- 🇸🇦 Saudi Aramco - $1.788T

- Silver - $1.619T

- 🇺🇸 Meta Platforms - $1.301T

- Bitcoin - $1.202T

- 🇹🇼 TSMC - $892.38B

- 🇺🇸 Berkshire Hathaway - $885.13B

- 🇺🇸 Eli Lilly - $811.49B

- 🇺🇸 Broadcom - $741.05B

- 🇩🇰 Novo Nordisk - $643.86B

- 🇺🇸 Tesla - $626.26B

- 🇺🇸 JPMorgan Chase - $566.95B

- 🇺🇸 Visa - $559.81B

- 🇺🇸 Walmart - $549.29B

- 🇺🇸 Exxon Mobil - $513.23B

- SPDR S&P 500 ETF Trust - $500.65B

- 🇨🇳 Tencent - $457.35B

- 🇺🇸 UnitedHealth - $445.50B

- 🇺🇸 Mastercard - $420.53B

- Ethereum - $406.21B

- 🇳🇱 ASML - $402.43B

- 🇺🇸 Procter & Gamble - $395.20B

- 🇫🇷 LVMH - $388.36B

- 🇰🇷 Samsung - $387.73B

- 🇺🇸 Oracle - $380.94B

- 🇺🇸 Costco - $379.86B

- 🇺🇸 Johnson & Johnson - $353.34B

- 🇺🇸 Home Depot - $338.95B

- 🇺🇸 Merck - $333.06B

- 🇺🇸 Bank of America - $304.99B

- 🇺🇸 AbbVie - $302.22B

- 🇺🇸 Netflix - $292.01B

- 🇺🇸 Chevron - $285.20B

- 🇯🇵 Toyota - $276.29B

- 🇺🇸 Coca-Cola - $275.92B

- 🇨🇭 Nestlé - $274.31B

- 🇨🇳 ICBC - $258.13B

- 🇨🇳 Kweichow Moutai - $254.76B

- 🇺🇸 AMD - $254.63B

- 🇫🇷 L'Oréal - $253.44B

- Platinum - $252.80B

- 🇮🇳 Reliance Industries - $247.09B

- 🇬🇧 AstraZeneca - $246.73B

- 🇫🇷 Hermès - $246.50B

- 🇦🇪 International Holding Company - $242.77B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news