Tuesday☕️

Trending:

- Frontier Cyberattack

- U.S. China Tech Tensions

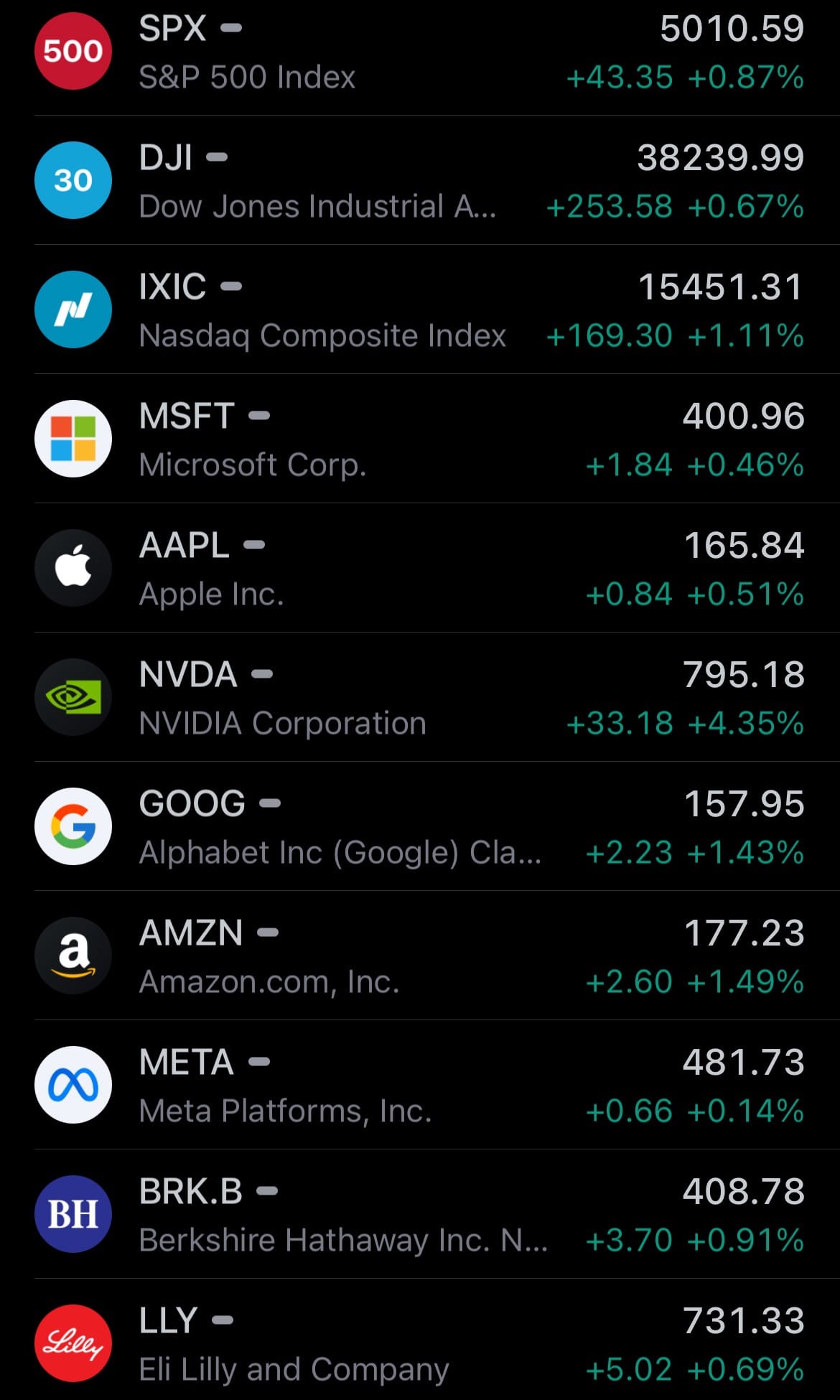

Markets:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Frontier Cyberattack:

- Frontier Communications, an American telecom provider, experienced a cyberattack that compromised its IT systems, as announced in a U.S. Securities and Exchange Commission filing on April 14, 2024. The breach led to the partial shutdown of some systems to prevent the cybercrime group, which had gained unauthorized access, from moving laterally across the network. This incident caused operational disruptions, but Frontier has reported that it has managed to contain the breach and is working towards restoring normal business operations.

- During the attack, the cybercriminals accessed personally identifiable information (PII), although it remains unclear whether this data pertained to Frontier's customers, employees, or both. The company has not disclosed the specific details of the PII accessed. In response, Frontier has engaged cybersecurity experts and notified law enforcement to help address the incident and prevent future breaches. They continue to investigate the scope and impact of the attack.

- Frontier's efforts to manage the aftermath of the cyberattack include restoring its core IT systems and reassurances to stakeholders that the incident is unlikely to materially impact its financial health. Despite these assurances, the company faces ongoing challenges with service disruptions, as indicated by warnings on its website and mobile apps, and customers have reported issues with internet connectivity and customer service. Frontier continues to work on fully resolving these issues and strengthening its cybersecurity measures to protect against future attacks.

U.S. China Tech Tensions:

- Apple has removed several messaging apps, including Meta's WhatsApp and Threads, as well as Signal and Telegram, from its App Store in China following orders from the Chinese government, which cited national security concerns. This action highlights ongoing tensions between the U.S. and China over technology use and governance. Concurrently, the U.S. Congress is advancing legislation that could force TikTok’s parent company, ByteDance, to divest from the app, a bill that President Biden has expressed readiness to sign into law.

- Amidst these geopolitical strains, Apple stated, "We are obligated to follow the laws in the countries where we operate, even when we disagree." The company is also seeking to reduce its dependence on Chinese manufacturing by expanding operations in other countries like India and Vietnam. Despite not being as popular in China as WeChat, the removed platforms provided some means for Chinese users to communicate with people outside their country.

Statistic:

- Largest financial service companies by market capitalization:

- 🇺🇸 Visa: $559.38B

- 🇺🇸 JPMorgan Chase: $544.00B

- 🇺🇸 Mastercard: $426.09B

- 🇺🇸 Bank of America: $296.81B

- 🇨🇳 ICBC: $249.37B

- 🇺🇸 Wells Fargo: $213.95B

- 🇨🇳 Agricultural Bank of China: $212.05B

- 🇨🇳 Bank of China: $171.90B

- 🇺🇸 American Express: $167.59B

- 🇨🇳 China Construction Bank: $160.04B

- 🇬🇧 HSBC: $157.16B

- 🇺🇸 Morgan Stanley: $149.79B

- 🇮🇳 HDFC Bank: $147.63B

- 🇨🇦 Royal Bank of Canada: $140.25B

- 🇺🇸 Charles Schwab: $135.66B

- 🇺🇸 Goldman Sachs: $135.44B

- 🇺🇸 S&P Global: $133.52B

- 🇦🇺 Commonwealth Bank: $121.79B

- 🇯🇵 Mitsubishi UFJ Financial: $118.00B

- 🇺🇸 Citigroup: $116.25B

- 🇨🇳 CM Bank: $113.87B

- 🇨🇦 Toronto Dominion Bank: $103.54B

- 🇮🇳 ICICI Bank: $91.68B

- 🇨🇭 UBS: $90.08B

- 🇺🇸 Fiserv: $87.60B

- 🇸🇦 Al Rajhi Bank: $85.45B

- 🇮🇳 State Bank of India: $82.04B

- 🇫🇷 BNP Paribas: $80.66B

- 🇺🇸 CME Group: $77.57B

- 🇪🇸 Santander: $76.86B

- 🇺🇸 Intercontinental Exchange: $75.49B

- 🇯🇵 Sumitomo Mitsui Financial Group: $74.30B

- 🇷🇺 Sberbank: $72.17B

- 🇸🇬 DBS Group: $71.14B

- 🇯🇵 SoftBank: $71.11B

- 🇮🇩 Bank Central Asia: $71.01B

- 🇺🇸 Moody's: $69.23B

- 🇨🇦 Bank of Montreal: $67.45B

- 🇦🇺 National Australia Bank: $67.21B

- 🇮🇹 Intesa Sanpaolo: $66.68B

- 🇺🇸 PayPal: $66.51B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria: $64.22B

- 🇺🇸 U.S. Bancorp: $64.03B

- 🇨🇳 Postal Savings Bank of China: $63.31B

- 🇺🇸 Apollo Global Management: $62.83B

- 🇺🇸 PNC Financial Services: $62.06B

- 🇨🇳 Bank of Communications: $61.02B

- 🇮🇹 UniCredit: $60.79B

- 🇬🇧 London Stock Exchange: $60.20B

- 🇧🇷 Itaú Unibanco: $59.79B

- 🇸🇦 The Saudi National Bank: $59.53B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news