Wednesday☕️

Trending:

- OpenAI Valuation

- U.S. Migrant Work Eligibility

Markets:

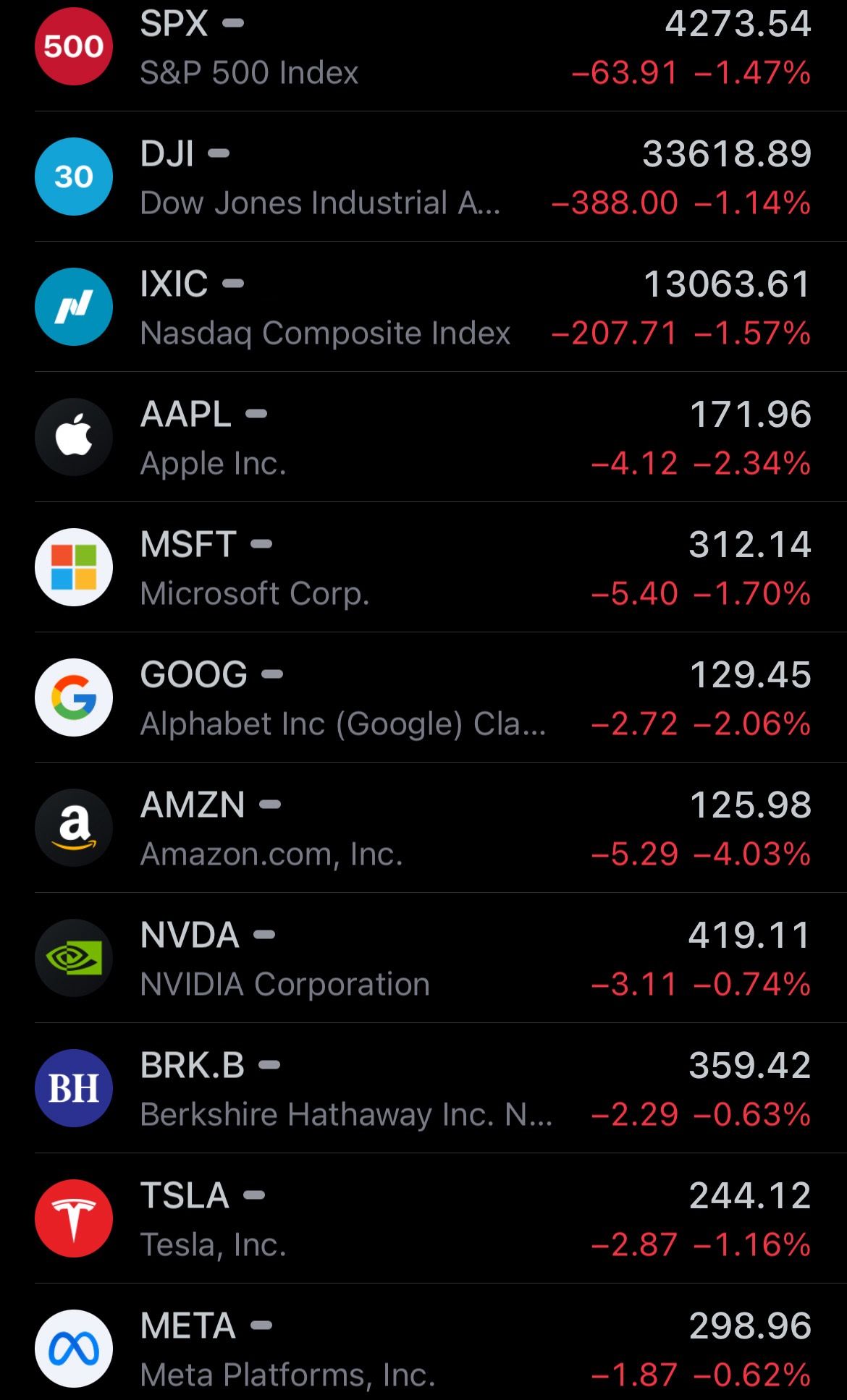

- Yesterday's U.S. stock market:

- Yesterday's commodity market:

- Yesterday's crypto market:

OpenAI Valuation:

- OpenAI, the AI firm behind ChatGPT, is in talks with investors about selling shares that could peg its value between $80 to $90 billion. This is a significant increase from its valuation in April at $29 billion. Currently, Microsoft holds a 49% stake in the startup, which anticipates hitting $1 billion in revenue for this year, with expectations for even more next year.

- OpenAI generates its income by charging a $20 monthly fee for access to GPT-4, its latest model, and through API access. Rather than issuing new shares, this deal is intended to provide an avenue for staff to sell their current shares. OpenAI's team is currently in discussions with investors regarding this transaction, but terms might still be subject to changes.

- If OpenAI secures a valuation over $80 billion, it will rank amongst the top global private startups, just behind notable names like SpaceX and ByteDance, the company behind TikTok. OpenAI has attracted funding from notable VC players such as Sequoia Capital, Andreessen Horowitz, Thrive, and K2 Global, separate from the earlier Microsoft investment in January.

U.S. Migrant Work Eligibility:

- The Biden administration has introduced a policy to grant over 472,000 Venezuelan migrants in the U.S. the legal right to work. These individuals, who came to the U.S. between March 2021 and July 2023, have yet to have their asylum requests finalized, leaving their legal status in the country in limbo and preventing most from working.

- The policy grants the right to work in the country for a duration of up to 18 months. This provision specifically targets those who have entered the country before the cutoff date of July 31, 2023.

- The main benefit of this policy is that it offers protection against deportation for the specified period. However, despite this temporary protection and work authorization, the policy does not provide a pathway or mechanism for these individuals to transition into permanent resident status.

Statistic:

- Top 50 companies by market cap:

- 🇺🇸 Apple: $2.688T

- 🇺🇸 Microsoft: $2.319T

- 🇸🇦 Saudi Aramco: $2.210T

- 🇺🇸 Alphabet (Google): $1.625T

- 🇺🇸 Amazon: $1.299T

- 🇺🇸 NVIDIA: $1.035T

- 🇺🇸 Berkshire Hathaway: $783.63B

- 🇺🇸 Tesla: $774.83B

- 🇺🇸 Meta Platforms: $769.27B

- 🇺🇸 Eli Lilly: $522.12B

- 🇺🇸 Visa: $477.62B

- 🇺🇸 UnitedHealth: $468.20B

- 🇺🇸 Exxon Mobil: $464.06B

- 🇺🇸 Walmart: $437.37B

- 🇹🇼 TSMC: $437.16B

- 🇺🇸 JPMorgan Chase: $421.17B

- 🇩🇰 Novo Nordisk: $410.55B

- 🇫🇷 LVMH: $404.41B

- 🇺🇸 Johnson & Johnson: $382.92B

- 🇺🇸 Mastercard: $372.53B

- 🇨🇳 Tencent: $364.34B

- 🇺🇸 Procter & Gamble: $351.93B

- 🇰🇷 Samsung: $336.87B

- 🇺🇸 Broadcom: $336.87B

- 🇺🇸 Chevron: $320.09B

- 🇨🇳 Kweichow Moutai: $312.12B

- 🇨🇭 Nestlé: $308.42B

- 🇺🇸 Home Depot: $302.56B

- 🇺🇸 Oracle: $287.35B

- 🇺🇸 AbbVie: $271.65B

- 🇺🇸 Merck: $267.42B

- 🇯🇵 Toyota: $245.62B

- 🇺🇸 Costco: $245.04B

- 🇺🇸 Coca-Cola: $244.45B

- 🇦🇪 International Holding Company: $240.08B

- 🇺🇸 Pepsico: $237.48B

- 🇺🇸 Adobe: $230.77B

- 🇫🇷 L'Oréal: $227.69B

- 🇳🇱 ASML: $227.51B

- 🇨🇭 Roche: $219.88B

- 🇨🇳 Alibaba: $218.79B

- 🇺🇸 Bank of America: $215.90B

- 🇬🇧 AstraZeneca: $214.08B

- 🇺🇸 Cisco: $213.73B

- 🇨🇳 ICBC: $213.43B

- 🇬🇧 Shell: $212.48B

- 🇨🇭 Novartis: $210.06B

- 🇫🇷 Hermès: $206.21B

- 🇺🇸 Salesforce: $197.02B

- 🇮🇪 Accenture: $196.08B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Email:

timeismoney@timeismon.com