Tuesday☕️

Trending:

- Morgan Stanley's New AI

- Citi Group's New Blockchain

- El Chapo's Son Extradition

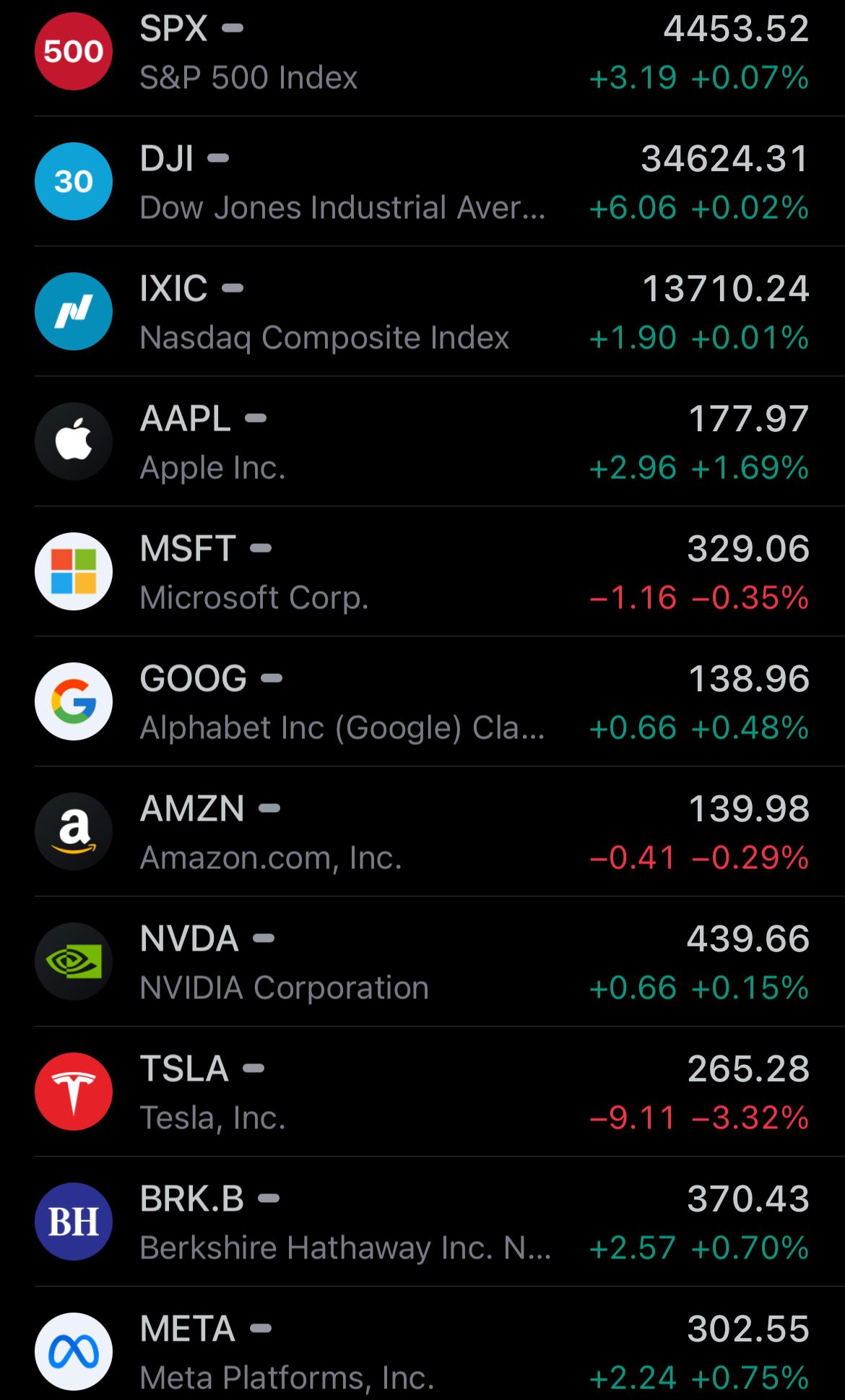

Markets:

- Yesterday's U.S. stock market:

- Yesterday's U.S. commodity market:

- Yesterday's crypto market:

Morgan Stanley's New AI:

- Morgan Stanley has initiated a new era of generative AI on Wall Street by introducing an AI assistant for financial advisors. Developed in collaboration with OpenAI using their latest generative AI GPT-4, this digital assistant is now available to all financial advisors and their support staff.

- The AI tool, named "AI @ Morgan Stanley Assistant," offers rapid access to a vast repository of around 100,000 research papers and documents. Morgan Stanley's co-President, Andy Saperstein, emphasized the bank's commitment to financial advisors, believing that this AI technology will redefine client interactions, streamline advisory practices, and allow professionals to focus more on client service.

- The bank had revealed its partnership with OpenAI's GPT-4 earlier in March, making it the first major Wall Street entity to deploy a customized solution based on this technology. The assistant aims to save time for both advisors and customer support representatives when it comes to market inquiries, recommendations, and internal procedures, allowing them to devote more time to client interaction.

- Instead of traditional coding, this system is trained by providing examples of desired outcomes, enabling it to "think" and apply human-like logic. The bank is also in the process of launching other AI solutions, including a tool named "Debrief" that automatically summarizes client meeting content and drafts follow-up emails.

Citi Group Blockchain:

- Yesterday, Citigroup announced the launch of "Citi Token Services," a new digital token system for real-time payments. This service is designed to transform customer deposits into digital tokens that can be swiftly transferred to anyone worldwide. The responsibility of overseeing this digital asset will fall under Citigroup’s treasury and trade solutions division.

- Shahmir Khaliq, the global head of the division, remarked that the development of Citi Token Services represents a significant stride in improving transaction banking services for institutional clients. For its operation, Citigroup will rely on a private blockchain exclusively under its control.

- Prior to this announcement, the financial institution had been testing a regulated liability network for several months. This network was conceptualized to enable banks to experiment with a digital currency that represents customer funds. The end goal was to settle these funds through central bank reserves on a distributed ledger.

- It's worth noting for Citigroup's clientele that there's no need to set up a new digital wallet to access this service. It will be conveniently integrated into Citibank’s existing system. Furthermore, Citi Token Services will play a pivotal role in a global cash management pilot, facilitating the transfer of liquidity between Citi branches around the clock.

El Chapo's Son Extradition:

- El Chapo, the infamous drug lord Joaquín Guzmán, who was arrested in Mexico in 2016 and subsequently sentenced to life imprisonment in the U.S., had the reins of his drug empire taken over by his sons, collectively known as "Los Chapitos." U.S. officials suggest that under their leadership, the cartel's involvement in smuggling illegal fentanyl into the U.S. has intensified.

- This year, Mexican authorities detained Ovidio Guzman, one of El Chapo's sons and an alleged key player in "Los Chapitos." Following his arrest, on Friday, the U.S. announced Ovidio's extradition, emphasizing his impending trial concerning his controlling role in fentanyl imports.

Statistic:

Top 50 public companies ranked by the number of employees:

- 🇺🇸 Walmart: 2,100,000

- 🇺🇸 Amazon: 1,541,000

- 🇹🇼 Foxconn (Hon Hai Precision Industry): 826,608

- 🇮🇪 Accenture: 732,000

- 🇩🇪 Volkswagen: 676,915

- 🇮🇳 Tata Consultancy Services: 614,795

- 🇩🇪 DHL Group (Deutsche Post): 583,816

- 🇨🇳 BYD: 570,100

- 🇺🇸 FedEx: 530,000

- 🇬🇧 Compass Group: 500,000

- 🇺🇸 United Parcel Service: 500,000

- 🇺🇸 Kroger: 500,000

- 🇺🇸 Home Depot: 475,000

- 🇷🇺 Gazprom: 468,000

- 🇨🇳 Agricultural Bank of China: 452,258

- 🇨🇳 China Mobile: 450,698

- 🇨🇳 Jingdong Mall: 450,679

- 🇺🇸 Target: 440,000

- 🇨🇳 ICBC: 427,587

- 🇫🇷 Sodexo: 422,000

- 🇳🇱 Ahold Delhaize: 414,000

- 🇺🇸 Starbucks: 402,000

- 🇭🇰 Jardine Matheson: 400,000

- 🇨🇳 Yum China: 400,000

- 🇺🇸 UnitedHealth: 400,000

- 🇨🇳 PetroChina: 398,440

- 🇺🇸 Berkshire Hathaway: 383,000

- 🇨🇳 China State Construction Engineering: 382,492

- 🇺🇸 Marriott International: 377,000

- 🇨🇳 China Construction Bank: 376,682

- 🇯🇵 Toyota: 375,235

- 🇨🇳 Sinopec: 374,791

- 🇲🇽 Fomento Económico Mexicano: 361,706

- 🇫🇷 Capgemini: 359,567

- 🇷🇺 Magnit: 357,000

- 🇺🇸 Cognizant Technology Solutions: 351,500

- 🇫🇷 Carrefour: 346,666

- 🇨🇳 Ping An Insurance: 344,223

- 🇯🇵 NTT (Nippon Telegraph & Telephone): 338,651

- 🇫🇷 Teleperformance: 334,896

- 🇺🇸 TriNet: 331,899

- 🇬🇧 Tesco: 330,000

- 🇺🇸 TJX Companies: 329,000

- 🇳🇱 X5 Retail Group: 325,000

- 🇺🇸 Walgreens Boots Alliance: 325,000

- 🇯🇵 Hitachi: 322,525

- 🇩🇪 Siemens: 316,000

- 🇺🇸 Concentrix: 315,000

- 🇺🇸 Pepsico: 315,000

- 🇩🇪 Fresenius: 313,812

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Email:

timeismoney@timeismon.com