Wednesday☕️

Trending:

- Red Sea Disputes

- Streaming Losses

Markets:

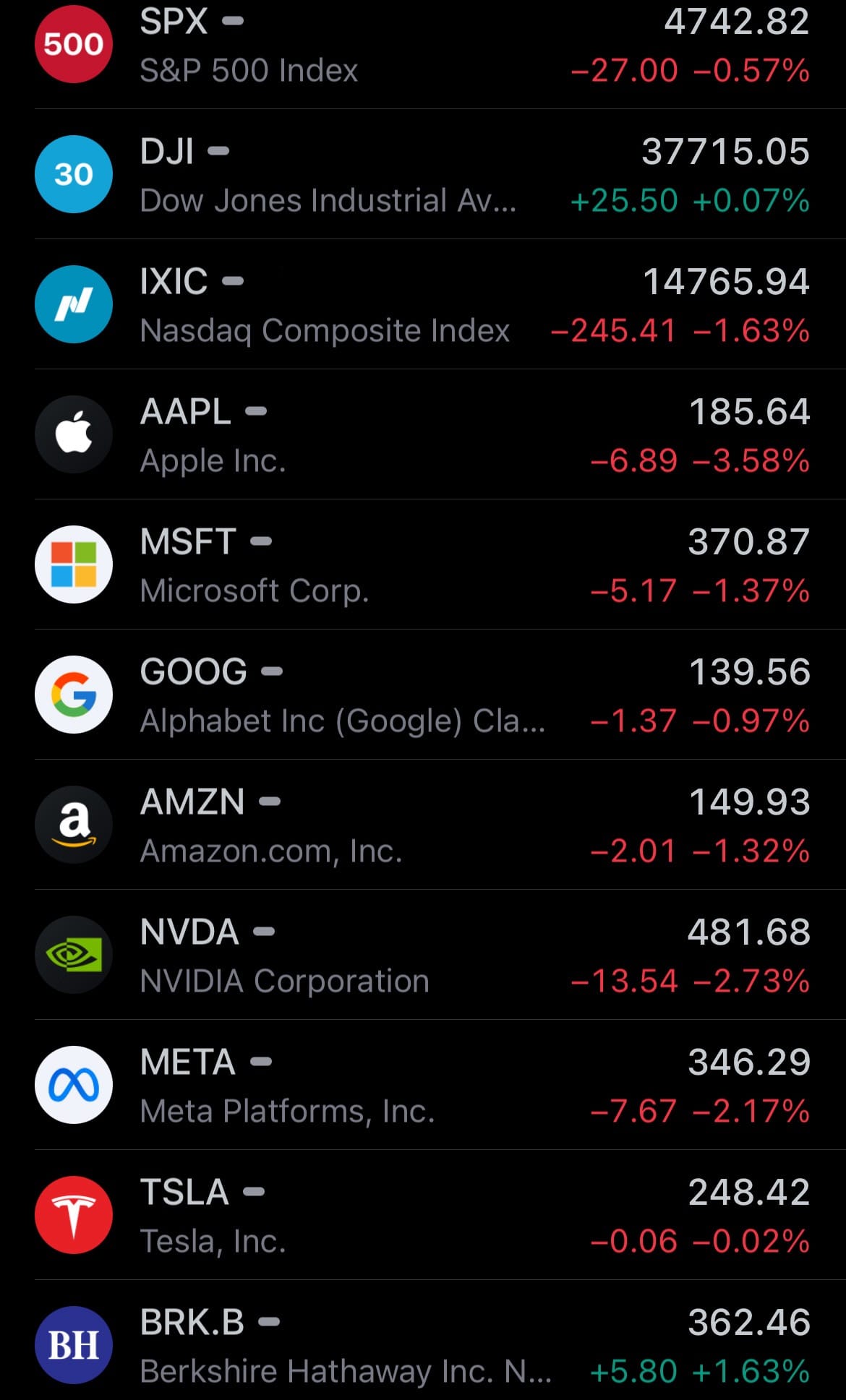

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

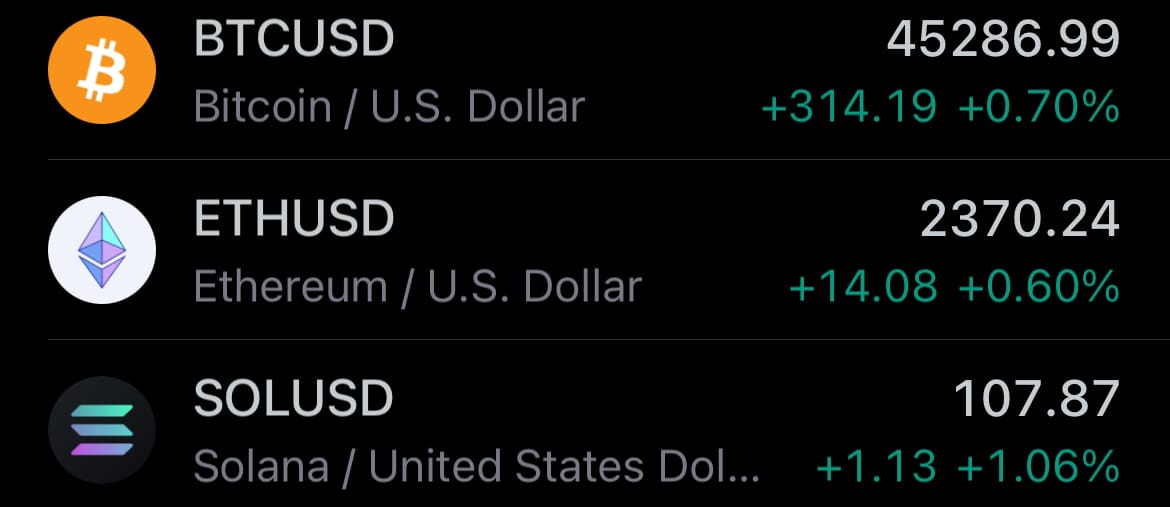

- Yesterday’s crypto market:

Red Sea Disputes:

- In response to a recent attack on its vessel Maersk Hangzhou, Danish shipping company A.P. Moeller-Maersk announced a halt to all its transits through the Red Sea and Gulf of Aden. This decision follows a series of attacks in the Red Sea by the Houthi rebel group, leading to several shipping firms suspending operations in the area.

- The Maersk Hangzhou, a Singapore-flagged container ship operating between Europe and Asia, was targeted by a missile and subsequent boarding attempts on December 30. U.S. Navy helicopters intervened, engaging boats controlled by the Houthis, resulting in the sinking of three boats and the loss of their crews. The attack on the Maersk Hangzhou is part of a larger pattern of hostility in the region, prompting Maersk to reroute some of its vessels via the Cape of Good Hope in South Africa.

- This incident aligns with similar actions by other shipping companies, such as Hapag-Lloyd, which has also rerouted its vessels around the Cape of Good Hope until at least January 9, as a precaution against the recent surge in Red Sea attacks. The ongoing conflict and its impact on maritime routes underscore the increasing security challenges in these waters.

Streaming Losses:

- In 2023, traditional entertainment studios invested heavily in streaming services to rival Netflix, but their efforts largely resulted in financial losses. According to recent data, Netflix's competitors collectively faced a staggering $5 billion loss in the streaming sector.

- NBCUniversal's Peacock led these losses with a $2.8 billion deficit, closely followed by Disney+, which lost $1.6 billion in the first nine months of the year. As a consequence of these substantial financial setbacks, industry analysts predict a potential wave of mergers or closures among these streaming services.

Statistic:

Largest banks and bank holding companies by market cap:

- 🇺🇸 JPMorgan Chase: $497.48B

- 🇺🇸 Bank of America: $268.27B

- 🇨🇳 ICBC: $223.63B

- 🇺🇸 Wells Fargo: $179.14B

- 🇨🇳 Agricultural Bank of China: $175.31B

- 🇮🇳 HDFC Bank: $168.60B

- 🇬🇧 HSBC: $154.52B

- 🇺🇸 Morgan Stanley: $154.11B

- 🇨🇳 China Construction Bank: $150.81B

- 🇨🇳 Bank of China: $149.68B

- 🇨🇦 Royal Bank Of Canada: $141.34B

- 🇦🇺 Commonwealth Bank: $128.63B

- 🇺🇸 Goldman Sachs: $126.62B

- 🇺🇸 Charles Schwab: $125.94B

- 🇨🇦 Toronto Dominion Bank: $115.08B

- 🇯🇵 Mitsubishi UFJ Financial: $102.71B

- 🇺🇸 Citigroup: $101.51B

- 🇨🇭 UBS: $98.60B

- 🇨🇳 CM Bank: $94.39B

- 🇸🇦 Al Rajhi Bank: $92.74B

- 🇮🇳 ICICI Bank: $82.82B

- 🇫🇷 BNP Paribas: $79.61B

- 🇮🇩 Bank Central Asia: $75.13B

- 🇨🇦 Bank of Montreal: $70.56B

- 🇮🇳 State Bank of India: $68.56B

- 🇺🇸 U.S. Bancorp: $68.36B

- 🇪🇸 Santander: $66.84B

- 🇧🇷 Itaú Unibanco: $66.76B

- 🇦🇺 National Australia Bank: $65.12B

- 🇸🇬 DBS Group: $64.68B

- 🇯🇵 Sumitomo Mitsui Financial Group: $64.63B

- 🇷🇺 Sberbank: $64.24B

- 🇸🇦 The Saudi National Bank: $63.99B

- 🇺🇸 PNC Financial Services: $62.34B

- 🇮🇳 Housing Development Finance Corporation: $60.76B

- 🇨🇦 Scotiabank: $57.65B

- 🇨🇳 Postal Savings Bank of China: $57.31B

- 🇮🇩 Bank Rakyat Indonesia: $55.36B

- 🇦🇺 Westpac Banking: $54.68B

- 🇮🇹 Intesa Sanpaolo: $53.82B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria: $53.70B

- 🇨🇳 Bank of Communications: $53.16B

- 🇦🇺 ANZ Bank: $52.74B

- 🇺🇸 Capital One: $50.31B

- 🇺🇸 Truist Financial: $50.02B

- 🇳🇱 ING: $49.42B

- 🇦🇺 Macquarie: $48.07B

- 🇧🇷 Banco Santander Brasil: $48.04B

- 🇨🇳 Industrial Bank: $47.15B

- 🇮🇹 UniCredit: $46.31B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news