Tuesday☕️

Trending:

- Red Sea Escalations

- Adobe Cancels Figma Deal

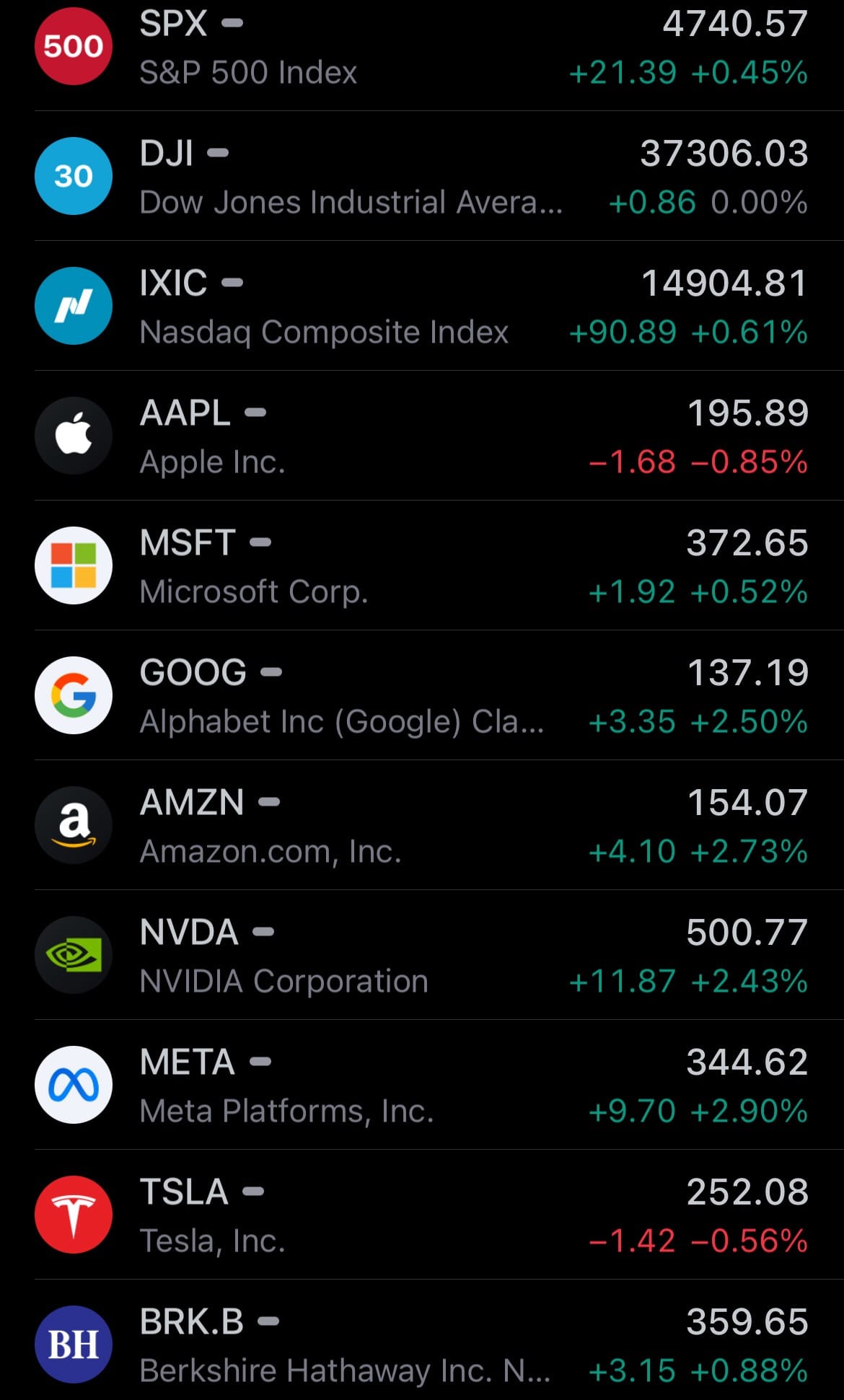

Markets:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Red Sea Escalations:

- In response to escalating threats in the Red Sea region, several leading shipping companies have temporarily ceased operations through the Suez Canal and Red Sea. This decision comes after multiple attacks on cargo ships by the Houthi forces, an Islamist group that has held significant control in Yemen since 2014. The Houthis have openly declared their intent to target or capture any vessels linked to Israel.

- The Suez Canal, a crucial maritime route that facilitates approximately 12% of global shipping by connecting the Mediterranean and Red Seas, is now at the center of these rising tensions. The disruptions caused by these threats have significant implications for international trade and shipping.

- In reaction to the situation, both the United States and the United Kingdom have deployed destroyers to the area. Their presence aims to mitigate the risk of further attacks and maintain order in this essential maritime corridor. The involvement of these naval forces underscores the seriousness of the threat and the importance of the Suez Canal in global commerce.

Adobe Cancels Figma Deal:

- Adobe has called off its proposed acquisition of Figma, a deal worth $20 billion, due to regulatory challenges in Europe and the UK. The decision to abandon this major software startup buyout comes after regulatory bodies expressed concerns over its potential impact on market competition.

- Adobe's planned purchase had been closely scrutinized for possibly stifling innovation in digital design software. The company, known for its flagship product Photoshop, will now pay a $1 billion termination fee to Figma. Figma's collaborative design platform is widely used by several high-profile companies, including Uber and Zoom.

- Both the UK's Competition and Markets Authority and the EU raised alarms about the deal limiting competition in a sector crucial for UK digital designers. Despite Adobe’s claim that its Adobe XD design tool, which has been operating at a loss, did not significantly compete with Figma, the company did not offer any concessions to address the antitrust concerns.

Statistic:

Largest oil and gas companies by market capitalization:

- 🇸🇦 Saudi Aramco: $2.135T

- 🇺🇸 Exxon Mobil: $406.27B

- 🇺🇸 Chevron: $282.55B

- 🇬🇧 Shell: $211.68B

- 🇨🇳 PetroChina: $166.67B

- 🇫🇷 TotalEnergies: $159.79B

- 🇺🇸 ConocoPhillips: $136.43B

- 🇬🇧 BP: $100.27B

- 🇧🇷 Petrobras: $99.54B

- 🇦🇪 TAQA: $98.57B

- 🇳🇴 Equinor: $93.52B

- 🇨🇳 Sinopec: $82.54B

- 🇨🇳 CNOOC: $78.27B

- 🇺🇸 Southern Company: $77.89B

- 🇨🇦 Enbridge: $75.47B

- 🇺🇸 Duke Energy: $74.89B

- 🇺🇸 Schlumberger: $74.67B

- 🇺🇸 EOG Resources: $70.92B

- 🇨🇦 Canadian Natural Resources: $68.84B

- 🇷🇺 Rosneft: $66.69B

- 🇦🇪 ADNOC Gas: $65.82B

- 🇺🇸 Phillips 66: $57.76B

- 🇺🇸 Marathon Petroleum: $57.64B

- 🇺🇸 Enterprise Products: $56.85B

- 🇺🇸 Pioneer Natural Resources: $53.37B

- 🇮🇹 ENI: $52.88B

- 🇺🇸 Occidental Petroleum: $51.75B

- 🇷🇺 Lukoil: $51.69B

- 🇷🇺 Novatek: $50.72B

- 🇺🇸 Sempra Energy: $47.07B

- 🇺🇸 Energy Transfer Partners: $46.57B

- 🇺🇸 Valero Energy: $44.91B

- 🇺🇸 Hess: $44.76B

- 🇺🇸 Pacific Gas and Electric: $44.05B

- 🇷🇺 Gazprom: $43.73B

- 🇺🇸 Williams Companies: $42.21B

- 🇨🇦 Suncor Energy: $40.74B

- 🇨🇦 TC Energy: $40.43B

- 🇺🇸 Oneok: $39.75B

- 🇦🇺 Woodside Energy: $39.33B

- 🇺🇸 Kinder Morgan: $39.05B

- 🇺🇸 MPLX: $36.36B

- 🇺🇸 Baker Hughes: $34.52B

- 🇺🇸 Halliburton: $32.40B

- 🇨🇦 Cenovus Energy: $30.84B

- 🇨🇦 Imperial Oil: $30.32B

- 🇮🇳 Oil & Natural Gas: $30.12B

- 🇹🇭 PTT PCL: $29.23B

- 🇺🇸 Devon Energy: $28.98B

- 🇮🇩 Chandra Asri Petrochemical: $28.32B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news