Tuesday☕️

Trending:

- On January 5-6, 2026, the Israel Defense Forces (IDF) conducted airstrikes on multiple sites in southern and eastern Lebanon, including the coastal city of Sidon, targeting what they described as Hezbollah and Hamas military infrastructure. The strikes hit weapon storage facilities (both above and below ground), military structures, and Hamas weapons production sites in southern Lebanon. The IDF stated these locations were in civilian areas, accusing the groups of using civilians as human shields, and reported taking measures such as issuing prior evacuation warnings to mitigate harm; no civilian casualties were reported in the targeted villages.

- The operations followed public warnings to residents of villages like Kfar Hatta, Ain al-Tinah, Annan, and Al-Manara, and extended to areas in the Bekaa Valley. Lebanese reports confirmed strikes, including one destroying a commercial building in Sidon (empty at the time) and drone attacks wounding two people identified by Israel as Hezbollah members. No immediate Hezbollah or Hamas response was reported. These actions align with ongoing IDF efforts to enforce the 2024 ceasefire by preventing rearmament, amid pressure on Lebanon to disarm Hezbollah south of the Litani River.

Economics & Markets:

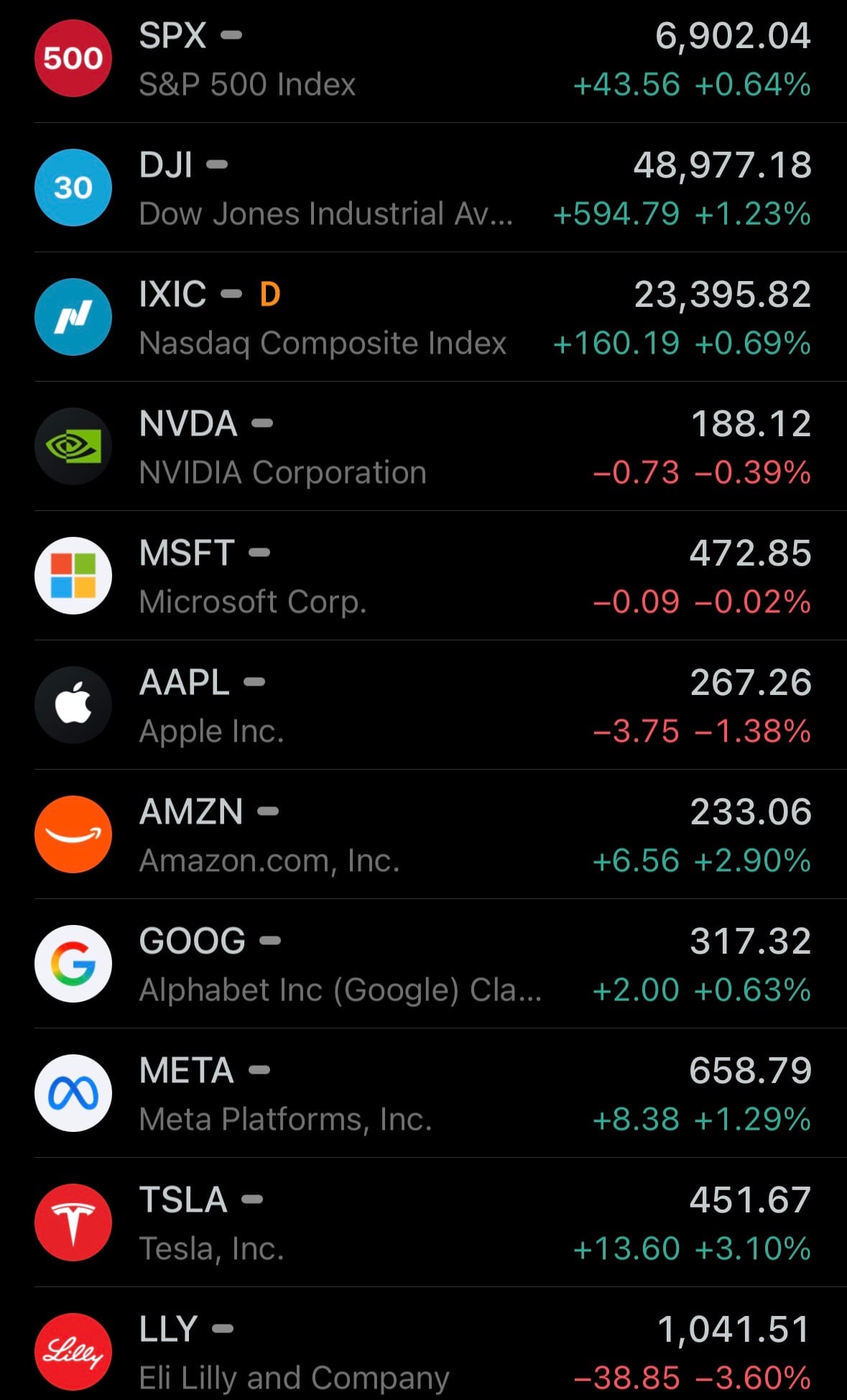

- Yesterday’s U.S. stock market:

- Today’s commodity market:

- Today’s crypto market:

Environment & Weather:

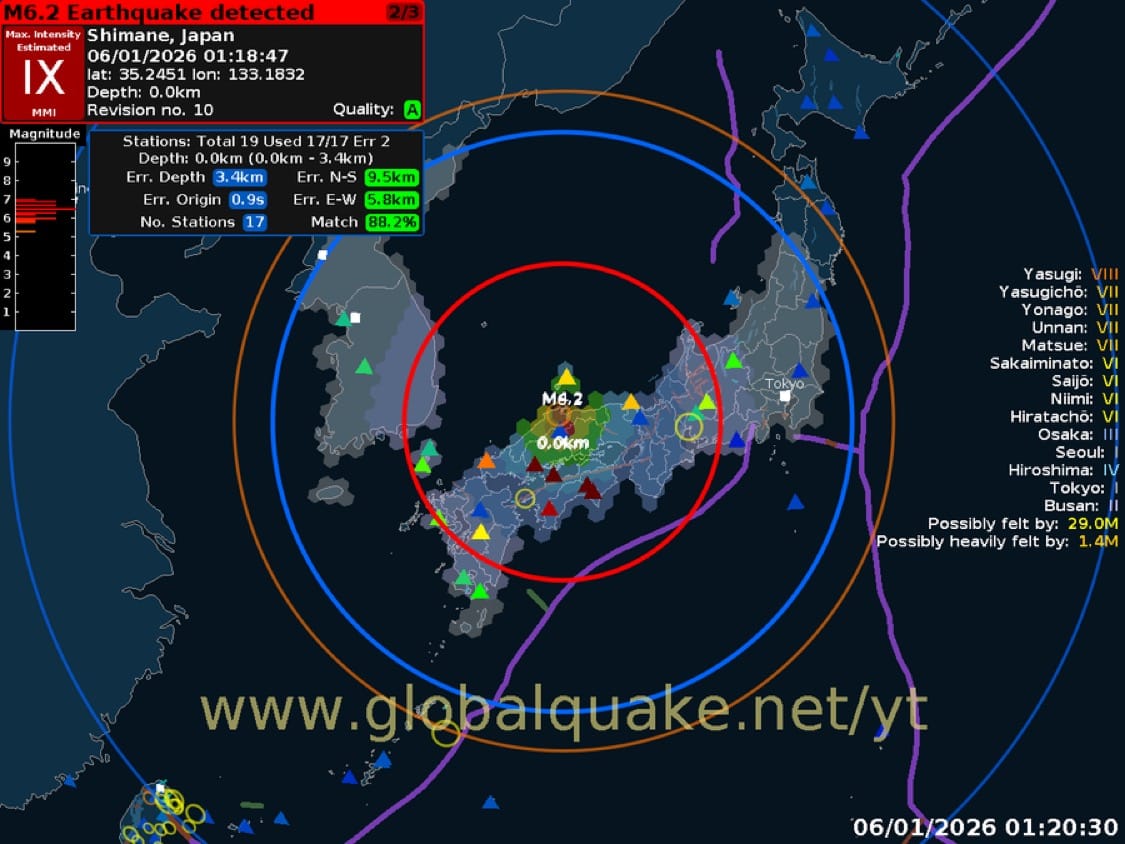

- On January 6, 2026 (morning local time), a magnitude 6.2 earthquake struck eastern Shimane Prefecture in western Japan's Chugoku region, with strong shaking also felt in neighboring Tottori Prefecture. The quake occurred at approximately 10:18 a.m. JST (01:18 UTC) at a shallow depth of about 10 km, registering an intensity of upper-5 on Japan's 7-level seismic scale in cities like Matsue and Yasugi (Shimane) and Sakaiminato (Tottori)—strong enough to make standing difficult but unlikely to cause widespread collapse in modern structures.

- No tsunami warning was issued, and initial reports indicated no major damage, injuries, or abnormalities at the nearby Shimane Nuclear Power Station (its Unit 2, recently restarted, continued normal operations). Bullet train services were briefly suspended for checks, and residents received early warnings via mobile alerts. Japan, located on the Pacific Ring of Fire, experiences frequent seismic activity, and strict building codes helped minimize impacts.

Science & Technology:

- On January 4-5, 2026, LG Electronics unveiled its CLOiD AI-powered home robot ahead of CES 2026 in Las Vegas (January 6-9). The humanoid-style robot features a wheeled base, articulated dual arms with seven degrees of freedom each, five-fingered hands for precise manipulation, and a head unit with display, speakers, cameras, and sensors. Powered by LG's Physical AI (combining vision-language models and action models trained on extensive household data), CLOiD integrates with the ThinQ ecosystem to automate chores like preparing breakfast, loading/unloading appliances, folding laundry, and coordinating smart home devices.

- The unveiling supports LG's "Zero Labor Home" vision, aiming to eliminate routine housework through robotics and connected appliances. Live demonstrations at CES booth #15004 show CLOiD in real-life scenarios, emphasizing natural human interaction, user habit learning, and safe navigation. No pricing or release date was announced; it positions LG in the growing home robotics market alongside competitors like Samsung's Ballie.

Statistic:

- Largest public banks on Earth by market capitalization:

- 🇺🇸 JPMorgan Chase: $918.52B

- 🇺🇸 Bank of America: $421.38B

- 🇨🇳 Agricultural Bank of China: $377.94B

- 🇨🇳 ICBC: $358.70B

- 🇨🇳 China Construction Bank: $342.82B

- 🇺🇸 Wells Fargo: $308.74B

- 🇺🇸 Morgan Stanley: $297.78B

- 🇺🇸 Goldman Sachs: $287.11B

- 🇬🇧 HSBC: $279.04B

- 🇨🇳 Bank of China: $257.50B

- 🇨🇦 Royal Bank of Canada: $243.20B

- 🇺🇸 Citigroup: $226.98B

- 🇺🇸 Charles Schwab: $188.31B

- 🇯🇵 Mitsubishi UFJ Financial: $186.80B

- 🇪🇸 Santander: $178.78B

- 🇦🇺 Commonwealth Bank: $175.25B

- 🇮🇳 HDFC Bank: $175.22B

- 🇨🇳 CM Bank: $168.61B

- 🇨🇦 Toronto Dominion Bank: $164.54B

- 🇺🇸 Capital One: $160.20B

- 🇨🇭 UBS: $151.60B

- 🇪🇸 BBVA: $137.50B

- 🇸🇬 DBS Group: $128.21B

- 🇯🇵 Sumitomo Mitsui Financial Group: $127.26B

- 🇮🇹 UniCredit: $126.18B

History:

- UBS traces its origins to 1862, when the Bank in Winterthur was founded in Switzerland to support industrialization and railway expansion, followed by the Toggenburger Bank in 1863. These regional banks reflected Switzerland’s early banking model: conservative, capital-focused, and closely tied to industry and trade. In 1912, a major consolidation created the Swiss Bank Corporation (SBC), one of Switzerland’s emerging national banking powers. Parallel to this, Union Bank of Switzerland was formed in 1912 through the merger of several regional banks, including Bank in Winterthur. Throughout the early and mid-20th century, both institutions expanded domestically and internationally, building reputations around stability, neutrality, and wealth preservation—traits that became synonymous with Swiss banking. Switzerland’s political neutrality during both World Wars, combined with strict banking secrecy laws formalized in 1934, positioned Swiss banks as global custodians of capital. By the late 20th century, both SBC and Union Bank of Switzerland had become major international financial institutions, spanning commercial banking, investment banking, and wealth management across Europe, the Americas, and Asia.

- The modern UBS emerged in 1998, when Union Bank of Switzerland and Swiss Bank Corporation merged, creating one of the world’s largest financial institutions under the unified UBS brand. The merger aimed to combine UBS’s strength in retail and wealth management with SBC’s global investment banking reach. In the 2000s, UBS expanded aggressively into investment banking and global markets, but this strategy exposed it to significant risk during the 2008 financial crisis, when UBS suffered heavy losses tied to U.S. mortgage-backed securities. The Swiss government intervened to stabilize the bank, marking a turning point that pushed UBS back toward its core strength: wealth management. Over the 2010s, UBS deliberately retrenched from high-risk trading, refocused on serving ultra-high-net-worth clients, and positioned itself as the world’s leading global wealth manager. That role was reinforced dramatically in 2023, when UBS acquired Credit Suisse in a government-brokered rescue, consolidating Switzerland’s banking sector and absorbing one of its oldest rivals. Today, UBS stands as a dominant global financial institution with trillions in assets under management, operating across wealth management, asset management, investment banking, and retail banking. Its evolution—from regional Swiss lenders to a consolidated global powerhouse—reflects the broader arc of modern finance: expansion, crisis, retrenchment, and strategic concentration around scale, trust, and long-term capital stewardship.

Image of the day:

Thanks for reading! Earth is complicated, we make it simple.

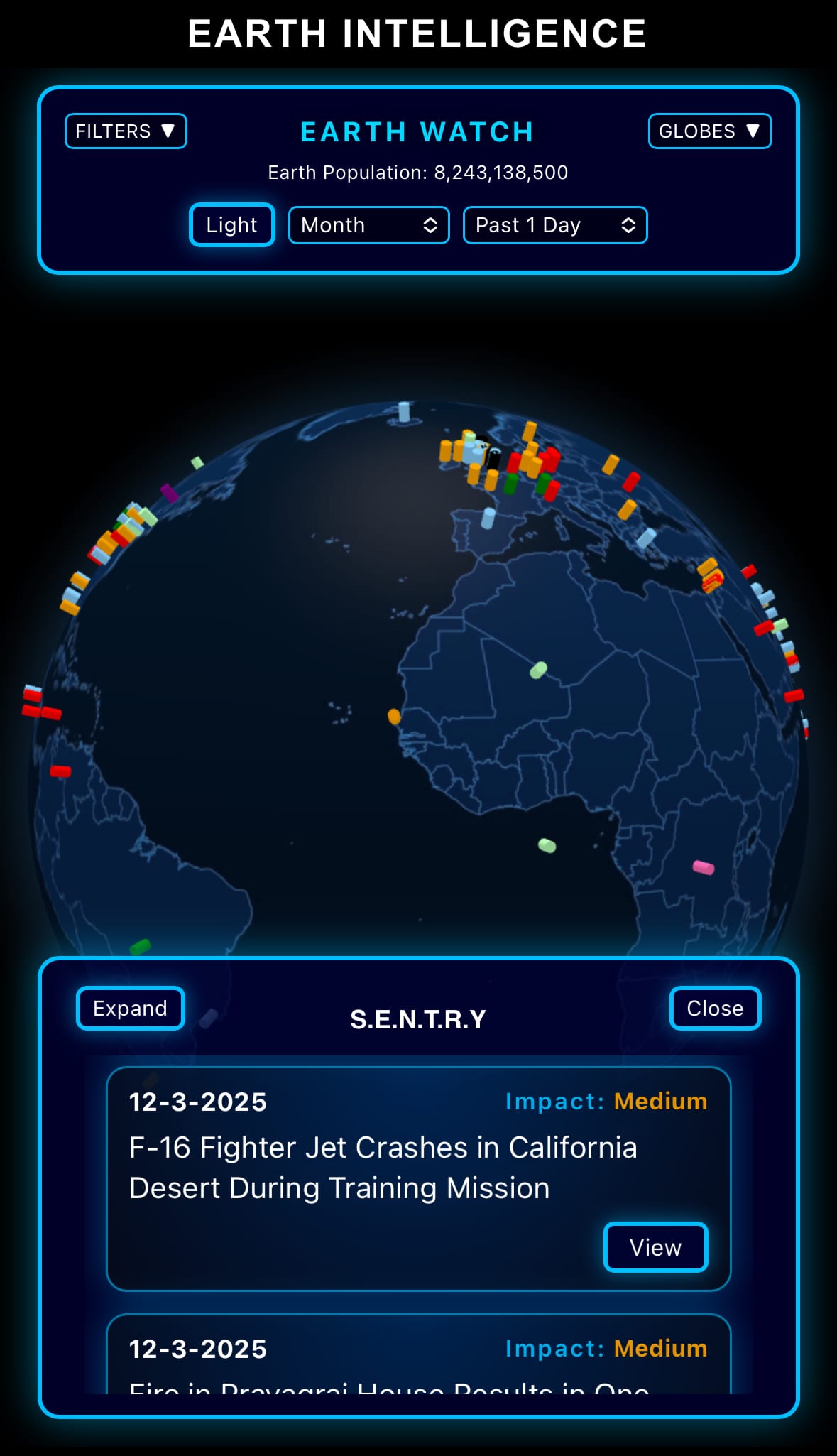

- Click below if you’d like to view our free EARTH WATCH globe:

- Download our mobile app:

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news