Thursday☕️

Trending:

- Google Gemini AI

- Banking Hearing

- U.S. Math Scores

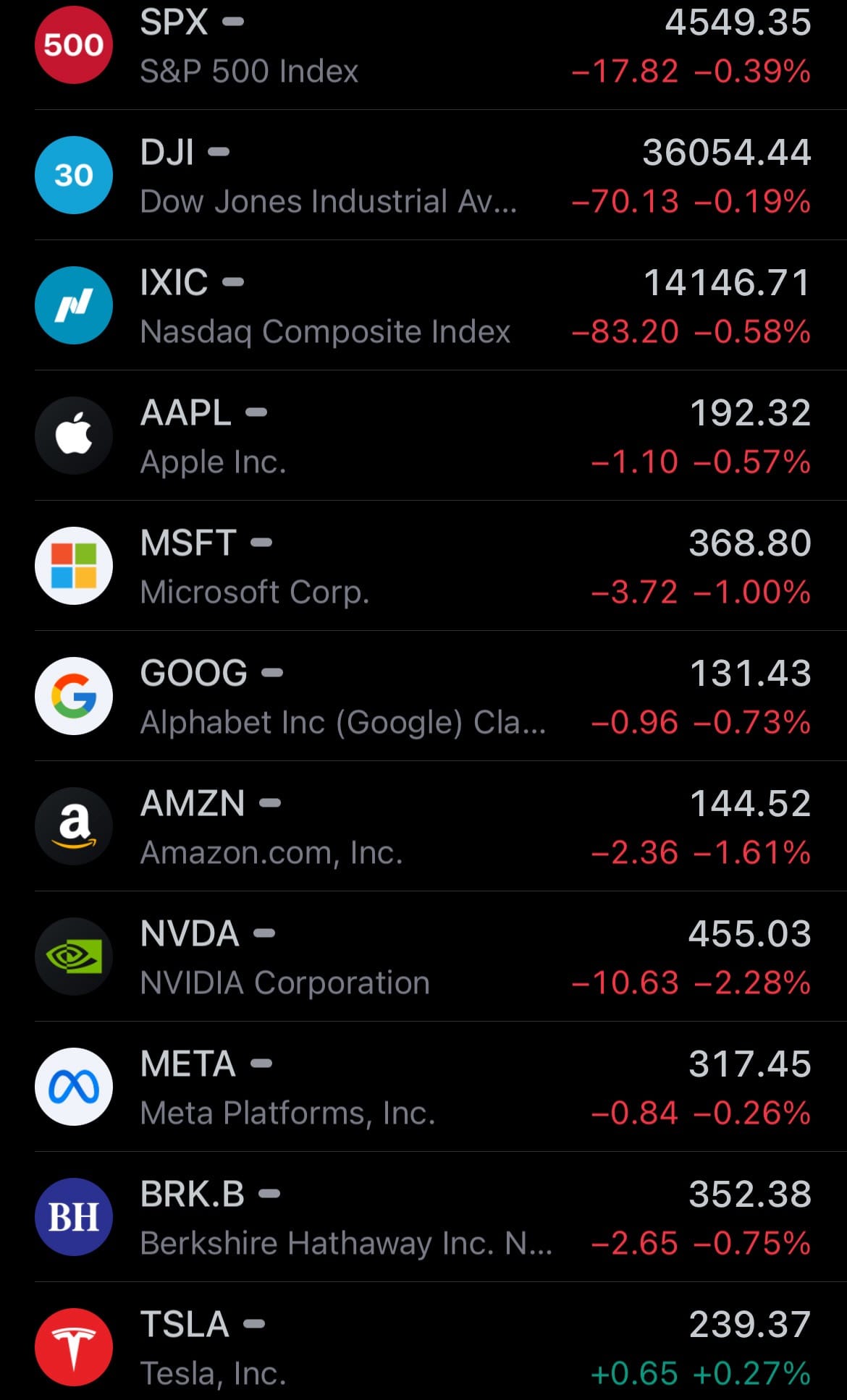

Markets:

- Yesterday’s U.S. stock market:

- Yesterday’s commodity market:

- Yesterday’s crypto market:

Google Gemini AI:

- Yesterday, Google announced Gemini, DeepMind's latest AI model, positioning it as the top competitor to OpenAI's GPT-4. This multimodal large language model, which can process text, audio, image, and video prompts, is set to revolutionize Google's suite of products, including the Bard chatbot. Gemini comes in three versions: Ultra, Pro, and Nano, each tailored for specific applications.

- The Pro version is already enhancing Bard, while Nano is designed for devices like the Pixel Pro smartphone. Gemini's integration into Google Search, Ads, and Chrome is planned, with the Ultra version becoming publicly accessible in 2024. Distinctive for its multimodal capabilities from the outset, Gemini demonstrates advanced functions like object and image recognition, video analysis, and creative tasks like music generation.

- Despite its cutting-edge technology, Google acknowledges Gemini's susceptibility to generating inaccurate responses, a common challenge in AI development. Nonetheless, Gemini Ultra has shown impressive performance, surpassing competitors in academic benchmarks and providing a significant challenge to ChatGPT/GPT-4, Claude, Palm, Grok, and many more.

U.S. Banking Hearing:

- Yesterday, leading Wall Street bankers testified before the Senate Banking Committee, voicing concerns over the Biden administration's proposed regulatory changes for banks. The heads of major banks, including JPMorgan's Jamie Dimon, Bank of America's Brian Moynihan, Citigroup's Jane Fraser, and Goldman Sachs' David Solomon, warned that these changes could adversely affect the economy, particularly during current challenges like geopolitical unrest and inflation.

- Unlike previous years where the focus was on the banking industry's positive contributions, this session centered on the risks of over-regulation. The bankers particularly opposed the new rules suggested by the Federal Reserve, known as the Basel Endgame, which would require banks to maintain additional capital. They argued that such regulations could restrict lending and weaken bank balance sheets, a significant concern for an industry seeking greater operational flexibility.

- Jane Fraser of Citigroup emphasized in her statement that the Basel III Endgame proposal would increase the cost of lending and other financial activities, especially impacting smaller businesses and consumers. This collective stance from Wall Street's top bankers reflects a growing apprehension about tighter regulatory measures and their potential economic implications.

U.S. Math Scores:

- Last year, U.S. 15-year-olds recorded the lowest ever math scores in the history of the international assessment known as the Programme for International Student Assessment (PISA). This exam, which assesses students from 81 countries in mathematics, reading, and science, was conducted last year for the first time since 2018. Despite the decline in math scores, the U.S. improved its global ranking in this subject, moving up from 29th in 2018 to 26th.

- This rise is attributed to a general decline in math scores worldwide. In contrast to math, U.S. scores in reading and science remained consistent with the 2018 results. In terms of global rankings, the U.S. advanced to sixth place in reading, up from eighth, and to 10th place in science, improving from 11th. This data indicates a stable performance in these areas even as the U.S. faces challenges in math education.

Statistic:

Largest banks by market capitalization:

- 🇺🇸 JPMorgan Chase: $451.89B

- 🇺🇸 Bank of America: $241.60B

- 🇨🇳 ICBC: $217.61B

- 🇨🇳 Agricultural Bank of China: $168.43B

- 🇺🇸 Wells Fargo: $161.60B

- 🇮🇳 HDFC Bank: $158.70B

- 🇬🇧 HSBC: $149.58B

- 🇨🇳 Bank of China: $146.55B

- 🇨🇳 China Construction Bank: $144.06B

- 🇺🇸 Morgan Stanley: $130.33B

- 🇨🇦 Royal Bank Of Canada: $128.12B

- 🇦🇺 Commonwealth Bank: $116.24B

- 🇺🇸 Charles Schwab: $113.29B

- 🇺🇸 Goldman Sachs: $111.52B

- 🇨🇦 Toronto Dominion Bank: $108.34B

- 🇯🇵 Mitsubishi UFJ Financial: $103.49B

- 🇨🇳 CM Bank: $96.19B

- 🇺🇸 Citigroup: $91.59B

- 🇨🇭 UBS: $90.45B

- 🇮🇳 ICICI Bank: $84.13B

- 🇸🇦 Al Rajhi Bank: $80.30B

- 🇫🇷 BNP Paribas: $74.97B

- 🇮🇩 Bank Central Asia: $70.03B

- 🇪🇸 Santander: $68.89B

- 🇮🇳 State Bank of India: $65.18B

- 🇯🇵 Sumitomo Mitsui Financial Group: $65.00B

- 🇧🇷 Itaú Unibanco: $62.74B

- 🇷🇺 Sberbank: $62.08B

- 🇨🇦 Bank of Montreal: $61.91B

- 🇺🇸 U.S. Bancorp: $60.84B

- 🇮🇳 Housing Development Finance Corporation: $60.71B

- 🇸🇬 DBS Group: $60.52B

- 🇦🇺 National Australia Bank: $59.55B

- 🇨🇳 Postal Savings Bank of China: $56.93B

- 🇺🇸 PNC Financial Services: $55.51B

- 🇪🇸 Banco Bilbao Vizcaya Argentaria: $54.90B

- 🇸🇦 The Saudi National Bank: $54.43B

- 🇨🇦 Scotiabank: $53.32B

- 🇮🇹 Intesa Sanpaolo: $53.15B

- 🇮🇩 Bank Rakyat Indonesia: $52.83B

- 🇨🇳 Bank of Communications: $51.72B

- 🇦🇺 Westpac Banking: $50.03B

- 🇳🇱 ING: $49.04B

- 🇦🇺 ANZ Bank: $48.28B

- 🇮🇹 UniCredit: $47.22B

- 🇧🇷 Banco Santander Brasil: $46.10B

- 🇺🇸 Truist Financial: $44.06B

- 🇮🇳 Kotak Mahindra Bank: $43.44B

- 🇺🇸 Capital One: $43.32B

- 🇦🇺 Macquarie: $42.51B

Article Links:

Thanks for reading!

TIME IS MONEY: Your Free Daily Scoop of Markets📈, Business💼, Tech📲🚀, and Global 🌎 News.

The news you need, the time you want.

Support/Suggestions Emails:

timeismoney@timeismon.news