Tuesday☕️

Trending:

- On January 12, 2026, U.S. President Donald Trump announced via Truth Social that, effective immediately, any country doing business with the Islamic Republic of Iran would face a 25% tariff on "any and all business being done with the United States of America." Trump described the order as "final and conclusive," without providing further details on implementation, definitions of "doing business," the legal basis, or exemptions. The announcement came amid ongoing anti-government protests in Iran, now in their third week, with reports of violent crackdowns and significant casualties.

- The tariff would apply to imports from Iran's major trading partners, including China, India, the United Arab Emirates, Turkey, Iraq, Russia, and Brazil, potentially raising costs for U.S. importers and affecting global trade flows. No official White House documentation or executive order was immediately published, and questions remain about enforcement mechanisms, scope (goods only or including services), and alignment with existing sanctions.

Nitric Acid Spill:

- On January 12, 2026, a hazardous spill of nitric acid occurred at the intersection of Montague Drive and Link Road in Montague Gardens, Cape Town, South Africa. The incident released toxic fumes, prompting a hazmat alert from emergency services, who are actively containing the spill and neutralizing the chemical.

- Multiple roads have been closed, including intersections with Link Road, Railway Road, First Street, Fifth Street, and Marconi Road. Authorities have urged the public to avoid the area completely, with possible evacuations in progress for nearby residents and businesses. No injuries have been reported so far, and the situation remains ongoing while response teams work to secure the site and mitigate further risks.

Economics & Markets:

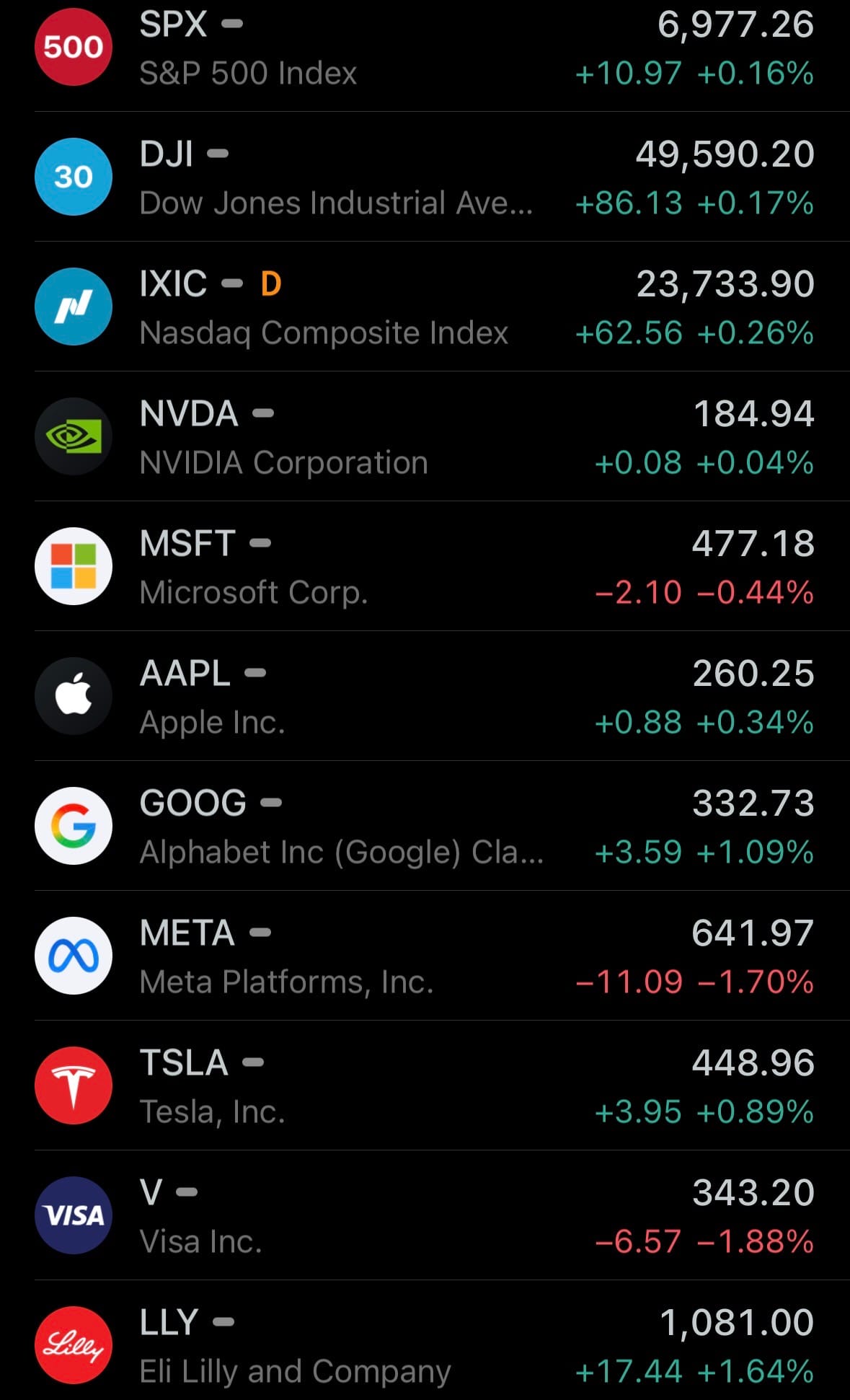

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Business:

- On January 12, 2026, OpenAI announced the acquisition of Torch, a healthcare startup specializing in unifying fragmented personal health data—including lab results, medications, doctor visit recordings, and information from wearables and other sources—into a single, AI-accessible "medical memory." The deal, reported by sources as valued at approximately $60-100 million (primarily in equity, though terms were not officially disclosed), brings Torch's small team (including co-founder/CEO Ilya Abyzov, Eugene Huang, James Hamlin, and Ryan Oman) to OpenAI to help enhance ChatGPT Health.

- Torch's technology will integrate with ChatGPT Health, launched just days earlier, to enable more accurate, personalized responses grounded in users' complete health records—such as explaining lab results, suggesting questions for doctors, or tracking medications—while emphasizing it supports (but does not replace) professional medical care. The acquisition accelerates OpenAI's push into consumer health tools, following partnerships with major health systems and amid competition from other AI firms in healthcare applications.

Science & Technology:

- On January 12, 2026, AI company Anthropic announced the launch of Cowork, a new feature integrated into its Claude AI platform designed to assist users with non-technical tasks in a collaborative, step-by-step manner. Described as "Claude Code for the rest of your work," Cowork enables users to break down complex projects—such as writing reports, planning events, or organizing research—into manageable steps, with Claude providing guidance, suggestions, and iterative refinements based on user input. It is immediately available to all Claude users on web and mobile apps, building on the existing Claude Code tool (which focuses on programming) by extending similar interactive workflows to everyday professional and personal tasks.

- Cowork functions by allowing users to describe a goal, after which Claude generates a structured plan, executes subtasks (e.g., drafting content or outlining strategies), and incorporates feedback for revisions, aiming to enhance productivity without requiring coding expertise. The feature emphasizes transparency, with users able to view and edit Claude's reasoning process, and includes safeguards for accuracy and ethical use.

Statistic:

- Largest public financial services on Earth by market capitalization:

- 🇺🇸 JPMorgan Chase: $892.26B

- 🇺🇸 Visa: $662.34B

- 🇺🇸 Mastercard: $511.92B

- 🇺🇸 Bank of America: $417.24B

- 🇨🇳 Agricultural Bank of China: $377.46B

- 🇨🇳 ICBC: $357.65B

- 🇨🇳 China Construction Bank: $341.79B

- 🇺🇸 Wells Fargo: $304.19B

- 🇺🇸 Morgan Stanley: $297.82B

- 🇺🇸 Goldman Sachs: $287.44B

- 🇬🇧 HSBC: $279.15B

- 🇨🇳 Bank of China: $255.55B

- 🇺🇸 American Express: $250.23B

- 🇨🇦 Royal Bank of Canada: $238.34B

- 🇺🇸 Citigroup: $216.67B

- 🇯🇵 Mitsubishi UFJ Financial: $197.45B

- 🇺🇸 Charles Schwab: $184.97B

- 🇪🇸 Santander: $179.52B

- 🇦🇺 Commonwealth Bank: $172.94B

- 🇮🇳 HDFC Bank: $171.89B

- 🇺🇸 S&P Global: $166.22B

- 🇨🇳 CM Bank: $162.87B

- 🇨🇦 Toronto Dominion Bank: $159.43B

- 🇯🇵 SoftBank: $153.97B

- 🇨🇭 UBS: $150.87B

- 🇺🇸 Capital One: $149.13B

History:

- The history of semiconductors begins with the realization that electricity could be controlled, not just conducted. In the late 19th and early 20th centuries, scientists studying materials like silicon and germanium discovered that their electrical conductivity could be altered by impurities—a property neither true conductors nor insulators possessed. This understanding matured during World War II, when radar and communications demands pushed solid-state research forward. The decisive breakthrough came in 1947, when John Bardeen, Walter Brattain, and William Shockley at Bell Labs invented the transistor, replacing bulky, fragile vacuum tubes with a small, reliable solid-state switch. This single invention reshaped the modern world. In 1958–1959, Jack Kilby and Robert Noyce independently developed the integrated circuit, allowing multiple transistors to be fabricated on a single piece of silicon. That leap—from discrete components to integrated silicon—made modern electronics scalable. By the 1960s, companies like Fairchild Semiconductor and Texas Instruments were producing chips for military, space, and industrial systems. In 1965, Gordon Moore observed that transistor counts on chips were doubling roughly every two years—what became known as Moore’s Law, a self-fulfilling roadmap that drove relentless miniaturization for decades.

- From the 1970s through the 1990s, semiconductors became the foundation of computing. Intel’s 4004 microprocessor (1971) put a full CPU on a single chip, followed by increasingly powerful processors that fueled personal computers, servers, and eventually mobile devices. As feature sizes shrank from micrometers to hundreds of nanometers, manufacturing complexity exploded. This led to a structural split in the industry: integrated device manufacturers (IDMs) like Intel designed and manufactured their own chips, while a new foundry model emerged in Asia, where specialized companies focused purely on manufacturing chips designed by others. The most important of these was Taiwan Semiconductor Manufacturing Company (TSMC), founded in 1987. This model proved decisive. As chips moved into the deep-submicron era (180 nm, 90 nm, 45 nm) in the late 1990s and early 2000s, fabrication costs soared into the billions of dollars per plant. Only a handful of companies could keep pace. Semiconductors became not just products, but industrial systems—requiring extreme precision, global supply chains, advanced lithography, and atomic-scale control. By the 2010s, leading-edge chips were measured in single-digit nanometers, a scale where quantum effects, heat dissipation, and material limits dominate design.

- Today’s semiconductor landscape is defined by extreme concentration and strategic importance. At 3–7 nanometers, manufacturing is among the most complex processes humans have ever built, relying on extreme ultraviolet (EUV) lithography, multi-patterning, and sub-atomic precision. TSMC has emerged as the central node of this system. As of the mid-2020s, TSMC produces roughly 60% of the world’s foundry output and more than 90% of the most advanced leading-edge chips (below 7 nm), supplying companies like Apple, NVIDIA, AMD, and many others. Samsung is the only other firm operating at comparable nodes, though at smaller scale, while Intel has struggled to maintain leadership after decades of dominance and is now attempting a strategic recovery. These advanced chips power everything from smartphones and laptops to AI models, data centers, military systems, satellites, and critical infrastructure. The result is that semiconductors—once laboratory curiosities—are now the most geopolitically sensitive industrial asset on Earth. Control of advanced manufacturing determines economic competitiveness, military capability, and technological sovereignty. The journey from early material science to 3-nanometer fabrication is not just a story of smaller transistors; it is the story of how modern civilization learned to engineer matter itself—and how a small number of companies, led by TSMC, came to sit at the center of the digital world.

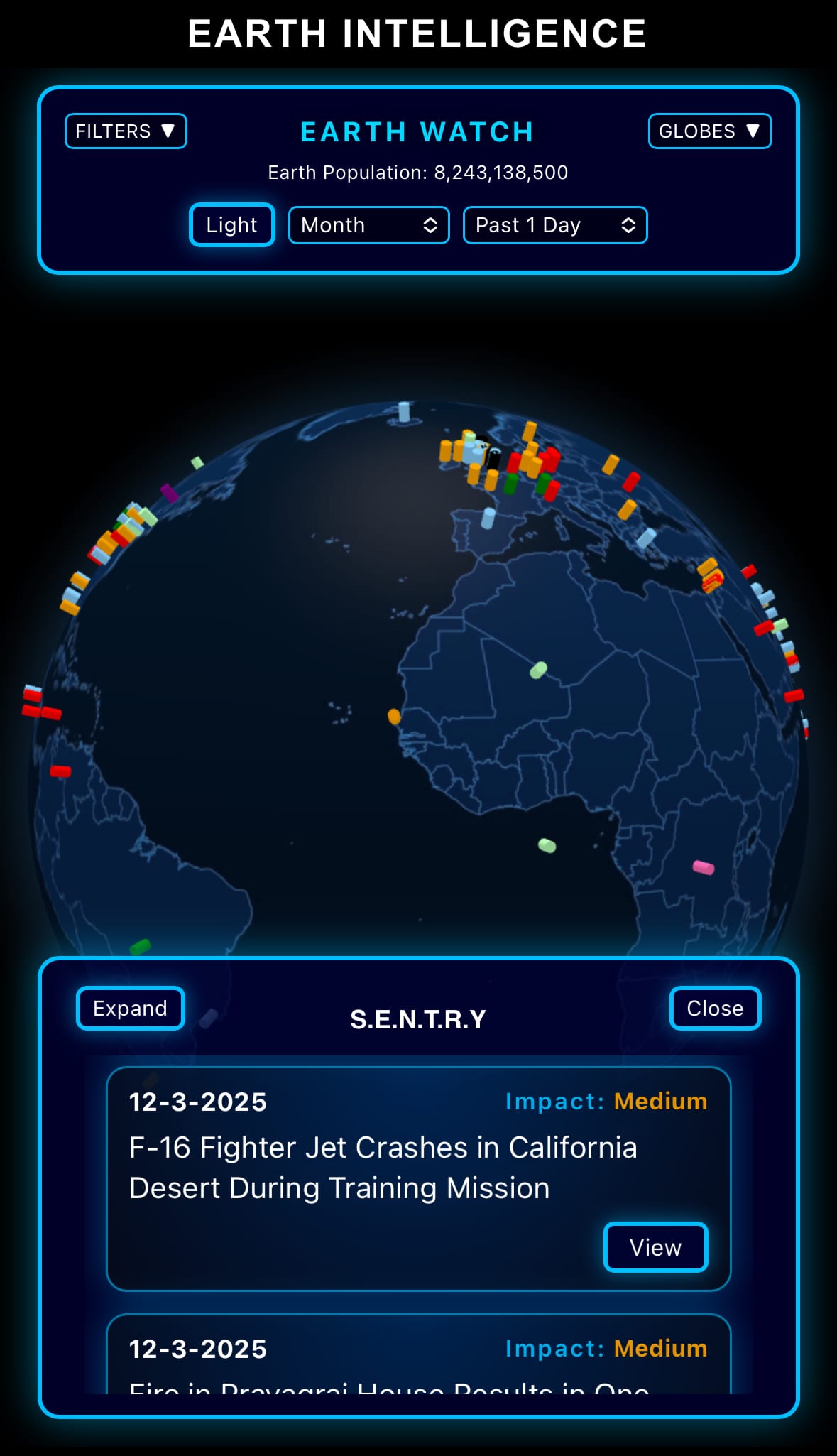

Image of the day:

Thanks for reading! Earth is complicated, we make it simple.

- Click below if you’d like to view our free EARTH WATCH globe:

- Download our mobile app:

Click below to view our previous newsletters:

Support/Suggestions Email:

earthintelligence@earthintel.news