Tuesday☕️

Trending:

- Houthi Missile Threats

- Cuban Fuel Prices

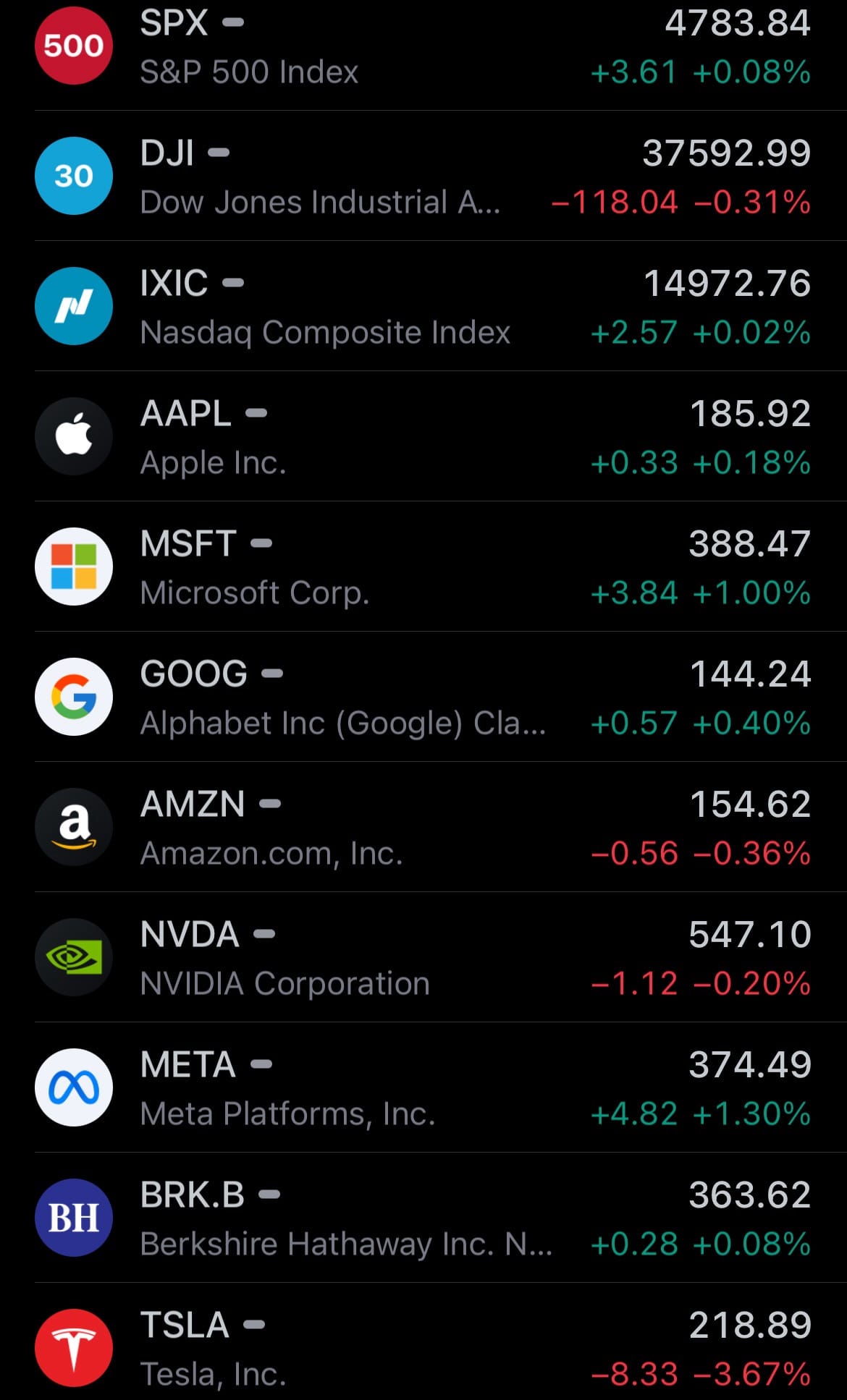

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Houthi Missile Threats:

- The U.S. Central Command (CENTCOM) reported recent hostile activities by Houthi militants in Yemen. Yesterday, around 4 PM Sanaa time, the Houthis fired an anti-ship ballistic missile, hitting the M/V Gibraltar Eagle, a Marshall Islands-flagged container ship operated by the U.S. The vessel reported no injuries or significant damage and continued its journey.

- Earlier the same day, at approximately 2 PM Sanaa time, U.S. Forces detected another Houthi missile launch aimed at the Southern Red Sea's commercial shipping lanes. This missile failed during flight and landed in Yemen, causing no reported injuries or damage. These incidents are part of a series of aggressive actions by the Houthis, who have been involved in over 28 separate incidents against ships in the Red Sea and Gulf of Aden since November 19, 2023.

- In response to these ongoing hostilities, U.S. forces have conducted multiple strikes on Houthi targets. On January 13th, at 3:45 AM Sana'a time, the USS Carney (DDG 64) launched a strike against a Houthi radar installation in Yemen using Tomahawk Land Attack Missiles. This operation aimed to diminish the Houthis' ability to conduct maritime attacks, including those targeting commercial ships.

- CENTCOM, responsible for U.S. military operations in the Middle East and Central Asia, often monitors and reports on regional security incidents, including maritime threats in strategic waterways. Their announcement highlights the ongoing tension and security challenges in the region, particularly concerning the safety of commercial shipping in the Red Sea and the Gulf of Aden.

Cuban Fuel Prices:

- Since the communist revolution led by Fidel Castro in 1959, Cuba has been known for providing heavily subsidized essential goods, including fuel, to its residents. This policy has resulted in Cuba having some of the world's cheapest oil prices, with gasoline historically priced at around $0.75 per gallon.

- However, Cuba is currently facing a severe economic crisis, exacerbated by factors such as the COVID-19 pandemic, global inflation, economic mismanagement, and U.S. sanctions. In 2023, the country's economy contracted by 2%, and it experienced an inflation rate of 30%. Despite the low fuel prices, many Cubans have found it challenging to afford gasoline, according to analysts.

- In response to the economic pressures, the Cuban government has decided to significantly raise fuel prices by over 500%. The new price for gasoline will be at a minimum $3.80 per gallon starting February 1st. This substantial increase marks a significant shift for Cuban residents, who have long been accustomed to some of the lowest fuel prices in the world.

Statistic:

Top 50 companies by market cap:

- 🇺🇸 Microsoft: $2.887T

- 🇺🇸 Apple: $2.874T

- 🇸🇦 Saudi Aramco: $2.120T

- 🇺🇸 Alphabet (Google): $1.794T

- 🇺🇸 Amazon: $1.597T

- 🇺🇸 NVIDIA: $1.354T

- 🇺🇸 Meta Platforms: $962.38B

- 🇺🇸 Berkshire Hathaway: $791.24B

- 🇺🇸 Tesla: $695.83B

- 🇺🇸 Eli Lilly: $610.32B

- 🇺🇸 Visa: $542.91B

- 🇹🇼 TSMC: $525.07B

- 🇺🇸 Broadcom: $518.55B

- 🇺🇸 JPMorgan Chase: $492.33B

- 🇺🇸 UnitedHealth: $482.35B

- 🇩🇰 Novo Nordisk: $478.17B

- 🇺🇸 Walmart: $434.31B

- 🇺🇸 Mastercard: $402.39B

- 🇺🇸 Exxon Mobil: $399.47B

- 🇺🇸 Johnson & Johnson: $390.91B

- 🇰🇷 Samsung: $367.38B

- 🇫🇷 LVMH: $367.22B

- 🇺🇸 Procter & Gamble: $354.94B

- 🇺🇸 Home Depot: $354.02B

- 🇨🇳 Tencent: $348.73B

- 🇺🇸 Costco: $303.17B

- 🇨🇭 Nestlé: $303.03B

- 🇺🇸 Merck: $300.61B

- 🇺🇸 Oracle: $293.03B

- 🇨🇳 Kweichow Moutai: $286.93B

- 🇺🇸 AbbVie: $286.72B

- 🇳🇱 ASML: $281.42B

- 🇺🇸 Chevron: $278.00B

- 🇺🇸 Adobe: $272.10B

- 🇯🇵 Toyota: $263.89B

- 🇺🇸 Salesforce: $263.22B

- 🇺🇸 Coca-Cola: $261.09B

- 🇺🇸 Bank of America: $259.12B

- 🇫🇷 L'Oréal: $248.33B

- 🇦🇪 International Holding Company: $243.68B

- 🇺🇸 AMD: $236.76B

- 🇨🇭 Roche: $236.46B

- 🇺🇸 Pepsico: $229.97B

- 🇮🇳 Reliance Industries: $226.48B

- 🇮🇪 Accenture: $223.41B

- 🇨🇳 ICBC: $221.08B

- 🇨🇭 Novartis: $220.85B

- 🇺🇸 Netflix: $215.40B

- 🇬🇧 AstraZeneca: $215.22B

- 50. 🇺🇸 McDonald's: $212.86B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news