Tuesday☕️

Trending:

- Capital One To Acquire Discover

- Weaponizing AI Models

- Google Gemini 1.5

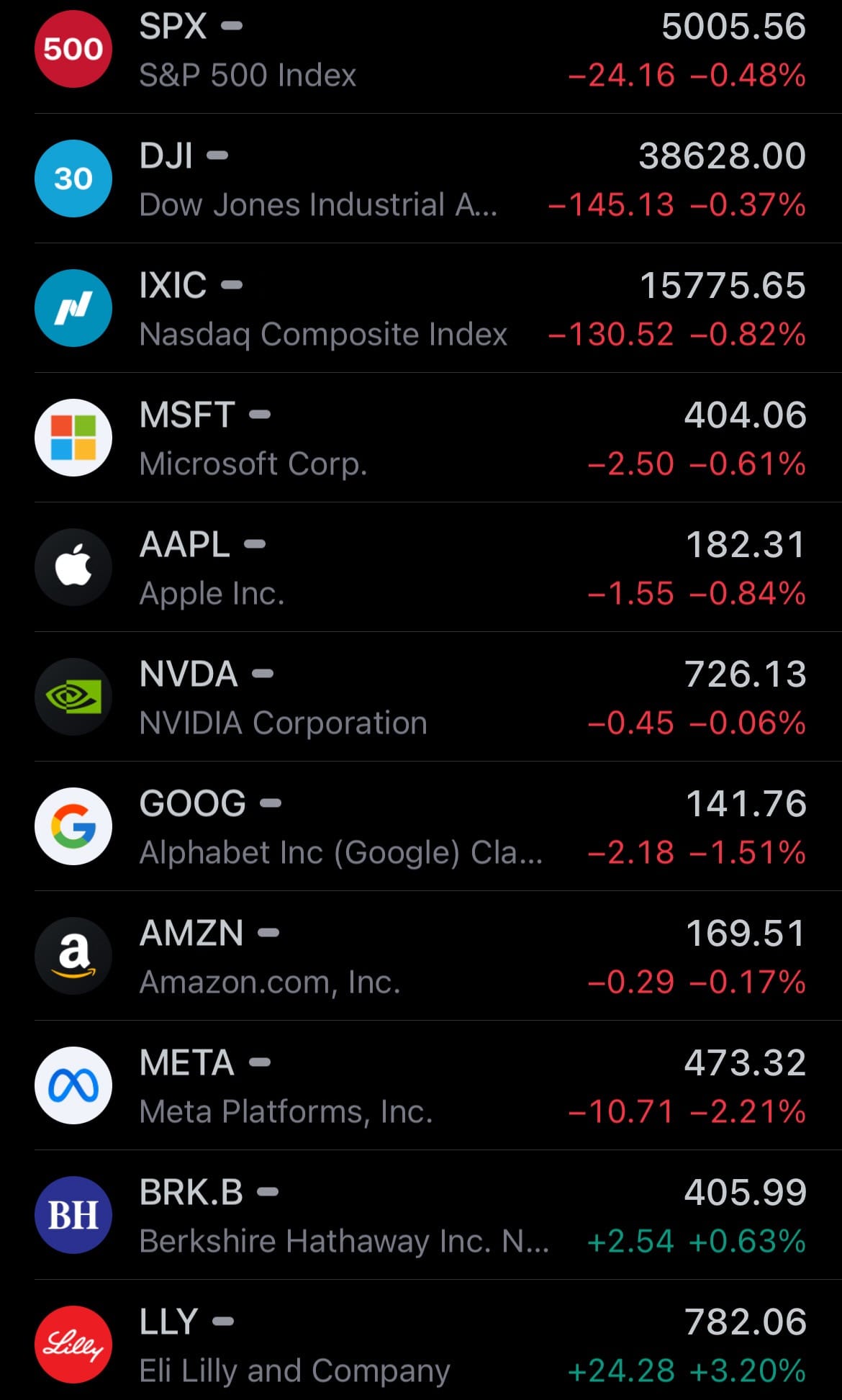

Market:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Capital One To Acquire Discover:

- Capital One plans to buy Discover Financial Services in a deal valued at $35.3 billion, aiming to create a formidable presence in the U.S. payments sector to rival major networks like Visa and Mastercard. Post-merger, Capital One and Discover shareholders will own 60% and 40% of the new entity, respectively.

- Capital One, with a market value of $52.2 billion and ranked fourth in U.S. credit card market volume, will merge with Discover, ranked sixth. This significant consolidation within the financial sector is expected to draw regulatory attention, especially under the Biden administration's push for increased competition across industries, including banking. The deal's finalization is anticipated between late 2024 and early 2025.

Weaponizing AI Models:

- Researchers at the University of Illinois Urbana-Champaign have shown how large language models (LLMs) could independently exploit website vulnerabilities. These LLMs, equipped with capabilities to interact with APIs and browse the web, can autonomously conduct cyber attacks like SQL injection without human intervention. The study revealed that even with existing safety mechanisms, these AI models could assist in creating malware and hacking into web applications.

- The team demonstrated that with the right tools, LLMs could navigate the web, identify, and exploit flaws in websites. This capability was proven through a series of tests in a controlled environment, ensuring no real harm was done. They utilized OpenAI's GPT-4 model among others, finding it exceptionally capable of performing such attacks successfully due to its advanced understanding and ability to adapt its approach based on feedback from the target system.

- This research underscores the dual-use nature of AI technologies, capable of both beneficial applications and potential misuse. It highlights the importance of incorporating robust safety and security measures in the development and deployment of AI systems to mitigate risks of malicious use. The findings also suggest the need for ongoing vigilance and development of countermeasures to protect against AI-powered cyber threats.

Google Gemini 1.5:

- Google and Alphabet have introduced Gemini 1.5, a significant upgrade to their AI model lineup. Under the leadership of CEOs Sundar Pichai and Demis Hassabis, Gemini 1.5 brings notable improvements in performance, especially in understanding complex and lengthy contexts. This advancement is a leap from the previous version, Gemini 1.0 Ultra, expanding the model's capabilities and efficiency.

- Gemini 1.5 showcases a breakthrough in processing extensive amounts of information, now capable of handling up to 1 million tokens. This enhancement opens new doors for developers and enterprise customers, offering them unprecedented access to AI that can digest and analyze large datasets with more depth and accuracy. The model's ability to maintain high-quality performance with reduced computational demands marks a step forward in AI efficiency and capabilities.

- The model not only excels in understanding long texts but also in multimodal tasks, including video, image, and audio analysis. This versatility makes Gemini 1.5 a powerful tool for a wide range of applications, from detailed content analysis to sophisticated problem-solving across various industries.

Statistic:

- Largest telecommunication companies by market capitalization:

- 🇺🇸 T-Mobile US: $190.38B

- 🇨🇳 China Mobile: $189.71B

- 🇺🇸 Verizon: $170.23B

- 🇺🇸 Comcast: $163.79B

- 🇺🇸 AT&T: $121.33B

- 🇩🇪 Deutsche Telekom: $119.39B

- 🇯🇵 NTT (Nippon Telegraph & Telephone): $102.78B

- 🇺🇸 American Tower: $87.23B

- 🇯🇵 SoftBank: $83.45B

- 🇮🇳 Bharti Airtel: $81.15B

- 🇨🇳 China Telecom: $72.72B

- 🇯🇵 KDDI: $64.01B

- 🇲🇽 America Movil: $56.80B

- 🇸🇦 Saudi Telecom Company: $55.65B

- 🇺🇸 Crown Castle: $46.93B

- 🇦🇪 Emirates Telecom (Etisalat Group): $45.13B

- 🇺🇸 Charter Communications: $42.55B

- 🇨🇦 BCE: $34.43B

- 🇫🇷 Orange: $30.83B

- 🇨🇭 Swisscom: $30.30B

- 🇹🇼 Chunghwa Telecom: $30.24B

- 🇦🇺 Telstra: $29.54B

- 🇸🇬 Singtel: $29.18B

- 🇮🇩 Telkom Indonesia: $26.36B

- 🇨🇦 Telus: $26.23B

- 🇪🇸 Cellnex Telecom: $25.21B

- 🇨🇦 Rogers Communication: $24.23B

- 🇬🇧 Vodafone: $22.93B

- 🇺🇸 SBA Communications: $22.31B

- 🇪🇸 Telefónica: $22.19B

- 🇭🇰 China Unicom: $21.59B

- 🇭🇰 CK Hutchison Holdings: $20.76B

- 🇨🇳 China Tower: $20.02B

- 🇺🇸 Sirius XM: $18.44B

- 🇧🇷 Telefonica Brasil: $17.96B

- 🇹🇭 Advanced Info Service (AIS): $17.27B

- 🇨🇳 ZTE: $15.25B

- 🇳🇴 Telenor: $15.20B

- 🇳🇱 KPN: $14.21B

- 🇬🇧 BT Group: $13.39B

- 🇸🇦 Etihad Etisalat (Mobily): $11.25B

- 🇮🇹 INWIT: $11.10B

- 🇲🇾 Celcomdigi: $10.63B

- 🇶🇦 Ooredoo Q.P.S.C.: $9.67B

- 🇿🇦 Vodacom: $9.49B

- 🇸🇪 Telia Company: $9.39B

- 🇮🇳 Vodafone Idea: $9.38B

- 🇹🇼 Far EasTone: $9.28B

- 🇦🇪 Ooredoo: $9.00B

- 🇭🇰 Hong Kong Telecom: $8.84B

- 🇹🇼 Taiwan Mobile: $8.81B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news