Wednesday☕️

Trending:

- Yesterday, April 22, 2025, a terrorist attack in Pahalgam, Jammu and Kashmir, killed between 20 and 26 tourists in Baisaran meadow, a popular tourist destination. The attackers, identified by Indian authorities as originating from Pakistan, opened fire on families dining in the area. The group "Kashmir Resistance" claimed responsibility, citing opposition to non-locals gaining domicile rights in the region. The victims included one person from the UAE and one from Nepal, with other nationalities unconfirmed. This was one of the deadliest attacks on civilians in the region in recent years, occurring during U.S. Vice President JD Vance’s visit to India.

- Jammu and Kashmir, a disputed territory claimed by both India and Pakistan, has faced militant violence since 1989, with tensions escalating after India revoked the region’s special status in 2019. Indian leaders, including Chief Minister Omar Abdullah and Prime Minister Narendra Modi, condemned the attack.

Economics & Markets:

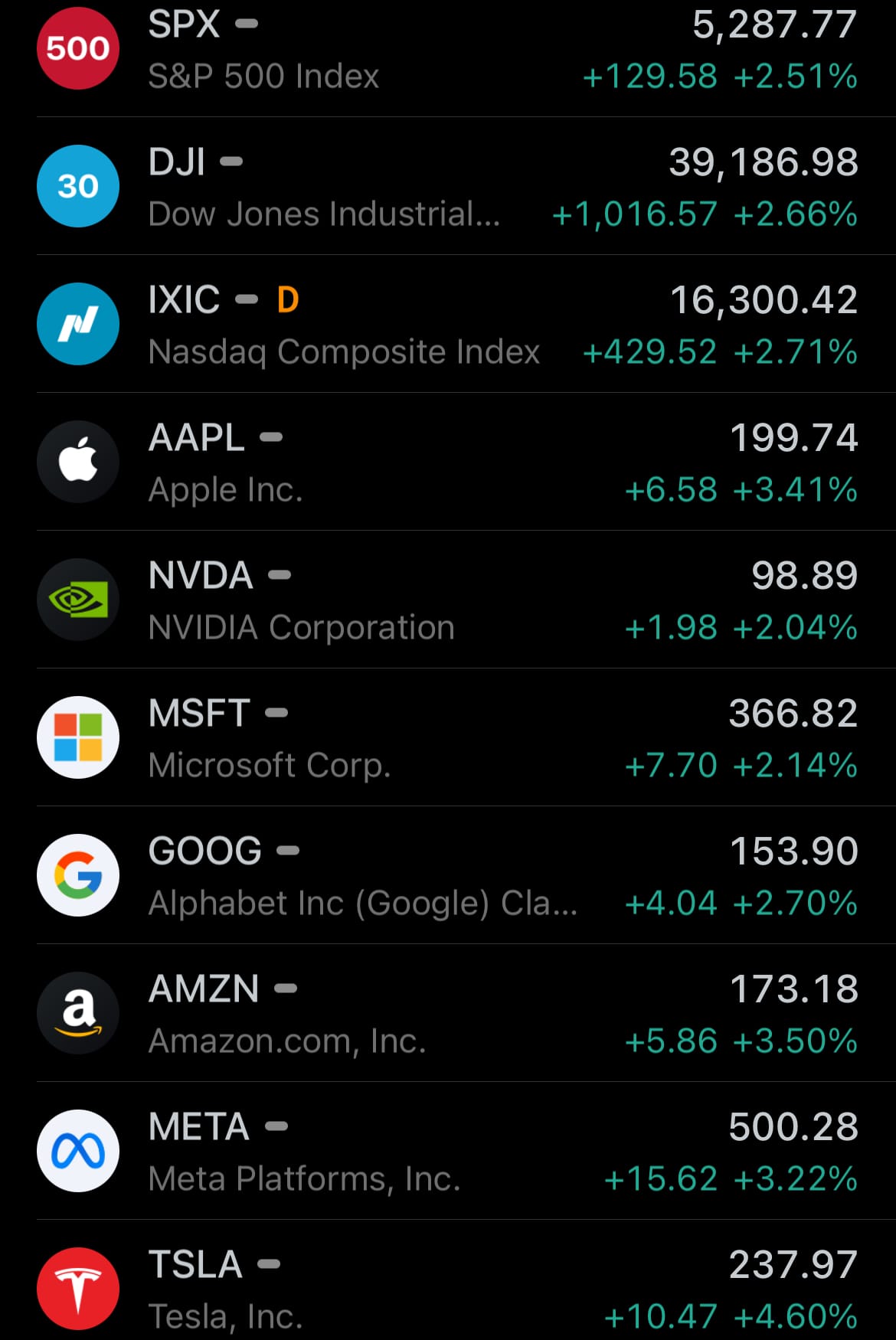

- Yesterday’s U.S. stock market:

- Today’s commodity market:

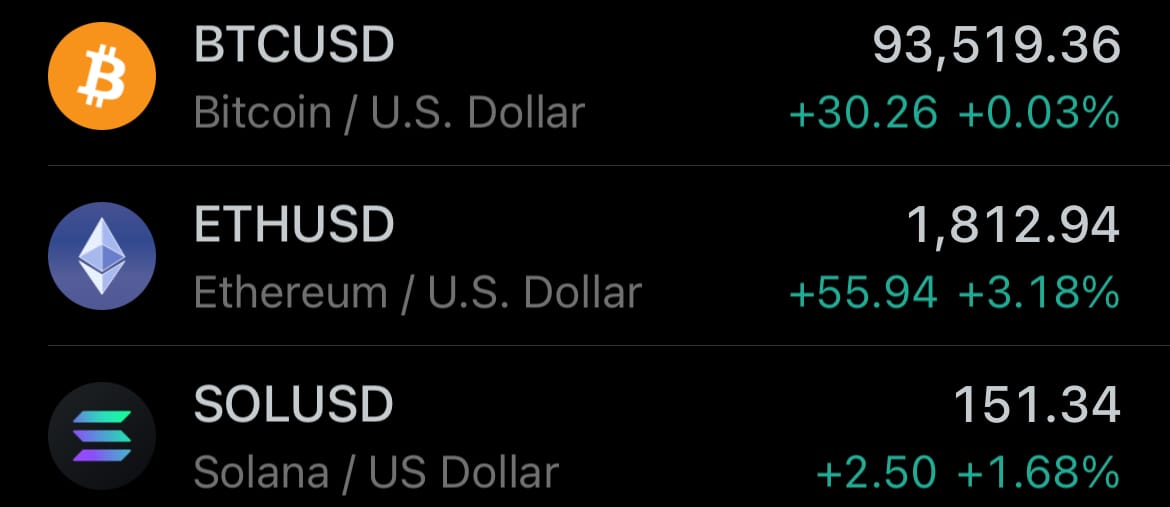

- Today’s crypto market:

Geopolitics & Military Activity:

- Yesterday, April 22, 2025, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on Iranian national Seyed Asadoollah Emamjomeh and his business network for illegally shipping hundreds of millions of dollars’ worth of Iranian liquified petroleum gas (LPG) and crude oil to international markets. These sanctions, part of the U.S. maximum pressure campaign against Iran under Executive Order 13902, target Iran’s illicit oil trade to disrupt funding for destabilizing activities.

- The sanctions block any U.S.-based assets of Emamjomeh and his network and bar U.S. persons from dealing with them, with penalties for violations. This action, aligned with National Security Presidential Memorandum 2, aims to cripple Iran’s oil revenue by isolating key players in its petroleum trade from global financial systems, limiting Iran’s ability to export oil.

Environment & Weather:

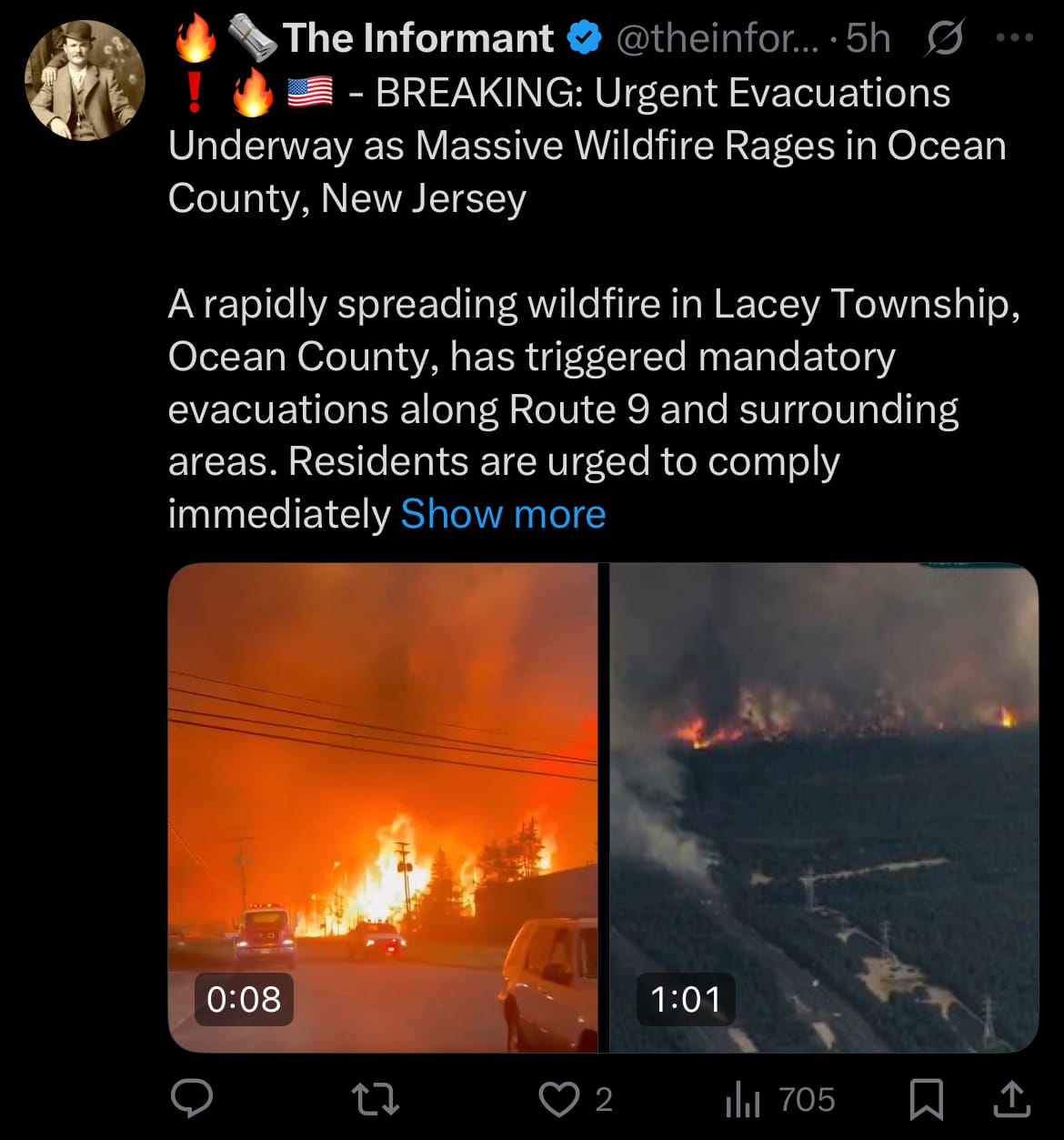

- Yesterday, April 22, 2025, the Jones Road Wildfire started at 12:22 p.m. in Lacey Township, Ocean County, New Jersey, within the Greenwood Forest Wildlife Management Area near Barnegat Township. By Tuesday night, it had burned 8,500 acres with 10% containment, prompting the evacuation of 3,000 residents and endangering 1,320 structures. Dry conditions and strong winds intensified the fire, leading to power outages for over 25,000 customers and road closures, including the Garden State Parkway between exits 63 and 80 and Route 9 from Lakeside Drive to Route 532.

- At least one structure was destroyed, and several businesses were damaged, but no injuries were reported. Firefighters, supported by aerial resources, are actively combating the blaze using backfiring operations and water drops. Evacuation shelters are available at Southern Regional High School (pet-friendly), Manchester Township High School, and the United Methodist Church in Waretown. The cause of the fire remains under investigation. Authorities are urging residents to avoid the area and comply with evacuation orders to facilitate firefighting efforts.

Statistic:

- Largest public electricity companies by market capitalization:

- 🇨🇳 CATL: $141.20B

- 🇺🇸 Nextera Energy: $137.18B

- 🇪🇸 Iberdrola: $112.46B

- 🇺🇸 Southern Company: $101.06B

- 🇨🇳 China Yangtze Power: $98.04B

- 🇦🇪 TAQA: $97.04B

- 🇺🇸 Duke Energy: $95.20B

- 🇺🇸 GE Vernova: $89.12B

- 🇮🇹 Enel: $86.66B

- 🇬🇧 National Grid: $72.82B

- 🇸🇦 ACWA POWER Company: $63.37B

- 🇳🇴 Equinor: $63.22B

- 🇺🇸 Constellation Energy: $62.93B

- 🇩🇪 Siemens Energy: $58.47B

- 🇺🇸 American Electric Power: $57.75B

- 🇰🇷 LG Energy Solution: $57.27B

- 🇫🇷 ENGIE: $52.27B

- 🇺🇸 Exelon Corporation: $47.82B

- 🇺🇸 Sempra Energy: $47.13B

- 🇩🇪 E.ON: $46.16B

- 🇺🇸 Dominion Energy: $45.50B

- 🇺🇸 PSEG: $41.56B

- 🇮🇳 NTPC Limited: $41.28B

- 🇺🇸 Xcel Energy: $41.12B

- 🇺🇸 Consolidated Edison: $40.81B

History:

- The history of the oil trade began in the mid-19th century with the discovery of commercially viable oil deposits, notably in Pennsylvania, USA, in 1859, when Edwin Drake drilled the first successful oil well. Initially, oil was refined into kerosene for lighting, driving local trade in the U.S. and Europe. By the late 1800s, companies like John D. Rockefeller’s Standard Oil dominated the market, establishing monopolistic control over production, refining, and distribution. The discovery of vast oil fields in the Middle East, starting with Iran in 1908 and later in Saudi Arabia and Iraq, shifted global attention to the region, laying the groundwork for an international oil trade. The early 20th century saw oil’s strategic importance grow with the rise of automobiles and industrial machinery, fueled by gasoline and diesel, while colonial powers and Western companies like Anglo-Persian Oil (later BP) and Royal Dutch Shell controlled much of the supply chain, often at the expense of resource-rich nations.

- Post-World War II, the oil trade became a cornerstone of global geopolitics. The formation of OPEC (Organization of the Petroleum Exporting Countries) in 1960 by nations like Saudi Arabia, Iran, and Venezuela aimed to counter Western dominance and stabilize prices, leading to greater control over production and pricing by oil-producing countries. The 1973 oil crisis, triggered by an OPEC embargo, highlighted oil’s role as a political weapon, causing price spikes and economic turmoil in importing nations. Since then, the trade has evolved with technological advances in extraction (e.g., fracking), the rise of non-OPEC producers like the U.S. and Russia, and growing environmental concerns pushing for renewable energy. Today, the oil trade remains critical, with major exporters like Saudi Arabia and Russia supplying global markets, though it faces challenges from geopolitical policies and fluctuating demand.

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

Click image to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news