Tuesday☕️

Trending:

- Yesterday, October 27, 2025, Reuters and other media outlets reported that Amazon plans to initiate its largest round of layoffs to date, potentially affecting up to 30,000 corporate roles, with notifications beginning as early as October 28. The reductions are anticipated to primarily impact areas such as Amazon Web Services (AWS), human resources, and various administrative functions, with employees receiving notice via email. Amazon has not issued an official statement confirming the details.

- The information originates from anonymous sources within the company and internal documents, initially covered by Reuters and subsequently reported by outlets including CNN, CNBC, and Business Insider. If verified, these layoffs could illustrate a direct consequence of AI progress, where such technologies replace human-performed routine tasks in administration, HR, and operations, leading to workforce reductions aimed at lowering expenses and increasing productivity in locations such as the US, UK, and Canada.

Economics & Markets:

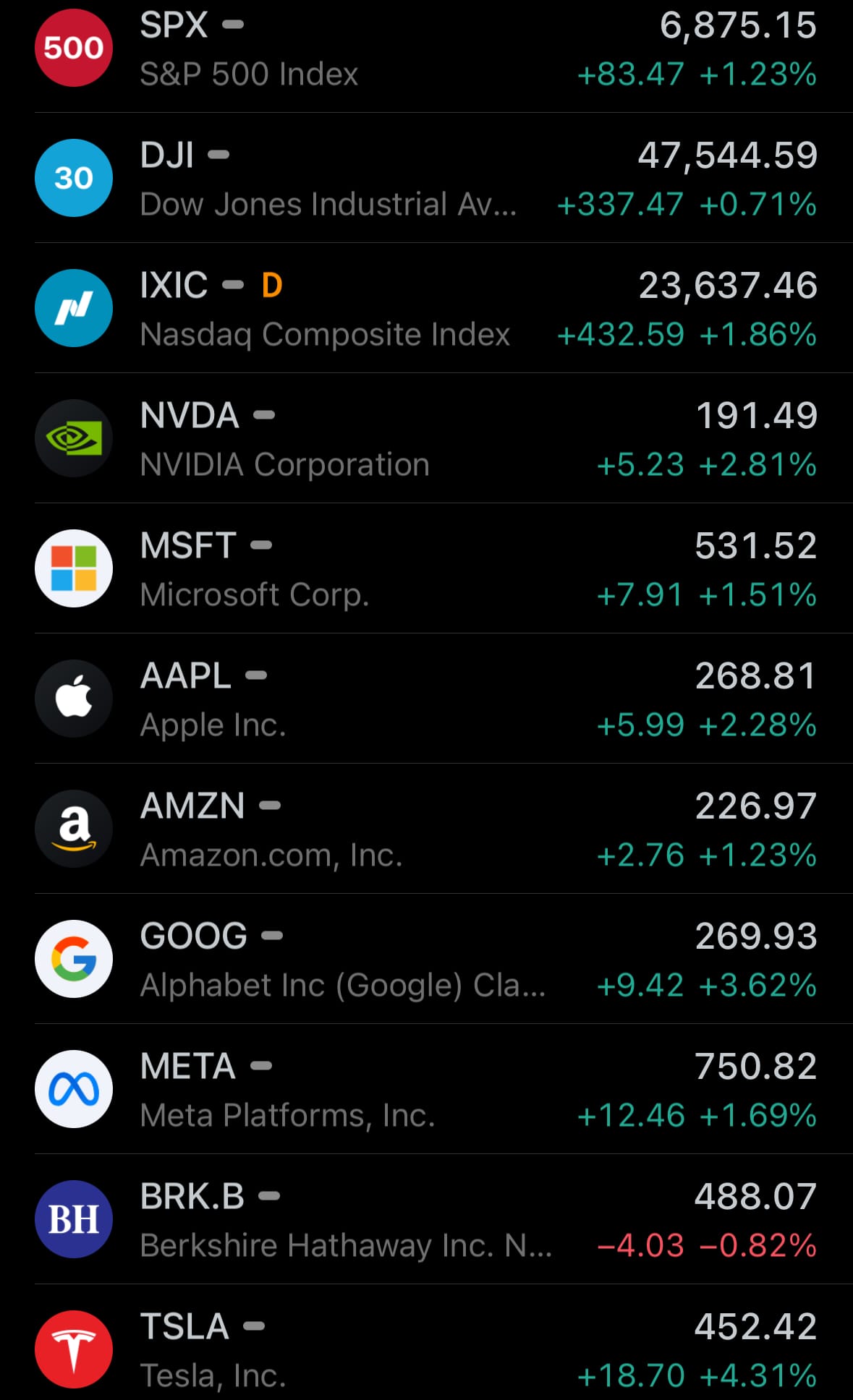

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Environment & Weather:

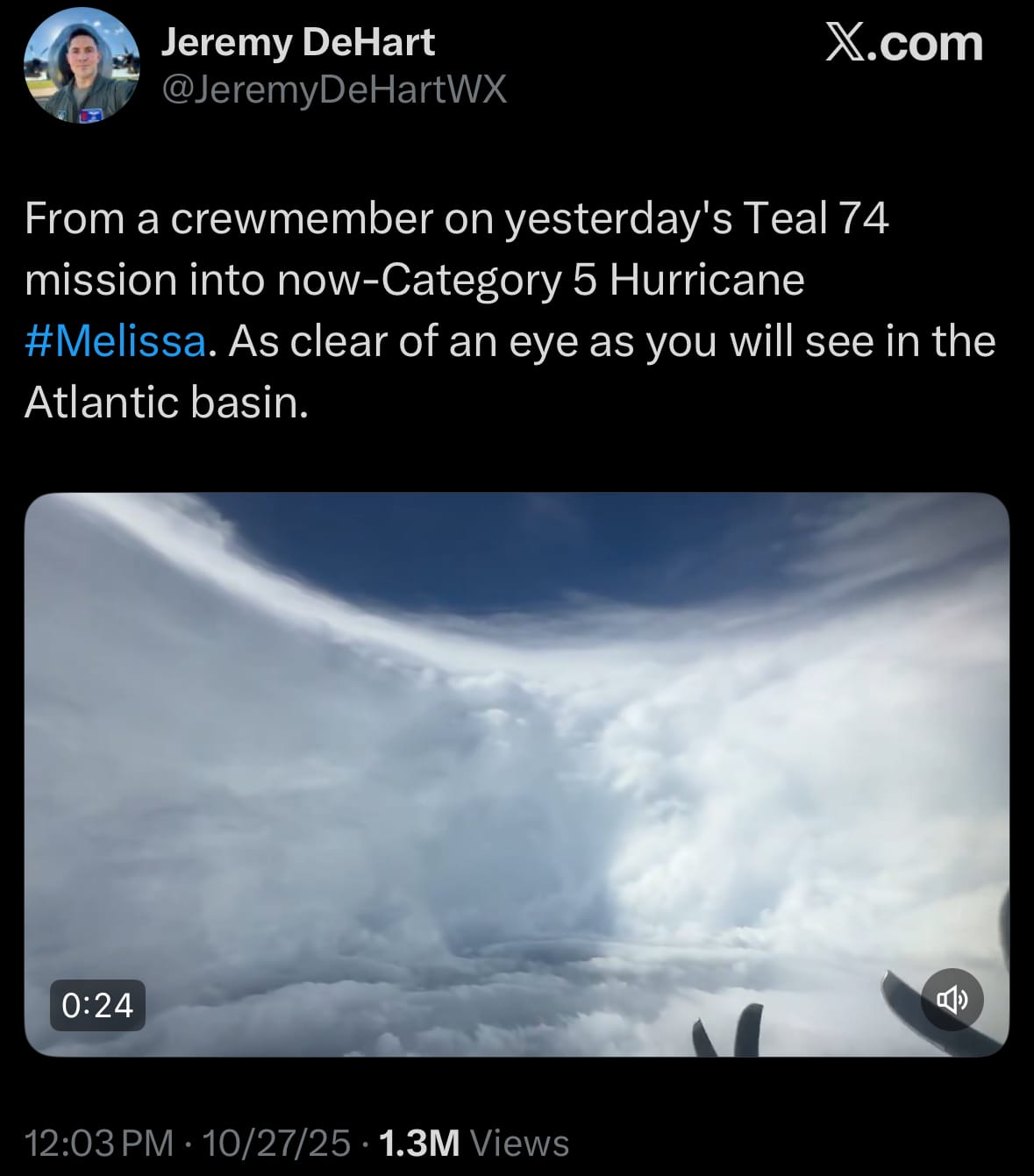

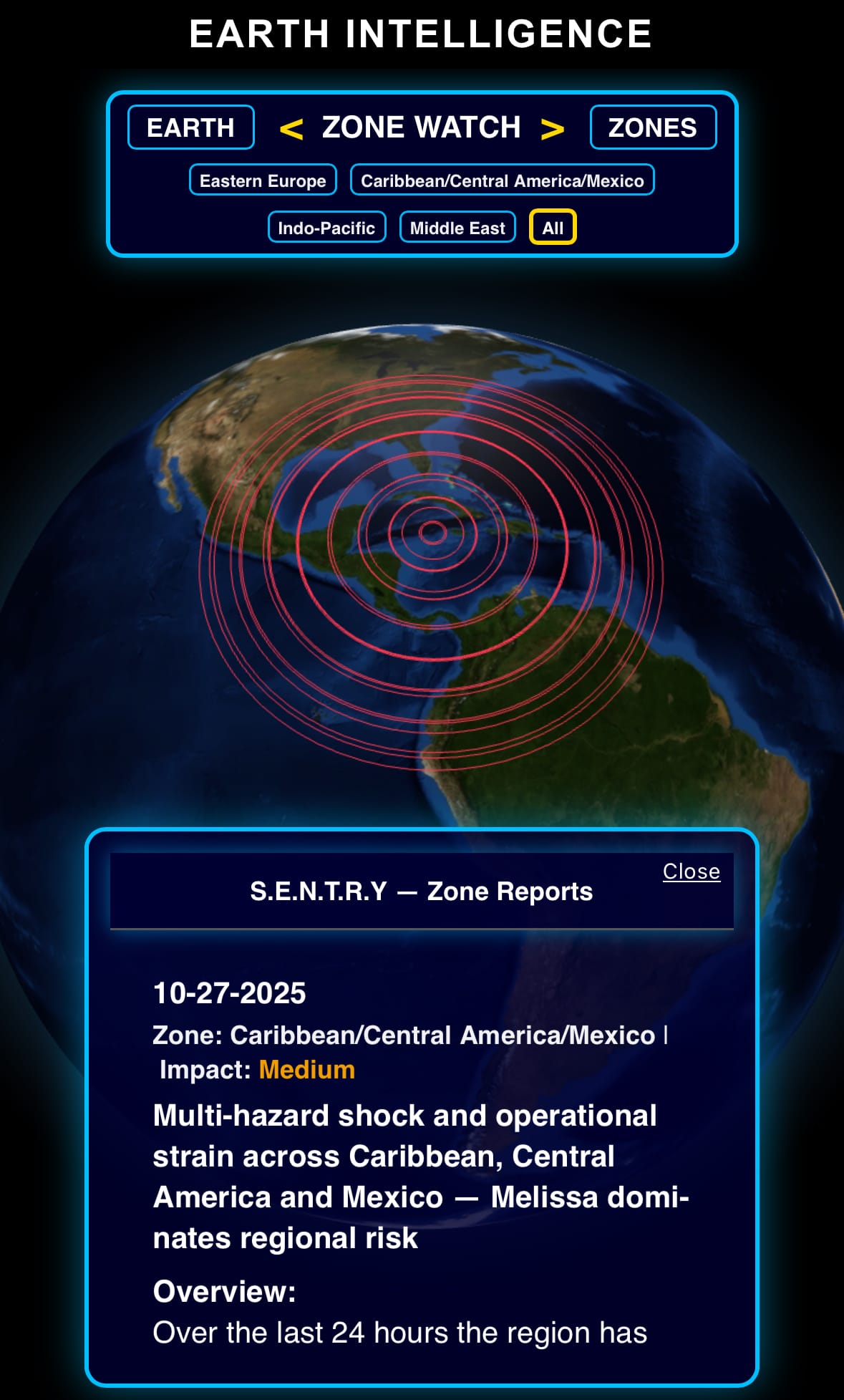

- Yesterday, October 27, 2025, the National Hurricane Center stated that Hurricane Melissa has strengthened to a Category 5 hurricane. It has sustained winds of 175 mph and a central pressure of 903 mb. The storm is located at about 16.6°N, 78.5°W and is moving north-northeast at 2 mph. Hurricane warnings are in place for Jamaica and parts of eastern Cuba, including Granma, Santiago de Cuba, Guantanamo, and Holguin. Tropical storm warnings cover Haiti and Las Tunas in Cuba.

- A hurricane watch applies to the southeastern and central Bahamas, plus the Turks and Caicos Islands. Expected effects include storm surge up to 13 feet, strong winds, and rainfall of 15 to 40 inches, which could cause flooding and landslides. If the path stays as predicted, effects may reach Cuba by Tuesday evening and the Bahamas on Wednesday. The storm's exact path and strength changes over land are still being tracked.

Space:

Science & Technology:

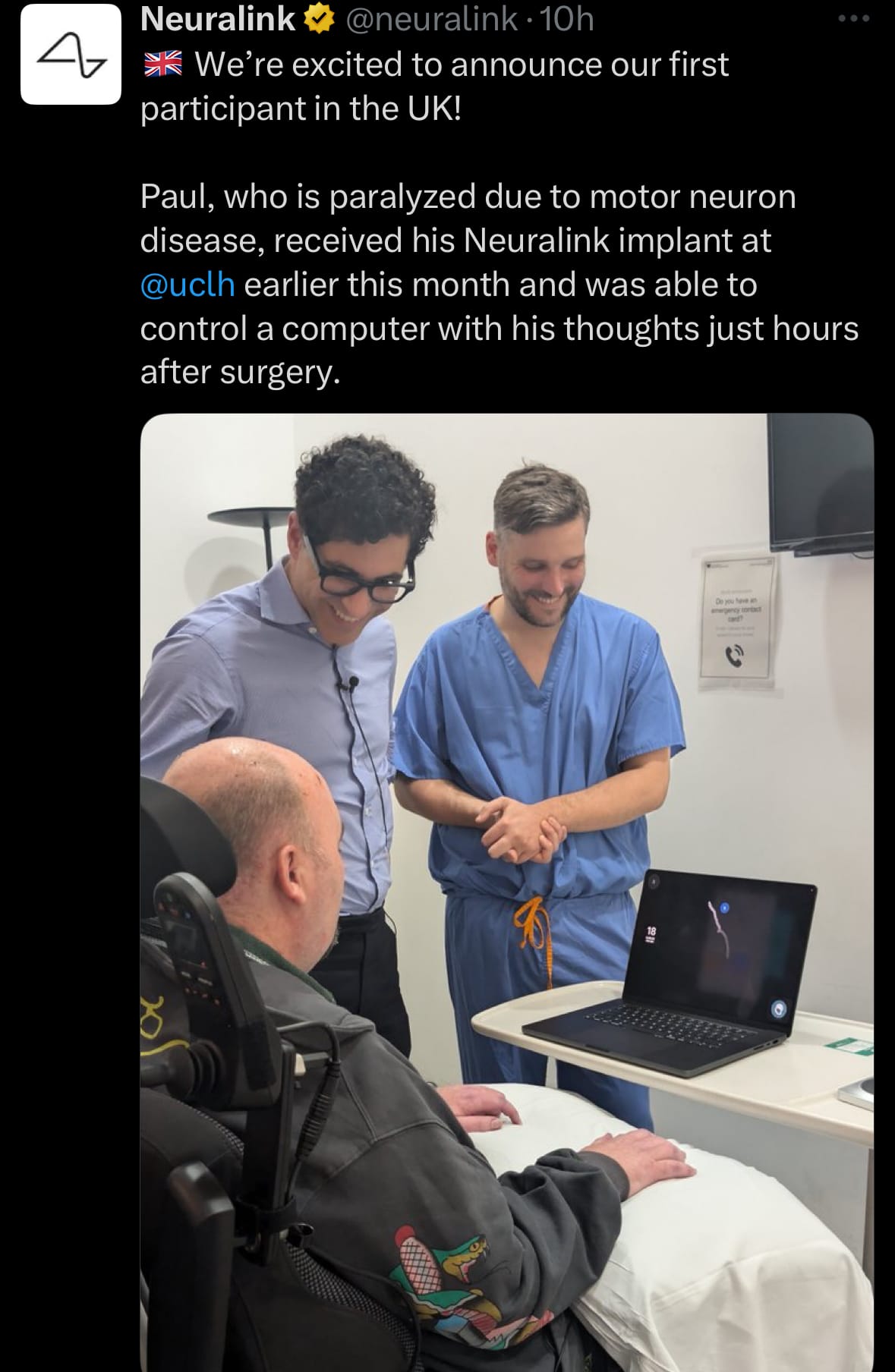

- On October 27, 2025, Neuralink announced the successful implantation of its brain-computer interface in its first UK participant, a man named Paul who is paralyzed due to motor neuron disease. The procedure, part of the GB-PRIME feasibility study, took place earlier in October at University College London Hospitals, allowing Paul to control a computer cursor with his thoughts within hours of surgery. This enabled him to perform tasks like playing games and regaining independence. Building on Neuralink's FDA approval for human trials in the U.S., where multiple participants—up to 12 worldwide by September—have received the N1 implant, the device interprets brain signals to address paralysis and neurological conditions, paving the way for wider adoption of such interfaces in medical treatments.

- This technology not only restores lost functions for individuals with disabilities but also enhances human capabilities by enabling direct thought-based control of devices, potentially surpassing natural limitations in speed and precision for tasks like operating computers or machinery. Over time, as adoption grows among patients, it could expand to non-medical uses, such as boosting cognitive performance and integrating with everyday technology. In warfare, this might allow soldiers & commanders to wield weapons, drones, or systems instantaneously through thought, shifting power dynamics toward faster, more intuitive combat strategies. Similarly, intelligence agencies and corporations could leverage it for enhanced surveillance, decision-making, or productivity, raising concerns about unequal access, privacy erosion, and ethical power imbalances, though these applications remain speculative and under regulatory review.

EARTH INTELLIGENCE:

- We have now launched a new system called ZONE WATCH that monitors four strategic zones in real time: Caribbean/Central America/Mexico, Middle East, Eastern Europe, and the Indo-Pacific (South China Sea/Other). These areas are pressure points for global stability—the Caribbean/Central America/Mexico corridor ties directly to the war on drugs, cartel networks, sea-lane security, and the Maduro regime’s regional effects; the Middle East remains volatile with the war in Gaza and broader regional flashpoints; Eastern Europe is defined by the Ukraine–Russia war and its ripple effects on NATO, energy, and grain corridors; and the Indo-Pacific revolves around the Taiwan Strait’s chip dominance, China’s naval expansion, and escalating U.S.–China friction.

- ZONE WATCH publishes automated daily reports for each zone and visualizes risk on our globe so decision-makers can see change at a glance. We track these four because they’re the most likely theaters for great-power miscalculation and the highest-impact flashpoints for governments, corporations, and war planners—and also, the core candidates for any World War III–scale scenario. While ZONE WATCH is free to access, we also build custom intelligence systems designed to monitor your specific zones, industries, or regions of interest from a planetary overwatch perspective. These systems provide continuous data streams for strategic decision-making, predictive modeling, and situational awareness—giving you the same level of insight governments and defense planners rely on, tailored entirely to your mission. Mobile app is on the way…

Statistic:

- Largest public banking companies by market capitalization:

- 🇺🇸 JPMorgan Chase: $827.95B

- 🇨🇳 Agricultural Bank of China: $394.18B

- 🇺🇸 Bank of America: $388.60B

- 🇨🇳 ICBC: $365.65B

- 🇺🇸 Wells Fargo: $273.98B

- 🇨🇳 China Construction Bank: $269.74B

- 🇺🇸 Morgan Stanley: $264.13B

- 🇺🇸 Goldman Sachs: $243.94B

- 🇨🇳 Bank of China: $234.40B

- 🇬🇧 HSBC: $231.06B

- 🇨🇦 Royal Bank Of Canada: $209.04B

- 🇦🇺 Commonwealth Bank: $191.46B

- 🇮🇳 HDFC Bank: $187.64B

- 🇺🇸 Citigroup: $180.70B

- 🇺🇸 Charles Schwab: $172.15B

- 🇯🇵 Mitsubishi UFJ Financial: $169.56B

- 🇨🇳 CM Bank: $149.05B

- 🇪🇸 Santander: $145.90B

- 🇺🇸 Capital One: $143.03B

- 🇨🇦 Toronto Dominion Bank: $139.35B

- 🇨🇭 UBS: $122.33B

- 🇸🇬 DBS Group: $118.52B

- 🇸🇦 Al Rajhi Bank: $116.26B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria: $115.18B

- 🇮🇹 UniCredit: $113.05B

History:

- Charles Schwab began in 1963 when Charles R. Schwab created an investment newsletter called Investment Indicator. The company was formally incorporated in 1971 and renamed Charles Schwab & Co. in 1973. In 1975, after the deregulation of brokerage commissions, Schwab opened a branch offering low-cost trading, helping pioneer the discount brokerage model. Through the 1980s and 1990s, Schwab grew rapidly by investing in technology, developing its own trading systems, and expanding client access with phone-based and later web-based trading, which launched in 1996. In 2003, it entered banking with the creation of Charles Schwab Bank, allowing clients to integrate banking and investing. The company continued to innovate with the launch of its robo-advisor platform in 2015, offering automated investment management, and in 2019 it eliminated U.S. stock and ETF trading commissions, setting off an industry-wide shift toward zero-fee trading. Schwab’s $26 billion acquisition of TD Ameritrade in 2020 significantly expanded its client base and technology resources, followed by the relocation of its headquarters to Westlake, Texas, in 2021. By 2024, Schwab completed the integration of TD Ameritrade’s trading systems and entered 2025 reporting record revenues and over $10 trillion in client assets, solidifying its place as one of the largest brokerage and banking firms in the United States.

- Today, Charles Schwab operates through an integrated model that combines brokerage, banking, and asset-management services. It offers trading in stocks, ETFs, and options for self-directed investors, along with savings and lending products through its banking arm. The company earns revenue from several sources: net interest income from client deposits and margin lending, asset-management and advisory fees from its funds and portfolios, trading-related income such as options activity, and banking service fees. It also provides custody, technology, and support services for independent registered investment advisors, helping them manage client portfolios efficiently. As of 2025, Schwab manages more than 37 million brokerage accounts, holds over $10 trillion in total client assets, and continues to expand its digital and advisory offerings to meet evolving investor needs.

Image of the day:

Thanks for reading!

- EARTH INTELLIGENCE builds private intelligence systems for organizations — connecting their internal and external data with AI to create one interactive command center for real-time awareness, decision making, and predictions.

Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news