Wednesday☕️

Trending:

- Cuban Crisis

- Nvidia’s GROOT

Markets:

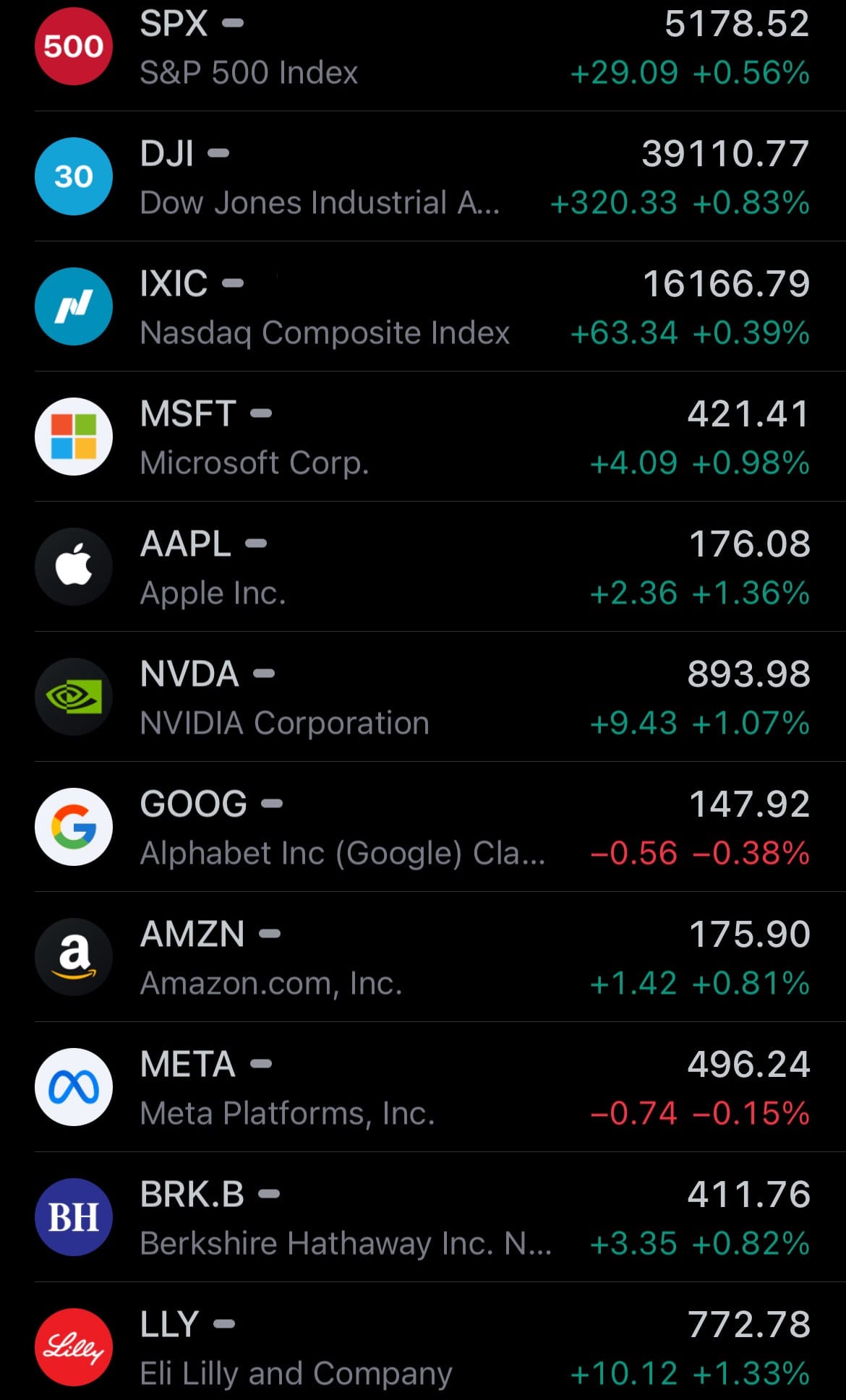

- Yesterday’s U.S. stock market:

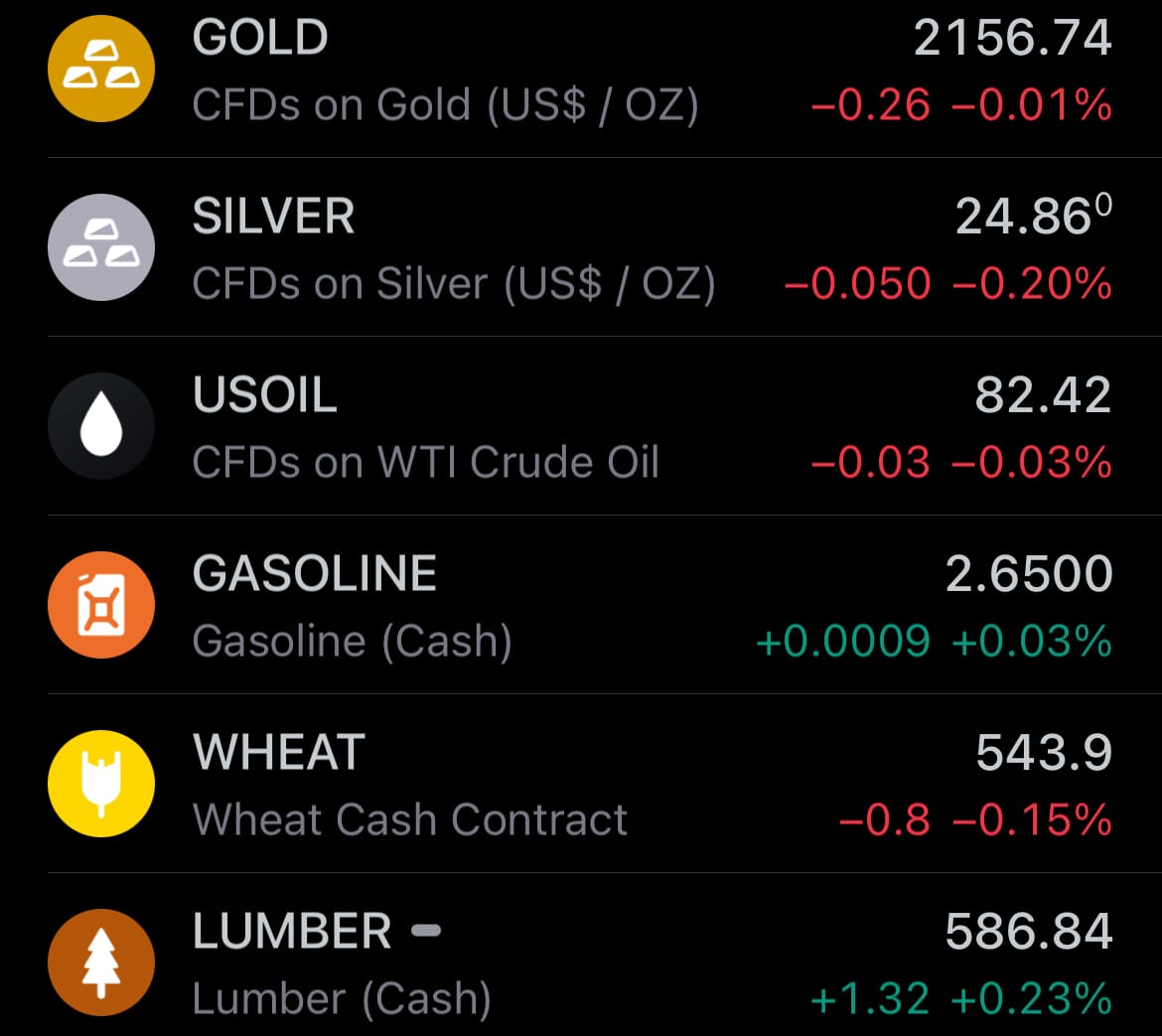

- Yesterday’s commodity market:

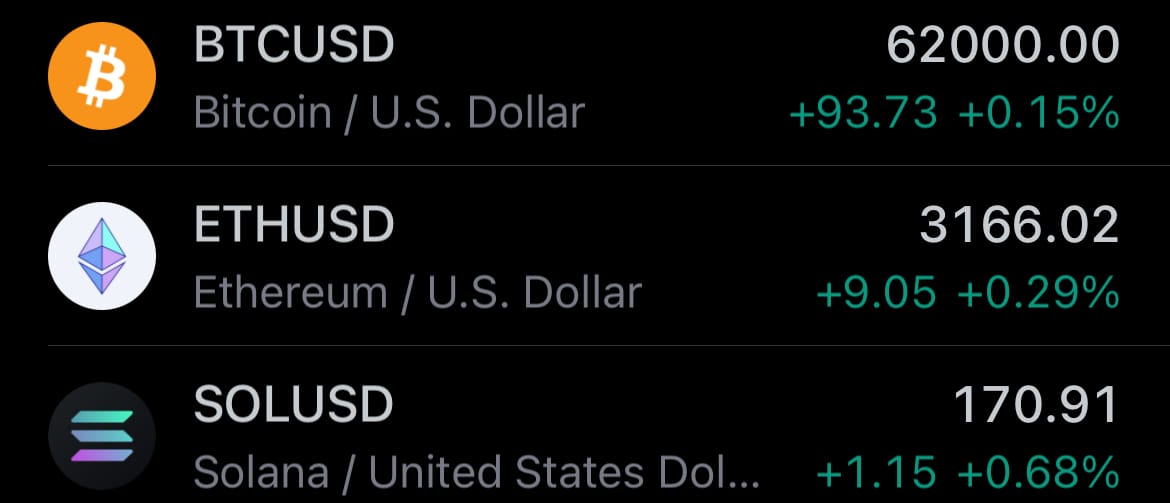

- Yesterday’s crypto market:

Cuban Crisis:

- Cuba is currently facing a severe economic crisis that has led to widespread protests across the nation. The primary grievances fueling these protests include acute food shortages, causing widespread hunger among the Cuban people. The situation is further aggravated by prolonged power outages, with some regions experiencing electricity cuts for up to 18 hours daily. These outages exacerbate the economic hardships faced by the population, who already endure the challenges of a low average state salary in a communist economy where inflation has made many essential goods unaffordable. Political dissatisfaction is also a significant concern, with calls for change in the government's communist policies.

- The protests, which have seen an uptick since the large-scale demonstrations in July 2021—the most significant since the 1959 revolution that established Cuba's communist regime—highlight the compounded effects of an economic crisis underpinned by the nation's centrally planned economic model. The Cuban government blames much of the hardship on U.S. sanctions, though critics argue that the inefficiencies inherent in the communist system also play a critical role.

- The immediate triggers for the recent wave of protests include the blackouts and food shortages, indicative of the broader economic and political discontent. The situation in Cuba, a country under communist rule, reflects the complex interplay between external sanctions and internal policy choices. On the international stage, reactions to Cuba's crisis vary, with some advocating for the government to address the protesters' demands for economic relief and political reform, while others highlight the role of sanctions in exacerbating the crisis.

Nvidia’s GROOT:

- Nvidia's recent unveiling of Project GROOT represents a major stride toward the era of humanoid robots, particularly for industrial applications. Announced at Nvidia GTC 2024, Project GROOT (Generalist Robot 00 Technology) is set to enhance robot intelligence and functionality by enabling them to learn from human actions. This initiative underscores Nvidia's commitment to bridging the gap between robots and humans, facilitating robots that are more adept at understanding natural language and mimicking human movements, thereby improving their coordination and interaction with the real world.

- Jensen Huang, Nvidia's CEO, introduced Project GROOT and its objectives, highlighting the platform's ability to observe and emulate human behavior. This breakthrough promises to equip robots with the skills needed for better navigation and adaptation in various environments. To back this ambitious project, Nvidia has developed Jetson Thor, a new computing system tailored for humanoid robots. Powered by a GPU based on Nvidia's latest Blackwell architecture, Jetson Thor delivers 800 teraflops of AI performance, making it capable of running sophisticated AI models, including those required by GROOT.

- In addition to Project GROOT, Nvidia also revealed enhancements to its Isaac robotics platform, aimed at making robotic arms more intelligent, flexible, and efficient. These upgrades, which include new collections of pretrained models and libraries, are designed to speed up learning and boost efficiency, making robotic arms a more attractive option for industrial and factory use. Through these initiatives, Nvidia is not only advancing the frontiers of AI and robotics but also shaping the future of industrial automation and robotics interaction.

Statistic:

- Largest banks and bank holding companies by market capitalization:

- 🇺🇸 JPMorgan Chase: $558.18B

- 🇺🇸 Bank of America: $284.29B

- 🇨🇳 ICBC: $240.32B

- 🇺🇸 Wells Fargo: $203.94B

- 🇨🇳 Agricultural Bank of China: $195.69B

- 🇨🇳 Bank of China: $161.15B

- 🇨🇳 China Construction Bank: $154.15B

- 🇬🇧 HSBC: $146.31B

- 🇺🇸 Morgan Stanley: $144.59B

- 🇮🇳 HDFC Bank: $140.41B

- 🇨🇦 Royal Bank Of Canada: $139.70B

- 🇦🇺 Commonwealth Bank: $127.12B

- 🇺🇸 Goldman Sachs: $126.13B

- 🇺🇸 Charles Schwab: $124.69B

- 🇯🇵 Mitsubishi UFJ Financial: $120.45B

- 🇺🇸 Citigroup: $112.50B

- 🇨🇳 CM Bank: $108.11B

- 🇨🇦 Toronto Dominion Bank: $105.28B

- 🇨🇭 UBS: $100.59B

- 🇮🇳 ICICI Bank: $91.39B

- 🇸🇦 Al Rajhi Bank: $90.81B

- 🇮🇩 Bank Central Asia: $79.84B

- 🇮🇳 State Bank of India: $77.83B

- 🇫🇷 BNP Paribas: $77.17B

- 🇯🇵 Sumitomo Mitsui Financial Group: $76.18B

- 🇪🇸 Santander: $71.31B

- 🇦🇺 National Australia Bank: $69.66B

- 🇷🇺 Sberbank: $69.21B

- 🇨🇦 Bank of Montreal: $68.22B

- 🇸🇬 DBS Group: $67.40B

- 🇧🇷 Itaú Unibanco: $67.36B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria: $66.24B

- 🇺🇸 U.S. Bancorp: $65.79B

- 🇮🇹 Intesa Sanpaolo: $65.01B

- 🇸🇦 The Saudi National Bank: $63.03B

- 🇨🇳 Postal Savings Bank of China: $62.74B

- 🇮🇹 UniCredit: $61.56B

- 🇨🇦 Scotiabank: $60.54B

- 🇦🇺 Westpac Banking: $60.47B

- 🇺🇸 PNC Financial Services: $59.72B

- 🇮🇩 Bank Rakyat Indonesia: $57.59B

- 🇨🇳 Bank of Communications: $56.64B

- 🇦🇺 ANZ Bank: $56.64B

- 🇧🇷 Nu Holdings: $56.47B

- 🇺🇸 Capital One: $52.05B

- 🇳🇱 ING: $51.96B

- 🇯🇵 Mizuho Financial Group: $50.06B

- 🇦🇺 Macquarie: $49.77B

- 🇺🇸 Truist Financial: $47.64B

- 🇨🇳 Industrial Bank: $46.72B

- 🇨🇦 CIBC: $46.61B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news