Wednesday☕️

Trending:

- U.S. Inflation

- Oracle Earnings

- The Tucker Carlson Network

Markets & Inflation:

- The Consumer Price Index (CPI) for November 2023 showed headline inflation at 3.1%, aligning with forecasts and marking a slight decline from the previous month's 3.2%.

- The core CPI, which excludes food and energy, increased by 0.3% over the month and recorded an annual rate of 4%. The federal funds rate, the benchmark interest rate set by the Fed, is currently in the range of 5.25% to 5.5%.

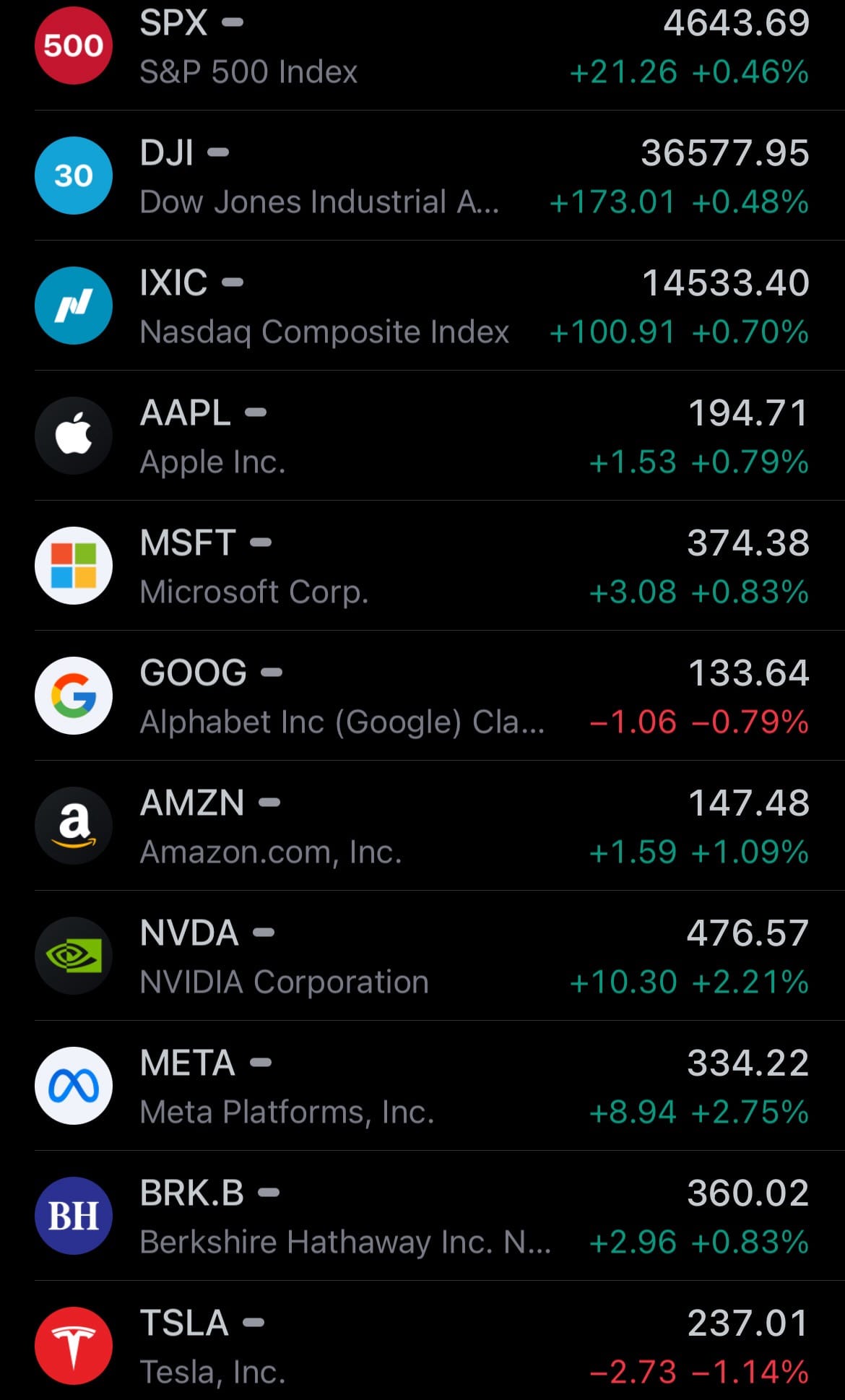

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Oracle Earnings:

- On Monday, Oracle reported a revenue of $12.9 billion, showing a 5% increase but falling short of the expected $13.1 billion. This shortfall, particularly in the cloud business's growth, caused a 12% drop (yesterday) in its stock price. Despite this, Oracle has shown resilience through its expansion in cloud services and competitive positioning in a market dominated by tech giants.

- Additionally, Oracle's integration of Cerner, a company specializing in electronic health records acquired for $28 billion, has faced challenges. The acquisition aimed to enhance Oracle's healthcare data management services. Oracle Corporation specializes in database software, cloud solutions, and enterprise software products. Their offerings range from managing business data, cloud computing services, customer relationship management (CRM) systems, to supply chain management applications.

Tucker Carlson Network:

- Tucker Carlson has launched a new streaming service, The Tucker Carlson Network, available from Monday at $9 per month. This move follows his departure from Fox News five months ago, where he was averaging 3 million viewers per episode. Since then, shifting his show to X as 'Tucker on X,' he has seen a significant increase in audience, reaching hundreds of millions of views.

- In a statement about the network, Carlson emphasized its commitment to honesty, contrasting it with mainstream media and government sources. With this venture, Carlson aims to create a space for straightforward reporting and discussion, seeking to appeal to viewers seeking an alternative to traditional news outlets.

Statistics:

Largest oil and gas companies by market capitalization:

- 🇸🇦 Saudi Aramco: $2.126T

- 🇺🇸 Exxon Mobil: $391.88B

- 🇺🇸 Chevron: $269.00B

- 🇬🇧 Shell: $208.64B

- 🇨🇳 PetroChina: $166.25B

- 🇫🇷 TotalEnergies: $157.38B

- 🇺🇸 ConocoPhillips: $131.87B

- 🇬🇧 BP: $99.19B

- 🇦🇪 TAQA: $98.90B

- 🇧🇷 Petrobras: $94.03B

- 🇳🇴 Equinor: $88.95B

- 🇨🇳 Sinopec: $82.71B

- 🇨🇳 CNOOC: $76.86B

- 🇺🇸 Southern Company: $76.85B

- 🇨🇦 Enbridge: $73.78B

- 🇺🇸 Duke Energy: $73.47B

- 🇺🇸 Schlumberger: $70.05B

- 🇺🇸 EOG Resources: $68.61B

- 🇨🇦 Canadian Natural Resources: $66.82B

- 🇦🇪 ADNOC Gas: $65.21B

- 🇷🇺 Rosneft: $64.65B

- 🇺🇸 Enterprise Products: $56.49B

- 🇺🇸 Phillips 66: $55.09B

- 🇺🇸 Marathon Petroleum: $54.43B

- 🇷🇺 Lukoil: $53.95B

- 🇮🇹 ENI: $52.16B

- 🇺🇸 Pioneer Natural Resources: $51.39B

- 🇷🇺 Novatek: $50.43B

- 🇺🇸 Occidental Petroleum: $48.90B

- 🇺🇸 Sempra Energy: $46.47B

- 🇺🇸 Pacific Gas and Electric: $45.09B

- 🇺🇸 Energy Transfer Partners: $44.55B

- 🇷🇺 Gazprom: $42.69B

- 🇺🇸 Williams Companies: $41.85B

- 🇺🇸 Hess: $41.40B

- 🇺🇸 Valero Energy: $41.16B

- 🇨🇦 TC Energy: $39.56B

- 🇺🇸 Oneok: $38.48B

- 🇨🇦 Suncor Energy: $38.36B

- 🇺🇸 Kinder Morgan: $38.27B

- 🇦🇺 Woodside Energy: $37.81B

- 🇺🇸 MPLX: $35.80B

- 🇺🇸 Baker Hughes: $32.72B

- 🇺🇸 Halliburton: $30.82B

- 🇨🇦 Imperial Oil: $29.71B

- 🇨🇦 Cenovus Energy: $29.65B

- 🇮🇳 Oil & Natural Gas: $29.19B

- 🇫🇮 Neste: $28.75B

- 🇹🇭 PTT PCL: $28.38B

- 🇺🇸 Devon Energy: $27.76B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news