Wednesday☕️

Trending:

- U.S.-Middle East Strikes

- Netflix Earnings

Markets:

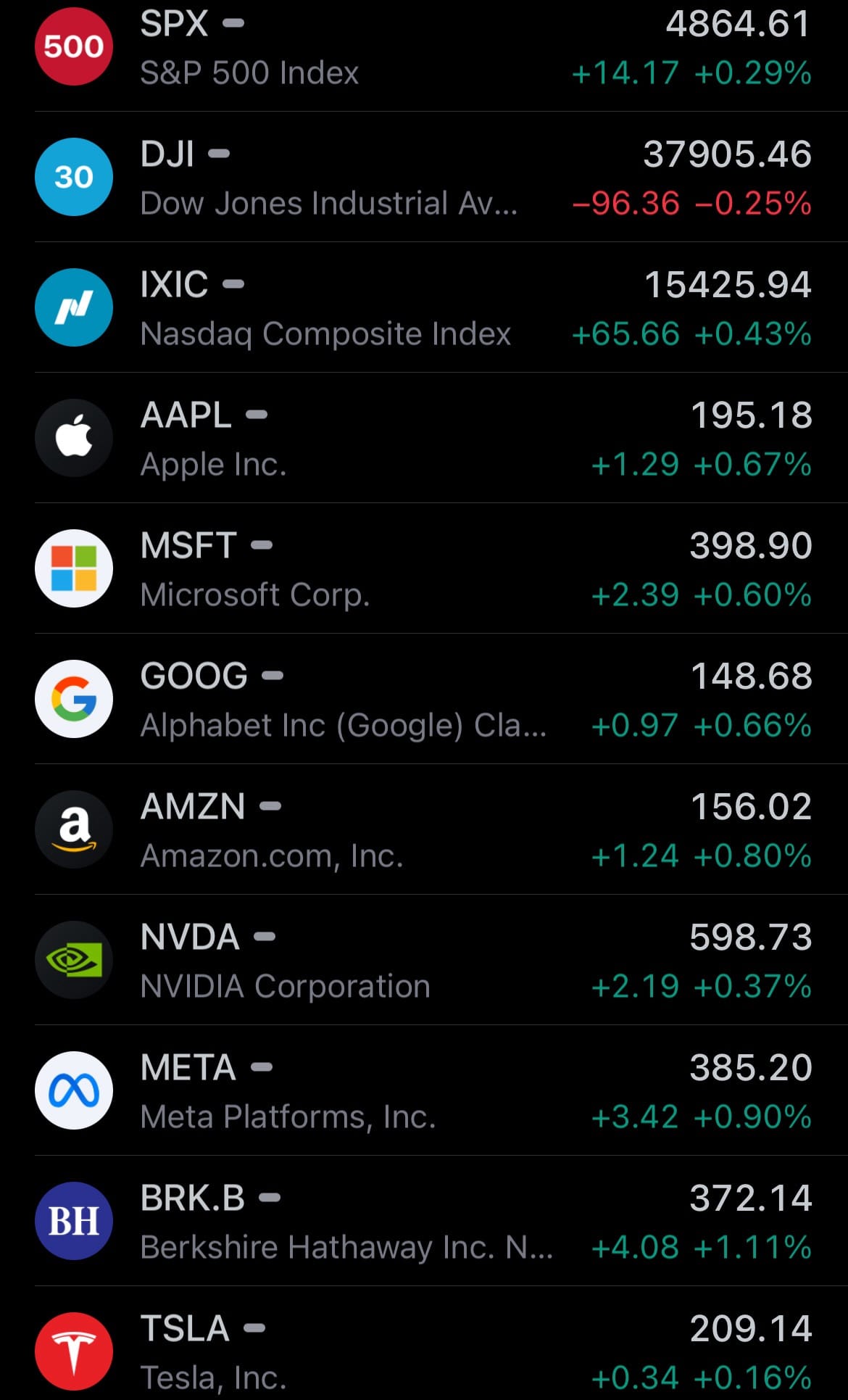

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

U.S.-Middle East Strikes:

- In recent military responses to militia activities in the Middle East, U.S. Central Command (CENTCOM) forces have conducted targeted airstrikes against militia groups in both Iraq and Yemen. On January 24th at 12:15 AM Iraq time, following attacks by the Iranian-backed militia group Kataib Hezbollah (KH), including an assault on al-Asad Airbase, U.S. forces launched unilateral airstrikes on three facilities in Iraq.

- These facilities, utilized by KH and other Iran-affiliated groups, included their headquarters, storage areas, and training locations for rocket, missile, and UAV capabilities. Additionally, on January 22nd, at approximately 11:59 PM Sanaa time, U.S. CENTCOM forces, in collaboration with the UK Armed Forces and with support from Australia, Bahrain, Canada, and the Netherlands, carried out strikes in Yemen.

- These operations targeted eight Houthi locations in areas controlled by the Iranian-backed Houthi terrorist group. The focus of these strikes was on sites used to launch attacks against international merchant vessels and U.S. Navy ships. The coalition targeted missile systems, launchers, air defense systems, radars, and buried weapons storage facilities in Houthi-controlled Yemen.

- The aim was to diminish the Houthis' capacity to continue their attacks on international shipping in the Red Sea, Bab Al-Mandeb Strait, and the Gulf of Aden. It's important to note that these strikes are separate from the multinational freedom of navigation operations conducted under Operation Prosperity Guardian.

Netflix Earnings:

- Netflix recently announced its fourth-quarter results, revealing a significant increase in subscriber growth that exceeded its own forecasts. The streaming giant added 13.12 million subscribers during the quarter, surpassing its estimate of around 9 million, and ending the full year 2023 with about 30 million net additions. This marks a considerable improvement from the 7.67 million new paying users it acquired in Q4 2022.

- The company's revenue for the quarter also exceeded expectations, reaching $8.83 billion against analysts' predictions of $8.71 billion, representing a 12.5% increase compared to the same period last year. This growth is credited to various revenue-boosting measures, including stricter password sharing policies, the introduction of an ad-supported tier, and recent price increases for certain subscription plans.

- For the first quarter, Netflix forecasts revenue of $9.24 billion, closely aligned with consensus estimates of $9.28 billion. Despite these positive trends, Netflix's earnings per share (EPS) for the quarter fell slightly short of expectations at $2.11, compared to the anticipated $2.20, but showed significant improvement from the $0.12 reported in the previous year's corresponding period.

- The company projects a more robust first quarter EPS of $4.49, surpassing the consensus forecast of $4.09. Netflix also reported strong profitability metrics, with operating margins at 16.9% for the quarter and 21% for the full year, surpassing its 20% target. The company's free cash flow stood at $1.58 billion for the quarter, outdoing the expected $1.26 billion and reaching $6.9 billion for the full year.

Statistics:

- Largest semiconductor companies by market capitalization:

- 🇺🇸 NVIDIA: $1.478T

- 🇹🇼 TSMC: $591.92B

- 🇺🇸 Broadcom: $574.08B

- 🇰🇷 Samsung: $366.47B

- 🇳🇱 ASML: $307.14B

- 🇺🇸 AMD: $281.86B

- 🇺🇸 Intel: $206.12B

- 🇺🇸 QUALCOMM: $171.43B

- 🇺🇸 Texas Instruments: $158.33B

- 🇺🇸 Applied Materials: $138.82B

- 🇺🇸 Lam Research: $109.43B

- 🇺🇸 Analog Devices: $99.85B

- 🇺🇸 Micron Technology: $96.62B

- 🇯🇵 Tokyo Electron: $87.96B

- 🇺🇸 KLA: $84.18B

- 🇺🇸 Synopsys: $83.71B

- 🇬🇧 Arm Holdings: $78.27B

- 🇰🇷 SK Hynix: $74.46B

- 🇺🇸 Marvell Technology Group: $61.03B

- 🇳🇱 NXP Semiconductors: $57.72B

- 🇺🇸 Microchip Technology: $49.77B

- 🇩🇪 Infineon: $49.24B

- 🇹🇼 MediaTek: $46.17B

- 🇨🇭 STMicroelectronics: $42.10B

- 🇺🇸 GlobalFoundries: $33.42B

- 🇺🇸 ON Semiconductor: $33.05B

- 🇯🇵 Renesas Electronics: $31.31B

- 🇺🇸 Monolithic Power Systems: $30.75B

- 🇯🇵 Disco Corp.: $29.64B

- 🇯🇵 Advantest: $29.31B

- 🇳🇱 ASM International: $27.07B

- 🇯🇵 Lasertec: $24.47B

- 🇨🇳 SMIC: $23.86B

- 🇹🇼 ASE Group: $20.39B

- 🇹🇼 United Microelectronics: $20.30B

- 🇺🇸 Entegris: $18.51B

- 🇺🇸 Skyworks Solutions: $17.56B

- 🇳🇱 BE Semiconductor: $11.98B

- 🇨🇳 AMEC: $11.83B

- 🇺🇸 Qorvo: $10.49B

- 🇹🇼 Novatek Microelectronics: $10.13B

- 🇺🇸 Lattice Semiconductor: $9.72B

- 🇹🇼 Alchip Technologies: $8.84B

- 🇹🇼 GlobalWafers: $8.29B

- 🇺🇸 Amkor Technology: $8.20B

- 🇺🇸 Onto Innovation: $8.15B

- 🇹🇼 Realtek: $7.30B

- 🇹🇼 Global Unichip Corp.: $7.27B

- 🇯🇵 Rohm: $7.12B

- 🇹🇼 Nanya Technology: $6.97B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news