Tuesday☕️

Economics & Markets:

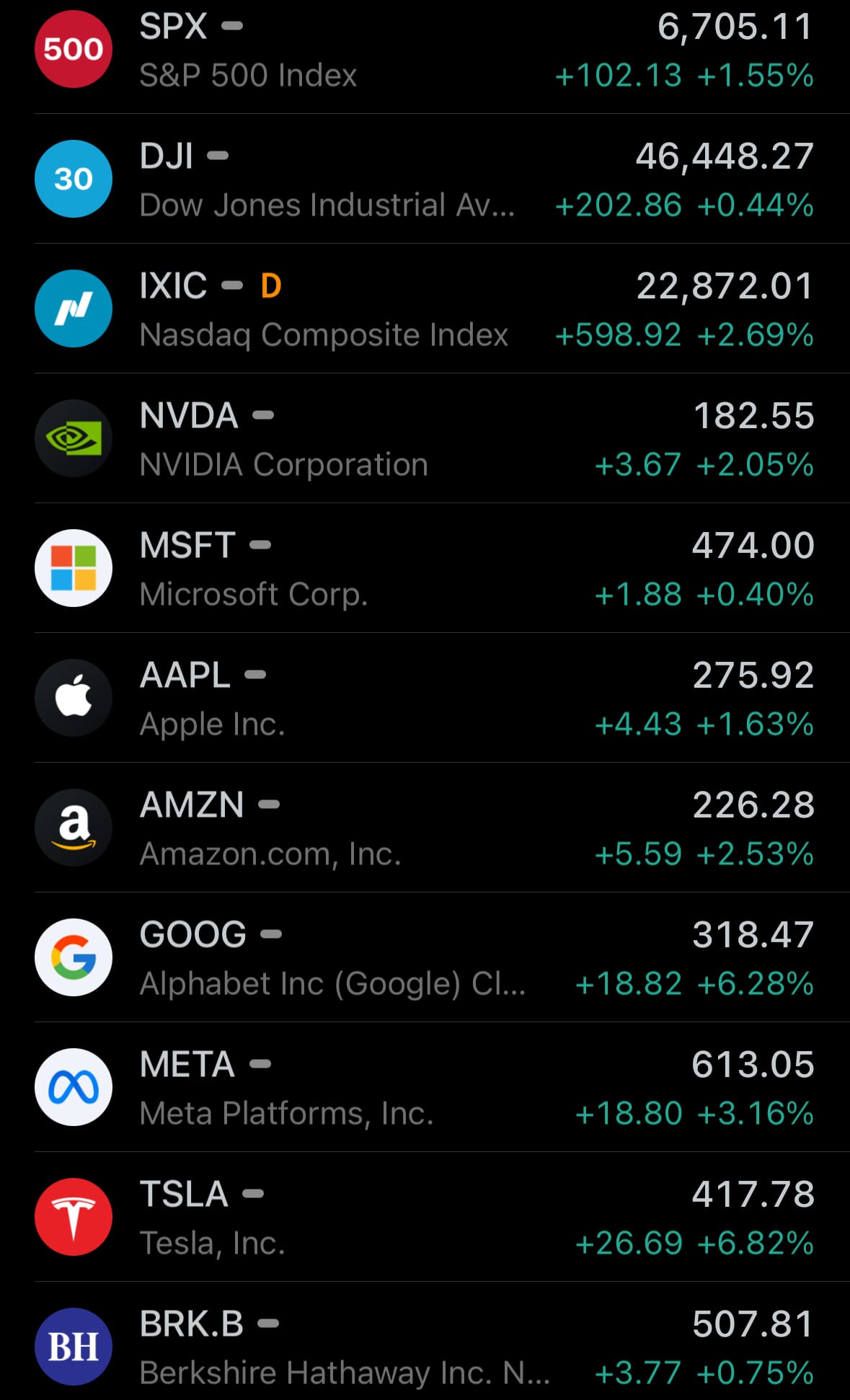

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- On November 24, 2025, Russian forces launched a large-scale drone and missile barrage targeting Kyiv and surrounding areas, resulting in at least six deaths and over 35 injuries, including a pregnant woman and children, according to Ukrainian officials. The assault involved around 430 drones and 18 missiles, including ballistic and aeroballistic types, with explosions reported across multiple districts such as Obolonskyi, Holosiivskyi, Shevchenkivskyi, Solomianskyi, Darnytskyi, Podilskyi, and Desnianskyi, causing fires, damage to residential buildings, cars, and the Azerbaijani Embassy from falling debris. Ukrainian air defenses intercepted most projectiles, but debris and direct impacts led to power and water outages in parts of the capital, as well as disruptions to energy infrastructure, prompting residents to seek shelter and emergency crews to respond to over 15 affected sites.

- Simultaneously, Ukrainian forces conducted drone strikes on Russian assets in the Black Sea, focusing on the port of Novorossiysk, where a major swarm attack damaged key energy infrastructure and halted oil deliveries, as reported by Russian and international sources. The operation, described as one of the most significant in recent months on the Krasnodar region, involved multiple unmanned aerial vehicles targeting the port's facilities, with Russian defenses claiming to repel the assault but acknowledging temporary suspension of exports. This reciprocal action highlights ongoing escalation in maritime domains, where Ukraine aims to disrupt Russian logistics and energy exports, while Russia maintains naval presence amid vulnerabilities exposed by prior strikes on ships and rigs in the area.

Cyber:

- On November 24, 2025, the U.S. Federal Communications Commission announced that Comcast agreed to pay a $1.5 million penalty to resolve an investigation into a 2024 data breach at its former debt-collection vendor, Financial Business and Consumer Solutions (FBCS). The breach exposed personal data—including names, addresses, Social Security numbers, dates of birth, and Comcast account information—of about 237,000 Comcast customers. The FCC found that Comcast had not sufficiently overseen FBCS’s data-security practices, violating federal Customer Proprietary Network Information (CPNI) rules. Under the settlement, Comcast must adopt a strengthened compliance program that includes enhanced vendor oversight, employee privacy training, and periodic reporting to the FCC.

- On November 22, 2025, Harvard University reported a data breach in its Alumni Affairs and Development Office systems, detected on November 18 after an attacker used a voice-phishing (vishing) scheme to gain access. The compromised databases contained contact details (email addresses, phone numbers, home and business addresses), donation records, event attendance, and biographical information for alumni, donors, family members, parents, some current students, and faculty. Harvard stated that Social Security numbers, passwords, and financial account details were not typically stored in the affected systems. The university immediately cut off the intruder’s access and is working with law enforcement and external cybersecurity specialists. This is Harvard’s second disclosed breach in 2025.

Science & Technology:

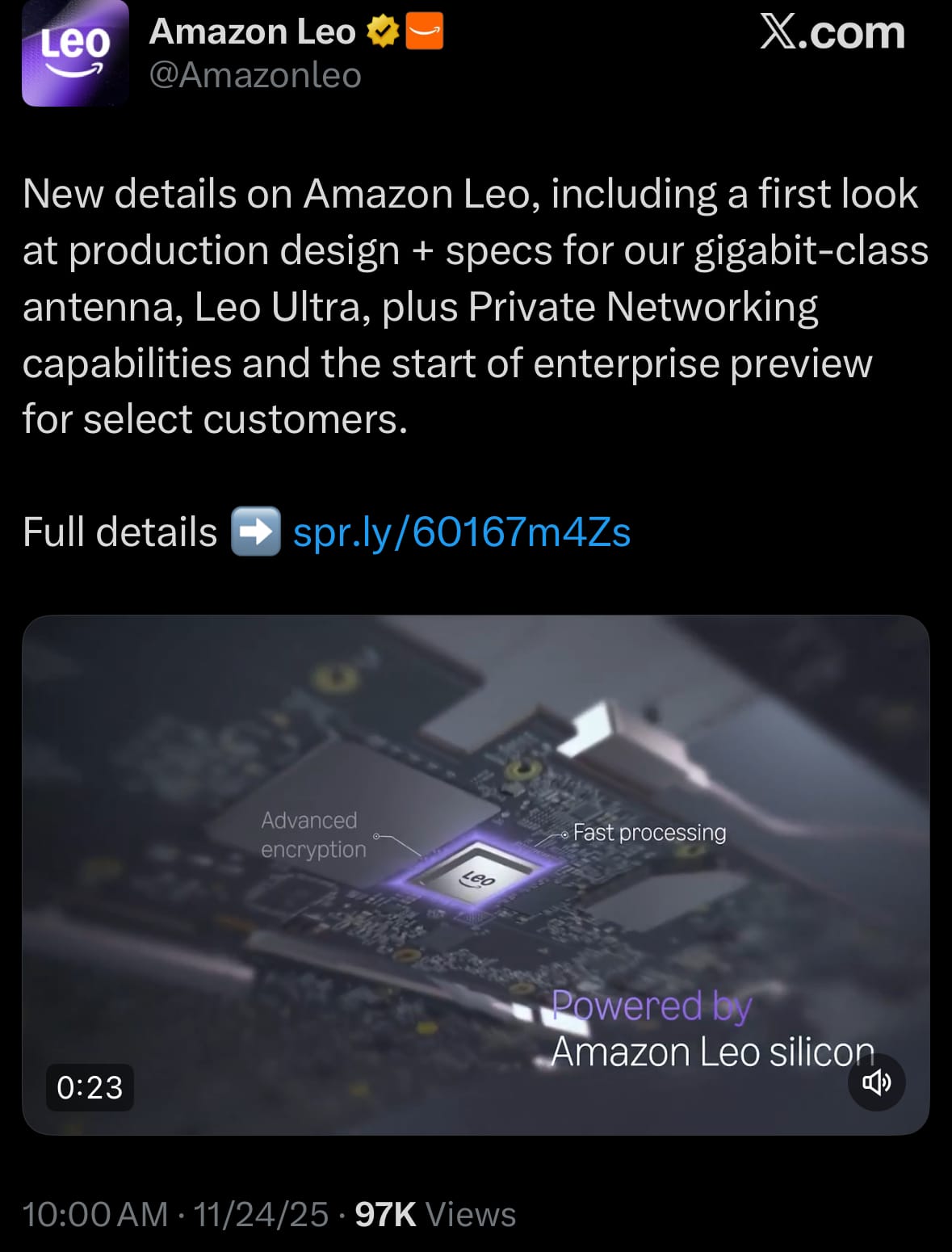

- On November 24, 2025, Amazon announced new details about its satellite internet service, Amazon Leo—formerly known as Project Kuiper—including the first public reveal of production designs and specifications for its antenna lineup, private networking features, and the launch of an enterprise preview program for select business customers. The service aims to provide low-latency broadband connectivity via a constellation of low Earth orbit satellites, with 153 production-grade satellites already deployed since April 2025 through partnerships with launch providers like United Launch Alliance and SpaceX. Amazon plans to expand to over 3,000 satellites in the initial constellation to enable global coverage, targeting underserved areas and competing with services like SpaceX's Starlink, though it currently trails with fewer satellites in orbit.

- Key highlights include the Leo Ultra antenna, a full-duplex phased array unit measuring 20 by 30 inches and weighing 43 pounds, capable of delivering download speeds up to 1 Gbps and upload speeds up to 400 Mbps through custom Amazon-designed silicon chips and signal processing algorithms for optimized throughput and low latency. Additional antennas comprise the Leo Pro (11 by 11 inches, up to 400 Mbps, 5.3 pounds) and Leo Nano (7 by 7 inches, up to 100 Mbps, 2.2 pounds), all supporting enterprise-grade features like advanced encryption, network management tools, and 24/7 priority support. The enterprise preview involves shipping these production terminals to early partners such as JetBlue for in-flight connectivity, Hunt Energy Network, Vanu Inc., Connected Farms, and NBN Co. in Australia, with private networking options including "Direct to AWS" for seamless cloud integration and interconnects to corporate data centers. While pricing remains undisclosed, the program allows for customer feedback to refine industry-specific solutions ahead of a broader consumer rollout expected in 2026.

Statistic:

- Largest public German companies by market capitalization:

- 🇩🇪 SAP: $278.03B

- 🇩🇪 Siemens: $201.33B

- 🇩🇪 Allianz SE: $161.36B

- 🇩🇪 Deutsche Telekom: $156.17B

- 🇩🇪 Siemens Energy: $97.84B

- 🇩🇪 Munich RE (Münchener Rück): $80.59B

- 🇩🇪 Rheinmetall: $72.51B

- 🇩🇪 Deutsche Bank: $65.31B

- 🇩🇪 Mercedes-Benz: $63.84B

- 🇩🇪 BMW: $61.18B

- 🇩🇪 DHL Group (Deutsche Post): $58.27B

- 🇩🇪 Merck KGaA: $56.55B

- 🇩🇪 Volkswagen: $56.18B

- 🇩🇪 Siemens Healthineers: $54.55B

- 🇩🇪 Infineon: $49.24B

- 🇩🇪 E.ON: $46.12B

- 🇩🇪 Porsche: $45.95B

- 🇩🇪 Deutsche Börse: $45.78B

- 🇩🇪 BASF: $45.62B

- 🇩🇪 HeidelbergCement: $42.76B

- 🇩🇪 Commerzbank: $41.67B

- 🇩🇪 RWE: $37.58B

- 🇩🇪 Hannover Rück: $35.46B

- 🇩🇪 Bayer: $34.66B

- 🇩🇪 Henkel: $33.60B

History:

- Tanks emerged from the mechanized logic of the First World War, when trench warfare made mobility almost impossible and armies needed a machine that could cross obstacles, endure machine-gun fire, and smash fortified lines. Britain fielded the first operational tank, the Mark I, in 1916 on the Somme—slow, armored, and capable of moving through terrain that stopped infantry cold. France followed with its first tank, the Schneider CA1, in 1917, then leapfrogged everyone with the Renault FT later that year: turret on top, engine at the rear, crew in front—the first truly “modern” tank layout that became the global blueprint. The United States’ first mass-produced tank, the M1917, was a license-built Renault FT copy that rolled off lines near the end of the war. Germany arrived late with the A7V in 1918, its first operational panzer, and supplemented it with captured British machines. Italy’s first indigenous tank, the Fiat 3000, entered service in 1921, again modeled on the FT and forming the backbone of early Italian armor. The Soviet Union’s first home-grown design, the MS-1/T-18, appeared in 1928—another FT descendant, but crucial for building a domestic tank industry. Japan’s first true indigenous medium tank, the Type 89 I-Go, was finalized in 1929 and became its primary armored workhorse in China through the 1930s. Poland developed the 7TP in the mid-1930s from the British Vickers 6-ton, adding diesel power and better armament and giving Warsaw one of the best light tanks of 1939—just not enough of them. By the late 1930s, most industrial nations had their own tank lineages and doctrines. The Soviets pursued high-speed maneuver warfare with BT-series tanks and early deep-battle theory; Britain tested fully mechanized formations; France emphasized thickly armored infantry tanks; Germany fused these ideas into a coherent vision of combined-arms mobility. When World War II began, tanks had shifted from experimental curiosities to the cutting edge of military power. Early German Panzers III and IV, paired with radios, enabled Blitzkrieg’s rapid, coordinated breakthroughs. As the conflict intensified, Germany fielded the Panther and Tiger—technologically formidable machines with powerful guns and advanced armor shaping—while the Soviet Union answered with the T-34, designed for mass production, ruggedness, and operational endurance. The United States deployed the M4 Sherman, not the most heavily armored tank on the field but exceptionally reliable, easy to build, and deadly when used in coordinated formations. Britain ran a mix of infantry and cruiser tanks before transitioning to more balanced designs, Japan kept lighter tanks suited to Asian terrain and opponents, and Italy’s armor lagged in firepower and protection. By 1945, the lesson was clear: tanks win when industrial mass, mechanical reliability, and doctrine align—not just when the armor is thickest.

- The postwar era turned “tank” into “main battle tank”—one universal platform meant to combine firepower, mobility, and protection. Britain’s Centurion, developed at the end of World War II and entering service in 1945, became one of the most influential early MBTs, defining the pattern of a well-armored, gun-focused universal design. The Soviet Union pushed into the late 1940s with the T-54/55 family, which became the most-produced tank line in history and the backbone of Soviet and Warsaw Pact armored forces, later evolving into the T-62, T-72, T-80, and T-90 families. China’s first true domestic tank generation began with the Type 59, a locally built T-54A derivative accepted into PLA service in 1959 and forming the core of Chinese armored units for decades, before transitioning to the second-generation Type 96 in the late 1990s and the more advanced third-generation Type 99 as it pushed toward parity with other major powers. Western Europe split into two main schools: France fielded the mobile AMX-30 family and later the Leclerc; West Germany developed the Leopard 1 and then the Leopard 2, entering service in 1979 and evolving into one of the premier NATO tanks. The United States moved from the M48 and M60 to the M1 Abrams in 1980, bringing composite armor, advanced fire control, and a gas turbine engine into frontline service. Israel, after years of operating imported tanks, fielded its first fully indigenous MBT, the Merkava Mark 1, in 1979, built around crew survivability, internal troop capacity, and rugged battlefield repair. Japan and South Korea joined the high-end club with the Type 74 and Type 90 (Japan) and later the K1 and K2 (South Korea). Poland and other Eastern European states evolved their own fleets from T-72 roots and imported Leopard 2s. India, after decades of relying on foreign designs, introduced its Arjun MBT in the 2000s following a long development effort that began in the 1980s. By the early twenty-first century, the main players—the United States with its M1 variants, Russia with its T-72/80/90 lines, China with the Type 96 and 99, Germany with the Leopard 2, the U.K. with the Challenger series, France with the Leclerc, Israel with the Merkava, and rising forces like India and South Korea—were all fielding heavily digitalized, sensor-fused tanks. Modern armor integrates thermal imaging, stabilized cannons, laser rangefinders, digital battle networks, and increasingly AI-assisted fire control, turning tanks from isolated machines into nodes in a larger sensor-to-shooter ecosystem. The hardware has shifted from riveted steel boxes to composite-armored, networked platforms, but the underlying competition is unchanged since 1917: which nations can turn steel, electronics, doctrine, and industry into the most effective mobile gun on the battlefield.

Image of the day:

Thanks for reading! Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

- Download our mobile app on the Apple App Store (Android coming soon):

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news