Wednesday☕️

Economics & Markets:

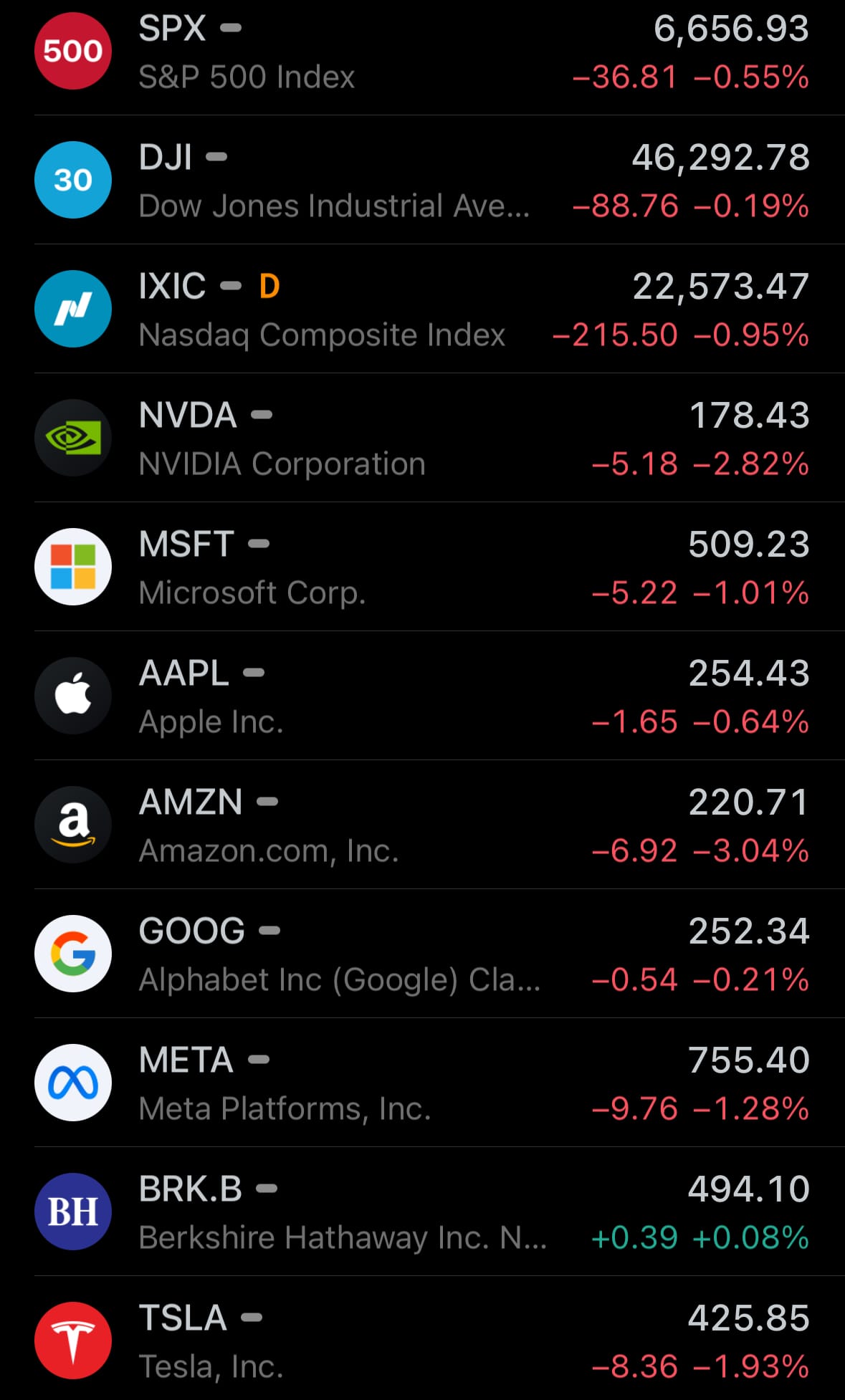

- Yesterday’s U.S. stock market:

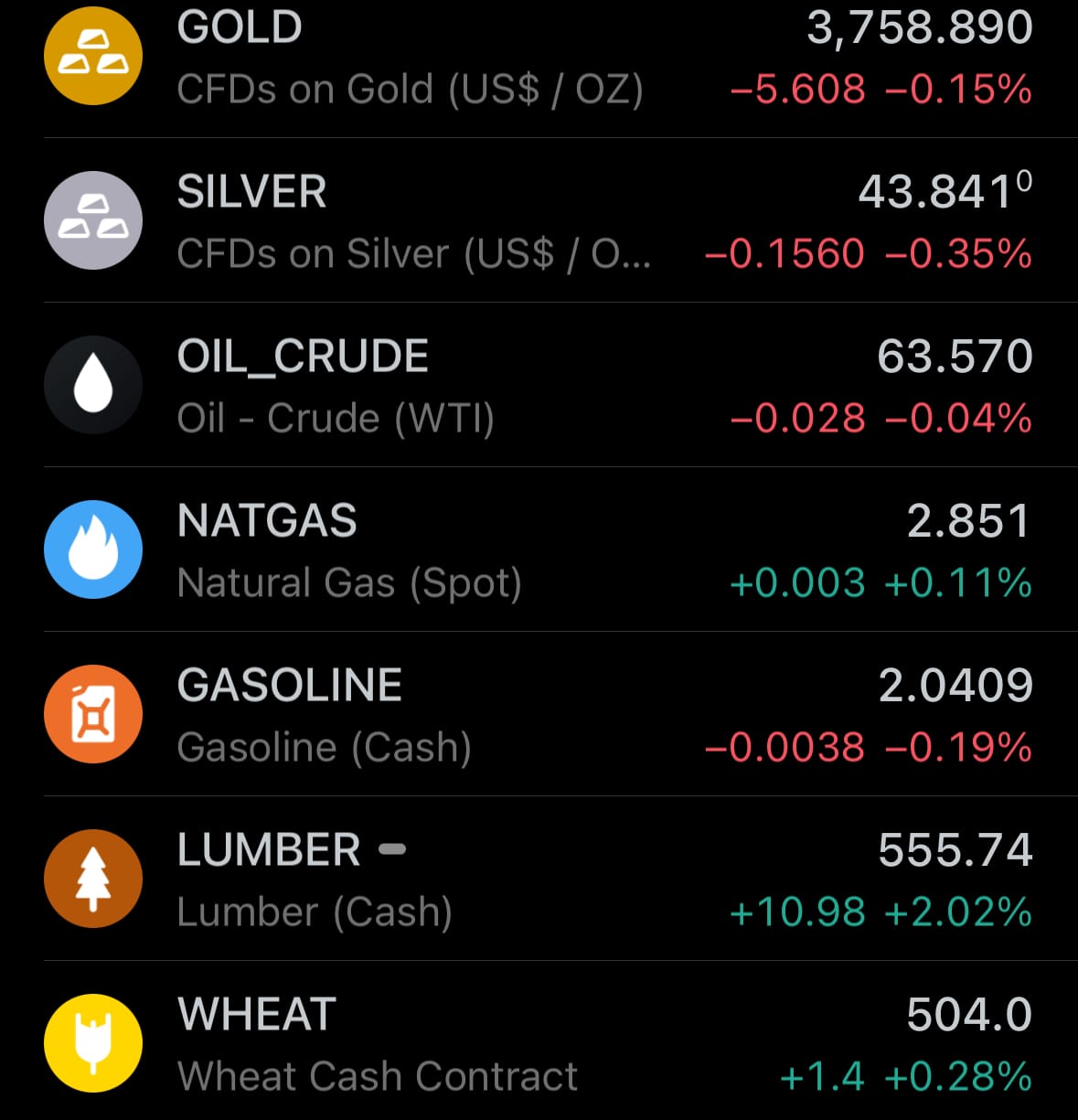

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Geopolitics & Military Activity:

- On September 23, 2025, France initiated nuclear strike exercises under the name Operation Poker, involving at least five Airbus A330 Multi-Role Tanker Transports, one E-3F Sentry Airborne Early Warning and Control aircraft, and several Dassault Rafale B jets from the Strategic Air Forces. These periodic drills, conducted at varying intensities throughout the year, consist of three phases: preparation, long-range raid, and simulated nuclear attack, aimed at testing the readiness and capabilities of France's air-based nuclear deterrent without actual weapon deployment. The exercises simulate strategic air raids over French territory, including refueling operations and simulated engagements, to maintain operational proficiency amid global security concerns.

- This iteration of Operation Poker coincides with notable U.S. military movements, including the rare deployment of a U.S. Navy E-6B Mercury airborne nuclear command post to Ramstein Air Base in Germany on September 21, and a flight of U.S. Air Force B-2A Spirit stealth bombers refueling over Nova Scotia while crossing the Atlantic toward Europe on September 24. While typically a unilateral French activity, the timing has prompted speculation about potential links to broader NATO readiness or snap exercises, though no official connections have been confirmed.

Environment & Weather:

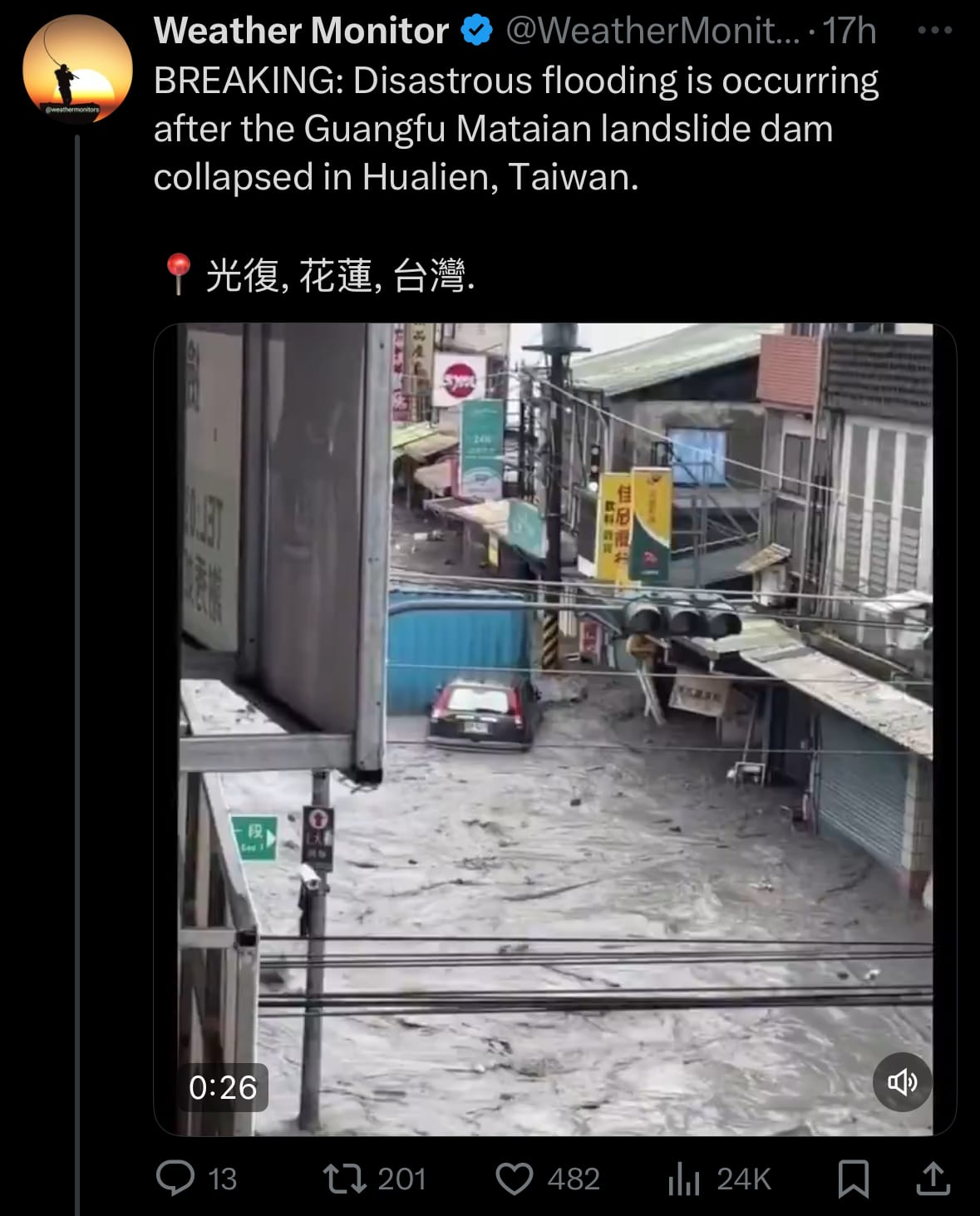

- On September 23, 2025, severe flooding struck Guangfu Township in Hualien County, eastern Taiwan, following the collapse of a landslide dam on the Matai'an Creek, which had formed a barrier lake upstream due to heavy rainfall. The breach released a massive surge of water, destroying the Mataian Bridge, inundating Guangfu Railway Station, sweeping away vehicles, and submerging homes and farmland in muddy torrents described as tsunami-like. Initial reports confirmed at least two deaths and 30 people missing in the immediate area, with rescue operations deploying military and emergency teams to evacuate over 3,000 residents and search for survivors amid ongoing risks of further landslides and debris flows.

- This event is part of the broader aftermath of Super Typhoon Ragasa, which brought record-breaking rains to Taiwan's eastern regions, exacerbating vulnerabilities in mountainous areas prone to landslides. The typhoon's impact has raised the overall death toll across the island to 14, with more than 124 people still missing and around 10,000 evacuated, disrupting flights and infrastructure.

Cyber:

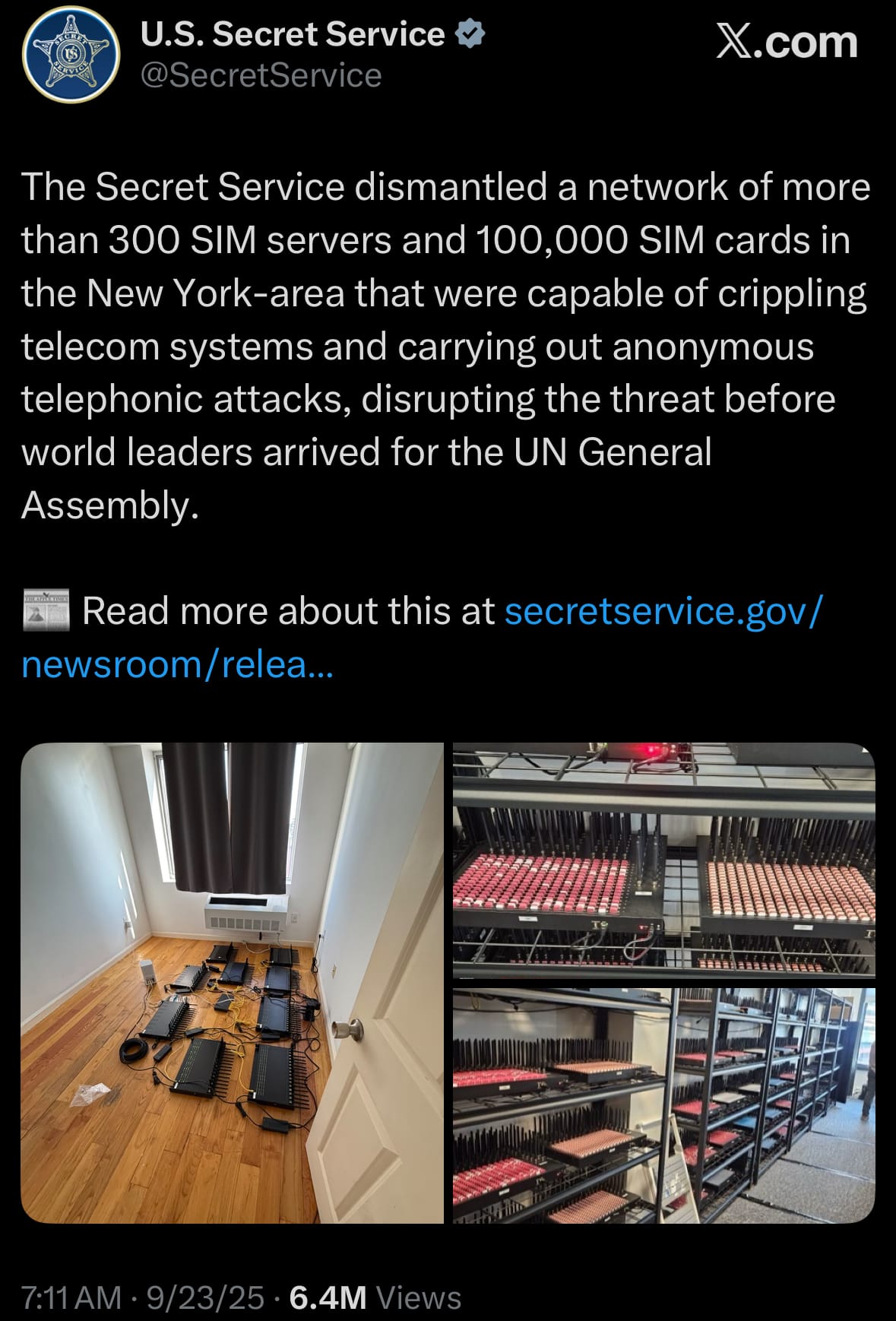

- On September 23, 2025, the U.S. Secret Service reported the discovery and shutdown of an extensive illegal telecommunications network in the New York City region, timed closely with the United Nations General Assembly. The network included more than 300 SIM servers and about 100,000 SIM cards distributed across sites within 35 miles of the UN headquarters, identified through enhanced security protocols. Although no confirmed intent to interfere with the assembly was found, the operation stemmed from a spring investigation into telecom-related threats against high-level U.S. officials. The seized devices were reportedly used to transmit encrypted messages involving individuals from specific countries connected to organized crime, cartels, and terrorist entities. Ongoing forensic examination aims to map communications and origins, and authorities have indicated no active threat to New York City or the public.

- SIM servers, commonly referred to as SIM farms or boxes, are hardware setups that can handle and control numerous SIM cards at once for large-scale automated tasks like messaging or call forwarding; here, the system could generate up to 30 million text messages per minute, which might overload cellular networks, cause tower disruptions via high-volume traffic, or block emergency lines such as 911 by mimicking denial-of-service effects, akin to post-9/11 communication failures. Such capabilities could be exploited to temporarily shut down local or regional networks, leading to widespread chaos and confusion by preventing people from communicating with authorities, emergency services, or each other via phones, potentially exacerbating panic during events or crises, though the network could also serve other purposes like facilitating bulk spam, anonymous routing for illicit activities, or evading surveillance. The network's complexity, size, and operational costs—requiring substantial investment in equipment, SIM procurement, and hidden locations—suggest resource-rich entities, potentially including sophisticated criminal networks or state-backed groups from opposing nations aiming to facilitate hidden activities or disruptions, though no firm identification has been released as the investigation proceeds.

Statistic:

- Largest public companies by market capitalization:

- 🇺🇸 NVIDIA: $4.470T

- 🇺🇸 Microsoft: $3.823T

- 🇺🇸 Apple: $3.775T

- 🇺🇸 Alphabet (Google): $3.049T

- 🇺🇸 Amazon: $2.353T

- 🇺🇸 Meta Platforms: $1.897T

- 🇸🇦 Saudi Aramco: $1.608T

- 🇺🇸 Broadcom: $1.600T

- 🇹🇼 TSMC: $1.466T

- 🇺🇸 Tesla: $1.416T

- 🇺🇸 Berkshire Hathaway: $1.066T

- 🇺🇸 Oracle: $932.50B

- 🇺🇸 JPMorgan Chase: $859.95B

- 🇺🇸 Walmart: $817.37B

- 🇨🇳 Tencent: $739.50B

- 🇺🇸 Eli Lilly: $676.78B

- 🇺🇸 Visa: $657.39B

- 🇺🇸 Netflix: $517.75B

- 🇺🇸 Mastercard: $515.25B

- 🇺🇸 Exxon Mobil: $485.79B

- 🇺🇸 Palantir: $433.07B

- 🇺🇸 Johnson & Johnson: $425.26B

- 🇺🇸 Costco: $418.46B

- 🇺🇸 Home Depot: $409.01B

- 🇰🇷 Samsung: $393.53B

History:

- The origins of trading algorithms date back to the 1970s and 1980s, when the NYSE’s DOT system (1976) and early program trading began automating order routing and basket trades. The infamous 1987 Black Monday crash revealed how portfolio insurance strategies could amplify market volatility, prompting new safeguards like circuit breakers. In the late 1980s and 1990s, quantitative funds rose to prominence: Jim Simons’ Renaissance Technologies and D.E. Shaw pioneered data-driven arbitrage, while Electronic Communication Networks (ECNs) such as Instinet and Island democratized access to electronic markets. Decimalization in 2001 further reshaped trading by narrowing spreads, encouraging high-frequency trading (HFT) strategies that exploited millisecond-scale opportunities, dominated by firms like Citadel Securities, Jane Street, and Virtu Financial.

- The 2000s and 2010s saw HFT reach its peak, with algorithms executing thousands of trades per second and accounting for a majority of U.S. equity volume. However, flash events like the 2010 Flash Crash, where markets plunged and rebounded within minutes, exposed the fragility of ultra-fast automated systems. Since then, the field has evolved toward intelligence over pure speed: hedge funds and banks began deploying machine learning, deep learning, and reinforcement learning models capable of pattern recognition, adaptive strategies, and multi-asset predictions. Today, AI-powered trading agents from firms like Two Sigma, Citadel, and JPMorgan integrate vast datasets—ranging from news sentiment to alternative data—into predictive frameworks, marking a shift from automation as efficiency to automation as intelligence.

Image of the day:

Thanks for reading!

Earth is complicated, we make it simple.

Monitor the planet with the Earth Intelligence System. Click the image below to view the Earth Intelligence System:

Support/Suggestions Email:

earthintelligence@earthintel.news