Tuesday☕️

Trending:

- SpaceX Launches

- China Evergrande Group Liquidation

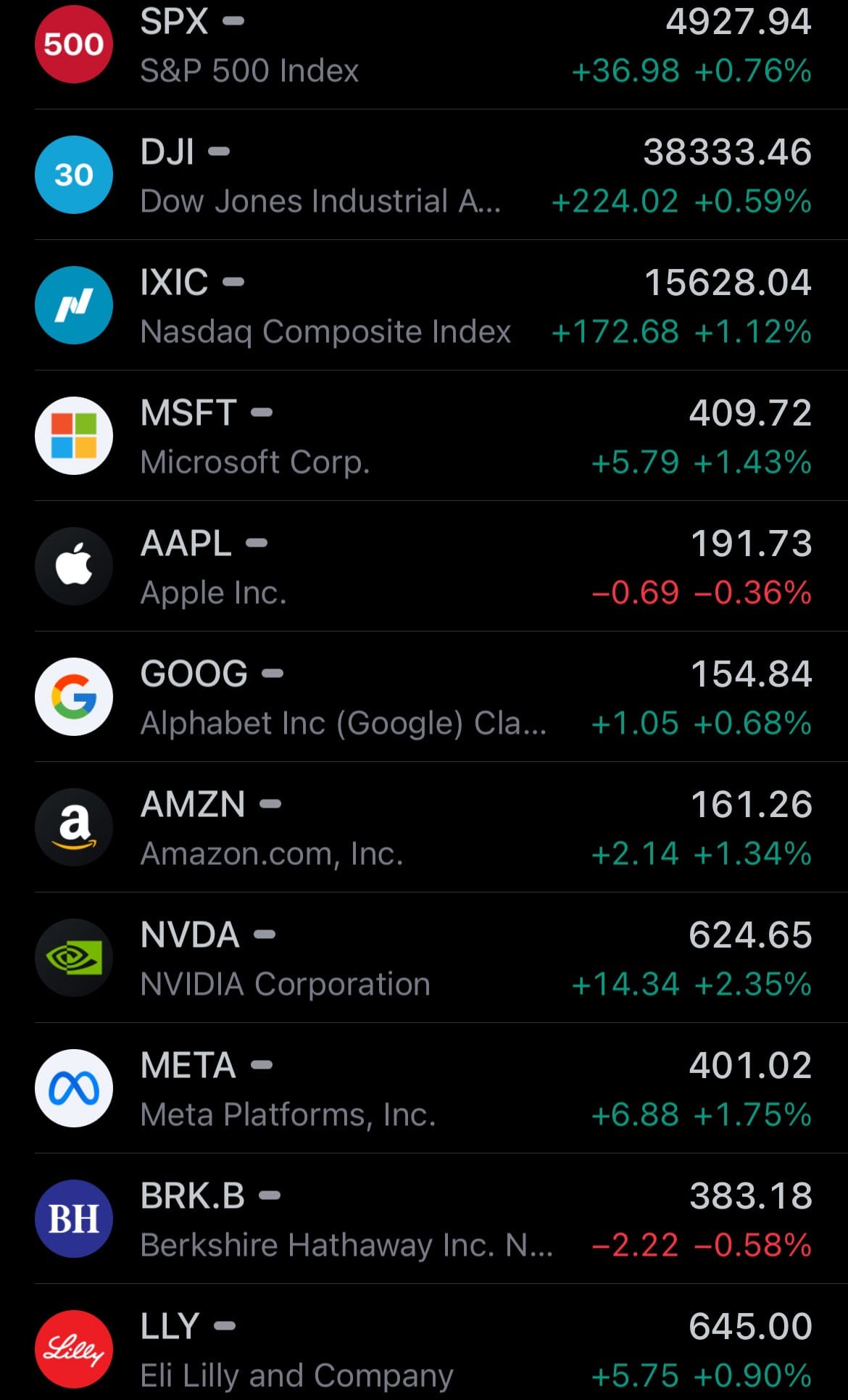

Markets:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

SpaceX Launches:

- SpaceX recently completed two Falcon 9 launches. The first, on January 28, involved a rocket with a notable history of 17 previous missions, lifting off from Cape Canaveral in Florida to deploy 23 Starlink satellites. The next day, January 29, a Falcon 9 rocket launched from Vandenberg Space Force Base in California, sending 22 Starlink satellites into orbit, marking its ninth mission. Both launches continued SpaceX's expansion of its Starlink satellite constellation.

- Additionally, SpaceX has planned another mission for today, targeting Northrop Grumman's 20th Commercial Resupply Services mission to the International Space Station. This launch, also from Cape Canaveral, would utilize a Falcon 9 booster with a diverse mission history, including Crew-5 and various satellite deployments. This mission emphasizes SpaceX's role in both commercial and governmental space endeavors.

- SpaceX, with over 5,400 satellites in orbit, operates the largest satellite constellation on the planet. Starlink, known for providing satellite-based internet connectivity, represents one aspect of this operation. Another crucial component is Starshield, focused on U.S. military communications, earth observation, and hosted payloads. Hosted payloads refers to the ability to carry additional equipment or technology, potentially including weaponry, on satellite missions.

- This extensive network grants significant global observation capabilities, allowing real-time monitoring of any location on Earth. Such surveillance power provides the U.S. military with unparalleled situational awareness, enabling efficient tracking and response to global developments, from potential invasions to monitoring foreign activities. This capability underscores the strategic importance of SpaceX's satellite constellation in global communications, security, and defense.

China Evergrande Group Liquidation:

- A Hong Kong court has mandated the liquidation of China Evergrande Group, a major real estate developer with significant debt. The decision came after the company's unsuccessful attempts to restructure its $300 billion debt. Judge Linda Chan, overseeing the case, pointed out Evergrande's failure to present a feasible restructuring plan and its insolvency as key reasons for the court's action.

- The collapse of China Evergrande is part of a broader trend affecting numerous Chinese property developers since 2020. These companies have been struggling due to the government's efforts to curb increasing debt levels, which are seen as a threat to the national economy. This crackdown, however, led to a crisis in the real estate sector, adversely affecting China's economic growth and causing concern in both local and global financial markets.

- Despite the turmoil, Chinese authorities believe that the potential global repercussions from Evergrande's downfall can be managed. Court documents reveal that Evergrande owes $25.4 billion to international creditors, a significant portion of its liabilities that far exceed its assets, estimated at around $240 billion. This situation underscores the challenges facing China's property sector and its impact on the wider economy.

Statistic:

Largest companies on earth by market cap (as of yesterday):

- 🇺🇸 Microsoft: $3.045T

- 🇺🇸 Apple: $2.964T

- 🇸🇦 Saudi Aramco: $2.036T

- 🇺🇸 Alphabet (Google): $1.913T

- 🇺🇸 Amazon: $1.666T

- 🇺🇸 NVIDIA: $1.542T

- 🇺🇸 Meta Platforms: $1.012T

- 🇺🇸 Berkshire Hathaway: $837.17B

- 🇺🇸 Eli Lilly: $612.30B

- 🇺🇸 Tesla: $608.07B

- 🇹🇼 TSMC: $606.70B

- 🇺🇸 Broadcom: $570.08B

- 🇺🇸 Visa: $562.11B

- 🇺🇸 JPMorgan Chase: $496.89B

- 🇩🇰 Novo Nordisk: $485.87B

- 🇺🇸 UnitedHealth: $466.66B

- 🇺🇸 Walmart: $444.32B

- 🇫🇷 LVMH: $420.25B

- 🇺🇸 Mastercard: $413.16B

- 🇺🇸 Exxon Mobil: $412.18B

- 🇺🇸 Johnson & Johnson: $383.96B

- 🇰🇷 Samsung: $370.04B

- 🇺🇸 Procter & Gamble: $367.44B

- 🇺🇸 Home Depot: $354.01B

- 🇳🇱 ASML: $348.27B

- 🇨🇳 Tencent: $341.15B

- 🇺🇸 Oracle: $316.12B

- 🇺🇸 Costco: $307.95B

- 🇨🇭 Nestlé: $307.83B

- 🇺🇸 Merck: $307.32B

- 🇺🇸 AbbVie: $289.38B

- 🇺🇸 AMD: $287.28B

- 🇺🇸 Adobe: $284.86B

- 🇨🇳 Kweichow Moutai: $282.62B

- 🇺🇸 Chevron: $281.42B

- 🇺🇸 Salesforce: $278.64B

- 🇯🇵 Toyota: $271.95B

- 🇺🇸 Bank of America: $265.36B

- 🇺🇸 Coca-Cola: $258.23B

- 🇫🇷 L'Oréal: $257.68B

- 🇺🇸 Netflix: $249.17B

- 🇦🇪 International Holding Company: $238.62B

- 🇨🇳 ICBC: $236.19B

- 🇮🇳 Reliance Industries: $235.77B

- 🇮🇪 Accenture: $234.08B

- 🇨🇭 Roche: $231.41B

- 🇺🇸 Pepsico: $231.18B

- 🇫🇷 Hermès: $223.21B

- 🇨🇭 Novartis: $221.88B

- 🇺🇸 McDonald: $215.57B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news