Friday☕️

Trending:

- U.S. GDP Growth

- Amazon Earnings

Markets:

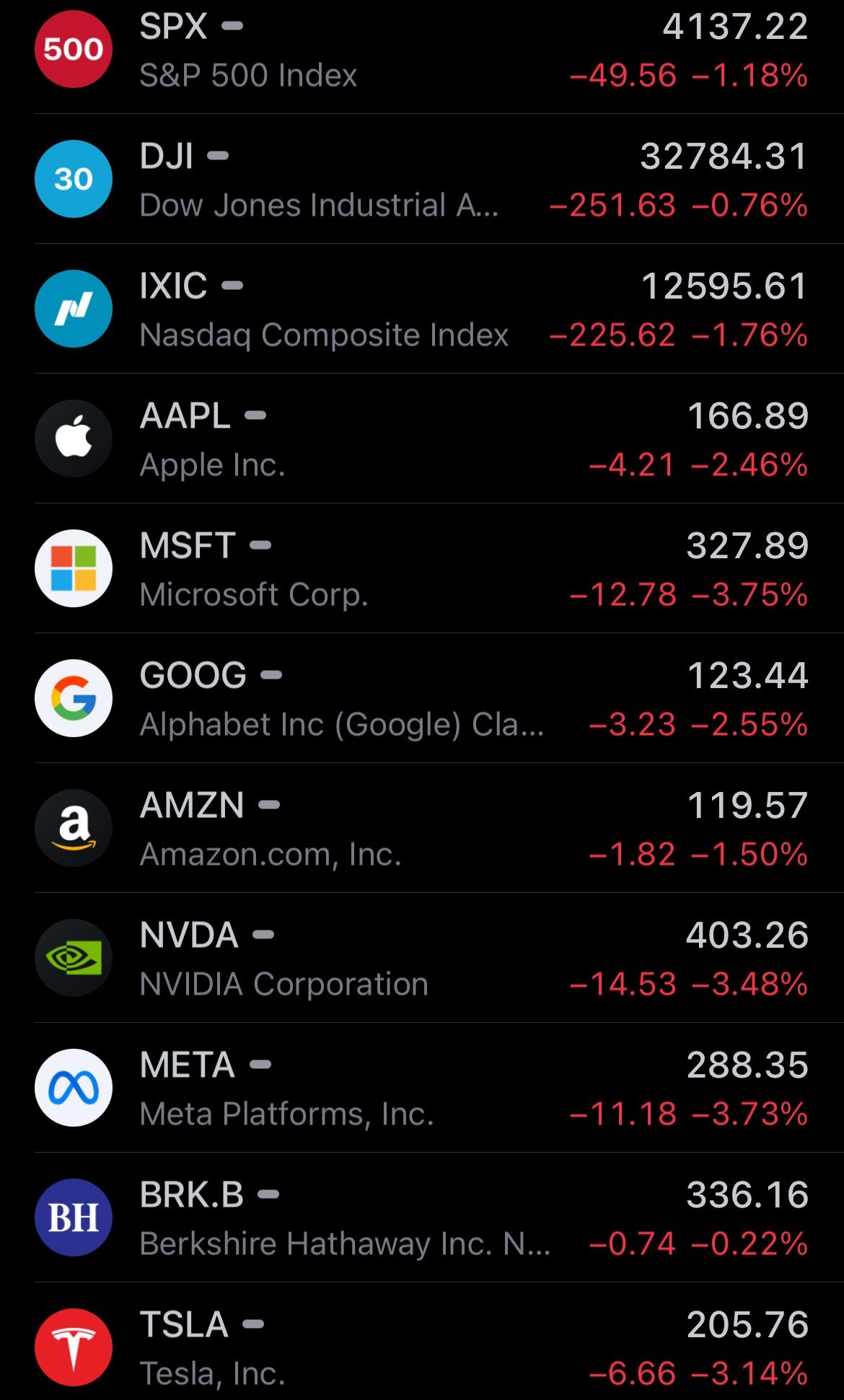

- Yesterday's U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

U.S. GDP Growth:

- In the third quarter, the U.S. economy outperformed expectations, growing at a 4.9% annual rate, showcasing resilience amidst challenges like high interest rates and ongoing inflation.

- The Gross Domestic Product (GDP) data was released by the Commerce Department revealing the increase, which was up from 2.1% in the previous quarter and surpassing the 4.7% growth economists had projected.

- Consumer spending on goods rose by 4.8%, while spending on services increased by 3.6%. Despite these positive indicators of economic health, the market’s response was muted, with mixed stock performance and a general decrease in Treasury yields.

- Additionally, while the real GDP growth reflects the economy’s true expansion in goods and services, the current dollar GDP, inclusive of inflation’s impact, increased by 8.5%, totaling $27.62 trillion, highlighting the dual effects of growth and price increases on the economy’s overall value.

Amazon Earnings:

- After the market closed on Thursday, Amazon shared its Q3 financial results showing sales of $143.1 billion, a 13% increase from the previous year and a faster growth rate than the 11% seen in the June quarter, exceeding expectations. Earnings came in at 94 cents per share, significantly higher than the predicted 58 cents, with a total profit of $9.9 billion, including a $1.1 billion gain from the company’s investment in Rivian Automotive.

- Amazon Web Services (AWS) reported a 12% increase in revenue, in line with Wall Street estimates. The company’s operating income increased to $11.2 billion, well above the forecasted range of $5.5 billion to $8.5 billion. This includes a noteworthy turnaround in North America, reporting an operating profit of $4.3 billion compared to a loss of $400 million in the same quarter of the previous year, and a substantial contribution from AWS with a $7 billion operating profit.

- Andy Jassy, Amazon's CEO, highlighted the strong quarter with improvements in delivery speed, stable AWS growth, robust advertising revenue growth, and significant increases in overall operating income and cash flow. Sales in the online store segment rose by 7% and the third-party services revenue saw a 20% increase, both showing improvements from the previous quarter.

Statistic:

Largest Companies by Market Cap:

- 🇺🇸 Apple: $2.609T

- 🇺🇸 Microsoft: $2.436T

- 🇸🇦 Saudi Aramco: $2.142T

- 🇺🇸 Alphabet (Google): $1.536T

- 🇺🇸 Amazon: $1.233T

- 🇺🇸 NVIDIA: $996.05B

- 🇺🇸 Meta Platforms (Facebook): $741.01B

- 🇺🇸 Berkshire Hathaway: $733.86B

- 🇺🇸 Tesla: $654.09B

- 🇺🇸 Eli Lilly: $539.29B

- 🇺🇸 UnitedHealth: $489.42B

- 🇺🇸 Visa: $478.29B

- 🇹🇼 TSMC: $453.55B

- 🇺🇸 Walmart: $435.41B

- 🇩🇰 Novo Nordisk: $428.09B

- 🇺🇸 Exxon Mobil: $426.41B

- 🇺🇸 JPMorgan Chase: $406.93B

- 🇫🇷 LVMH: $382.14B

- 🇺🇸 Johnson & Johnson: $377.69B

- 🇺🇸 Procter & Gamble: $353.06B

- 🇨🇳 Tencent: $351.41B

- 🇺🇸 Mastercard: $343.52B

- 🇺🇸 Broadcom: $341.22B

- 🇰🇷 Samsung: $326.63B

- 🇨🇭 Nestlé: $298.99B

- 🇺🇸 Chevron: $295.20B

- 🇨🇳 Kweichow Moutai: $288.41B

- 🇺🇸 Home Depot: $278.01B

- 🇺🇸 Oracle: $275.03B

- 🇺🇸 Merck: $267.83B

- 🇺🇸 AbbVie: $256.28B

- 🇺🇸 Costco: $242.44B

- 🇺🇸 Coca-Cola: $241.15B

- 🇦🇪 International Holding Company: $238.61B

- 🇳🇱 ASML: $237.96B

- 🇺🇸 Adobe: $234.15B

- 🇯🇵 Toyota: $233.19B

- 🇺🇸 Pepsico: $221.91B

- 🇫🇷 L'Oréal: $220.70B

- 🇨🇳 ICBC: $220.12B

- 🇬🇧 Shell: $219.88B

- 🇨🇳 Alibaba: $210.27B

- 🇺🇸 Cisco: $208.07B

- 🇨🇭 Roche: $207.83B

- 🇺🇸 Bank of America: $206.95B

- 🇬🇧 AstraZeneca: $198.67B

- 🇨🇭 Novartis: $195.02B

- 🇫🇷 Hermès: $191.02B

- 🇺🇸 Salesforce: $190.95B

- 🇺🇸 McDonald's: $186.43B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news